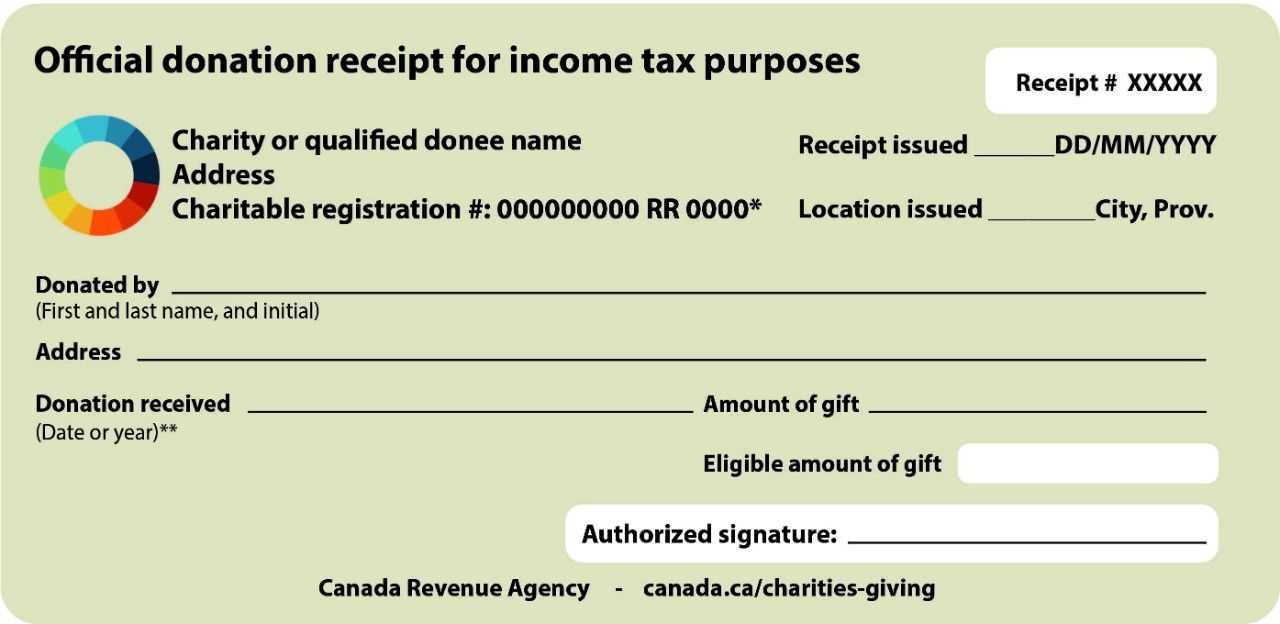

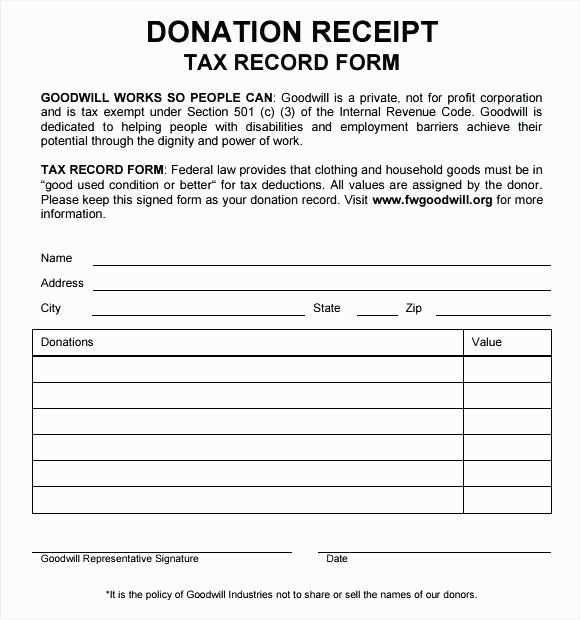

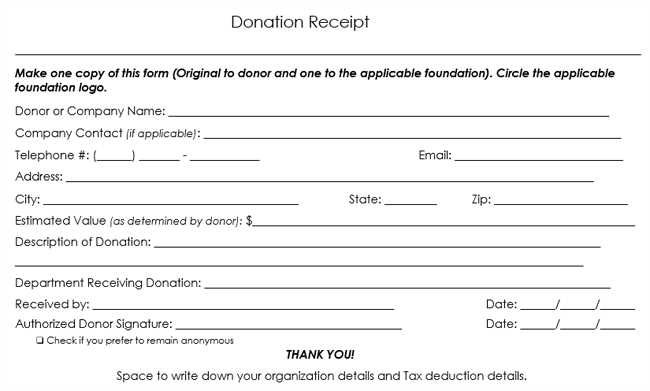

To create a donation receipt that complies with the Canada Revenue Agency (CRA) requirements, ensure it includes all necessary details for both the donor and the organization. A proper template should contain the donor’s name, address, and donation amount, along with a clear statement of the charity’s name and registration number.

