To create a donation receipt template for use in Australia, start by ensuring it complies with the Australian Taxation Office (ATO) requirements. The receipt must include specific information to make the donation tax-deductible for the donor, such as the donor’s name, the donation amount, and the date of the donation.

Include the organization’s name and details of its registered charity status. This helps verify that the donation is eligible for tax benefits. If applicable, mention if the donation is tax-deductible, as not all donations qualify under Australian law.

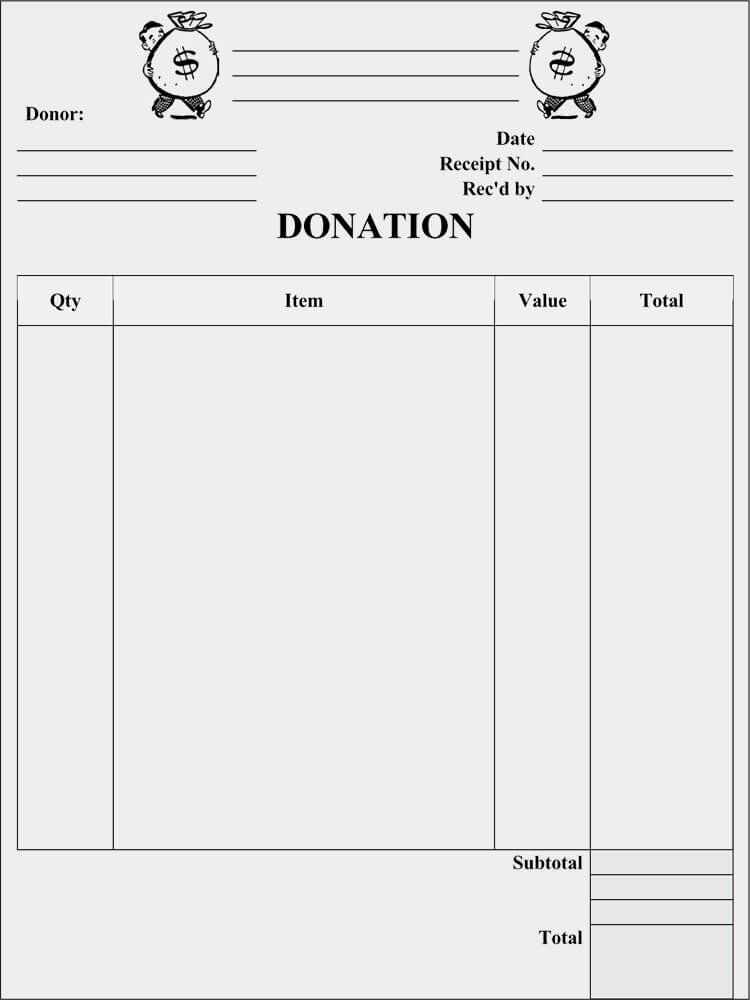

Next, provide clear information on the type of donation. For monetary donations, state the exact amount received. If goods or services were donated, describe them accurately and provide a fair market value. This ensures transparency and clarity for both parties.

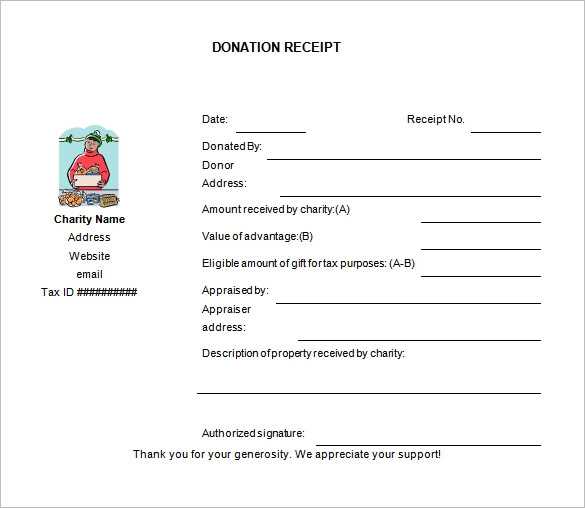

Don’t forget to include a statement confirming no goods or services were provided in exchange for the donation, as this is required for tax deduction purposes in Australia. Lastly, make sure the receipt is signed by an authorized representative of the charity, adding credibility to the document.

