How to Create a Donation Receipt in QuickBooks

QuickBooks allows you to generate donation receipts for non-profit organizations and donors. Follow these steps to create a structured and professional receipt:

- Go to Sales: Open QuickBooks and navigate to the “Sales” section.

- Select Customers: Choose the donor from the customer list or add a new one.

- Create a Sales Receipt: Click on “New Transaction” and select “Sales Receipt.”

- Enter Donation Details: Add the donation amount, description, and category.

- Customize the Receipt: Modify the template by adding your organization’s name, logo, and tax-exempt status.

- Save and Send: Save the receipt and send it via email or print a copy for records.

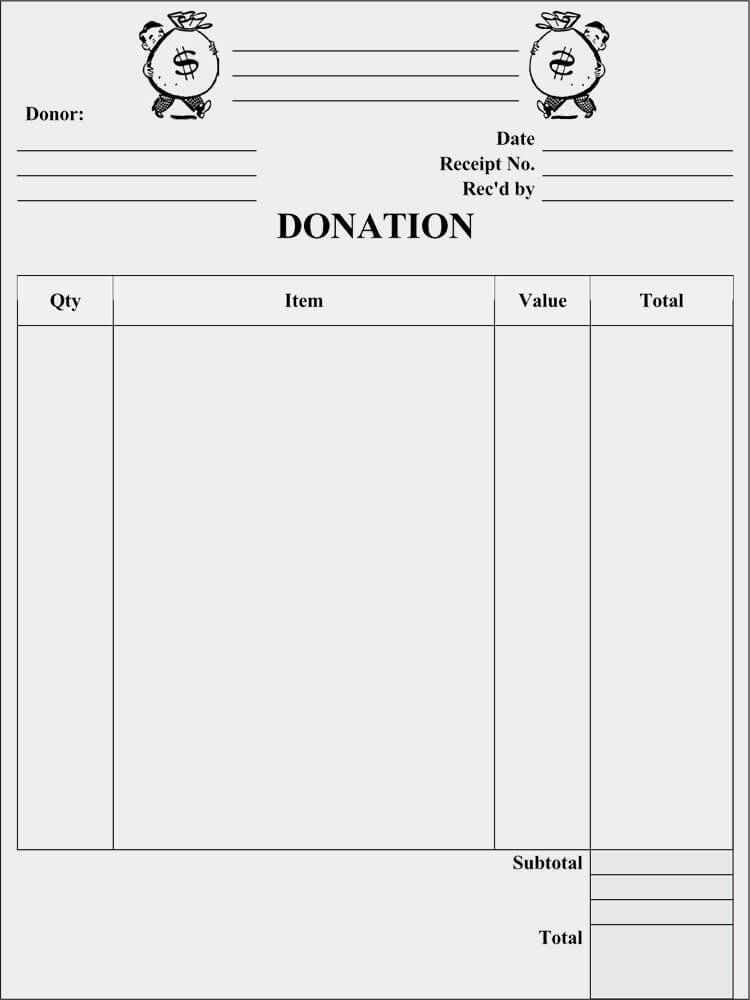

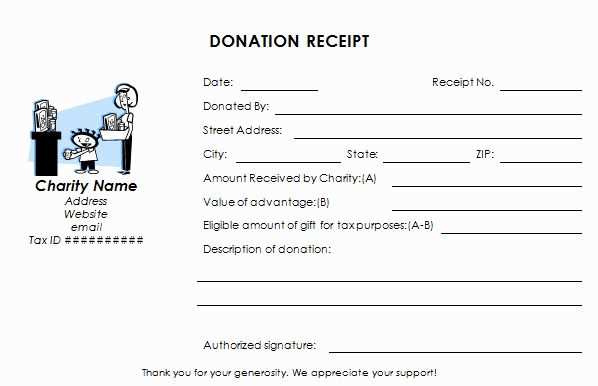

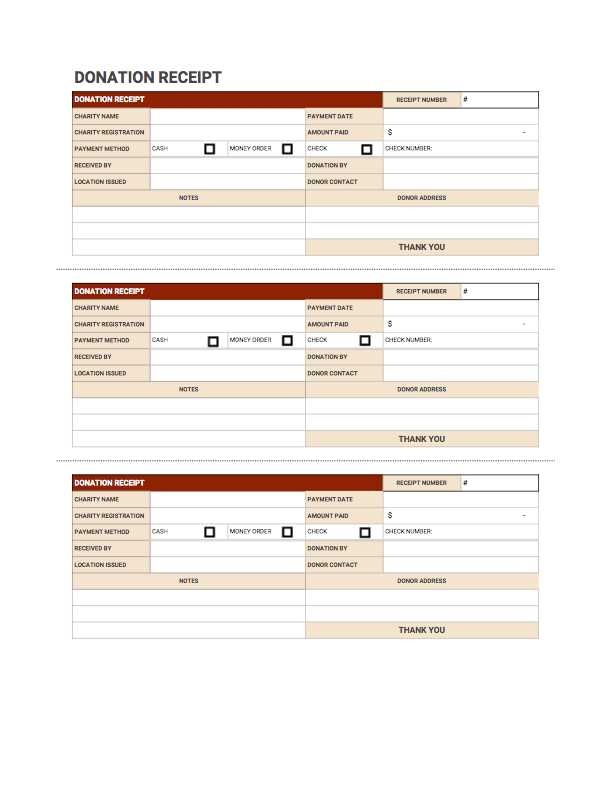

What to Include in a Donation Receipt

To ensure compliance with tax regulations and provide clear documentation, include the following details:

- Organization’s Information: Name, address, and tax ID.

- Donor’s Information: Full name and contact details.

- Donation Amount: Clearly state the value of the donation.

- Donation Date: Specify when the contribution was made.

- Description: Indicate whether the donation was cash, goods, or services.

