For any nonprofit organization, maintaining accurate records of donations is key. A donation receipt serves as both a legal document and a token of appreciation to the donor. Use a clear and straightforward template to ensure all necessary details are included for both the donor and the organization.

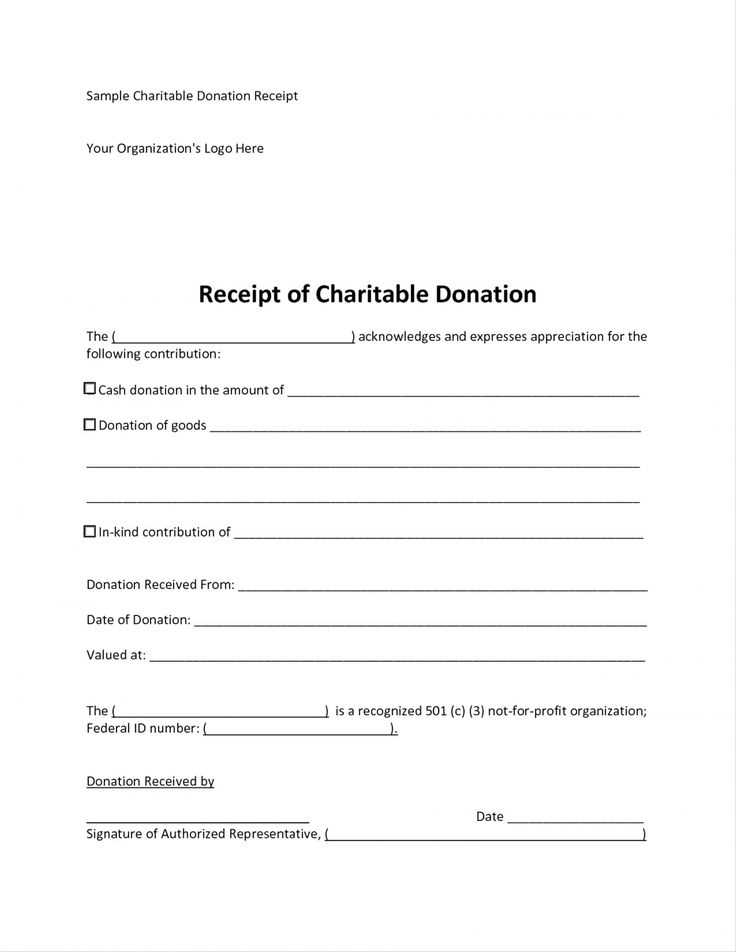

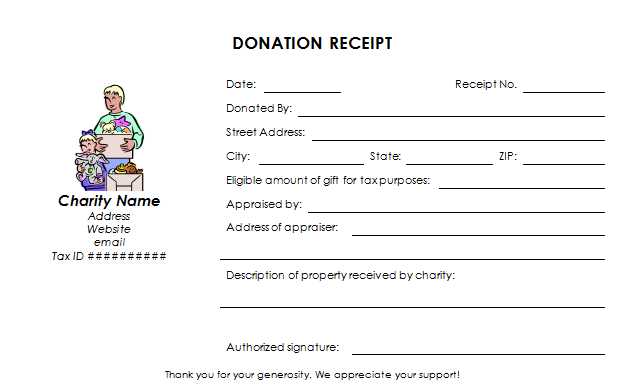

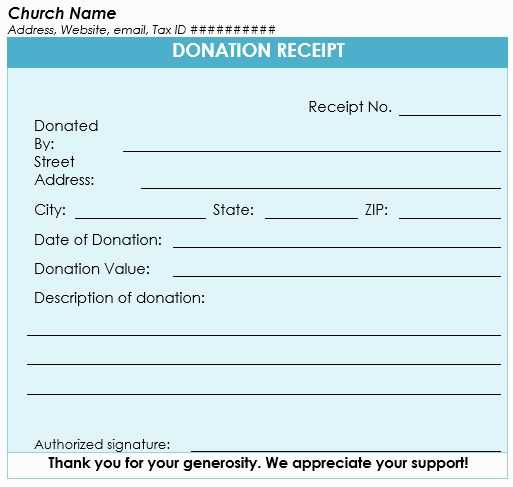

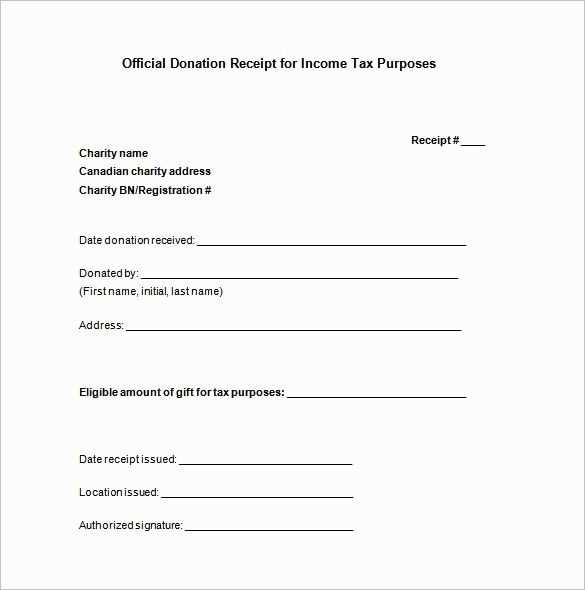

A basic donation receipt template should feature the donor’s name, the organization’s details, the donation amount or description of the gift, and the date of the transaction. It’s important to specify whether the donation is tax-deductible and to include any specific details required for tax reporting purposes.

