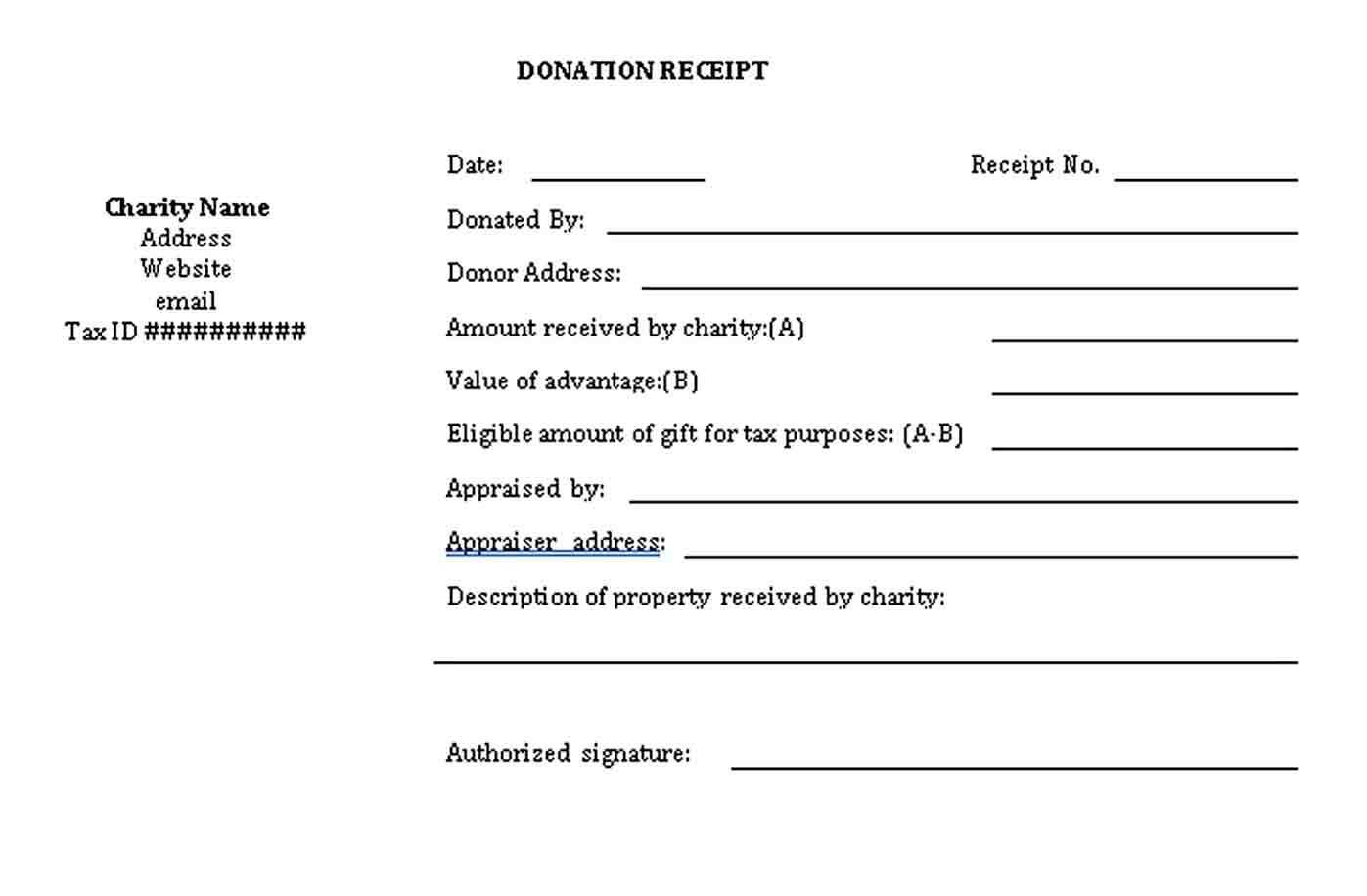

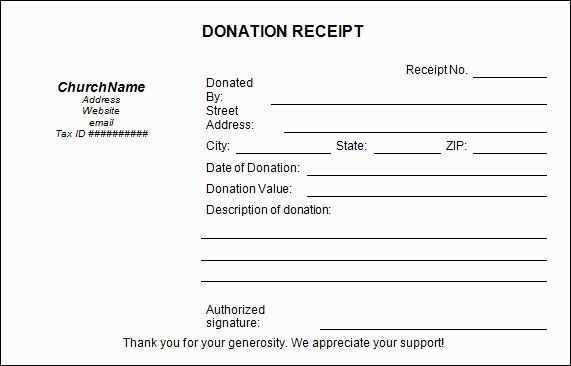

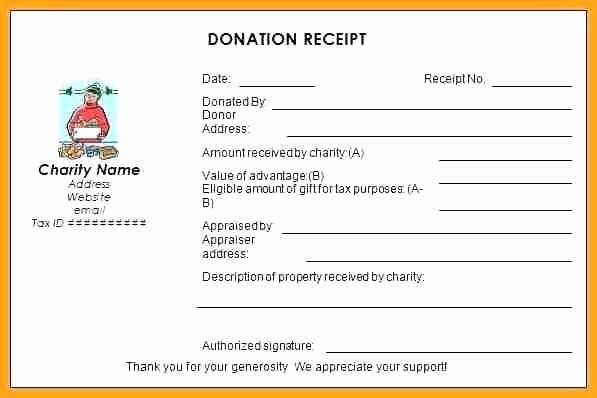

To issue a proper donation receipt, use a structured template that includes essential details. The receipt should clearly state the donor’s name, contribution amount, donation date, and organization details. Including a unique receipt number helps with tracking and record-keeping.

For tax-deductible donations, ensure the receipt specifies whether the donor received any goods or services in return. If the donation was entirely charitable, adding a note such as “No goods or services were provided in exchange for this donation” will meet compliance requirements in many jurisdictions.