- Statement of No Goods or Services: If applicable, confirm that no goods or services were provided in exchange.

- Signature: Include an authorized signature for authenticity.

Customizing the Receipt in QuickBooks

QuickBooks allows template customization through the settings menu. Adjust fonts, colors, and layout to match your organization’s branding. Use the “Customize Form Style” option under “Sales” to modify the receipt appearance.

Saving and Exporting Donation Receipts

To maintain records, QuickBooks enables you to save donation receipts in PDF format or export them for accounting purposes. Store digital copies for easy access and compliance.

Sending Receipts Automatically

Set up automated email templates for donation receipts under the “Preferences” menu. This saves time and ensures donors receive confirmations immediately after making a contribution.

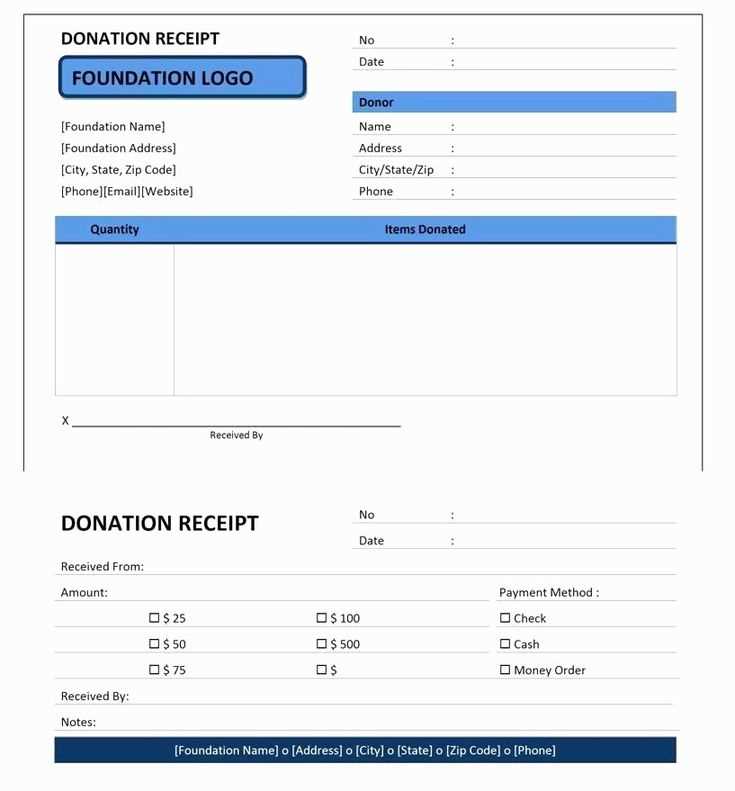

Donation Receipt Template in QuickBooks

Use the built-in donation receipt template in QuickBooks to ensure each contribution acknowledgment meets regulatory requirements. Access the template by navigating to Sales > Customers, selecting the donor, and clicking Create Sales Receipt. Enter donation details, including date, amount, and purpose.

