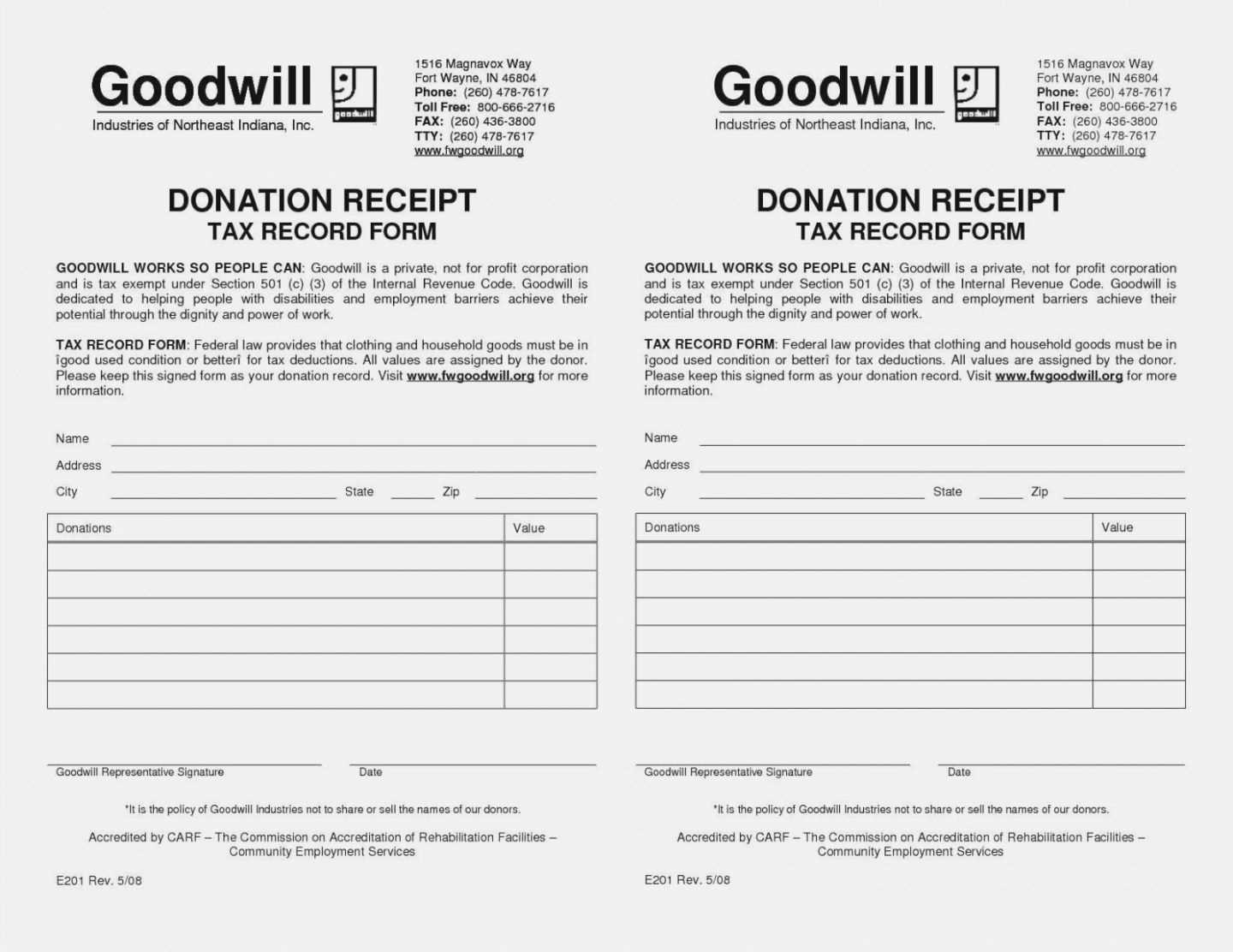

To comply with California’s tax regulations, providing donors with a detailed and accurate receipt is a must. A donation receipt letter serves as proof of a charitable contribution for tax deductions. Goodwill, as a 501(c)(3) nonprofit, follows a specific format to ensure donations are properly documented for the donor’s benefit.

