Every donation receipt should include specific details to comply with tax regulations and provide clarity for donors. At a minimum, include the donor’s name, the organization’s name, donation amount, and date. If the contribution is non-monetary, describe the donated items but avoid assigning a value–this is the donor’s responsibility.

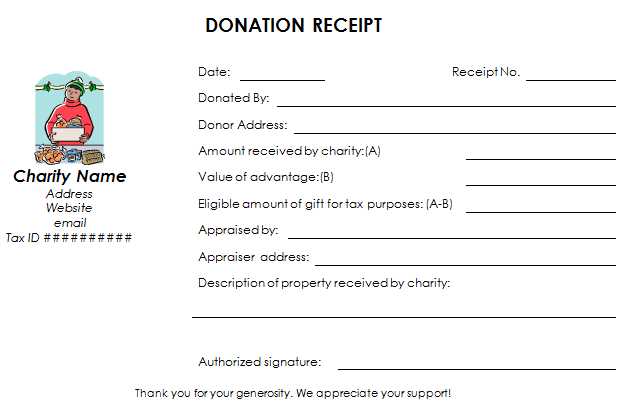

IRS regulations require certain elements for tax-deductible donations in the United States. If the contribution exceeds $250, the receipt must include a statement confirming whether the donor received goods or services in return. For international donors, check local tax laws to ensure compliance.