How to Create a Contribution Receipt in QuickBooks

Generate a contribution receipt by selecting New Transaction > Sales Receipt. Choose the donor’s profile or add a new one. Under Product/Service, create a category for donations if not already available. Enter the amount and ensure proper tax-exempt classification.

Customizing Receipt Layout and Details for Donations

Modify the layout by going to Settings > Custom Form Styles. Select an existing template or create a new one. Adjust fields like donor name, contribution type, and acknowledgment wording. Save and apply changes to ensure consistency.

Tracking and Managing Supporter Contributions

Use Reports > Transaction List by Customer to monitor donor contributions. Filter transactions by date or donor name to analyze trends. Enable recurring receipts for repeat donors to streamline acknowledgment.

Generating and Sending Gift Acknowledgments

Automate acknowledgments by enabling email delivery under Settings > Sales. Select Customize Emails and edit the template with a personalized thank-you message. Use Send Later to schedule batch deliveries.

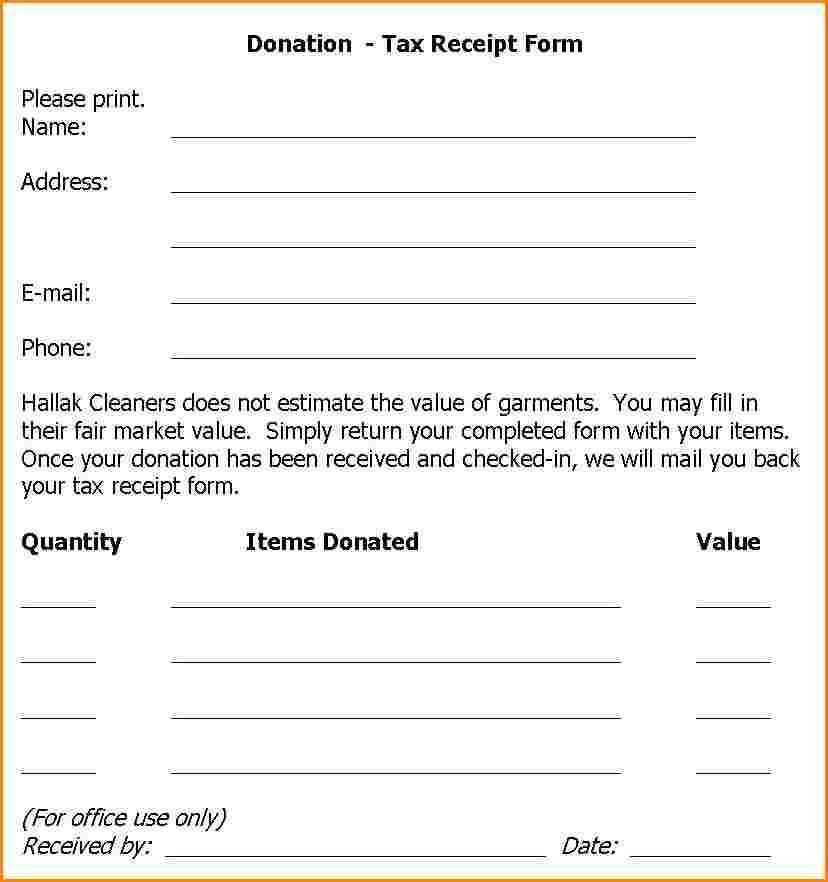

Ensuring IRS Compliance for Charitable Receipts

Include key IRS-required details, such as the organization’s name, donor’s contribution amount, and a disclaimer stating whether goods or services were provided. Review IRS Publication 1771 for compliance guidelines.

Fixing Common Issues with Contribution Receipts in QuickBooks

If receipts fail to display donor details, check Settings > Company Settings to ensure proper customer profile configuration. If email delivery fails, verify sender settings under Account and Settings. Run a test receipt to confirm formatting.