If you manage donations for a nonprofit or personal cause, creating a clear and structured donation receipt is crucial. A well-organized Excel template for donation receipts simplifies the process and ensures accuracy for both you and your donors.

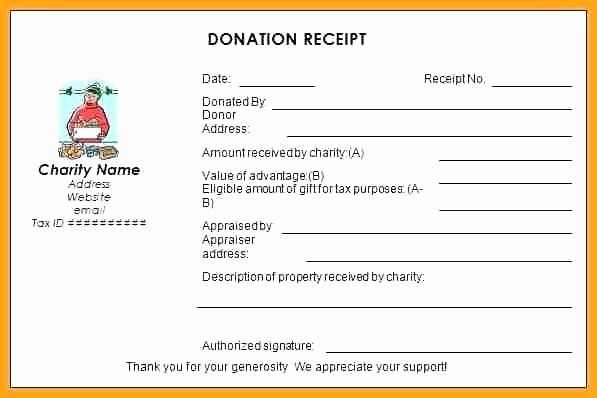

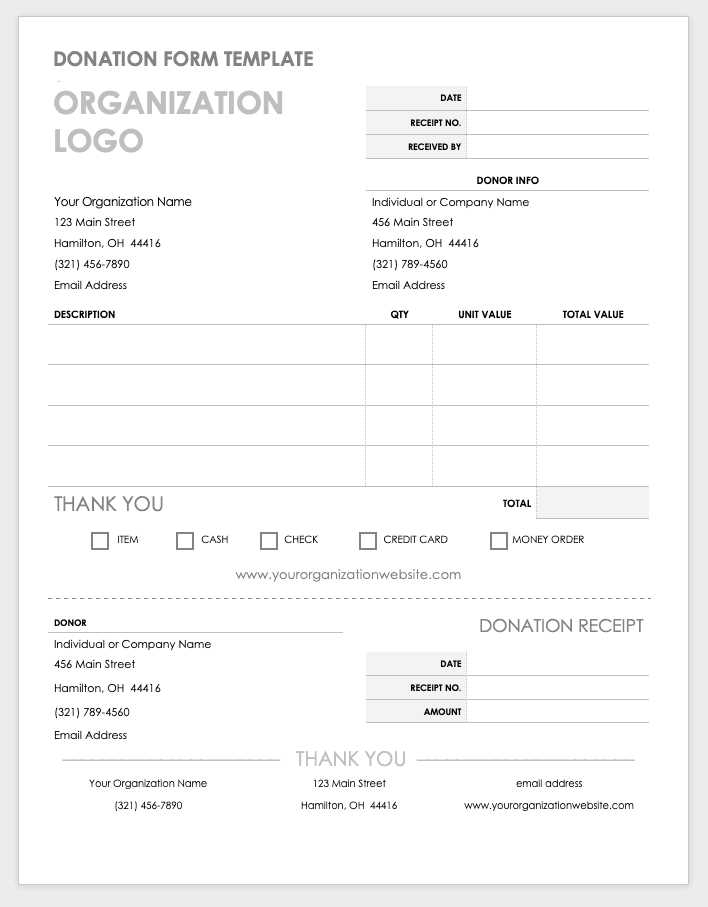

The first step is to include essential information: donor name, donation amount, date, and a brief description of the donation. You can easily customize an Excel template to include these fields and others, such as donor contact details and donation method, to tailor it to your needs.

To make the template user-friendly, consider setting up formulas that automatically calculate totals and summaries for different donation categories. This minimizes errors and saves time when tracking donations for multiple events or campaigns. You can also add a thank you note or a personalized message to show appreciation to your donors.

Using a simple, customizable Excel template not only improves efficiency but also ensures your receipts are professional and consistent. Whether for tax purposes or donor acknowledgment, having a standardized format helps keep everything organized.

Here are the corrected lines with reduced repetitions while maintaining the meaning:

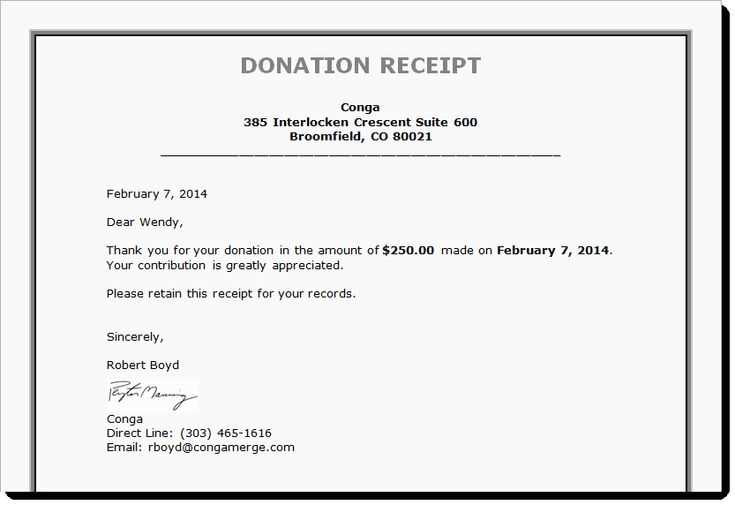

Focus on simplifying the information without losing the key details. For example, instead of stating “We kindly ask for your donation, and your generous contribution is appreciated,” try: “We appreciate your generous donation.” This reduces redundancy while keeping the message intact.

