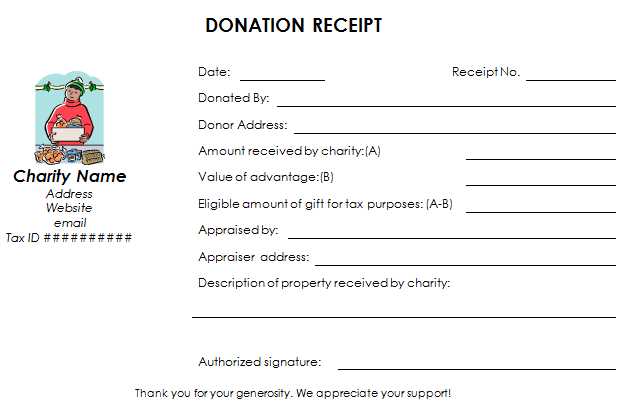

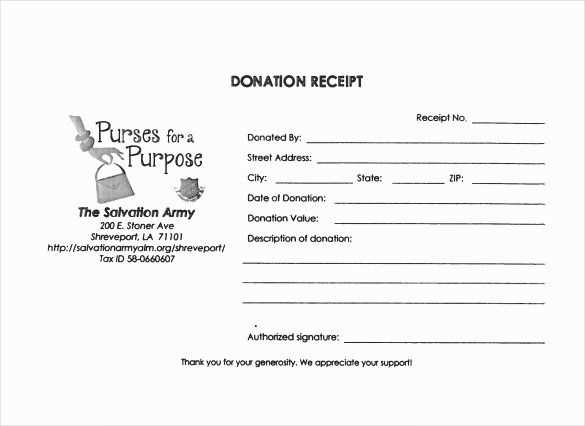

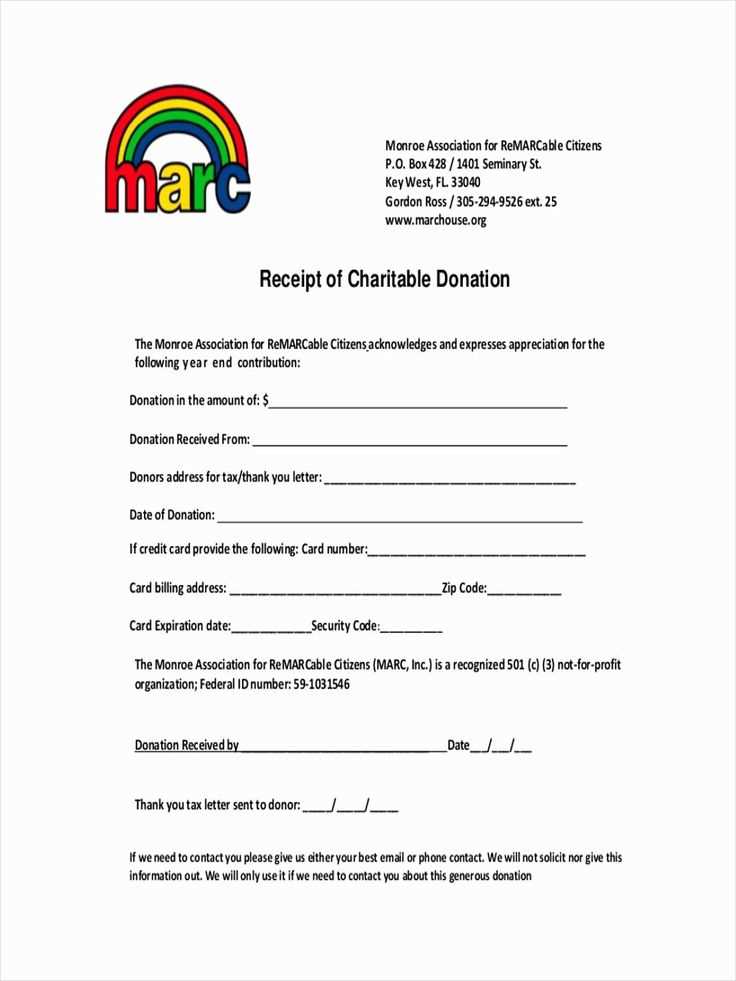

Creating a donation receipt for charitable events is straightforward, but it must contain specific details to be both legally compliant and helpful for donors. The receipt should include the charity’s name, the donor’s name, the amount donated, and the date of the donation. This ensures transparency and allows donors to claim tax deductions where applicable.

