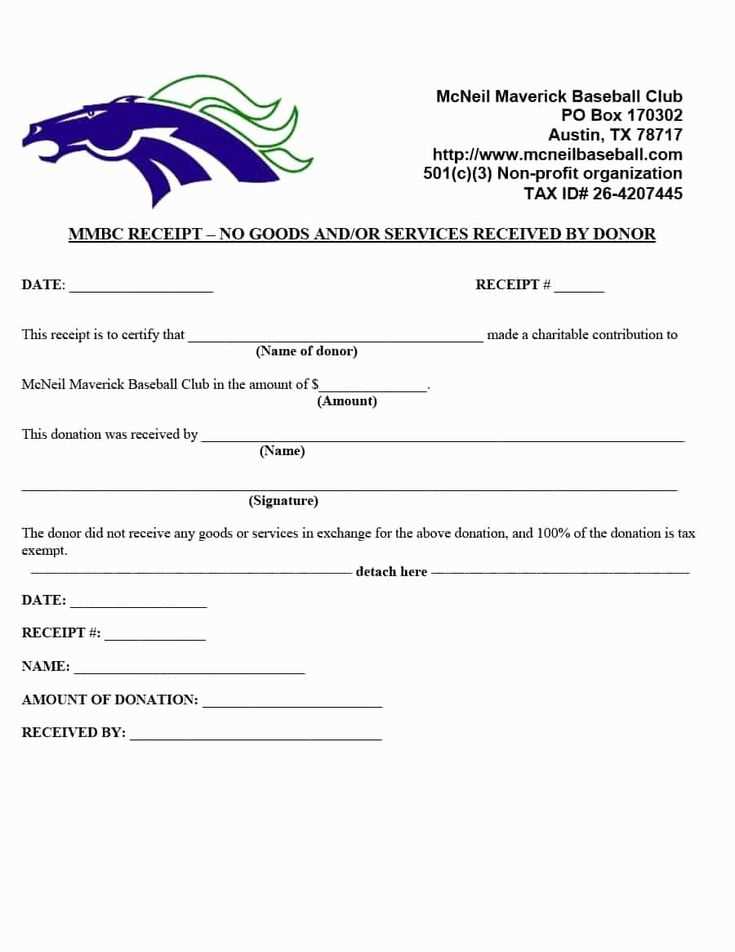

A well-structured donation receipt helps ensure compliance with IRS regulations and provides donors with the documentation they need for tax deductions. For non-cash contributions, the receipt should include specific details about the donated items, making it clear what was given and when.

Key Information to Include:

- Organization’s Name and EIN: Clearly state the nonprofit’s legal name and Employer Identification Number.

- Date of Donation: The exact date when the donor provided the items.

- Description of Donated Items: Provide a brief but clear description (e.g., “two laptops” instead of just “electronics”). Avoid assigning a value–this is the donor’s responsibility.

- Statement of No Goods or Services: If no benefits were provided in exchange for the donation, include a statement confirming this.

- Authorized Signature: A signature from an official representative adds credibility.

Nonprofits should issue receipts promptly and keep copies for their records. A well-documented receipt not only helps donors but also strengthens the organization’s transparency and accountability.

Here’s your text with redundancy removed:

For a 501(c)(3) organization issuing a donation receipt for items, ensure the document includes key information. Start with the donor’s name, address, and the date of the donation. Clearly describe the donated items without overvaluing them. List each item individually, including quantity and condition. Include a statement that the organization did not provide goods or services in exchange for the donation, unless applicable. Conclude with the charity’s name, tax identification number, and the signature of an authorized representative. This ensures compliance and provides a clear record for both the donor and the organization.

