If you’re looking for a simple way to create a donation receipt in New Zealand, you can easily use a template to ensure compliance with local tax regulations. A well-crafted receipt not only helps maintain accurate records but also provides your donors with a clear record of their contribution for tax purposes.

The template should include several key pieces of information: the donor’s name, the amount donated, the date of the donation, and the charitable organisation’s details. Make sure to specify whether the donation was in cash or in-kind, as this will impact how it is recorded for tax purposes. It’s also a good idea to include your organisation’s registration number if applicable, as this adds legitimacy to the receipt.

Using a template helps streamline the process and ensures consistency across all your receipts. Adjust the format to suit your needs, but always be sure to maintain the necessary details to comply with New Zealand’s regulations. This way, both you and your donors will be on the same page when it comes to managing charitable contributions.

Donation Receipt Template NZ: A Practical Guide

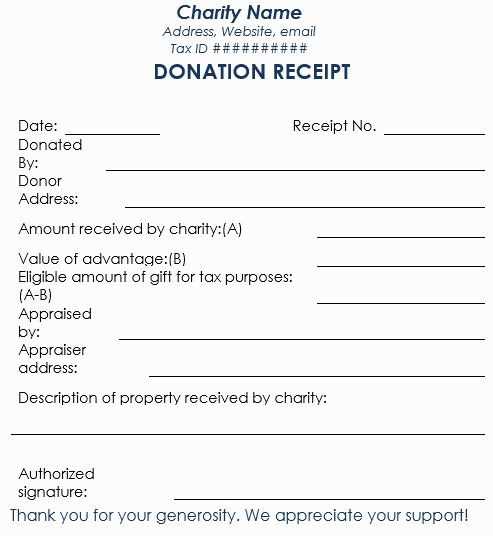

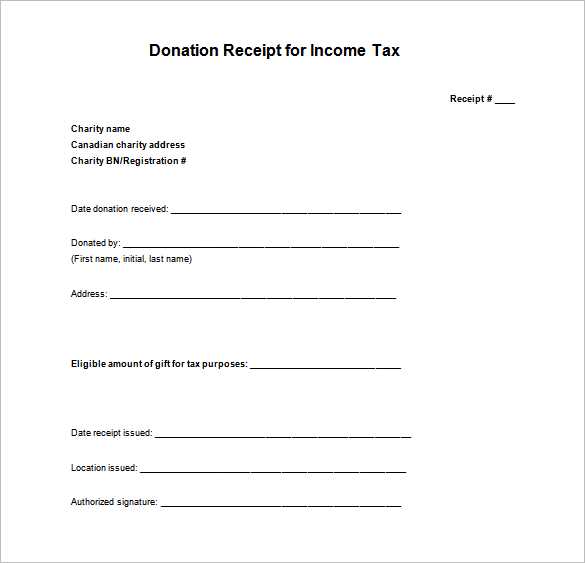

Creating a donation receipt in New Zealand involves providing clear, accurate, and specific details. A well-structured template ensures transparency and helps donors claim tax deductions. Below is a breakdown of what to include:

Key Information: The receipt must display the charity’s legal name, address, and registration number. For tax purposes, the donation amount, date, and the donor’s details are necessary. If the donation is in-kind, list the item(s) and their estimated value. Always state whether the donation is eligible for a tax refund.

Donation Amount: For monetary donations, specify the exact sum given. For non-monetary gifts, a description of the goods or services, along with their fair market value, is needed. Be clear about the donation’s nature, whether it’s a cash gift or a non-cash contribution.

Tax-Exempt Status: Indicate if the charity is registered with the New Zealand Charities Commission and authorized to issue receipts that donors can use for tax deductions. This information ensures the donor knows if they can apply for a tax refund.

Template Format: The template should include a section for the donor’s name, contact details, and donation specifics. An easy-to-read format helps prevent confusion and supports administrative processes. Ensure the receipt is dated and signed by the authorized representative of the organization.