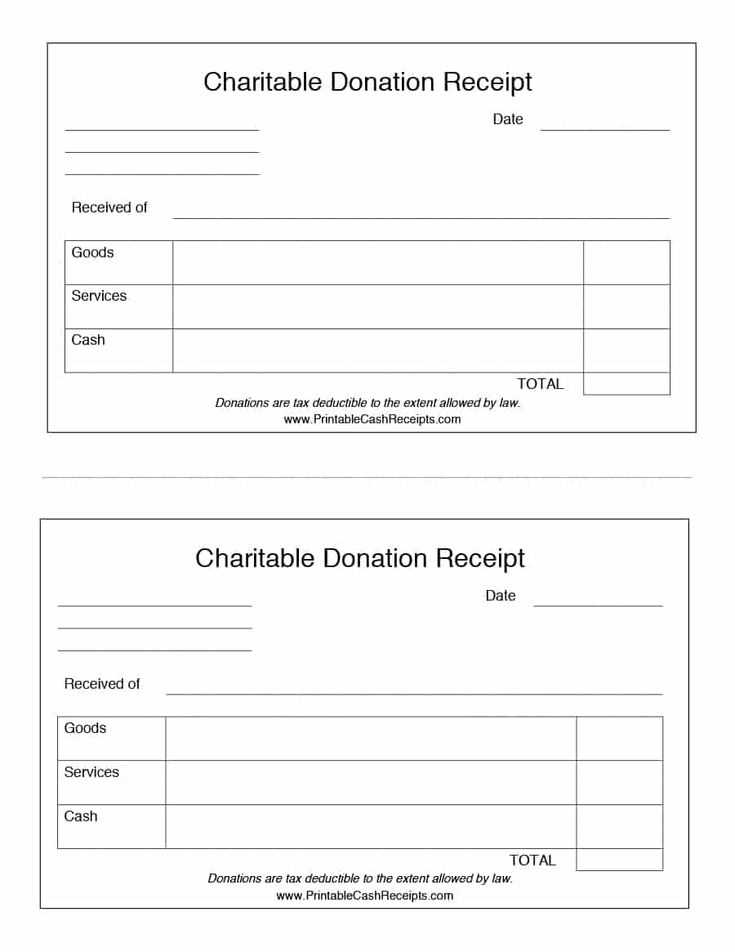

Make sure to note whether the donation was monetary or in-kind. If it’s a physical item, a description of the item and its estimated value should be included. This helps maintain clarity for both the donor and the organization. It’s also a good practice to mention that no goods or services were exchanged for the donation, particularly for tax purposes.

Ensure the receipt is signed by an authorized representative of the organization. This simple step adds an official touch and further validates the transaction. Always maintain a copy for your records, as both donors and organizations may need these for future reference.

Sure! Here’s a revised version of the list, with repetitions minimized:

Begin by clearly stating the donation amount and specifying if it’s a one-time contribution or recurring. Ensure that the donor’s full name and contact details are included for proper acknowledgment. Add the date of the donation, as well as the event or cause it supports, so the purpose is easily identifiable.

Provide a brief description of the charitable organization, including its tax-exempt status if applicable. This helps to clarify the legitimacy of the donation and ensures donors can claim deductions if eligible. Include a statement confirming that no goods or services were provided in exchange for the donation, which is crucial for tax reporting purposes.

End with a thank-you message, expressing gratitude for the donor’s support. Keep the tone warm and sincere to maintain a strong connection with contributors.

