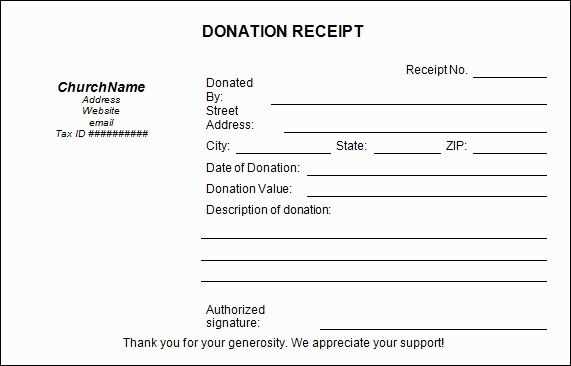

Creating a donation receipt using Google Docs is quick and simple. Begin by opening a blank document in Google Docs and use a template for faster formatting. These templates are available in the Google Docs template gallery or can be customized according to your needs. Add necessary fields such as donor name, donation amount, and donation date. Include the organization’s details such as name, address, and tax identification number for transparency.

Customize Your Template

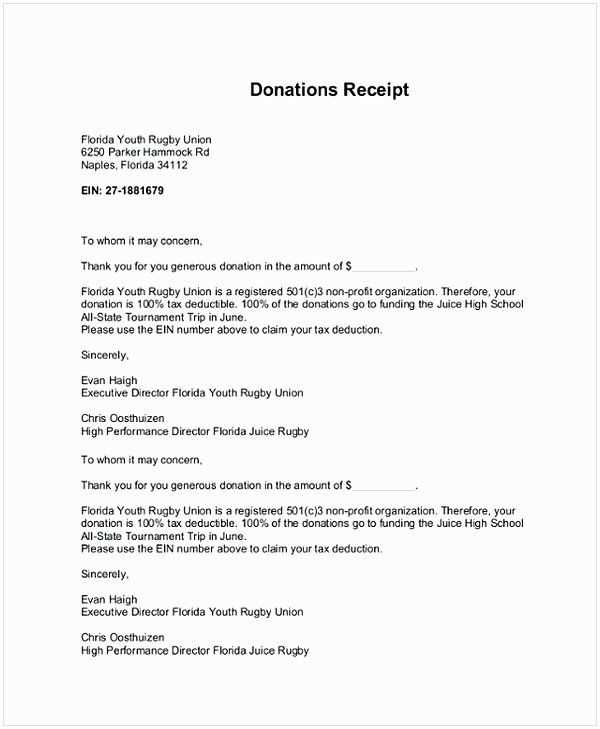

Once you choose a template, adjust it to fit your style. Include a short thank-you message and any additional information that may be relevant, such as the donation method or purpose. This will help convey gratitude and provide clarity to the donor for their records. Don’t forget to mention if the donation is tax-deductible, as this is important for the donor’s filing purposes.

Sharing and Saving the Receipt

Once your template is ready, save it as a PDF or share the link directly with your donors. Using Google Docs allows you to easily manage and distribute receipts without the need for complex software. Make sure to keep a copy of all receipts for your records and track your donations effectively.

Here’s the corrected version:

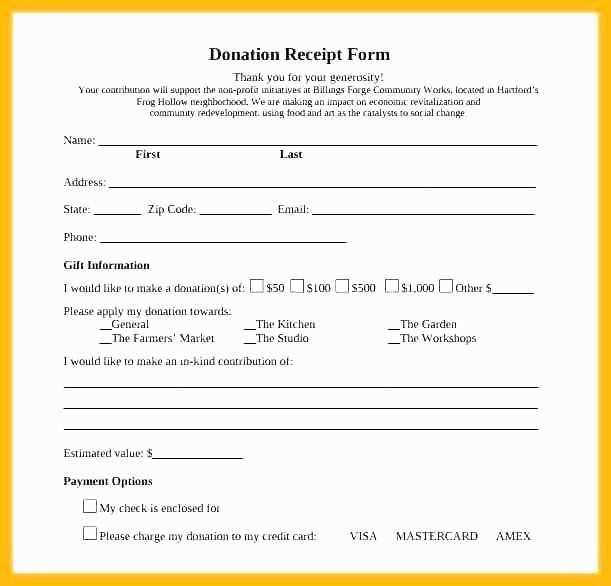

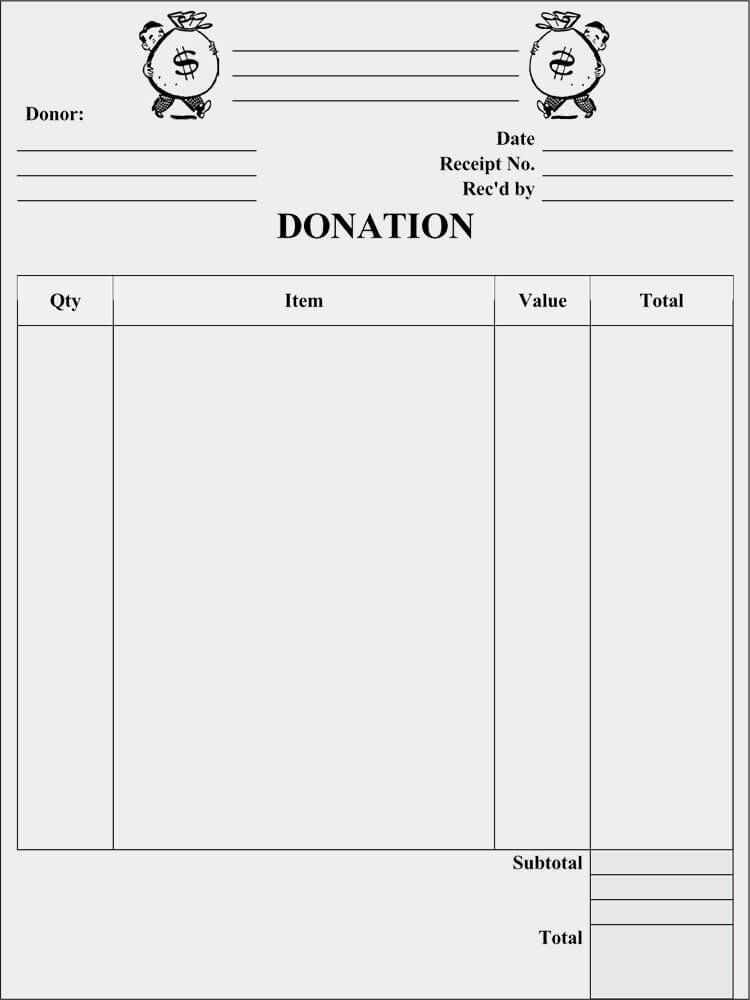

To create a donation receipt in Google Docs, start by including essential details such as the donor’s name, the donation amount, and the date of the contribution. Make sure to specify whether the donation was monetary or in-kind, and if in-kind, describe the item donated. Include your organization’s name, address, and contact information at the top.

Key Information to Include:

- Donor’s Full Name: Ensure the name is spelled correctly for official records.

- Donation Amount: Clearly state the amount donated, whether in cash or as a gift.

- Date of Donation: Include the exact date when the donation was made.

- Tax Deductibility Statement: If applicable, add a statement about the tax-deductible nature of the donation.

- Organization Information: Include your organization’s name, address, and phone number for confirmation purposes.

By structuring your donation receipt this way, both you and your donors will have clear and accurate records for future reference. It also ensures transparency for any tax-related purposes.

Donation Receipt Template in Google Docs

How to Create a Template for Donation Receipts

Setting Up Donation Information in Google Docs

Formatting the Receipt for Better Readability

Including Tax Deductible Details in the Template

Sharing and Printing Your Donation Receipt

Updating the Template for Various Donation Types

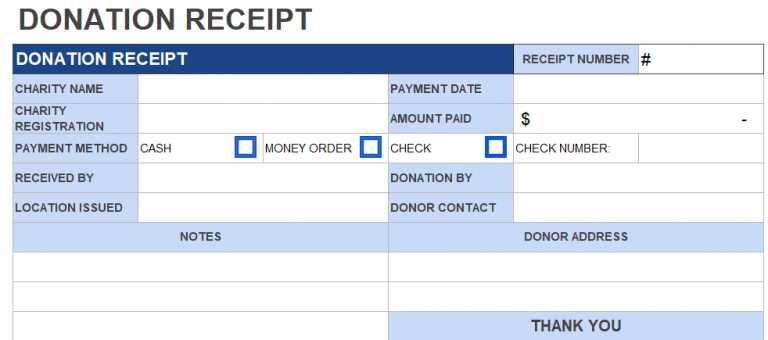

To create a donation receipt template in Google Docs, open a blank document and organize it into clear sections. Start with a header that includes the organization’s name, logo, and contact information. Follow this with a “Receipt Number” for tracking purposes and the date of the donation.

Next, include the donor’s name and address. Add a line that specifies the amount donated, and if applicable, the type of donation (e.g., monetary, goods, services). Use simple tables for clarity and alignment.

For better readability, break up text into sections. Use bullet points for the donation details and bold headings for important information like the donation amount, the donor’s name, and the date. Keep the font size large enough for easy reading, and ensure there’s enough white space around each section to avoid clutter.

If the donation is tax-deductible, include a statement confirming this, along with the IRS tax-exempt number or other relevant tax info. Clearly mention if goods or services were provided in exchange for the donation, as this can affect the tax deduction.

Once your template is set, you can share it with others through Google Docs’ sharing feature. You can also download it as a PDF for printing. When printing, ensure that the template’s layout fits on the page and appears professional.

Finally, update your template regularly to accommodate different types of donations. For example, if you start accepting online donations or in-kind gifts, make sure your template reflects these changes, including the necessary fields for these donations.