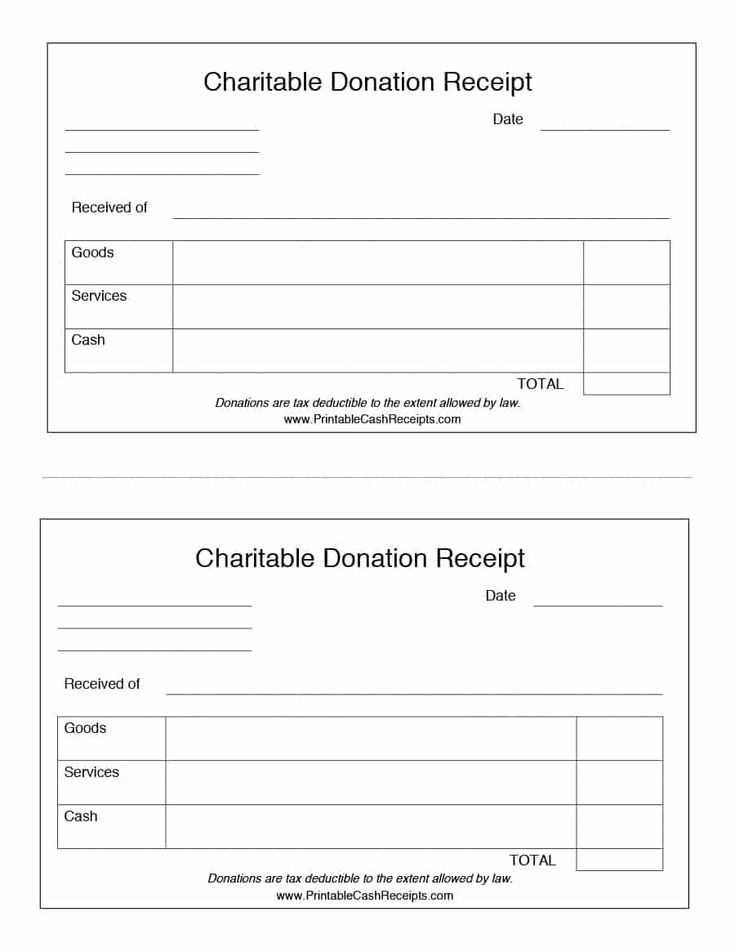

Use the template below to create a receipt letter that includes all required information. This should contain the donor’s name, address, a description of the donated items, and the date of donation. Additionally, ensure the letter clearly states whether any goods were exchanged for the donation, as this affects tax deduction eligibility. Goodwill recommends avoiding vague language like “many items” and instead listing individual categories (e.g., clothing, electronics) along with an estimated value, if applicable.

Make sure the letter is signed by an authorized representative of the organization. This signature adds legitimacy to the receipt and confirms that Goodwill has acknowledged the donation. While an appraisal is not necessary, the donor is responsible for valuing the items themselves.

Finally, always include a statement about the tax deductibility of the donation, clarifying that Goodwill cannot assign a monetary value to donated items, as required by law. Keep the letter concise but informative to avoid confusion and ensure a smooth process for tax filing.

Here’s an improved version with minimized repetition:

Make sure the donation receipt clearly identifies the donor and the items donated. Include the donor’s full name, address, and the date of the donation. It is also important to specify the condition of the items–whether they are new, used, or in need of repair.

Provide a concise list of donated items, without repeating descriptions. For example, instead of “old clothes, used shoes, and worn-out coats,” say “clothes, shoes, and coats (used).” Be direct and keep the item descriptions straightforward.

Ensure the donation’s value is either estimated by the donor or determined by the receiving organization. If necessary, include a brief disclaimer stating that the donor is responsible for assessing the value of their items.

State that the donation was made without any goods or services being provided in return, as required for tax purposes. This simple line will help the donor during tax season without unnecessary wording.

Conclude with a thank you for the donor’s contribution. A short and sincere statement goes a long way in showing appreciation without overdoing it. Keep the tone warm and professional.