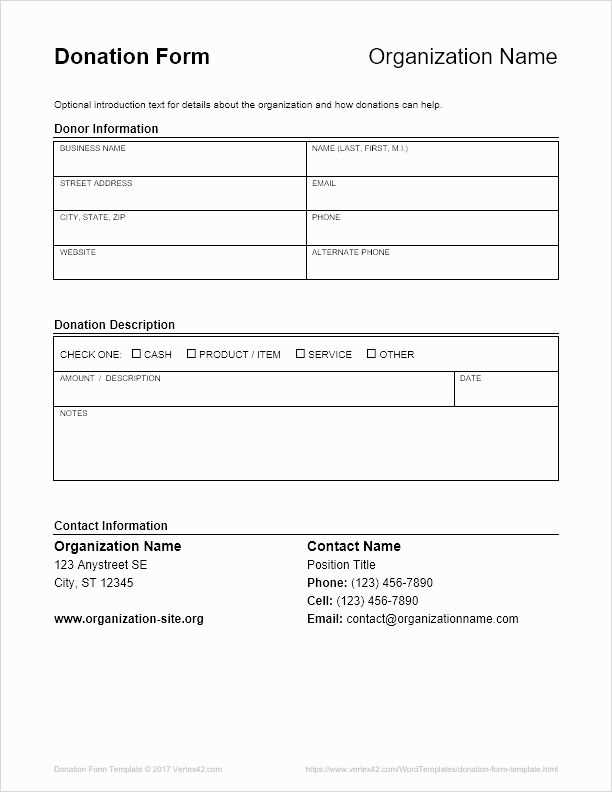

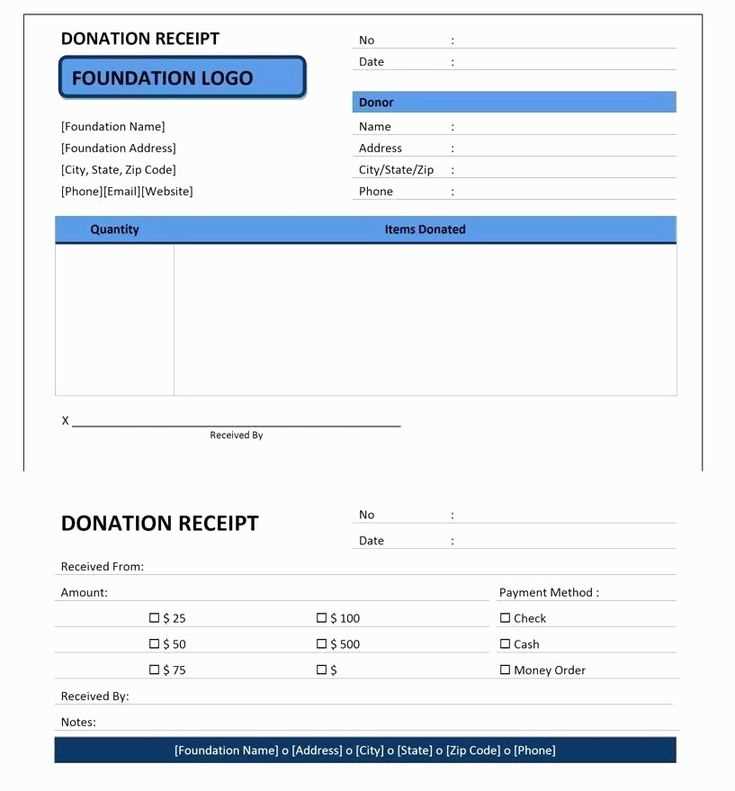

Choose a template that suits your needs, whether for single or recurring donations. Digital formats like PDF and DOCX allow easy customization, while pre-formatted print templates provide convenience for handwritten receipts. Consistency in format simplifies accounting and ensures transparency for both donors and organizations.

Here is the corrected version without unnecessary repetitions:

The donation receipt template should include key details like the donor’s name, donation amount, date of donation, and the organization’s name. Ensure clarity by listing each piece of information in its own section. For instance, place the donor’s details at the top, followed by the donation specifics and the organization’s tax ID number if applicable.

Make sure the receipt clearly states whether the donation was monetary or material. If it’s a material donation, list the items and their approximate value. Providing this transparency ensures both the donor and organization have accurate records for tax purposes.

To streamline the process, use a consistent format with simple language and avoid any unnecessary jargon. This not only makes the receipt easier to read but also helps the donor recognize all the relevant details at a glance.

Lastly, remember to thank the donor for their support. A brief note expressing appreciation adds a personal touch and strengthens the relationship between the donor and the organization.

- Donation Receipt Template Order

Ensure the donation receipt template includes these key sections in this order:

- Organization Information: Start with the organization’s name, address, and contact details. Include the nonprofit status or tax-exempt number if applicable.

- Donor Information: Clearly list the donor’s name and address. If needed, include their contact details for reference.

- Donation Details: Specify the date of the donation and its value. Include a description of the donated goods or services, if applicable.

- Tax Deductible Status: State whether the donation is tax-deductible. Include a note confirming that no goods or services were exchanged for the donation, if relevant.

- Signature: Provide space for an authorized representative’s signature, confirming the receipt of the donation.

- Additional Information: Add any additional notes that may be helpful, such as the donation purpose or any restrictions placed on it.

By following this template order, you ensure clarity and compliance with donation receipt requirements.