When dealing with donation amounts, avoid stating the same information in multiple places. Instead of saying “A donation of $50 will help, and $50 will be used to support our cause,” simplify it to: “A $50 donation will support our cause.”

Clear and Direct Communication

Make each sentence purposeful. For example, replace “Your contribution will help us, and we sincerely thank you for your support,” with: “Your contribution supports our work, and we thank you for it.”

Consistency Across Statements

Ensure consistency in language. Instead of repeating phrases like “We welcome your donation,” “We are thankful for your donation,” streamline it to: “Your donation is greatly appreciated.”

- Donation Receipt Template Excel: Practical Guide

Creating a donation receipt in Excel is straightforward and highly customizable. First, open a new spreadsheet and create columns for the donor’s name, donation amount, date of donation, and purpose of the donation. Ensure each column is clearly labeled for easy data entry.

To make the template more structured, use Excel’s built-in formatting options. Apply bold text to headers, and adjust column widths to fit the data properly. This helps avoid clutter and ensures readability. You can also use conditional formatting to highlight specific donation types or amounts, which will make it easier to categorize donations at a glance.

When including the donation amount, format the cell as currency to automatically apply the correct symbols and decimal points. You can also set up a total donation field at the bottom, using the SUM function to automatically calculate the total for the donor or organization.

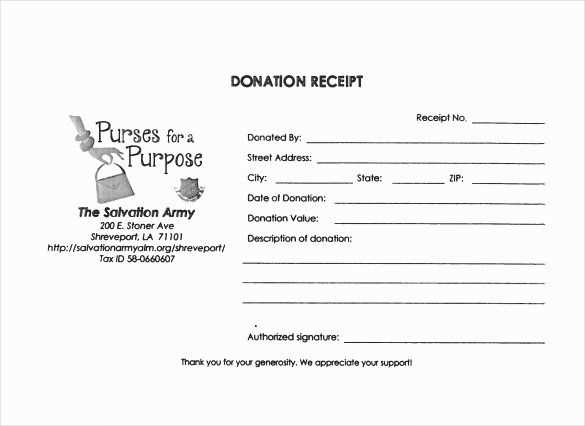

Don’t forget to add a receipt number and the organization’s contact information in the template. This provides legitimacy and allows for easy reference if needed. Customizing the footer with legal disclaimers, or tax-exempt status, will give a professional look and ensure the receipt meets regulatory requirements.

Lastly, save the template as a reusable file, so it can be adapted for different donors. With Excel’s flexibility, you can modify the template to suit the needs of your organization or any particular event.

Creating a donation receipt template in Excel is straightforward and allows you to generate personalized receipts for each donor quickly. Follow these steps to make one yourself.

Step 1: Set Up Basic Structure

Begin by opening a new Excel sheet. Label the first row with headers such as:

- Receipt Number

- Donor Name

- Donation Amount

- Date of Donation

- Donor Address

- Donation Type (Cash, Check, etc.)

- Organization Name

- Tax ID Number (if applicable)

Step 2: Enter Data

After setting the structure, you can input data into each corresponding row for each donor. Fill in details like donor names, donation amounts, and other relevant information.

Step 3: Formatting

Use Excel’s built-in formatting tools to make your receipt look professional:

- Bold the header row to make it stand out.

- Adjust the column widths to ensure all text is visible.

- Use borders or shading to separate sections for clarity.

Step 4: Add Formulas for Total Amounts

If you want to calculate the total donations, use the SUM function. Enter the formula at the bottom of the ‘Donation Amount’ column to calculate the total.

Step 5: Save and Reuse Template

Save your file as a template so you can use it for future donations. Simply enter new information without altering the structure.