Make sure to include the date of the donation, a description of the gift, and the signature of an authorized representative of the charity. If the donation was a non-monetary gift, provide a description of the property and its fair market value. Always issue receipts for donations over $20, as per CRA guidelines.

Double-check that the receipt clearly states that no goods or services were provided in exchange for the donation, as this is a key requirement. Additionally, ensure your organization’s information is up to date and compliant with CRA standards to avoid any issues during audits or verification processes.

Donation Receipt Template for CRA

To create a donation receipt that meets CRA requirements, ensure the document includes the following key elements:

- Organization’s Name and Contact Info: Clearly state the name of the charitable organization and its contact details.

- Date of Donation: Record the exact date of the contribution to validate the donation year.

- Amount Donated: Specify the total value of the donation, including cash or non-cash items. If applicable, estimate the fair market value of goods.

- CRA Registration Number: Include the organization’s charitable registration number issued by the CRA.

- Receipt Number: Assign a unique identifier to each receipt for tracking and reporting purposes.

- Signature: The signature of an authorized person within the organization verifies the authenticity of the receipt.

By including these elements, the receipt will meet CRA standards and help donors claim eligible tax benefits. Ensure the format is clear, concise, and easy for both the organization and donor to understand.

How to Create a Valid Donation Receipt

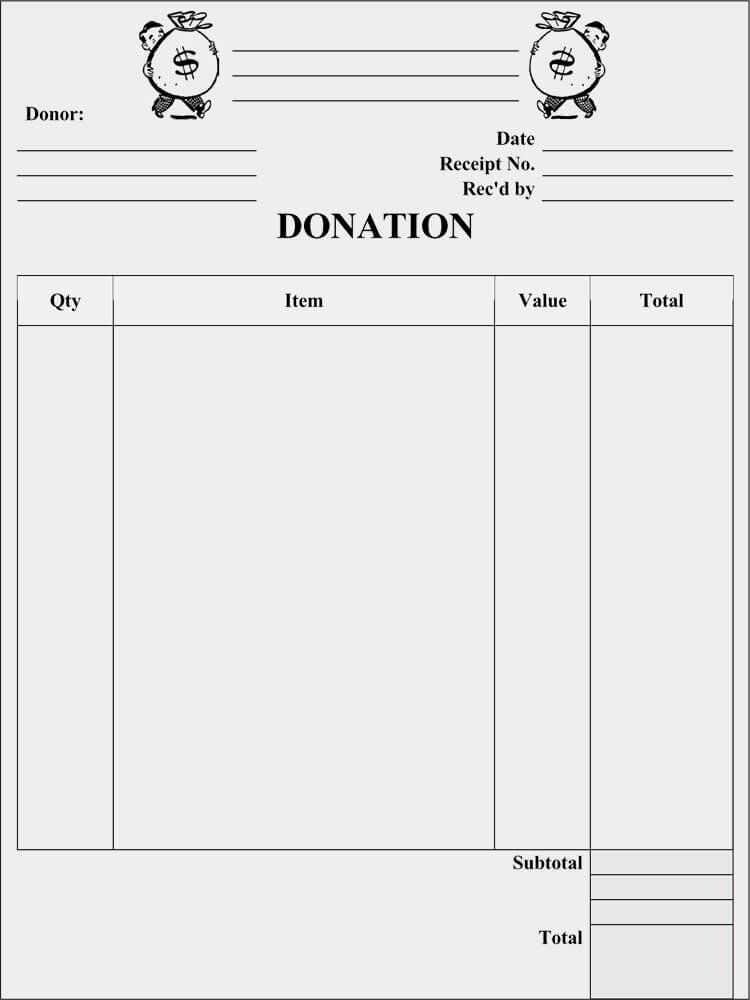

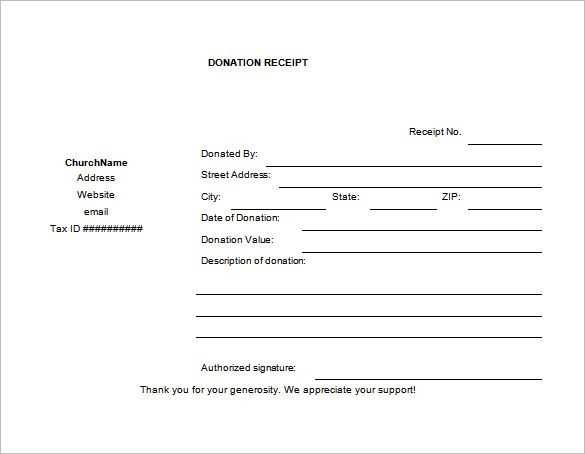

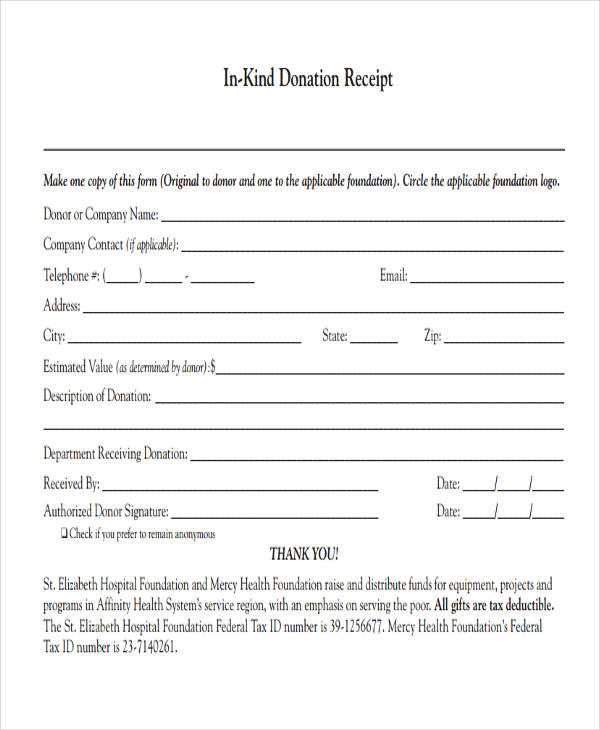

To create a valid donation receipt, include the donor’s full name and address. Ensure the receipt specifies the date of donation and the amount given. If the donation is non-monetary, describe the donated items with enough detail to verify their value. If applicable, state the fair market value of the items donated.

The receipt should also confirm whether the donor received anything in return for the donation. A simple statement like “No goods or services were provided in exchange for this gift” is usually sufficient for tax purposes. Ensure your organization’s name, address, and registration number are included to validate the receipt.