Begin with the donor’s name and address to properly identify them. This helps both parties keep accurate records for tax and organizational purposes.

Include the date of the donation, which is crucial for both tax filings and accounting. This confirms when the contribution was made.

Clearly state the donation amount, whether it’s a cash donation or the value of goods donated. For in-kind donations, provide a description of the items along with their estimated value.

If the donation was a gift of services, mention the value of those services. For IRS compliance, it’s best to note that the donor is responsible for determining the value of non-cash gifts.

State whether any goods or services were provided in exchange for the donation. This will impact the donor’s tax deduction, and transparency is necessary here. If applicable, mention the fair market value of these items.

Finally, provide your organization’s name and tax-exempt status. Include your IRS tax ID number or equivalent, as this is a requirement for tax deductions.

Donations come in various forms, and each type requires specific details on the receipt. The key is to ensure transparency and provide all necessary information for both the donor and the receiving organization.

Cash Donations

For cash donations, include the exact amount given and the date. Clearly state that the donation was made in cash, ensuring there is no ambiguity. A simple line such as “Received $50 in cash” is sufficient. If possible, include a statement like “No goods or services were provided in exchange for this donation” to clarify the tax-deductibility of the gift.

Check or Credit Card Donations

For donations made via check or credit card, note the check number or the last four digits of the credit card used. This helps link the donation to the donor’s transaction. It’s also helpful to list the amount, transaction date, and mention whether the donation was a one-time or recurring payment.

Always confirm that the receipt clearly indicates whether any benefits or goods were given in exchange for the donation, as this impacts the tax reporting requirements. If no goods or services were exchanged, you can add a line stating this.

Ensure your donation receipts include all the required legal details to avoid issues with tax authorities. A valid receipt should clearly state the donor’s name, the date of the donation, and a description of the donated items or cash. If the donation is monetary, include the exact amount. If it is a non-cash donation, provide a description of the items donated without assigning a value unless you have a qualified appraiser’s assessment.