Here’s the corrected version:

Ensure your donation receipt includes the following details to comply with Australian tax laws:

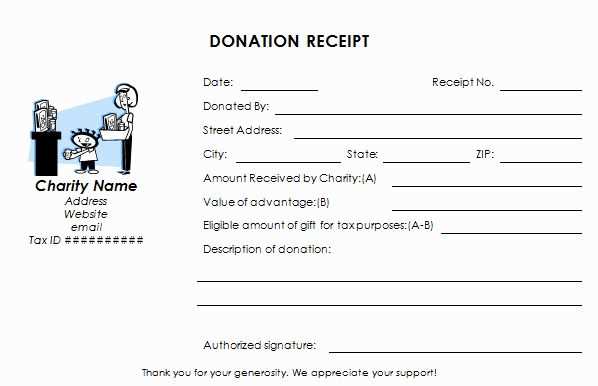

- Donor Information: Full name, address, and contact details.

- Charity Information: Name of the charity, ABN (Australian Business Number), and registration details.

- Donation Details: Amount donated, date of donation, and a brief description of the donation (cash, goods, etc.).

- Receipt Number: Assign a unique receipt number for record-keeping purposes.

- Statement of Deductibility: Clearly state if the donation is tax-deductible under Australian law.

Additional Tips:

- Ensure all receipts are numbered sequentially for easy tracking.

- If the donation is in-kind (goods or services), specify the nature and value of the donation.

- Provide a thank you note along with the receipt to acknowledge the donor’s contribution.

Always keep a copy of each receipt for your records and issue them promptly after receiving the donation.

- Donation Receipt Template Australia

For organizations in Australia, it’s crucial to issue donation receipts that meet legal and tax requirements. A donation receipt should include specific details to ensure both the donor and the organization comply with regulations set by the Australian Taxation Office (ATO). The key components of a valid receipt are:

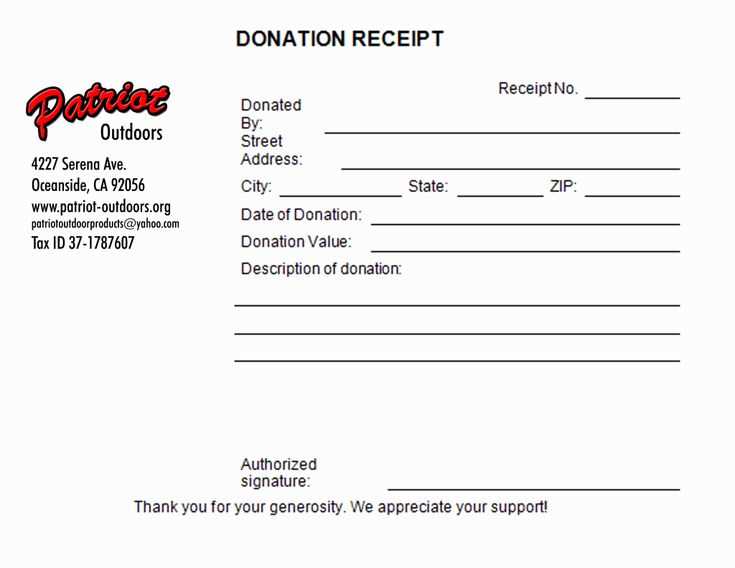

- Organization details: Include the legal name of the organization, address, and Australian Business Number (ABN).

- Donor information: Record the donor’s name and contact information. Ensure it matches the details on file.

- Donation amount: Specify the exact amount donated. If it’s a non-monetary donation, describe the item and its estimated value.

- Date of donation: Include the date the donation was received. This helps in establishing the tax year in which the donation is eligible for deductions.

- Statement of no goods or services received: If the donor did not receive any goods or services in return for the donation, a statement should be included, such as: “No goods or services were provided in exchange for this donation.”

- Charitable status confirmation: A statement confirming that the organization is a registered charity, making donations tax-deductible.

- Receipt number: To maintain proper record-keeping, assign a unique receipt number to each donation.