Make sure to also include a statement such as: “This donation is tax-deductible as allowed by law,” along with the nonprofit’s EIN (Employer Identification Number), which donors may need for tax filings. By providing this information clearly, you make it easier for donors to use the receipt for tax purposes.

In addition, it’s good practice to include a thank you note or a short expression of appreciation. This small gesture can strengthen relationships and encourage future support. Make sure your template leaves enough space for these personal touches while keeping all necessary information organized.

Here is the revised version with minimal repetition of words:

To create a clear and organized donation receipt, include the donor’s name, donation amount, and the date of contribution. Specify whether the gift is monetary or in-kind. If the donation is tax-deductible, ensure that the receipt includes a statement about it, along with the organization’s tax ID number.

Key Details to Include:

| Detail | Description |

|---|---|

| Donor Name | Full name of the donor |

| Donation Amount | Specify the dollar amount or value of goods/services donated |

| Date | Exact date of donation |

| Tax-Deductibility | Statement if the donation is eligible for tax deductions |

| Tax ID | Organization’s tax ID number |

Additional Information

For in-kind donations, describe the items donated, their condition, and an estimated value. Keep the language straightforward to avoid ambiguity. Always ensure the receipt is signed by an authorized individual from the organization.

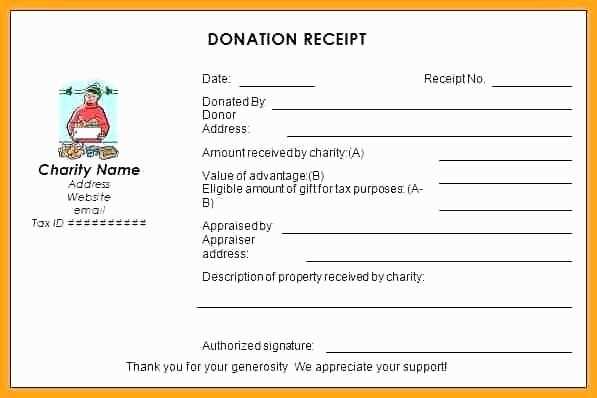

- Donation Receipt Sample Template

To create a clear and accurate donation receipt, ensure the following details are included:

- Donor Information: Full name, address, and contact details of the donor. Include their email or phone number for follow-up communication.

- Organization Details: Name, address, and EIN (Employer Identification Number) of the charity receiving the donation.

- Date of Donation: The exact date when the donation was received. If the donation was in installments, list each transaction separately.

- Amount Donated: Clearly state the amount of the donation. If it’s a non-monetary gift, provide a description of the donated item(s) and estimated value.

- Purpose of Donation: If relevant, include a brief description of how the donation will be used by the organization.

- Statement of No Goods or Services Provided: Mention that no goods or services were exchanged for the donation. If any were, describe them and their value.

- Signature of Authorized Representative: The receipt should be signed by a person authorized by the organization to verify the donation.

This template structure ensures clarity and legal compliance, particularly for tax deductions or record-keeping purposes. Make sure to keep copies of all receipts for organizational audits.

Choose a format that suits both your organization’s needs and the donors’ expectations. A simple and clear structure ensures ease of use. Focus on including all necessary information without unnecessary complexity.

Paper vs. Digital

Decide whether to issue paper receipts, digital receipts, or both. Paper receipts are traditional and tangible, while digital receipts are more efficient and eco-friendly. Digital formats are often preferred for ease of storage and quick retrieval.

Key Elements to Include

Ensure the receipt contains the following key elements:

- Donor’s name and contact information

- Organization’s name, address, and tax identification number (TIN)

- Donation amount and date of the contribution

- Statement confirming the donation is tax-deductible (if applicable)

- Details of any goods or services provided in exchange for the donation

Standard or Customized Design

Opt for a standard format or customize it with your branding. A clean, professional look enhances the donor’s experience. Including your organization’s logo or colors can create a more personalized touch.

Begin with the donor’s name and address. Make sure to mention the specific amount donated and the date of the donation. If the gift is designated for a particular project or cause, include that information clearly. Specify whether the donation was cash, check, or other assets to ensure transparency. If applicable, note any benefits or goods the donor received in return for their contribution. Finally, provide the nonprofit’s tax-exempt status and any relevant legal information, especially if the donor plans to claim the contribution on their taxes. Clear, concise, and accurate details build trust and ensure compliance.