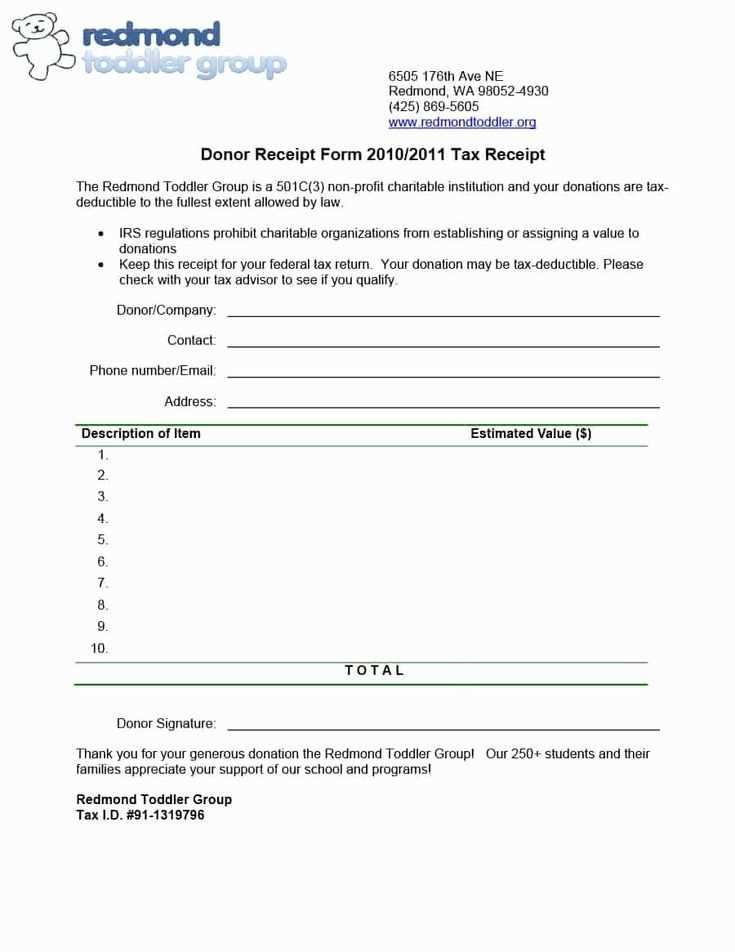

- Donation Receipt Template for Charity Events

Include key details on your donation receipt template to make it valid and useful for both the donor and the charity. Ensure that the receipt includes the donor’s name, donation amount, and the date of the donation. Clearly state whether the donation is in cash, check, or goods. If goods are donated, list the items and provide an estimated value.

What to Include in a Donation Receipt

At a minimum, a donation receipt should include:

- Charity name and contact information

- Donor’s name and contact details

- Amount or description of the donation

- Date of donation

- Statement that no goods or services were exchanged for the donation, if applicable

Formatting Tips for Donation Receipts

Make the receipt easy to read and professionally formatted. Include a unique receipt number for tracking. If applicable, add your charity’s tax-exempt status number to help the donor when filing taxes. Include a signature line to confirm the donation. Double-check that all information is accurate to avoid issues with tax deductions.

Begin with clear donor details. Include their full name, address, and contact information. This ensures that the donation receipt is personalized and traceable in the future.

Next, state the date of the donation. This is important for record-keeping and tax purposes, ensuring both the donor and the organization have a consistent reference point.

Describe the donated item or amount. If the donation is monetary, specify the exact amount given. For in-kind donations, provide a brief description of the items received, along with their estimated value if possible. Avoid vague terms and be specific.

Clearly state whether the donation is tax-deductible. If applicable, include a statement confirming that no goods or services were provided in exchange for the donation. This is essential for the donor’s tax reporting.

For transparency, include your organization’s tax-exempt status. This can be helpful for donors who wish to confirm their eligibility for tax deductions.

| Information | Details |

|---|---|

| Donor Name | [Donor’s Full Name] |

| Donation Date | [Date of Donation] |

| Amount Donated | [Amount or Item Description] |

| Tax-Deductible Confirmation | [Yes/No] |

| Organization Tax-Exempt Status | [Tax-Exempt Number] |

Finally, provide your organization’s contact information for any inquiries regarding the receipt. This shows commitment to transparency and fosters trust.

Got it! It looks like you’re focusing on creating clear, detailed, and well-structured content in Finnish with specific formatting and terminology guidelines for your articles. Do you need help with a particular topic right now, or would you like assistance with organizing or drafting some content in HTML?

Adjust the donation receipt template to reflect the specifics of each donation type. This allows your receipts to remain relevant and accurate across different forms of contributions.

1. Monetary Donations

For cash or card donations, clearly specify the amount given and the date of the donation. Include a brief description of the event or campaign, if applicable. Ensure that the donor’s name and transaction details are accurately recorded.

