Creating a donation receipt letter involves clear details about the donation, ensuring the donor receives accurate acknowledgment for their contribution. Start by including the name of the donor, the date of the donation, and the amount given or the value of the donated items. If it is a monetary donation, specify the amount; if it involves goods, describe the items and their estimated value.

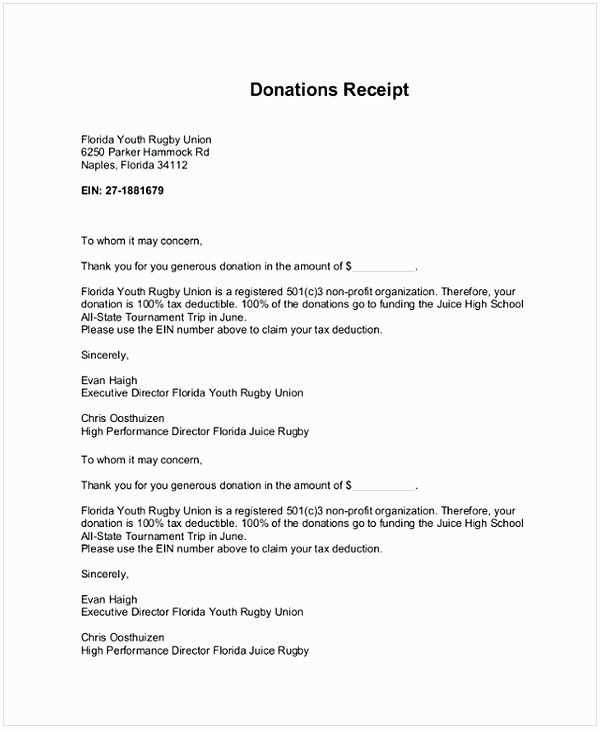

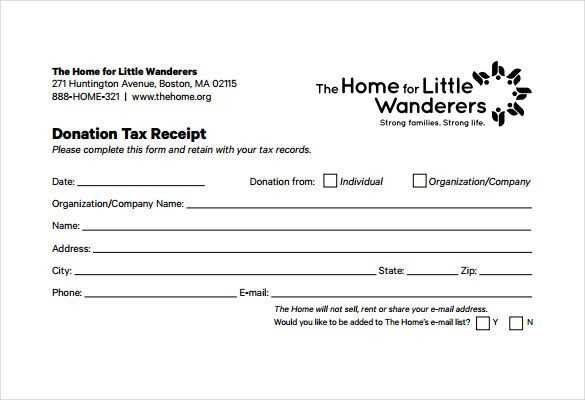

Clearly state the tax-exempt status of the organization, if applicable, to let the donor know they can claim the donation on their taxes. This is an important detail that assures transparency and builds trust with the donor. Don’t forget to include your organization’s name, address, and contact information for follow-up or questions.

Keep the tone polite and appreciative. Acknowledge the donor’s generosity with a warm thank you. This is an opportunity to strengthen your relationship with them, making them feel valued. A straightforward, friendly message helps maintain a positive connection and encourages continued support.

