If you are looking to create a donation receipt template in a doc format, it’s crucial to include the necessary details that ensure both clarity and compliance. A well-structured donation receipt not only serves as proof of the transaction but also helps donors track their contributions for tax purposes.

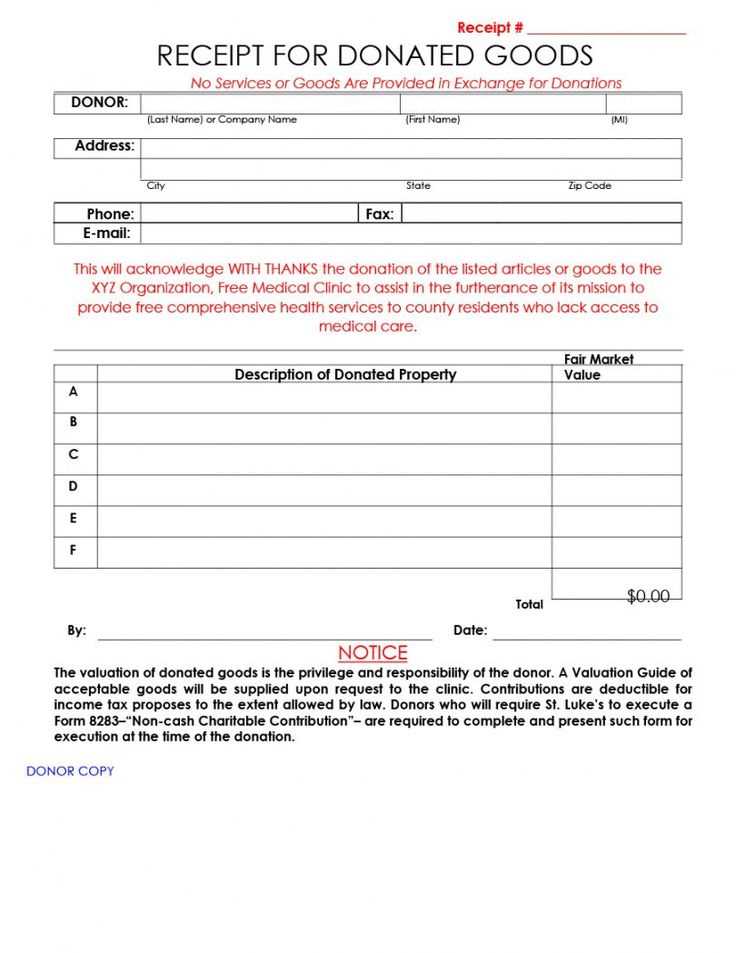

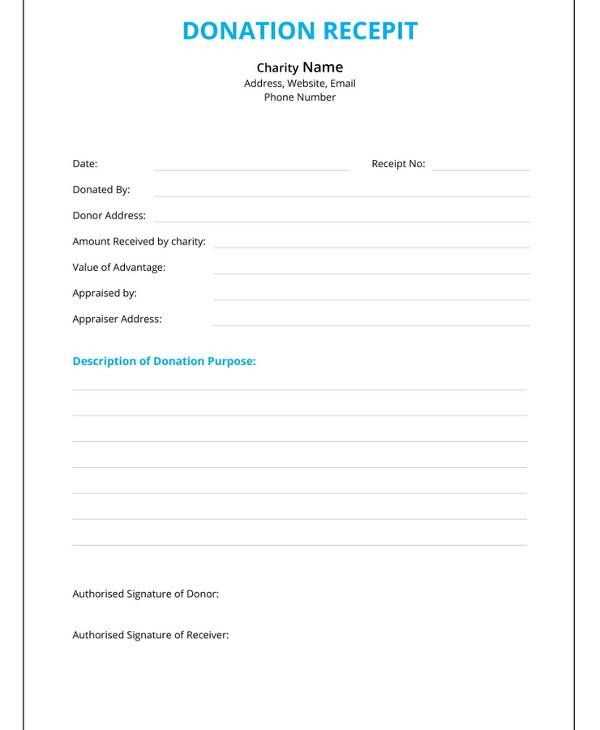

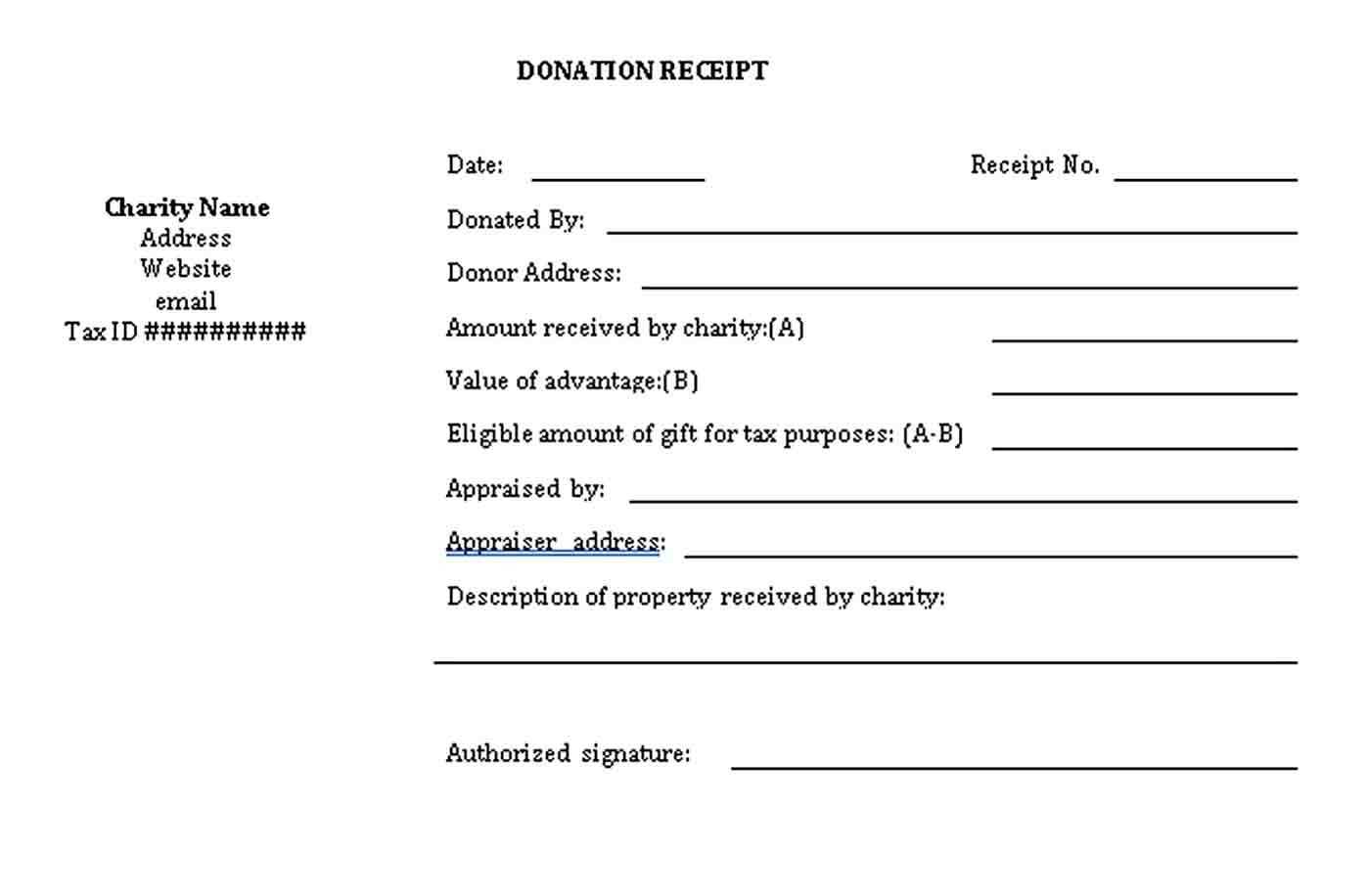

Your template should start with the donor’s name and contact information, followed by the date of the donation and the amount donated. Be sure to specify whether the donation is monetary or an in-kind gift, and provide a description of the item if applicable. Always include the organization’s name, address, and contact details for transparency and legitimacy.

In addition to basic information, make it clear if any goods or services were provided in exchange for the donation, as this may affect the donor’s tax deduction eligibility. A simple statement like “No goods or services were provided in exchange for this donation” can suffice. If there was something offered in return, provide an estimated value for the goods or services provided.

Conclude your template with a thank you message, expressing appreciation for the donor’s contribution. This gesture not only shows gratitude but also strengthens the relationship between your organization and its supporters.

Here are the corrected lines with repeated words removed:

Remove redundancies in your donation receipt template by checking for overused phrases. For example, “donation contribution” can be simplified to “donation.” Instead of “receipt document,” use “receipt.” If you notice other duplications like “thank you very much” or “sincere gratitude,” opt for one phrase for clarity. A clean, concise statement enhances professionalism in your documentation.

Another key area is the elimination of unnecessary qualifiers. For example, instead of “the donation given,” simply say “the donation.” If you find sentences with repeating terms like “donor contributor,” streamline it to “donor.” Each correction helps the document look more polished and focused on the recipient’s information.

- Donation Receipt Template Document

Creating a donation receipt template requires clear details to ensure legal compliance and transparency. Start with basic information like the name of the donor, the amount donated, and the date of the donation. This should be followed by a brief description of the charity or organization receiving the donation. Always specify whether the donation was monetary or in-kind, and if applicable, the fair market value of non-cash contributions.

Key Elements to Include

Each receipt should clearly state the following:

- Donor’s Name: The full name of the donor.

- Donation Amount: Specify the exact amount of money or a description of the goods donated.

- Date of Donation: The exact date when the donation was made.

- Organization’s Name and Address: Include the charity or organization’s legal name, address, and any registration numbers if applicable.

- Tax-Exempt Status: If the organization is registered as tax-exempt, mention this, along with the IRS 501(c)(3) number if in the U.S.

- Statement of No Goods or Services Provided: Confirm whether the donor received anything in return for the donation. If goods or services were provided, include an estimate of their value.

