Creating a clear and professional donation receipt is an important step for both the donor and the recipient organization. It provides the necessary documentation for tax purposes and ensures transparency in the donation process. A well-designed receipt can help build trust and encourage future contributions. Use the template below to streamline the process of generating receipts for monetary donations.

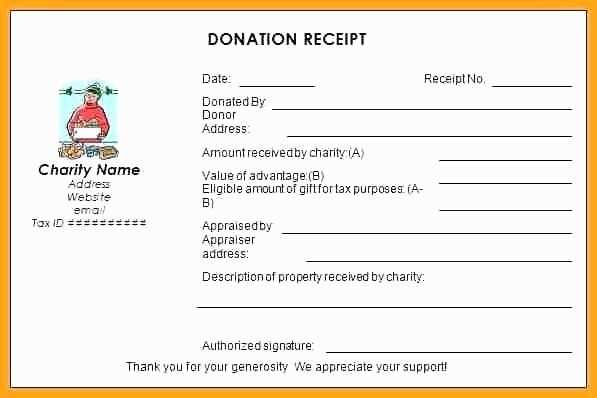

Include the following key elements in your donation receipt:

- Donor Information: Name, address, and contact details of the donor.

- Organization Details: Name, address, and tax-exempt status of the receiving organization.

- Donation Amount: Clearly state the exact amount donated and, if applicable, the method of payment.

- Date of Donation: Ensure the date is accurate and matches the transaction.

- Thank You Statement: A brief acknowledgment to express gratitude for the contribution.

- Tax Deductibility: A note about whether the donation is tax-deductible, including your organization’s tax ID number.

By using this template, you create a record that can be easily referenced by both parties. Keep it simple, clear, and professional to ensure it fulfills its purpose without any confusion.

Here are the revised lines without repetition:

Ensure that your donation receipt includes the donor’s name, the donation amount, and the date. Include a clear statement about the purpose of the donation. Provide your organization’s name and tax ID number for transparency. Keep the format clean and readable.

Clearly state whether the donation was monetary or in-kind, and include any relevant details. If applicable, mention the method of payment (e.g., credit card, check). Don’t forget to add a thank-you note for the donor’s contribution.

Make sure the receipt indicates whether the donation is tax-deductible, and offer the donor a way to reach out with questions. Keep all information accurate and up-to-date to ensure smooth processing during tax season.

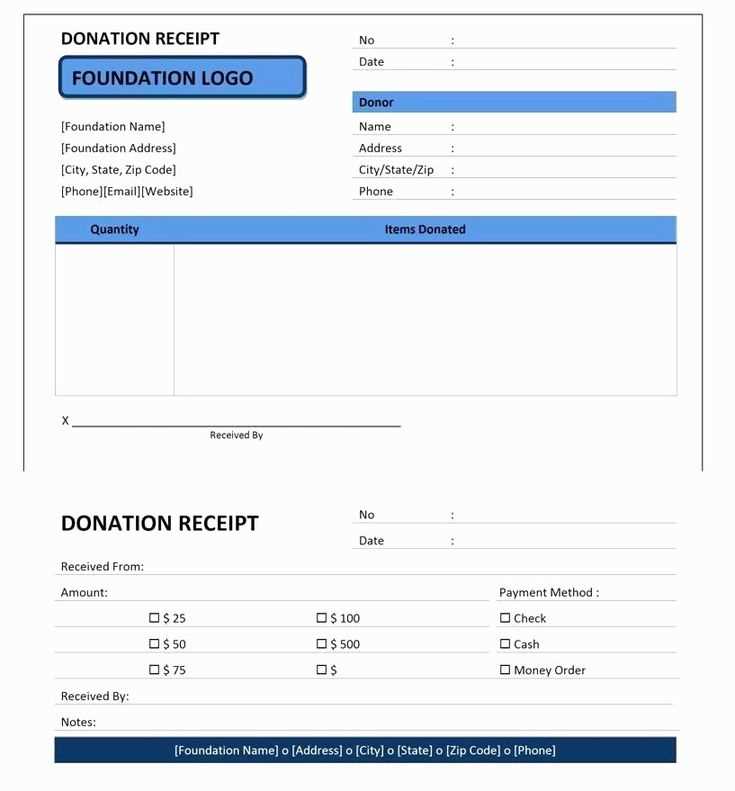

- Donation Receipt Template for Funds

Ensure your donation receipt includes the following key details:

Donor Information

Record the donor’s full name, address, and contact information. This allows you to properly acknowledge their contribution and provide any necessary follow-up communication.

Donation Details

Clearly state the donation amount and the date it was received. If applicable, specify the payment method (e.g., cash, check, credit card) and any designations for the funds (e.g., for a specific program or project). Include the organization’s tax identification number (TIN) for tax purposes, as well as the receipt number for reference.

Lastly, express gratitude for the donor’s support and contribution. This not only reinforces their generosity but also strengthens the donor relationship.