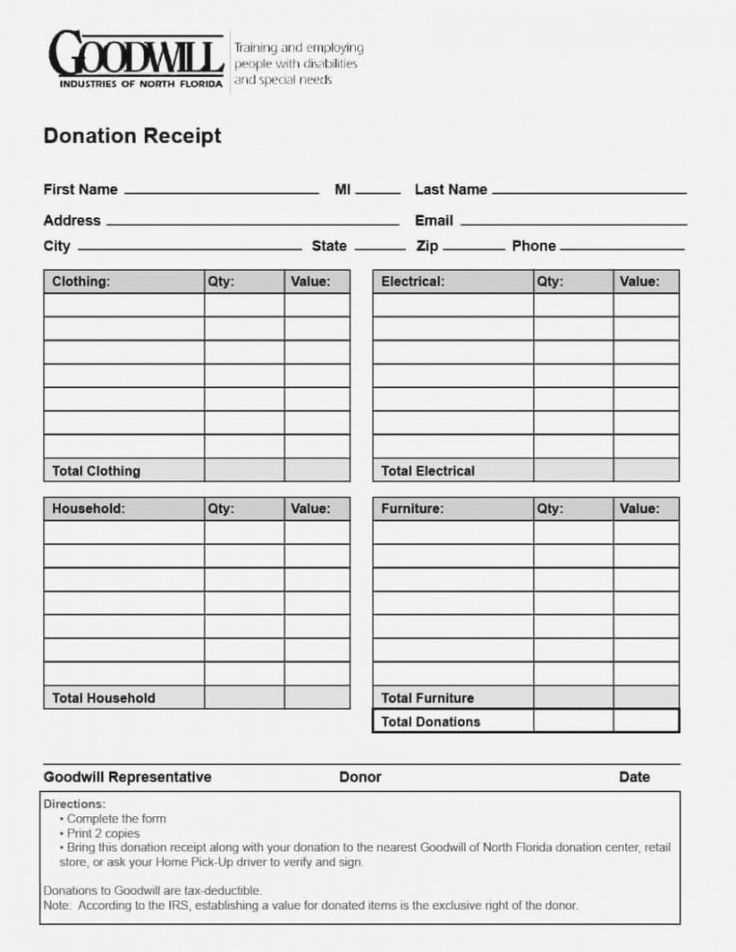

Adapt your donation receipts to reflect the specific nature of each contribution. Whether the donation is a cash gift, in-kind, or a recurring payment, adjusting the template ensures accurate records for both your organization and the donor. Here’s how to tailor the receipts for various types of donations:

1. Cash Donations

For cash donations, include the date, donor’s name, and the exact amount received. If applicable, add a note about whether the donation was in person or via mail. This information is key for both tax purposes and donor record keeping.

2. In-Kind Donations

In-kind donations require additional details to describe the items donated. Include a brief description of each item, its estimated value, and the condition it was received in. While your organization is not responsible for assigning a fair market value, offering an approximate value for tax deduction purposes can be helpful.

3. Recurring Donations

For donors who give on a recurring basis, clearly outline the donation frequency, payment method, and total amount contributed in the period covered by the receipt. Specify whether the donor has authorized automatic payments and include a breakdown of the total annual contribution if applicable.

4. Special Event Donations

If the donation was made as part of a fundraising event, ensure the receipt reflects the specific event name, date, and any items or services received in exchange. This is particularly relevant if the donor attended a charity auction or bought tickets for a fundraising dinner.

| Donation Type | Receipt Information |

|---|---|

| Cash Donations | Donor name, date, amount, payment method (if relevant) |

| In-Kind Donations | Item description, estimated value, condition |

| Recurring Donations | Frequency, total contributions, payment method, authorization |

| Special Event Donations | Event name, date, donated amount, any goods or services received |

By adjusting your receipts for each donation type, you’ll create clear, organized records that are useful for both your organization and donors. This not only keeps your financials in order but also provides transparency for tax purposes and future donations.

Use Excel templates to structure donor data efficiently. Create a dedicated spreadsheet with columns for donor names, contact details, donation amounts, and dates. This allows quick access to each donor’s history, ensuring you never miss important follow-up actions or tax-related documents.

Set up separate tabs for different donor categories, such as one-time donors and recurring supporters. Add filters to each column to streamline data retrieval. For instance, a filter for the donation amount can help you identify high-value contributions or sort donors based on their support frequency.

Implement conditional formatting to visually highlight significant data points. For example, use color-coding for donations above a certain threshold or to mark donors who have made their last donation several months ago. This visual aid simplifies decision-making and enables targeted outreach.

Track interactions with donors using additional columns like “last contacted” or “donor preferences.” This creates a complete picture of each donor’s history and preferences, helping you personalize future communications.

Ensure the template is updated regularly. You can set up a routine for entering new donations, adding contact notes, and removing outdated entries. A well-organized template will provide an ongoing record of support, making donor management more straightforward and less time-consuming.

Use a simple structure when creating a donation receipt template in Excel to ensure clarity and accuracy. Include the donor’s name, donation amount, date of donation, and the charity’s details. This helps both the donor and the organization keep accurate records for tax purposes.

Key Components

The template should include the following elements:

- Donor’s Full Name

- Donation Amount

- Date of Donation

- Charity’s Name and Address

- Tax ID Number

- Donation Type (cash, goods, etc.)

Formatting Tips

Use separate columns for each data point to ensure easy organization and filtering. Bold key information like the donor’s name and donation amount to make the receipt stand out. Ensure the font is clear and legible, and adjust column widths for readability.

Remember to save the template for future use, making it easy to adjust for new donors and donations. This approach saves time and minimizes errors, ensuring all necessary information is included in each receipt.