- Donation Receipt Letter Template for California Goodwill

A donation receipt letter for Goodwill in California should contain specific details to comply with both state and federal tax requirements. Below is a simple and clear template that covers the key points donors expect from Goodwill in California. This ensures they can claim their donations on their taxes with ease and accuracy.

Goodwill Donation Receipt

Goodwill California

[Goodwill Organization Name]

[Address Line 1]

[City, State, Zip Code]

[Phone Number]

Donor Information:

[Donor Name]

[Donor Address Line 1]

[City, State, Zip Code]

Donation Date: [Date of Donation]

Description of Donated Items:

[List of Donated Items] (Do not assign a value to the items as Goodwill cannot assess value for the donor.)

Declaration:

We acknowledge receipt of the items listed above. No goods or services were provided in exchange for this donation.

Tax Information:

Goodwill is a tax-exempt organization under section 501(c)(3) of the Internal Revenue Code. For tax purposes, the donor is responsible for determining the fair market value of the items donated.

Signature of Authorized Representative:

[Signature of Goodwill Representative]

[Title of Representative]

[Date]

Note: This receipt is intended for tax purposes only. Please keep a copy of this receipt for your records.

Tax-exempt Status:

Goodwill is recognized as a charitable organization under the Internal Revenue Code (IRC) section 501(c)(3). Donations made to Goodwill are tax-deductible to the full extent permitted by law.

In California, a Goodwill donation receipt letter should be clear, concise, and meet IRS guidelines to ensure donors can claim their deductions. Start with a header that includes your organization’s name, address, and contact information.

Next, include a statement acknowledging the donation. Be specific about the items or type of goods donated, if possible, and ensure the donor’s name and date of donation are clearly mentioned. If the donation consists of clothing, household goods, or furniture, list them by category.

Indicate the value of the donation. For non-cash donations, it is common for donors to assign a value to their items. While Goodwill cannot appraise items, the letter should state that the donor is responsible for determining the value of their goods. A simple phrase like “Value of items donated is determined by the donor” is sufficient.

Ensure the letter includes a statement that no goods or services were provided in exchange for the donation. If there were any goods or services provided, such as a receipt for a purchase or an event ticket, they must be clearly described and valued.

Lastly, sign the letter with a representative’s name and title from Goodwill. This adds authenticity and ensures the donor has a valid receipt for their tax records. If desired, include a thank-you note to express appreciation for the donation.