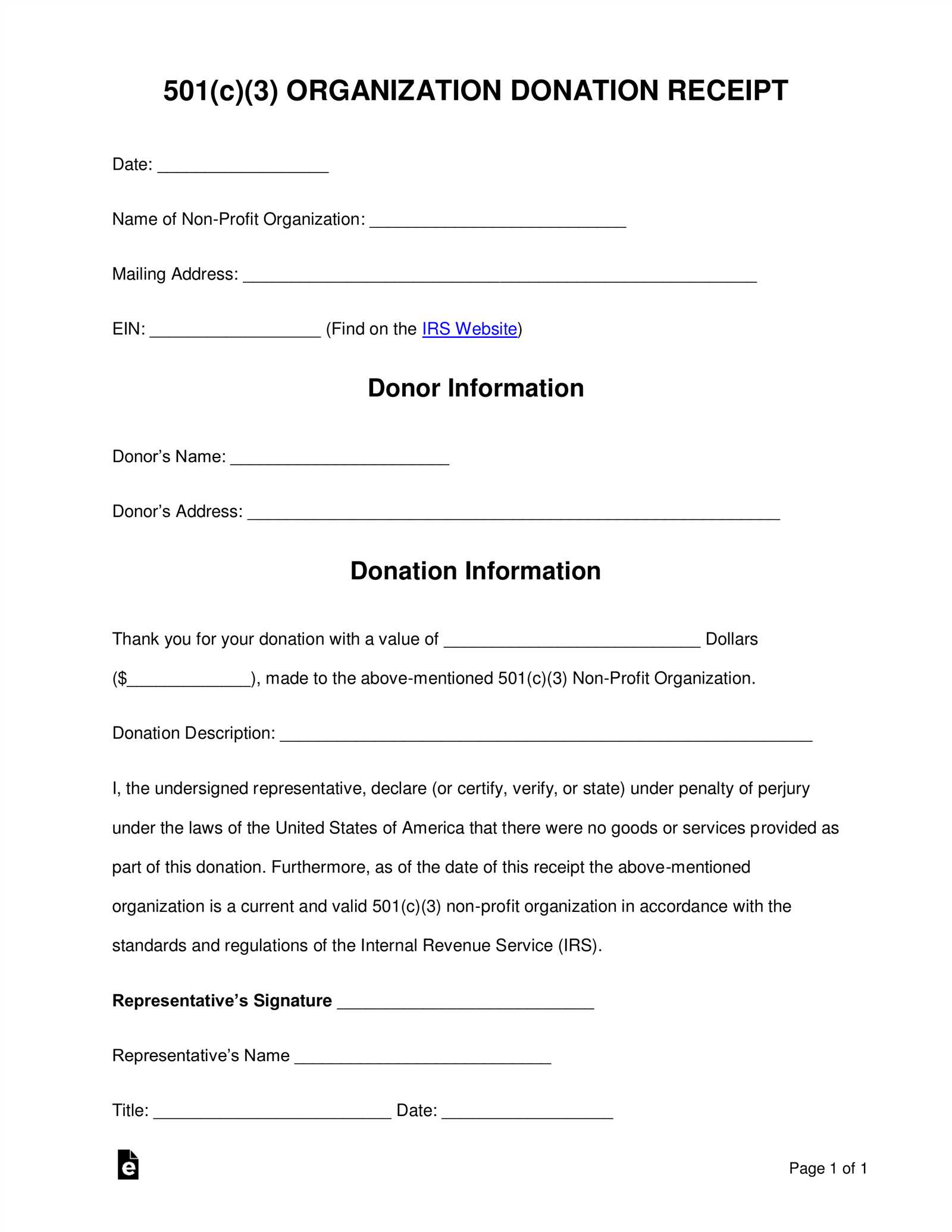

- Donation Receipt Template for 501(c)(3) Organizations

For 501(c)(3) organizations, a donation receipt must include specific details to ensure compliance with IRS requirements. Below is a simple yet detailed template that meets these needs:

- Organization Name: [Insert Name of 501(c)(3) Organization]

- Organization Address: [Insert Address]

- Phone Number: [Insert Phone Number]

- Email Address: [Insert Email Address]

- Tax-Exempt Status: 501(c)(3) [Insert IRS Determination Letter Date]

- Donor Name: [Insert Donor’s Name]

- Donation Date: [Insert Date of Donation]

- Description of Items Donated: [Insert Description of Donated Goods or Services]

- Value of Donation (if known): [Insert Value or Statement “No Goods or Services were provided in exchange for this donation.”]

- Statement of No Goods or Services Provided: [Insert Statement]

- Signature of Authorized Organization Representative: [Insert Representative Name and Title]

This format keeps everything clear, ensuring transparency for both the donor and the organization while fulfilling IRS regulations. Make sure to include all the required elements, especially the donor’s name, donation description, and confirmation of no goods or services exchanged to ensure proper tax reporting for both parties.