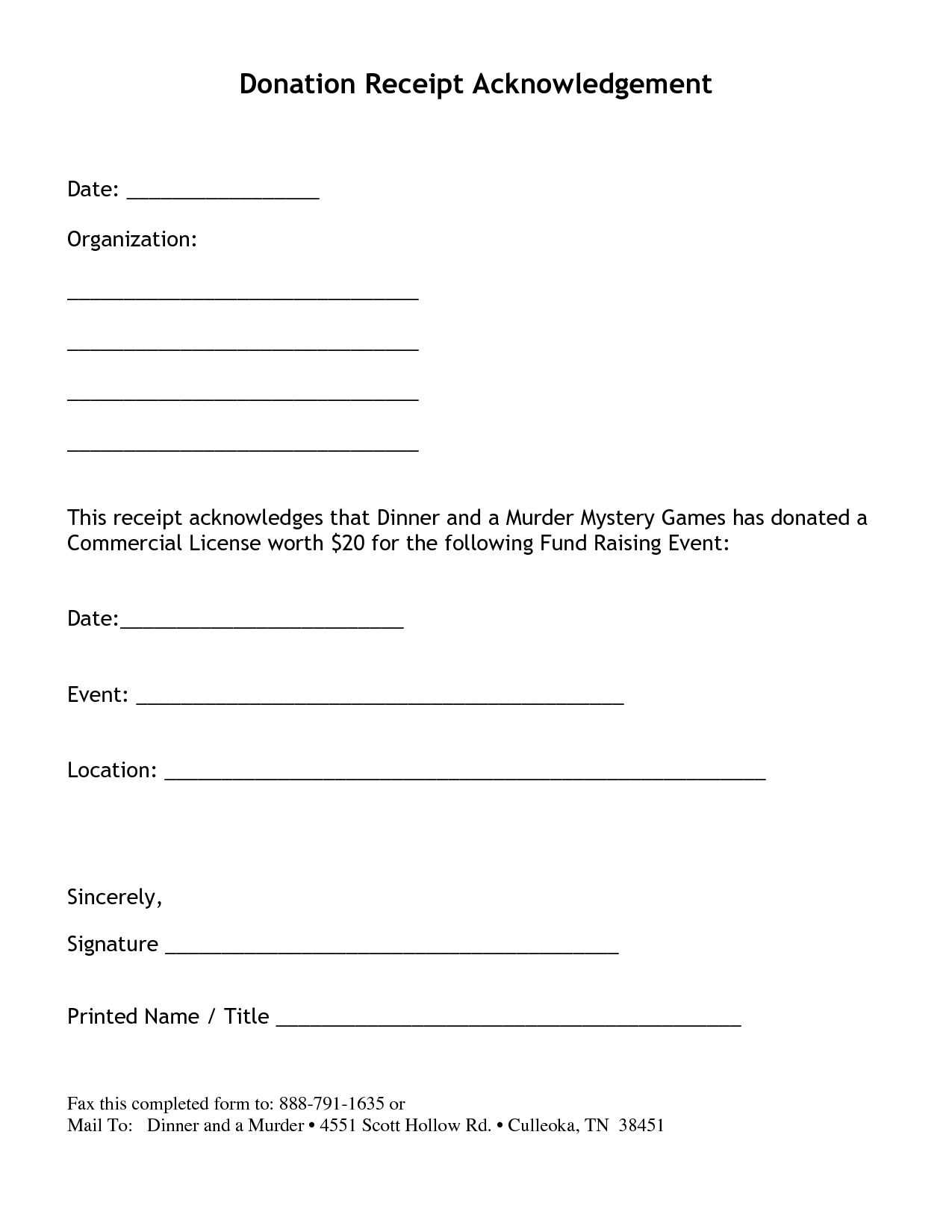

End the letter by providing the necessary signatures and confirming the authenticity of the receipt. Ensure all required legal statements, such as disclaimers or certifications, are included if necessary for compliance with local tax laws.

Here’s the revised version:

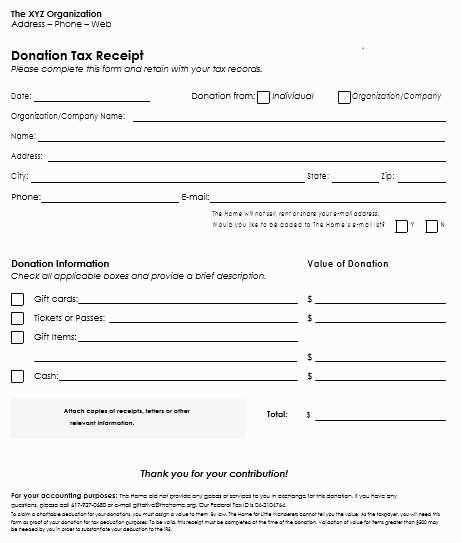

To create a clear and concise donation receipt, start by including the donor’s name and address. Ensure the date of the donation is noted, along with a brief description of the donation itself. Specify the amount, including the currency if applicable, and clarify whether the contribution was cash, goods, or services.

Key Elements to Include

Make sure to mention the organization’s name, address, and tax-exempt status if applicable. If goods or services were provided in exchange for the donation, include a statement describing what was received in return and its estimated value.

Signature and Acknowledgment

End the letter with an acknowledgment of the donor’s generosity, signed by a representative of the organization. This adds a personal touch and confirms the legitimacy of the receipt for tax purposes.