Finally, include a unique receipt number and the signature of an authorized person from your organization. This step reinforces the legitimacy of the receipt and helps with record-keeping. Always double-check that the information is accurate and complete before issuing the receipt to the donor.

Essential Information for the Receipt

Include the full name of the organization that received the donation. This provides clarity on where the donation went.

Clearly state the date of the donation. It helps to establish a timeline for tax purposes and record-keeping.

Provide the donor’s details: their full name and address. This ensures proper acknowledgment and makes it easier for both parties to verify the donation.

Donation Amount and Description

Specify the exact amount donated. If the donation includes goods, provide a description of the items and their approximate value.

Tax Exemption Status

If the organization is registered as a charity, mention the registration number. This clarifies its tax-exempt status, making the receipt valid for tax deductions.

Lastly, include a statement that the donor did not receive any goods or services in exchange for the donation, unless applicable. This statement solidifies the receipt’s legitimacy for tax filings.

Common Errors to Avoid When Issuing Receipts

Ensure the donation amount is accurate. Double-check the figures before finalizing the receipt to prevent discrepancies that could confuse the donor or the tax authority.

Always include the donor’s full name and address. Missing or incorrect details could make the receipt invalid for tax purposes. Verify the information with the donor before issuing the receipt.

Don’t omit the organization’s registration number or tax identification number. This is a legal requirement and helps verify the authenticity of the donation receipt.

- Confirm the date of the donation is correct.

- Include a clear description of the donated items or money.

Avoid using ambiguous wording like “general donation.” Be specific about the amount or item donated to ensure clarity.

Check that the receipt reflects the correct donation type. If the contribution is in-kind, the value must be stated appropriately.

Don’t forget to thank the donor in a polite and appreciative manner. It helps strengthen the relationship and encourages future contributions.

Lastly, ensure the receipt is signed by an authorized person within the organization. This confirms its validity and authenticity.