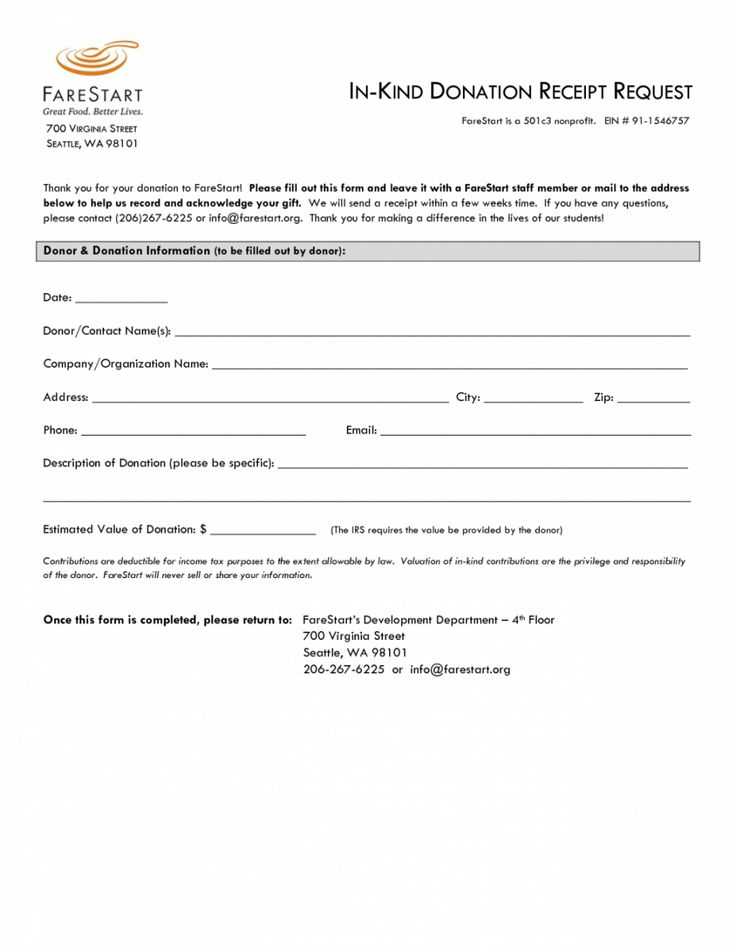

For a non-cash donation receipt, certain details must be included to comply with IRS requirements and provide transparency to the donor.

- Donor’s Name: Always include the full name of the donor as provided on the contribution record.

- Description of the Donated Items: Offer a clear description of the donated goods. Avoid listing values; provide enough information to recognize the nature of the items.

- Date of Donation: The exact date when the donation was received should be recorded.

- Organization’s Name and Address: Clearly state the legal name and address of the 501(c)(3) organization.

- Statement of No Goods or Services Received: Indicate that the donor received no goods or services in exchange for the donation, or if they did, specify the value of those goods/services.

- Value of the Donated Items: While the organization cannot assign a value to donated items, it is helpful to include a statement advising the donor to assess the fair market value for tax purposes.

By including these elements, you ensure the receipt is properly formatted for the donor’s tax purposes and maintains compliance with IRS guidelines.

Ensure the donor receives a written acknowledgment for any contribution over $250. This receipt should include the organization’s name, the date of the donation, and a detailed description of the donated items. Avoid assigning a dollar value to non-cash gifts; this responsibility falls on the donor. The IRS requires you to state whether goods or services were provided in exchange for the donation, and if so, a good-faith estimate of their value. For gifts over $500, donors must complete IRS Form 8283 and attach it to their tax return. If the donation exceeds $5,000, an appraisal might be required for non-cash items. Ensure all records are clear and accurate to meet IRS standards and facilitate proper documentation.

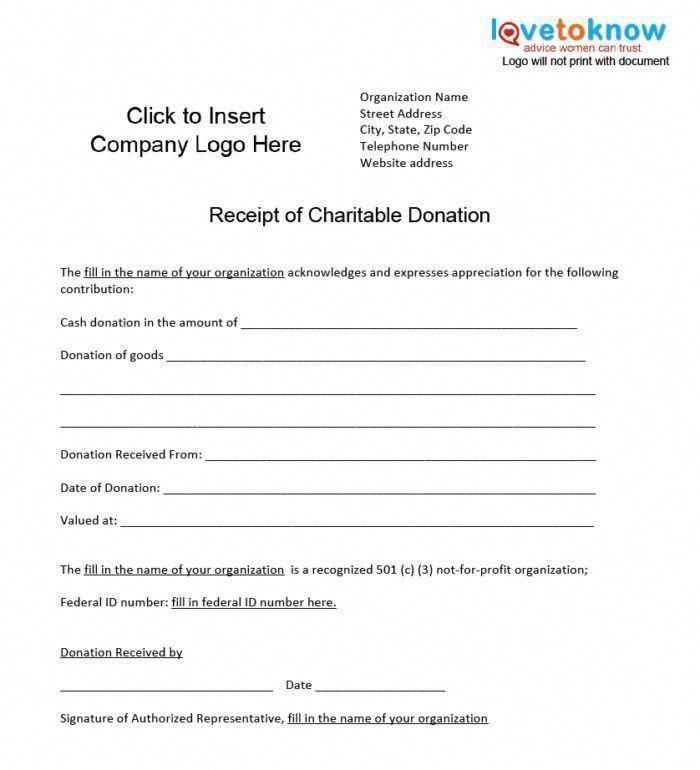

Keep the layout clean and simple to ensure readability. Use clear headings and subheadings to guide the reader through the document.

- Header: Include your organization’s logo and name at the top for immediate recognition. Place the receipt title prominently, such as “Donation Confirmation” or “Gift Receipt.”