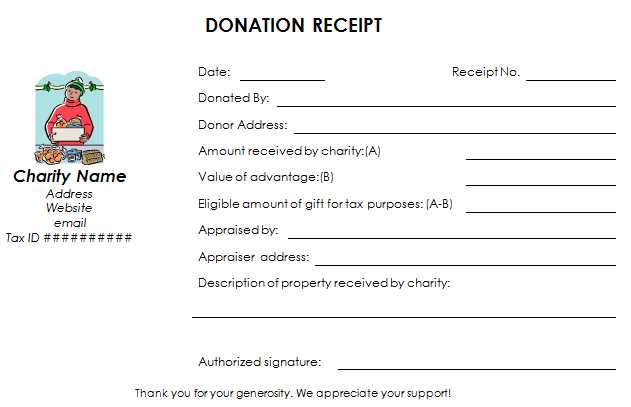

Begin with the donor’s name and contact information at the top of the receipt. This helps ensure clarity for both the donor and the recipient organization.

Next, include a clear statement about the donation. Specify the amount, whether it’s a one-time or recurring donation, and the form of payment used. If applicable, mention any goods or services provided in exchange for the donation.

The date of the donation must be present, as this affects tax documentation and accounting records. Include both the donation’s transaction date and the year for clarity.

Clearly identify the charity or organization receiving the donation, along with their legal name and tax-exempt status. If the organization is registered with the IRS, include their EIN (Employer Identification Number).

Indicate the purpose of the donation, especially if it’s designated for a specific project, campaign, or cause. This allows both parties to track funds effectively and keeps records transparent.

Finally, include a thank-you message. It’s a simple, but meaningful way to acknowledge the donor’s support. Make it personal and express gratitude for their contribution.

Donation receipts must include specific information to comply with tax laws and provide transparency to donors. The receipt must clearly state that the donation is tax-deductible and meet all legal obligations. Here are the key elements to include:

- Organization Name and Details: Include the legal name of your organization, its address, and tax identification number (TIN or EIN). This proves your organization’s legitimacy.

- Donor Information: List the donor’s name and address to confirm the recipient of the donation.

- Donation Date: The exact date of the donation must be recorded to establish when the contribution took place.

- Amount of the Donation: Specify whether the donation is in cash or property. If it’s cash, the exact amount should be stated. For non-cash donations, provide a description of the item and its estimated value.

- Statement of No Goods or Services Provided: If your organization did not provide any goods or services in exchange for the donation, the receipt should clearly state this. If anything was provided, a description and its value must be mentioned.

- Organization’s IRS Status: Clearly state that the organization is a 501(c)(3) or other eligible tax-exempt entity. This informs donors that their donation is eligible for tax deductions.

Ensure these details are included in each receipt to avoid legal complications and provide donors with accurate records for their tax filings.

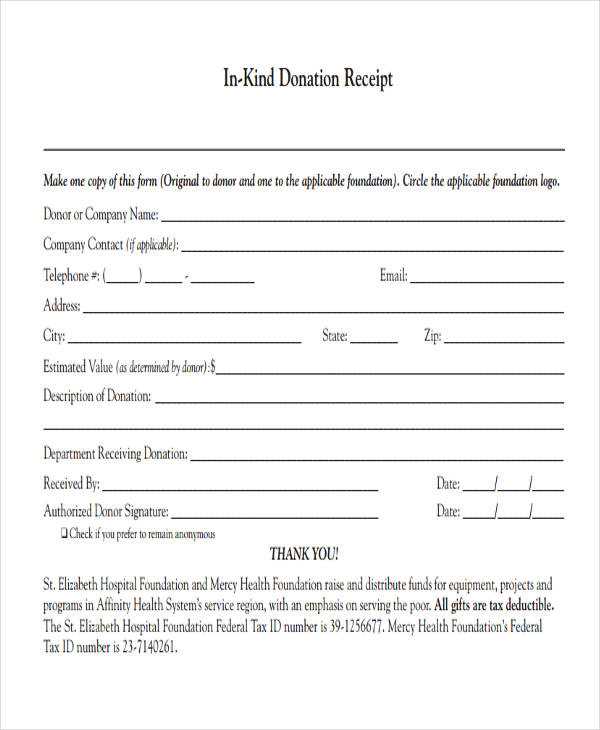

When creating donation receipts, tailor the content based on the donation type to ensure clarity and compliance with tax regulations. For one-time donations, include the exact amount and a clear statement confirming the receipt of the donation. For recurring donations, specify the frequency of the contributions, total amount contributed during the year, and the dates of each donation. This ensures transparency for both the donor and the organization.

For in-kind donations, list a description of the items received along with their estimated value. If possible, provide a specific value range for each item to help donors with tax deductions. In the case of event donations, make sure to highlight any tickets, perks, or benefits that were provided in exchange for the donation. This distinction helps clarify the value of the donation versus the value of the benefits the donor received.

If donations are made anonymously, ensure the receipt does not include any identifying details. However, it should still include the necessary tax-deductible language and a unique transaction ID for future reference. Customizing receipts in this way ensures both compliance and personalized acknowledgment for every type of donation, reinforcing the trust between the donor and the organization.

Ensure each donation receipt includes the donor’s full name, donation amount, and the date of the transaction. This keeps records clear and accessible for both your organization and the donor.

Include Tax Information

For donations that are tax-deductible, provide a statement confirming the donation’s eligibility. Clearly mention that no goods or services were exchanged for the donation if that is the case. This helps donors with their tax filings and ensures compliance with regulations.

Provide an Acknowledgement Statement

Always express gratitude for the donation. A simple thank you note will make donors feel appreciated and encourage future contributions. Include your organization’s contact details for any inquiries or further support.