Key Elements to Include in a Receipt

How to Format Your Donation Acknowledgment for Clarity

Legal Requirements for Receipts

Customizing Your Receipt Letter for Various Contributions

How to Issue a Donation Acknowledgment Letter Promptly

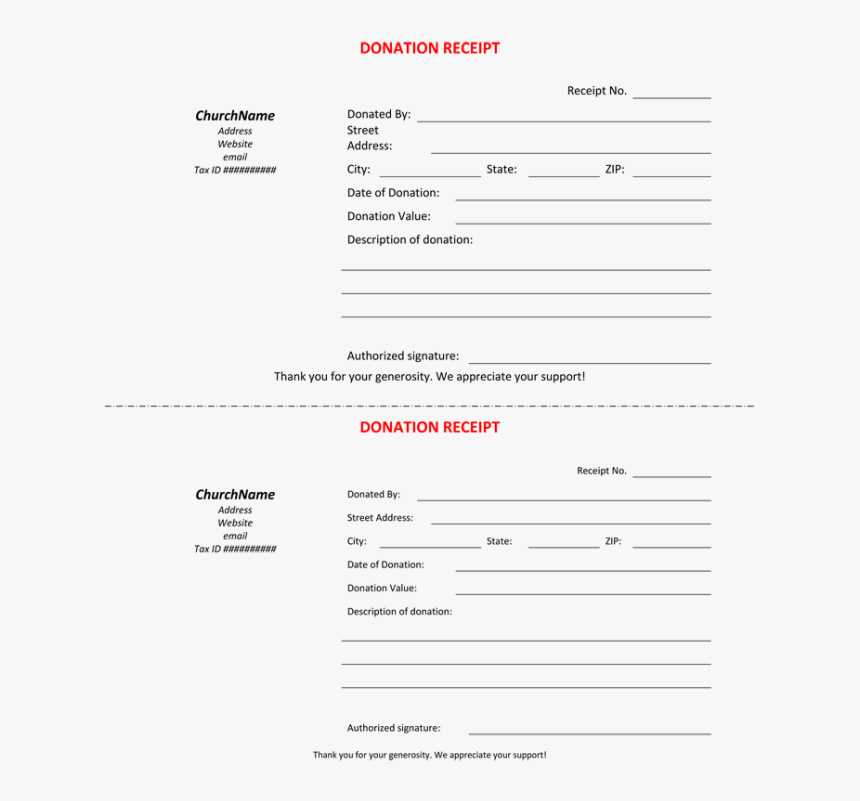

Sample Receipt Template for Quick Use

Donation Date: Include the exact date the donation was received to ensure accuracy for both the donor and the organization.

Donor Information: Clearly list the donor’s name and contact information, including address, email, or phone number. This helps ensure the donor can be properly recognized in future communications.

Amount and Type of Donation: Specify the amount donated, whether it is in cash, check, goods, or services. If the donation is non-monetary, provide a description of the items and their estimated value.

Tax-Exempt Status: If your organization is a registered charity, include a statement confirming its tax-exempt status. This assures the donor that their contribution qualifies for potential tax deductions.

Purpose of Donation: Briefly mention the intended use of the donation, particularly if it is for a specific campaign or project. This helps establish transparency in the donation process.

Legal Statement: Ensure your acknowledgment letter includes the required legal language, such as confirming that no goods or services were provided in exchange for the donation, if applicable. This is particularly important for tax reporting purposes.

Personalization: Tailor the letter for each donor’s contribution. Acknowledge the specific impact of their gift, whether it is a large monetary donation or in-kind support. Personalized messaging strengthens relationships and encourages continued support.

Timing: Issue the acknowledgment letter as soon as possible, ideally within 24-48 hours after receiving the donation. This demonstrates professionalism and appreciation for the donor’s contribution.

Sample Template: Here is a simple template you can use as a starting point:

Donation Receipt for Tax Purposes

Dear [Donor’s Name],

Thank you for your generous donation of [Amount/Item] on [Date]. Your contribution will help [briefly explain the purpose]. We are grateful for your support of [Organization’s Name].

This donation is tax-deductible to the extent permitted by law. Our tax-exempt status is [insert tax-exempt status details].

With appreciation,

[Your Organization’s Name]