By following these guidelines, you can create a donation receipt that meets legal standards and builds trust with your donors. Always keep a record for future reference and auditing purposes.

Creating a Legally Compliant Donation Receipt for New Zealand

Ensure your donation receipt meets New Zealand’s legal requirements by including key details. The receipt must clearly identify the donor, the amount donated, and the charity or organization receiving the gift.

Include the following on every receipt:

1. The charity’s registered name and registration number with the Charities Services.

2. The donor’s full name and address, or alternatively, their email address.

3. The date of the donation.

4. A description of the donation (e.g., money, goods, or services).

5. The amount donated, including the currency used (NZD).

6. A statement confirming whether the donation is eligible for a tax credit under New Zealand’s donation laws.

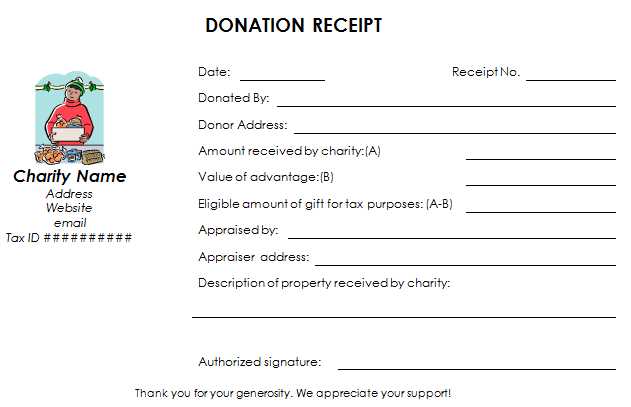

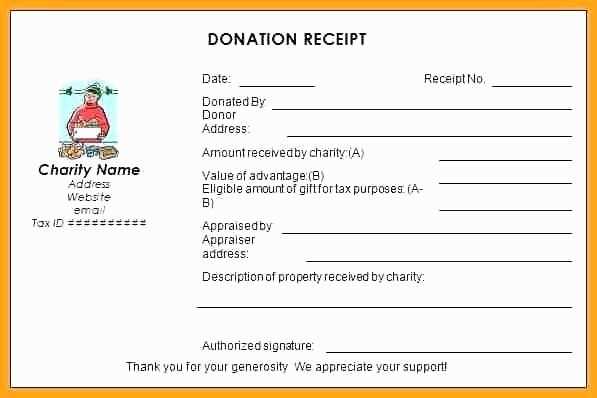

If the donation is over $5,000, provide a statement that the donor did not receive any goods or services in exchange for the donation. If the donor received any benefits, this should be clearly stated with their estimated value deducted from the total donation.

For tax credit purposes, include a statement that confirms the receipt is being issued by a registered charity. This ensures that the donor can claim the tax credit under the Donation Tax Credit Scheme.

Key Information to Include in a Donation Receipt

Ensure your donation receipt includes the following key elements for accuracy and compliance:

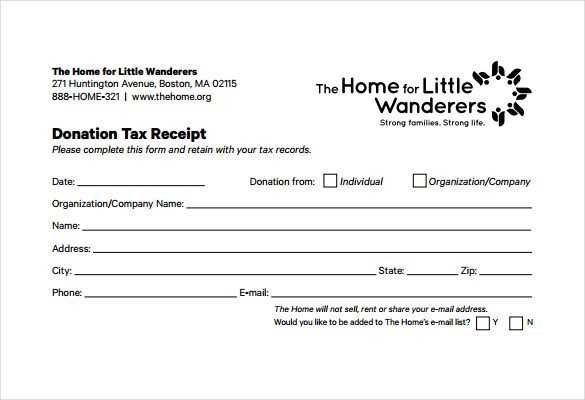

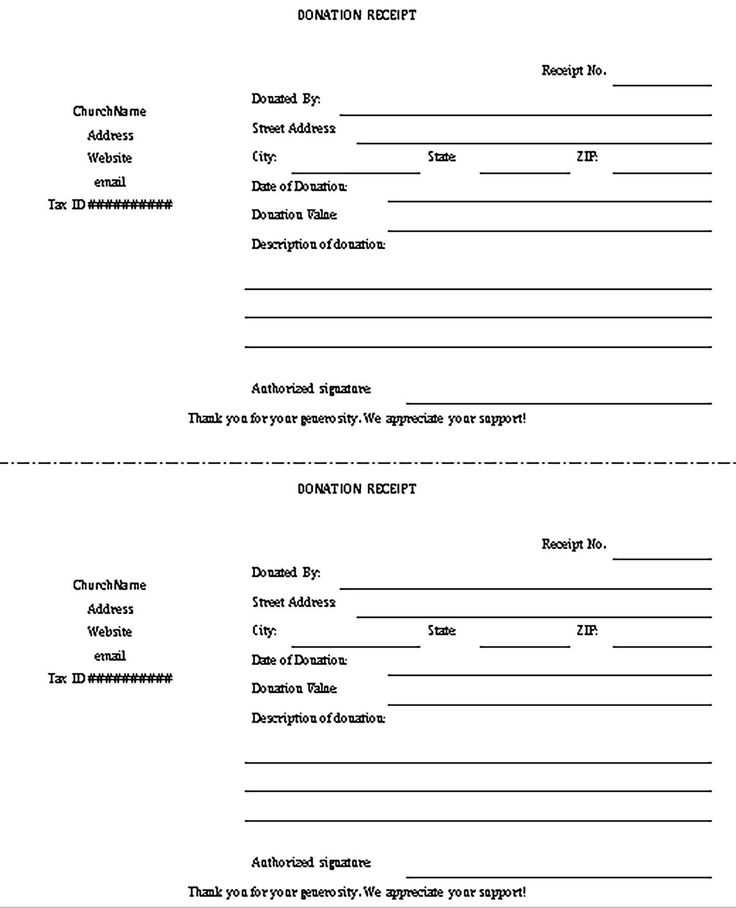

- Organization’s Name and Contact Details: Clearly display the name, address, and contact information of the charity or nonprofit.

- Donor’s Name and Address: Include the donor’s full name and address for record-keeping purposes.

- Date of Donation: List the exact date the donation was made.

- Donation Amount or Description: Specify the amount donated, or if the contribution is in-kind, describe the item(s) donated.

- Receipt Number: Assign a unique reference number for easy tracking and future reference.

- Charity Registration Number: Include the official registration number of the charity, if applicable.

- Statement of Non-Refundability: Include a statement confirming the donation is non-refundable.

- Tax Deduction Disclaimer: If applicable, include a note explaining that the donation is tax-deductible according to New Zealand law, and any other relevant details about deductions.

- Signature: Include the signature of an authorized representative from the charity or organization.

Designing a Template That Meets Charity Standards in NZ

Make sure your donation receipt template includes the charity’s full name, legal status, and registration number with the Charities Services. This is mandatory for compliance with New Zealand’s charity regulations. The template should clearly state the amount donated and the date of the contribution. If the donation is a non-cash item, provide a brief description of the donated item(s) and their estimated value.

The template should also specify whether the donation is tax-deductible. To qualify for tax exemption under the Income Tax Act 2007, your charity must confirm its approved donee status. Include the statement: “This donation is eligible for a tax credit for New Zealand taxpayers.” for donations made in cash or goods where applicable.

Another important aspect is the clarity and accuracy of your template’s format. Use easy-to-read fonts and maintain a professional design. Ensure the layout guides the donor’s eye through the required information, without cluttering the document. A well-organized, clean template adds to the credibility of the charity.

Additionally, ensure there is space for both the donor’s and charity’s signatures, if needed. Providing contact information such as an address, phone number, or email makes it easier for donors to get in touch with any questions about their donations.