Template Example

Here’s a simple structure for a donation receipt template:

[Organization Name]

[Address Line 1]

[Address Line 2]

[City, State, Zip Code]

Phone: [Organization’s Contact Number]

Email: [Organization’s Email Address]

Date: [Date of Donation]

Receipt No: [Receipt Number]

Donor’s Information:

Name: [Donor’s Full Name]

Address: [Donor’s Address]

Email: [Donor’s Email]

Donation Details:

Amount Donated: [Donation Amount]

Description of Goods (if applicable): [Item Description and Value]

Statement of Goods or Services Provided:

[State if any goods or services were provided. If not, state “No goods or services were provided in exchange for this donation.”]

Tax-Exempt Status:

[Tax-Exempt Statement if applicable]

Thank you for your generous support!

Open Microsoft Word and start with a blank document. At the top, include your organization’s name and contact details, such as address, phone number, and email. Ensure this information is clearly visible and easy to find.

Next, add a title like “Donation Receipt” in a bold, large font. This helps recipients identify the document right away.

Below the title, include the donor’s name, address, and contact information. This verifies that the receipt is linked to the right person or entity. For individual donations, make sure to capture the full legal name of the donor.

State the donation amount, including the currency, and describe what was donated (cash, check, items). If relevant, include the check number or transaction ID for tracking purposes.

Include the donation date. This is essential for both the donor and the organization for record-keeping and tax purposes.

If the donation was a non-cash gift, provide a description of the item(s) donated and their estimated value. This helps both parties in case of audits or tax-related questions.

Make sure to note if any goods or services were exchanged in return for the donation, as this can affect the donor’s tax deductions. If there were no goods or services provided, include a statement to this effect, such as “No goods or services were provided in exchange for this donation.”

Finally, thank the donor for their generosity. A short, sincere thank-you note goes a long way in building strong relationships.

Once all the details are filled in, save the document as a template to streamline future receipts. You can customize it for different types of donations as needed.

List the donor’s name and contact details clearly at the top of the receipt. This ensures proper documentation and helps to identify the donor for future reference or communication.

Donation Information

Specify the donation type (cash, check, or goods). For cash donations, include the exact amount contributed. For non-cash donations, provide a detailed description of the items and their fair market value. This allows the donor to calculate their tax deduction accurately.

Tax Status and Acknowledgment

Include the organization’s tax-exempt status, such as the IRS designation or tax ID number. If any goods or services were exchanged, disclose their value to comply with IRS regulations. If no goods or services were received, note this as well. A brief thank you message adds a personal touch to the receipt.

Using donation receipt templates requires attention to detail to ensure they meet legal requirements and provide accurate information. Here are some common mistakes to avoid:

- Missing Donor Information: Always include the donor’s full name, address, and contact details. Incomplete data may lead to confusion and tax issues later.

- Incorrect Date Format: Ensure the donation date is accurate and presented clearly. A misplaced date can cause discrepancies, especially for tax deductions.

- Omitting Donation Amount: Clearly state the exact amount of the donation, specifying whether it’s a cash donation, check, or in-kind contribution.

- Failure to State Tax-Exempt Status: If your organization is tax-exempt, include this information. It’s crucial for donors to claim deductions on their taxes.

- Not Including a Unique Receipt Number: Assign a unique identifier to each receipt to avoid confusion with multiple donations. This helps in record keeping.

- Not Acknowledging Non-Cash Donations Properly: For non-cash donations, provide an accurate description of the donated item or service and an estimated value, if applicable.

- Incorrect Language in the Template: Be precise with the language used in the receipt. Avoid ambiguous terms that may cause misunderstanding or compliance issues.

- Failure to Sign the Receipt: Depending on your jurisdiction, the receipt may need to be signed by an authorized person within the organization.

- Not Providing a Thank You Note: While not legally required, including a brief thank-you note enhances donor relations and encourages continued support.

Avoiding these errors will help ensure that your receipts are both accurate and compliant, making the donation process smoother for both your organization and donors.

Ensure that the donation receipt template includes clear and concise data, making it easy for donors to understand and use for tax purposes. Here’s a recommended structure for the donation receipt template.

Donation Receipt Structure

Follow a straightforward format for the donation receipt to maintain clarity. The document should cover the following sections:

| Field | Description |

|---|---|

| Donor Information | Include the full name of the donor, as well as their address or email if necessary for future correspondence. |

| Donation Amount | Clearly state the total donation amount. For non-monetary gifts, include a description of the item and its estimated value. |

| Organization Name | Provide the name and official address of your nonprofit organization. Ensure the tax-exempt status is also included. |

| Donation Date | Indicate the exact date the donation was received. |

| Goods or Services Provided | If the donor received goods or services in exchange for their donation, include a clear description. |

| Authorized Signature | Include space for the signature of the authorized representative of your organization. |

Formatting Recommendations

Organize the content logically to enhance readability. Start with the donor’s details, followed by the donation specifics, and finish with the organization’s information and signature. Keep the document simple but thorough to avoid confusion and ensure compliance for tax deduction purposes.