- Donor Information: Make sure to list the donor’s full name and contact details clearly. This information should be easy to spot, usually right under the header.

- Donation Details: Provide specific details about the donation. Include the date, a description of the donated items, their estimated value, and the quantity. If applicable, include the fair market value of the items.

- Tax Exempt Status: Add a short statement that your organization is a 501(c)(3) nonprofit. This ensures the donor knows their contribution is tax-deductible.

- Amount and Acknowledgment: For financial donations, list the exact amount and acknowledge the donor’s contribution. If the donation is in-kind, specify the items received.

- Footer: Conclude with your organization’s contact information, including address, website, and phone number. You may also include a note of appreciation for their support.

Leave enough white space between sections to prevent the document from feeling crowded. Use bullet points for lists to improve clarity and allow for quick scanning.

Be specific about the condition and type of each donated item. For example, if you receive a used laptop, state the model, age, and any noticeable wear or damage. Include clear details like color, size, brand, and any accessories or additional parts. Avoid vague terms such as “miscellaneous” or “variety” and instead list exact items.

Provide Detailed Descriptions of Each Item

For example, rather than just noting “furniture,” describe the type of furniture (e.g., wooden desk, four-legged dining table), its dimensions, condition, and any distinguishing features. Mention if items have been refurbished, cleaned, or are in their original state.

Value Estimation for Donated Items

If required, estimate the fair market value of each item based on current prices for similar items. Be honest about the condition of the items to avoid inflated or misleading claims. Including receipts or appraisals, when available, can support these valuations.

Ensure the donation receipt includes the donor’s complete name and address. Missing or incorrect contact information can cause issues for both your organization and the donor during tax filing.

Always provide an accurate description of donated items. A vague or generalized description such as “miscellaneous items” can lead to confusion and challenges for donors when claiming their tax deductions.

Don’t forget to include the date of the donation. A missing or incorrect donation date can complicate a donor’s tax reporting and may result in the rejection of deductions by the IRS.

Ensure that the fair market value of donated items is clearly stated. Avoid guessing values; instead, reference reliable sources or consult with an expert if necessary. Donors need a precise value for proper tax deductions.

Avoid providing a valuation for non-cash donations if the IRS guidelines are not followed. Inaccurate valuations may lead to non-compliance issues. Only provide valuations for property donations that are listed according to IRS rules.

Incorrect language is another common error. Always specify that no goods or services were provided in exchange for the donation, or detail any goods or services that were exchanged. This distinction ensures compliance with IRS guidelines.

| Error | Recommendation |

|---|---|

| Missing Donor Information | Always include the full name and address of the donor. |

| Vague Item Description | Provide a clear and specific description of donated items. |

| Omitting Donation Date | Include the exact date of the donation. |

| Incorrect Valuation | Use reliable sources for determining the fair market value of donations. |

| Failure to State Goods/Services Received | Specify if any goods or services were provided in exchange for the donation. |

By avoiding these errors, you ensure that your donation receipts remain clear, compliant, and beneficial for both your organization and your donors.

Store all issued donation receipts for a minimum of three years from the donation date. This ensures compliance with IRS guidelines and provides a reliable reference in case of audits. Keep both physical and digital copies securely stored. Use encrypted digital storage systems for easier access and long-term preservation of records.

| Record Type | Retention Period | Recommended Storage |

|---|---|---|

| Donation Receipts | 3 years | Physical & Digital |

| Non-Cash Donations | 3 years | Digital |

| Donor Information | 3 years | Digital |

For each receipt, ensure all required details are included: donor name, donation date, item description, and value. These details must be stored in an easily accessible system. Regularly review records for accuracy. Once the retention period has passed, securely destroy physical documents by shredding and ensure digital files are deleted following data privacy rules.

So the meaning is preserved, and repetitions are minimized.

To ensure clarity and minimize redundancy in your donation receipt template, structure it with clear and concise information. Focus on essential details only, such as donor name, date, description of the donated items, and the estimated value. Avoid excessive wording that doesn’t add value.

- Donor’s Information: List the donor’s full name and address clearly. This will be helpful for both the donor and the nonprofit organization for future correspondence and tax purposes.

- Donation Details: Include a brief description of the items donated. Keep this section clear and specific–mention the quantity, type, and condition of the items.

- Value of Items: While you cannot assign a specific value to donated items, provide a general estimate or range based on the organization’s standards. This helps donors when filing their taxes.

- Statement of No Goods or Services: Make sure to state that no goods or services were provided in exchange for the donation, which is required for 501(c)(3) status.

- Signature of Authorized Representative: The receipt should be signed by an authorized representative of the nonprofit organization. This adds legitimacy and confirmation to the transaction.

Keep the format simple and easy to follow. The focus should always be on the necessary data while eliminating redundancy, ensuring both the donor and the organization can easily reference the details when needed.