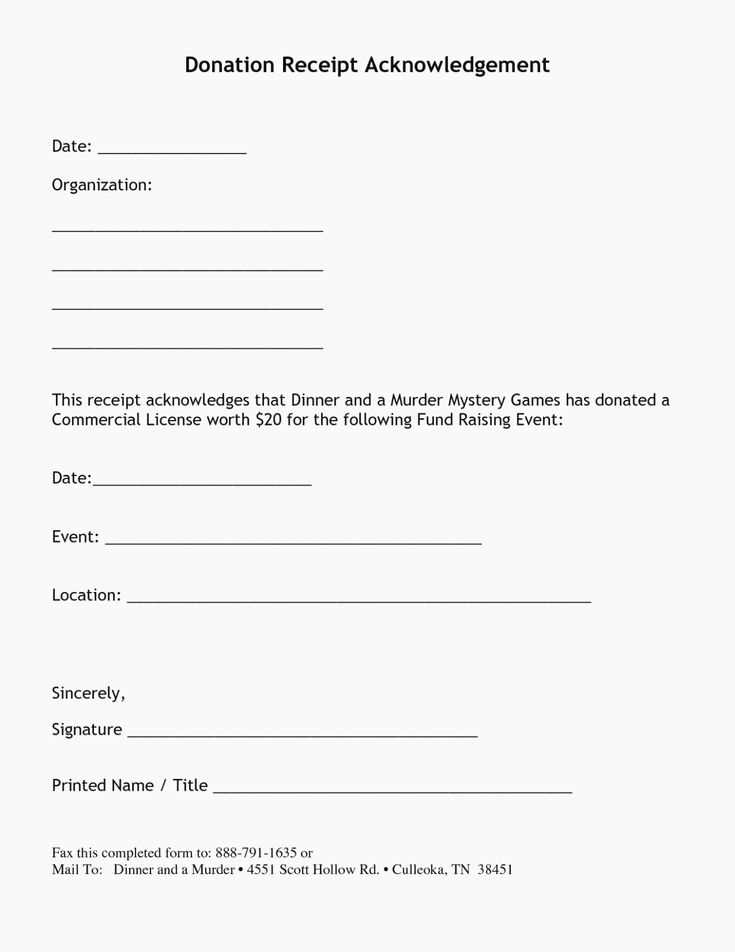

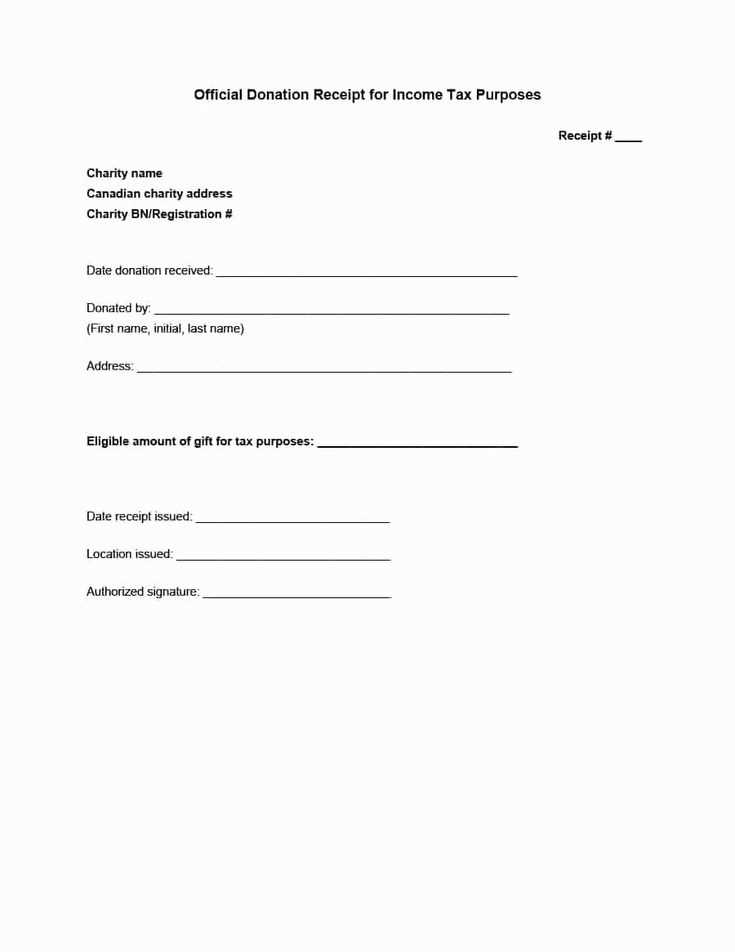

To ensure donors can claim tax deductions for their charitable contributions, a donation receipt must contain specific details. These details serve as proof of donation and ensure compliance with IRS requirements.

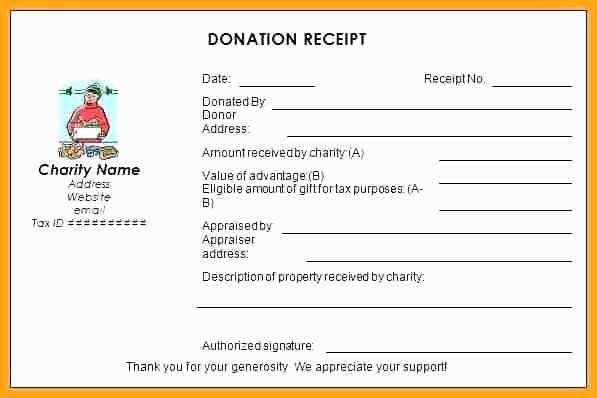

1. Organization Information

The receipt should clearly state the name and address of the organization receiving the donation. Include the nonprofit’s federal tax identification number (EIN) to verify its charitable status. This is a key element for donors to claim deductions on their taxes.