Adjust your donation receipt template based on the specific type of contribution to make it relevant and clear. Tailor the details such as donor information, contribution amount, and tax information to match the contribution type accurately.

1. Monetary Donations

- Include the exact dollar amount donated and the date of the transaction.

- Provide a clear statement that the donation is tax-deductible, if applicable.

- For recurring donations, specify the frequency of the contribution (e.g., monthly, quarterly) and the total donated during the period.

2. In-Kind Donations

- Describe the donated items in detail, including their estimated value, if available.

- Clearly state that no goods or services were provided in exchange for the donation, unless applicable.

- If the donor has provided any items for a specific event or program, note this connection in the receipt.

3. Volunteer Contributions

- For volunteer hours, list the total hours worked and the equivalent value based on your organization’s rate for volunteer work.

- Clarify that this is a non-cash contribution but provide a breakdown of volunteer contributions and their impact.

Customizing each section based on the contribution type ensures your receipts reflect accurate, meaningful information for both the donor and your organization’s records.

Donation acknowledgment letters must meet specific legal criteria depending on the jurisdiction. These letters generally need to include the date of the donation, the name of the donor, and the amount donated. However, the details can vary by region and the type of organization receiving the donation.

U.S. Requirements

In the United States, the IRS mandates that donation acknowledgment letters include the value of any goods or services provided in exchange for the donation. For cash donations over $250, organizations must provide a written acknowledgment containing a statement that no goods or services were exchanged for the donation, or if they were, a description and good-faith estimate of their value. The acknowledgment must be sent by the earlier of the date the donor files their tax return or the due date for the return.

European Union Requirements

In the European Union, different countries have varying standards. For instance, in the UK, donations over £250 require a Gift Aid declaration for tax purposes. The acknowledgment letter must clearly mention that Gift Aid can be claimed and include the donor’s details. Many other EU countries follow similar practices, ensuring that the acknowledgment includes specific tax-related language that complies with local laws.

Prioritize simplicity and clarity. Choose a clean layout with clear, readable fonts. Stick to a font size between 10pt and 12pt for the body text, and make headers slightly larger to separate key sections. Avoid fancy fonts that might hinder readability, and choose standard, easily accessible options like Arial, Helvetica, or Times New Roman.

Key Sections to Include

Ensure the receipt includes essential details: the donor’s name, address, date of the donation, description of the donation, amount, and the non-profit organization’s name and tax ID. Include a thank-you note, but keep it brief. Organize these elements logically and leave enough white space between sections to reduce visual clutter.

Legibility and Consistency

Use consistent spacing and alignment to help the information flow naturally. Align all text to the left for easy scanning, and ensure that all financial figures are formatted uniformly (e.g., $XX.XX). Use bold text or larger font sizes sparingly, only for critical details like the donation amount or date.

Begin by setting up a system to capture donor details. Collect necessary information such as name, donation amount, and date through a form or database. Automating this step ensures no details are missed.

1. Use Donation Management Software

Choose software that integrates donation records with acknowledgment templates. Look for features that allow you to automatically generate receipts and thank-you letters as soon as donations are logged.

2. Create a Template for Acknowledgments

Develop a customizable receipt template that includes all relevant donation information. The template should dynamically fill in donor details like name, amount, and transaction date. Consider using placeholders in your template that are replaced with actual data from your records.

3. Automate the Process with Triggers

Set triggers in your system to automatically generate and send acknowledgments after a donation is processed. This can be configured to send an email, print a receipt, or store the acknowledgment for later use.

4. Integrate with Payment Systems

Ensure that your donation platform is integrated with payment gateways. This helps automatically pull donor data into the acknowledgment system without manual input.

5. Test Your System Regularly

Before fully relying on the automated process, run tests to ensure it works as expected. Test different donation amounts, donor types, and email delivery methods to confirm everything runs smoothly.

6. Monitor and Update Templates

Review and update acknowledgment templates regularly. Ensure they align with your current branding and include any necessary legal language or tax information.

Donation Receipt Sample Template

Creating a donation receipt requires careful attention to detail. Start by including the organization’s name and address at the top of the receipt. Follow it with the donor’s name and address for proper recognition and tax purposes.

Key Details to Include

Make sure to include the donation date, the amount donated, and whether the donation was monetary or in-kind. If the donation is in-kind, provide a description of the items donated along with their estimated value. Clearly state that no goods or services were provided in exchange for the donation, especially for tax-exempt contributions.

Formatting Tips

Keep the receipt layout simple and organized. Use bullet points or numbered lists for clarity. Ensure that the text is legible and the receipt is easy to read. Providing a donation receipt in PDF format or as a printed version ensures the donor can keep a copy for their records.