For tax purposes, always issue a receipt with a statement confirming whether any goods or services were provided in exchange for the donation. If so, include a description and the estimated fair market value of those goods or services. Failure to include this information could disqualify the donor from claiming a tax deduction.

Be aware of thresholds that trigger different tax requirements, such as donations above $250. For these donations, include a specific written acknowledgment of the contribution. Be transparent about the fair market value of any non-cash donations, as tax deductions depend on accurate reporting.

Consult with a tax advisor or legal professional to stay up-to-date on specific local and national regulations. These rules may vary based on the country or state where the charity is located. A well-documented donation receipt will support both the donor’s tax deductions and your organization’s compliance with tax laws.

Choose digital formats if you need convenience, speed, and environmental benefits. Digital receipts are easy to store, share, and search. They take up no physical space and can be backed up online for safekeeping. Paper formats, on the other hand, may be more appropriate for individuals who prefer tangible records or when a recipient requests a paper version. Paper receipts also don’t rely on technology or internet access, which can be helpful in areas with unreliable service.

Advantages of Digital Formats

Digital receipts can be generated quickly and easily from any device with internet access. They can be stored in cloud services, reducing the need for physical storage. Tracking donations becomes effortless with organized digital folders, and sending receipts via email ensures immediate delivery. Additionally, digital records help reduce paper waste, aligning with sustainability efforts.

Advantages of Paper Formats

For non-tech-savvy donors or those who need to keep physical proof, paper receipts offer a straightforward solution. Paper can also serve as a reliable backup if an electronic copy is lost or a donor experiences difficulty with technology. Physical receipts can be easier to file for tax purposes, especially for those who prefer traditional filing systems.

Tailor your donation receipt template to reflect your organization’s identity and the needs of your donors. Begin by including your organization’s name, logo, and contact details at the top. This establishes a professional connection and makes the receipt instantly recognizable to your donors.

Next, ensure that all mandatory details are visible and easy to find. Include the donor’s name, address, the date of the donation, and the donation amount. If applicable, note whether the donation was cash, check, or in-kind. These details will make the receipt useful for tax purposes.

Customizing the messaging on the receipt can also add a personal touch. Consider adding a thank-you note or a brief statement explaining how the donation will be used. This helps reinforce the donor’s decision to contribute to your cause.

For non-profit organizations, add a section stating your tax-exempt status, including your IRS determination letter number if applicable. This is especially useful for donors who wish to claim their contributions as deductions.

If your organization has specific recurring donors or members, include a section for recurring donation information, such as the frequency and amount of their contributions. This will provide clarity for both your organization and the donor.

- Review all templates regularly to ensure accuracy.

- Update the template as your organization grows, especially if there are changes in tax laws or your donation process.

- Consider using dynamic fields in the template that automatically pull in donor information for quick generation.

To get a ready-made donation receipt template, several websites offer immediate access to downloadable or customizable options. Trusted platforms like Template.net and FormSwift provide templates specifically designed for donation receipts. These templates come in various formats, including Word, PDF, and Excel, making it easy to choose one that suits your needs.

Sites like Canva and Microsoft Office Templates also offer editable templates that allow you to personalize the layout and content. These platforms are especially helpful if you want a visually appealing design along with functional components. Most templates are free, but premium options are also available with extra features, such as automated fields for donor information.

If you require templates with added legal details or tax compliance features, LegalZoom and Rocket Lawyer provide templates specifically tailored to meet legal standards. These are particularly useful for nonprofits that need to ensure their receipts adhere to tax regulations.

When choosing a template, make sure it includes all the necessary components: donor name, donation amount, date, and organization details. Customizing these templates is straightforward, and many websites allow you to order a printed version as well, which can be useful for organizations that handle physical donations.

To create a donation receipt template, ensure you include these key details:

- The donor’s full name and contact details.

- The organization’s name, contact information, and tax-exempt status if applicable.

- The date of the donation.

- A description of the donation item or amount (if cash, include the exact amount).

- Confirmation that no goods or services were provided in exchange for the donation (if applicable).

The format should be clear and easy to read. Avoid cluttering the receipt with unnecessary information. Here’s an example template:

| Receipt # | Donor Name | Donation Amount | Donation Date | Organization Name | Tax-Exempt Status |

|---|---|---|---|---|---|

| 001 | John Doe | $100 | 2025-02-08 | Charity ABC | Yes |

Make sure the receipt is signed by an authorized person from the organization, ensuring its legitimacy. You can also add a thank you note or any additional information relevant to the donation.