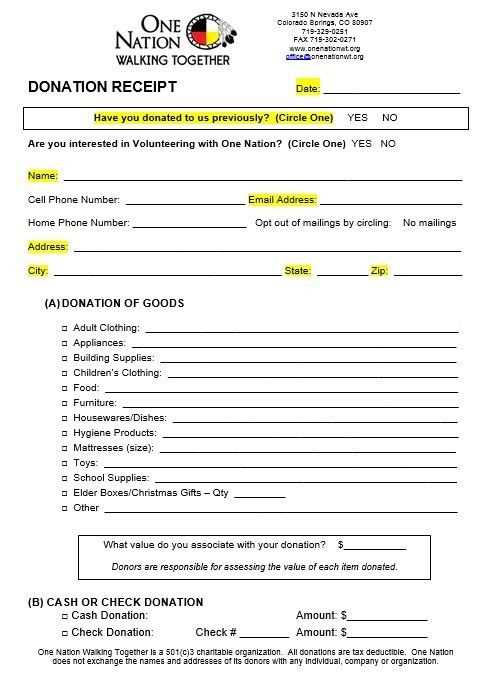

2. Donation Details

List the items donated along with their fair market value (FMV). For non-cash donations, the IRS requires a description of the donated goods, and in some cases, a rough estimate of their value. If the donation is cash, include the amount donated and the date of the donation.

If the donation includes both cash and non-cash items, the receipt should break down both components for clarity.

3. No Goods or Services Provided

The receipt must state whether the donor received any goods or services in exchange for the donation. If no goods or services were provided, include a statement like: “No goods or services were provided in exchange for this donation.” This is important for the donor’s tax deductions, as contributions that involve exchanges may affect the deductible amount.

4. Date of Donation

Ensure the date of donation is clearly listed on the receipt. This allows donors to accurately claim deductions for the correct tax year.

5. Signature of Authorized Representative

The receipt should be signed by an authorized representative of the organization. This adds validity and confirms the legitimacy of the donation, which is crucial when the donor submits their tax returns.

To meet California’s specific requirements for donation receipts, ensure your letter includes the following key elements:

- Donor Information: Clearly list the donor’s full name, address, and date of donation. This should match their records for tax filing purposes.

- Nonprofit Identification: Include your organization’s legal name, address, and tax-exempt status (e.g., 501(c)(3)) to confirm its eligibility for tax-deductible donations.

- Detailed Description of Donated Items: For physical donations, provide a description of the donated items. You do not need to assign a value, but a clear description is required. For cash donations, specify the amount given.

California-Specific Additions

- State Tax Identification: Mention your state tax ID number to verify your nonprofit status in California. This helps donors cross-check with state records.

- Fair Market Value (FMV) Statement: If the donor receives any goods or services in exchange for the donation, the receipt must indicate that the donor is only allowed to claim a deduction for the amount exceeding the FMV of the goods or services provided.

- Statement of No Goods or Services Received: If no goods or services were given in return for the donation, explicitly state that. This will avoid confusion for donors trying to claim deductions.

Additional Tips for Compliance

- Ensure your receipt is signed by an authorized representative from your nonprofit.

- If the donation exceeds $250, include a statement confirming that no goods or services were provided in exchange for the donation, or the FMV of what was received if applicable.

- Double-check that the donation letter is issued in a timely manner to allow the donor to use it for tax filing purposes.

Donation Receipt Letter Template California Goodwill

For a donation receipt letter to be valid in California, it must include specific details. Begin with a statement acknowledging the donor’s contribution. Clearly state the description of the items donated, including quantity and condition (e.g., “5 bags of clothing in good condition”). Avoid vague descriptions like “miscellaneous items.” Include the date the donation was received and the name of the organization (Goodwill, in this case). Make sure the letter is signed by an authorized representative.

Key Information to Include

To ensure the receipt serves its intended purpose, include the following:

- Donor’s name and address

- A description of the donated items

- Condition of the items

- Date of the donation

- The name of the organization receiving the donation

- Signature of an authorized representative

Tax Deductibility Statement

Clearly state that the donor will not receive any goods or services in exchange for the donation. This reinforces that the donation is eligible for a tax deduction. A simple phrase such as: “No goods or services were provided in exchange for this donation” suffices.