A donation receipt for a 501(c)(3) organization must include specific details to meet IRS requirements. This ensures that the donor can claim their charitable contribution on their tax return. The receipt should include the name of the organization, its tax-exempt status, the donor’s name, the amount of the donation, and the date it was received.

Make sure to clearly indicate whether the donation was in cash or non-cash items. If it’s a non-cash donation, provide a description of the items received and, if applicable, an estimate of their fair market value. If the donor received any goods or services in exchange for the donation, include a statement that acknowledges this and provides a good-faith estimate of the value of the goods or services.

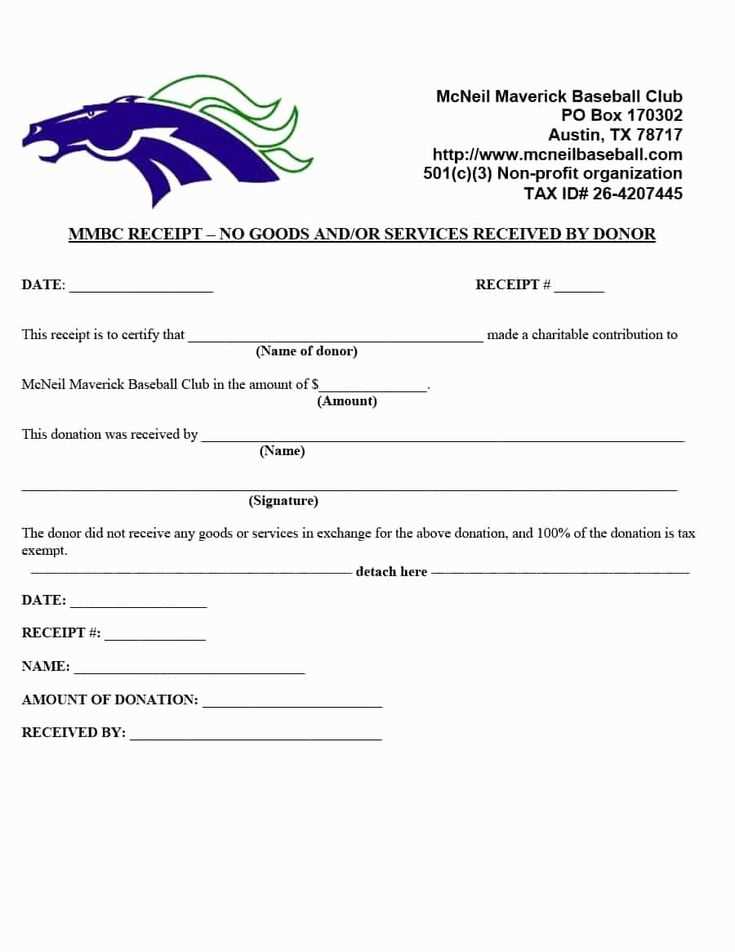

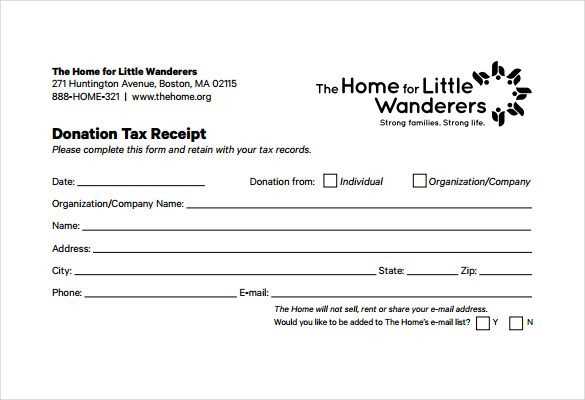

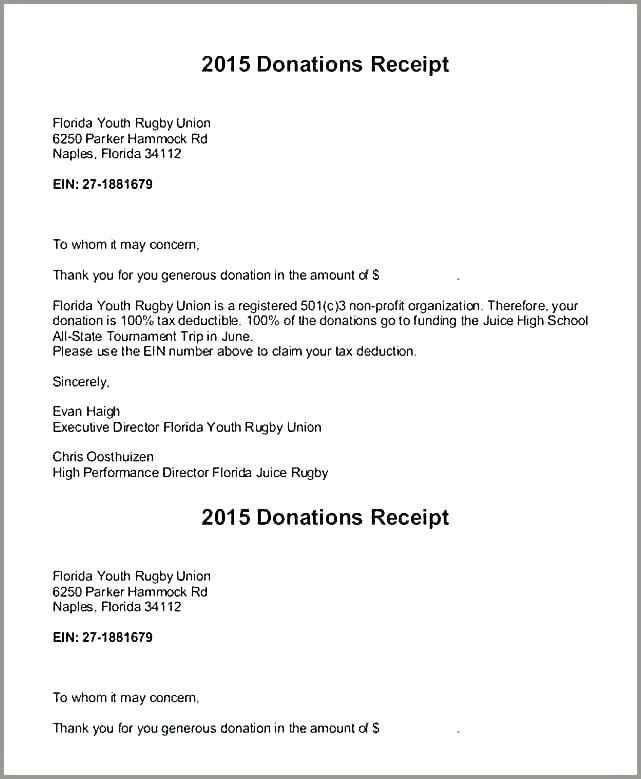

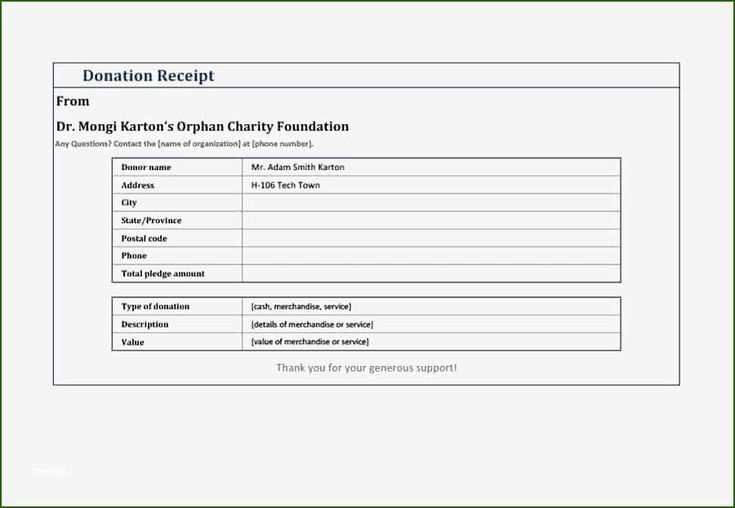

Template Example: Include a template that your organization uses for donations, ensuring it aligns with IRS standards. Include fields for all required information such as donor name, donation amount, and whether the donation was tax-deductible based on the receipt’s specifics. This ensures both the donor and the organization stay compliant with tax regulations.

To simplify the process, create a donation receipt template that can be easily customized for each donor. This ensures consistency and eliminates any errors while ensuring compliance with the 501(c)(3) tax-exempt guidelines.

It seems like you’re diving into creating content related to pin configurations for various connectors and devices. Is there a specific one you’d like help with right now? Let me know how I can assist with your next article or section!

Designing a Tax-Exempt Donation Acknowledgment Letter

Clearly state the name of your organization at the beginning of the letter. Mention that the organization is tax-exempt under section 501(c)(3) to confirm the donor’s contribution is eligible for tax deductions.

Include a specific description of the donation received, including the amount or, if applicable, a description of the donated goods. This helps establish the value of the donation for tax reporting purposes.

Ensure you provide the date the donation was received. This serves as a key reference for the donor’s records and tax filing.

If the donation was a monetary gift, confirm that no goods or services were provided in exchange for the donation. This statement is required by the IRS for tax-exempt acknowledgment letters.

If any goods or services were given in return, clearly describe the value of those items and the amount of the contribution that is tax-deductible. This prevents any confusion regarding the deductible portion of the gift.

End the letter with a warm and appreciative tone, thanking the donor for their generosity. Make it personal, reflecting how their support contributes to the mission of the organization.

Including Required Legal Information for 501c3 Status

To meet IRS requirements, a donation receipt must clearly state the donor’s contribution, the nonprofit’s 501c3 status, and specific tax-related information. Here’s what to include:

- Nonprofit Status Statement: Clearly state that the organization is a 501c3 tax-exempt entity. This statement should specify that donations are tax-deductible to the extent allowed by law. For example: “This organization is a 501c3 tax-exempt organization. Contributions are tax-deductible as allowed by law.”

- Tax Identification Number (TIN): Include the nonprofit’s IRS-assigned Employer Identification Number (EIN). This number verifies the nonprofit’s legal status. Make sure it’s displayed in the receipt, typically near the nonprofit name.

- No Goods or Services Provided: If the donation was entirely monetary and no goods or services were exchanged, this must be clearly noted. For example: “No goods or services were provided in exchange for this contribution.” If items were provided, list their fair market value.

- Amount of Donation: Clearly list the donation amount. For non-cash donations, provide a description of the donated property, but not an estimate of its value.

- Date of Donation: Include the exact date the donation was made. This is critical for tax deduction purposes.

Additional Recommendations

- Nonprofit Name and Address: Always include the full legal name and address of the nonprofit organization on the receipt for verification purposes.

- Donor Information: Include the donor’s name and address. This information helps ensure that the tax records match the donor’s filings.

- Receipt Number: Assign a unique identification number to each donation receipt for record-keeping and auditing purposes.

Customizing the Template for Different Donation Types

Adjust your donation receipt template based on the type of contribution. For cash donations, ensure the template includes a clear statement acknowledging the amount and the date of the donation. If a donor contributed goods or services, provide an accurate description and estimated value. In both cases, avoid overstating values, as the IRS requires fair market value assessments.

For Monetary Donations

For monetary gifts, the template should specify the exact donation amount and the payment method (cash, check, online transfer, etc.). This helps maintain clarity for both the donor and the organization. Make sure to include the nonprofit’s tax ID number for tax deduction purposes, as it is required by the IRS.

For Non-Cash Donations

Non-cash contributions require a detailed description of the donated items or services. List each item separately, providing a brief explanation and valuation. If the valuation is determined by the donor, make a note that it is the donor’s estimate. Include an itemized list for donations over $500 to meet IRS requirements.

| Donation Type | Required Details | Additional Notes |

|---|---|---|

| Monetary | Amount, Date, Payment Method | Include Nonprofit’s Tax ID Number |

| Non-Cash (Goods/Services) | Item Description, Estimated Value, Date | List items separately for donations over $500 |

Tailoring your template to reflect these details will help donors keep track of their contributions and ensure the nonprofit remains compliant with IRS guidelines. It also helps prevent misunderstandings during tax filing season.