This template ensures transparency and provides donors with the necessary information for tax purposes. It’s a simple yet effective way to maintain compliance while acknowledging the generosity of those who contribute. Make sure the receipt is provided in a timely manner, ideally within 30 days of receiving the donation.

Ensure your donation receipt includes specific details to meet Australian legal requirements. The key elements to include are the charity’s name, the Australian Business Number (ABN), and the receipt number. These details establish the receipt’s authenticity and traceability.

Include the Date and Amount

The donation date must be clearly stated, along with the total amount donated. If the donation is in-kind, such as goods or services, include a description and the estimated value. Cash donations should be itemised with the total sum provided.

Provide Donor Information

List the donor’s name and address, ensuring that it matches the records held by the charity. If the donation is anonymous, note that on the receipt. This will help the donor claim any tax deductions they are entitled to.

If the donation exceeds $2,000, include a statement that the donor has not received any goods or services in return for their contribution. This ensures the receipt meets the ATO’s criteria for claiming tax deductions.

By following these steps, you’ll create a legally compliant donation receipt that both satisfies Australian regulations and supports the donor’s tax claims.

To ensure your donation receipt is valid for tax deduction purposes in Australia, include the following key details:

1. Organization Details

Provide the legal name of the organization receiving the donation, along with their Australian Business Number (ABN). This information verifies that the donation was made to a registered charity.

2. Date and Amount of Donation

Clearly state the date the donation was made, along with the exact monetary value of the contribution. If the donation is non-cash (e.g., goods), include an estimated market value of the donated items.

3. Acknowledgment of the Donation

Include a statement acknowledging that no goods or services were provided in exchange for the donation, as per the requirements for tax-deductible donations.

4. Receipt Number and Transaction Details

Each receipt should have a unique number for tracking purposes. Include transaction details such as payment method (cash, card, bank transfer) to help both the donor and organization keep accurate records.

5. Donation Purpose (Optional)

If the donation was intended for a specific project or fund, it’s helpful to note this on the receipt. This makes it easier for the donor to claim the deduction on their tax return.

Sample Receipt Template

| Field | Details |

|---|---|

| Organization Name | ABC Charity Ltd |

| ABN | 12 345 678 901 |

| Donation Date | 15 March 2025 |

| Donation Amount | $100.00 |

| Acknowledgment Statement | No goods or services were provided in exchange for this donation. |

| Receipt Number | 123456789 |

Make sure your receipt contains all of these elements to ensure it meets tax deduction requirements and simplifies the donor’s tax filing process.

Tailor the donation receipt template to match the nature of each donation type. For one-time donations, include a section for a clear, fixed amount with date and payment method. A recurring donation template should note the frequency, total donation amount, and the next scheduled donation date.

One-Time Donations

For one-time contributions, emphasize a simple format that includes the donor’s name, the exact amount donated, and the transaction method. You may also add a section for tax deductibility if applicable. Clearly highlight the donation date and reference number for future records.

Recurring Donations

Recurring donations require a more detailed approach. Include a breakdown of the donation schedule (weekly, monthly, annually), and the total contribution to date. It’s also helpful to provide a reminder about upcoming payments and potential changes to the donation amount.

Always update the template to reflect any relevant changes such as tax laws or organizational preferences. A customized receipt helps maintain accurate records and strengthens donor relations.

Donation Receipt Template Australia

When creating a donation receipt template for Australia, it’s critical to include specific details. Begin with the name of the charity, its Australian Business Number (ABN), and the donor’s name. Ensure you specify the amount donated and the date of the contribution. Acknowledge if any goods or services were provided in exchange for the donation. This helps to maintain compliance with Australian tax laws.

For tax-deductible donations, include a clear statement that the donation is tax-deductible. Avoid vague terms. Be concise but ensure the donor understands their rights. A receipt should also have the charity’s contact details for any inquiries regarding the donation.

Use a simple, clear format. Keep the language precise so that both the donor and the charity have an easy reference for tax purposes. You may also want to add a unique receipt number to ensure traceability. This number helps in record-keeping and can simplify accounting for both parties.

By focusing on these key elements, you ensure the receipt meets all necessary requirements and avoids confusion. Always check the latest regulations to stay updated with any changes to legal requirements or tax benefits for donors in Australia.