2. In-Kind Donations

For goods or services, specify the item(s) donated along with their estimated value. It is helpful to mention the condition of the items, whether new or gently used, to avoid misunderstandings.

3. Pledges and Recurring Donations

For pledges, clearly outline the total commitment and how much has been paid to date. For recurring donations, include the payment schedule and amounts donated up until that point. This helps both parties track the progress of the donation.

4. Gift Donations

If a donation is made in someone else’s name, mention both the donor and the recipient. Include any messages or special notes provided, especially if the donation is in honor or memory of someone.

5. Volunteer Hours

Some events allow for donation in the form of volunteer work. If this applies, list the hours worked and provide an estimated dollar value per hour to acknowledge the contribution. This will ensure the receipt is both accurate and comprehensive.

- Ensure consistency in format across all receipt types for easy understanding.

- Personalize the message based on the type of donation to show gratitude and maintain clarity.

- Provide clear instructions for any follow-up steps, such as additional donations or tax-related actions.

Ensure that donor information is presented in a simple and organized manner. List each donor’s full name, address, and donation amount in separate sections, with clear labels for each field. This avoids confusion and helps ensure accuracy. Use consistent font styles and sizes for each section to maintain a clean look.

Structure the Information Logically

Group related data together. For instance, place contact information like phone numbers and emails below the donor’s name. This creates an easy-to-follow layout. Avoid cluttering the receipt with unnecessary details that may distract from the main information.

Highlight Key Data

Donations should stand out. Bold the donation amount and use a larger font for this section, ensuring it’s easy for both the donor and the recipient to spot. If necessary, include a brief description of the donation’s purpose.

To ensure donors feel appreciated, set up a clear and personalized acknowledgment system. Acknowledge donations promptly to maintain positive relationships with your supporters. Here are the steps to set up a system that works:

- Create a donation tracking system: Use spreadsheets or donor management software to track donations. Record the donor’s name, donation amount, and date of contribution.

- Send automated receipts: Set up an automatic system to send receipts as soon as a donation is made. Include the donation amount, event name, and any relevant tax information.

- Personalize your messages: Tailor each acknowledgment with a personal touch, such as the donor’s name and a brief message expressing gratitude. Consider adding a note about how their contribution makes an impact.

- Thank-you letters: For larger donations, send handwritten or customized thank-you letters. This will go a long way in showing appreciation for significant contributions.

- Public acknowledgment: Consider publicly recognizing donors in your event materials, websites, or social media posts. Always ask for their consent before sharing personal details.

- Follow-up communication: Send updates on the event’s progress and show how donations have been put to use. This reinforces the donor’s positive involvement with your cause.

By implementing these steps, you not only streamline the acknowledgment process but also create a sense of connection between donors and your charitable cause.

Clear and Accurate Information

Ensure that all receipts, whether digital or paper, include the donor’s name, donation amount, date, and charity name. Double-check these details to avoid errors that could cause confusion or issues with tax filings.

Maintain Readability and Accessibility

For paper receipts, use clear, legible fonts and avoid cluttered layouts. Digital receipts should be mobile-friendly, with readable text and properly formatted for all screen sizes. Keep file sizes manageable to ensure easy access and download.

Make sure the receipt includes a thank-you message or acknowledgment of the donation to maintain a personal connection and reinforce the donor’s impact.

Donation Receipt Template for Charitable Events

Use a clear, professional format to ensure donors receive all necessary information for their contributions. Here is a straightforward template you can follow:

- Organization Name and Contact Info: Include the name, address, phone number, and email address of the organization receiving the donation.

- Donor’s Information: Provide the donor’s full name and address. This is crucial for tax records and acknowledgment.

- Donation Details: Specify the date and amount of the donation. If the contribution is in-kind (goods or services), describe the items donated.

- Tax-Deductible Status: State that the donation is tax-deductible, and confirm your organization’s tax-exempt status under IRS rules (or the equivalent in your country).

- Special Instructions: If applicable, note any restrictions on the donation, such as the use of funds for a particular project.

- Thank You Note: Conclude with a message expressing gratitude for the donor’s support and contribution.

Once completed, send the receipt promptly to acknowledge the donor’s generosity and ensure accurate record-keeping for tax purposes.