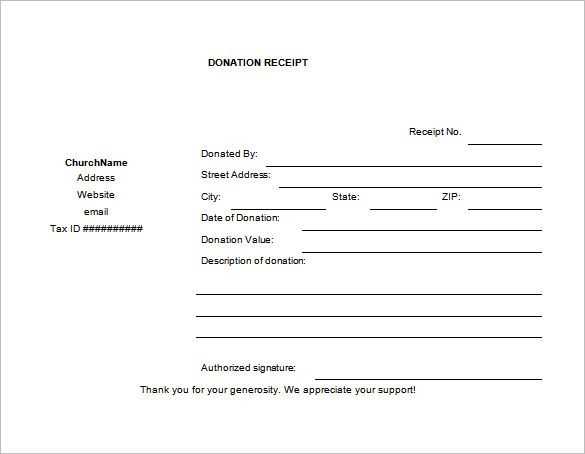

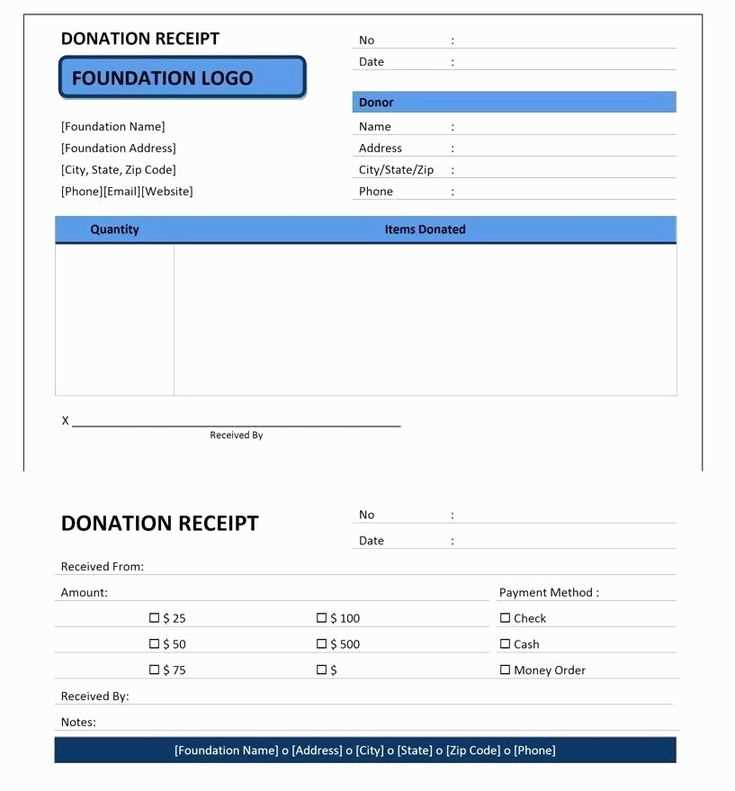

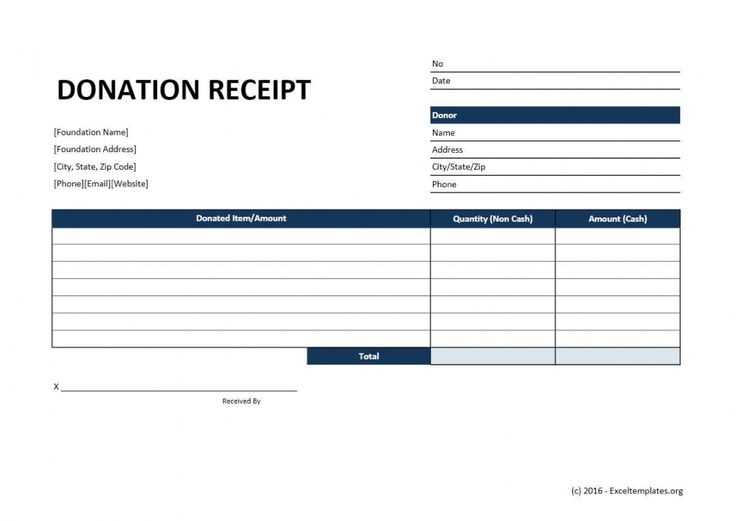

Consistency in formatting makes record-keeping easier. Use a structured template with clearly defined sections for essential information. Including the organization’s tax-exempt status and contact details builds credibility and reassures donors that their contributions are properly documented.

Automating receipt generation saves time and reduces errors. Accounting software, donor management systems, or simple templates in Word or Excel can streamline the process. Ensure that digital receipts are formatted for easy printing and secure long-term storage.

Donation Receipts Template

A well-structured donation receipt includes key details to ensure compliance with tax regulations and transparency for donors. Include the organization’s legal name, address, and tax-exempt status. Clearly state the donor’s name, contribution date, and amount. If the donation was non-monetary, describe the item but avoid assigning a value.

Mandatory Information

Every receipt should confirm whether goods or services were provided in exchange for the donation. If none were given, include a statement such as, “No goods or services were provided in exchange for this donation, except for intangible religious benefits.” This ensures compliance with IRS or local tax authority requirements.

Digital and Physical Formats

Issue receipts via email or print, depending on donor preferences. Use templates with consistent formatting, including organization branding, to maintain professionalism. Retain copies for record-keeping, as tax authorities may request verification during audits.

Key Legal Requirements for Donation Receipts

A valid donation receipt must include the donor’s full name, the organization’s legal name, and the date of the contribution. Omitting any of these details can lead to compliance issues.

Required Information for Tax Deductibility

To qualify for tax deductions, a receipt must state whether the donor received any goods or services in return. If no benefits were provided, the receipt should explicitly say, “No goods or services were received in exchange for this donation.” If something was given in return, the receipt must specify its estimated value.

Specific Amount and Description

For cash donations, the receipt must indicate the exact amount. For non-cash contributions, it should include a detailed description but not the estimated value–that is the donor’s responsibility. Contributions over $250 require a written acknowledgment to claim a deduction.

Ensuring all these elements are correctly documented prevents disputes and helps donors claim tax benefits without complications.

Essential Elements to Include in a Donation Receipt

Include the donor’s full name and contact details. This ensures accurate record-keeping and simplifies tax reporting.

Specify the organization’s legal name, address, and tax identification number. This establishes legitimacy and allows donors to claim deductions.

State the donation date. Tax authorities require precise records, and this helps donors report contributions for the correct year.

Provide a clear description of the donation. For monetary gifts, list the exact amount. For non-cash contributions, describe the item but avoid assigning a value.

Confirm whether the donor received any goods or services in exchange. If none were provided, include a statement confirming this to maintain tax-deductible status.

Add a declaration of the organization’s tax-exempt status. This reassures donors that their contributions align with legal requirements.

Ensure the receipt is signed by an authorized representative. This adds credibility and reinforces the document’s authenticity.

Customizing Templates for Different Types of Donations

Adapt donation receipt templates based on the type of contribution to ensure clarity and compliance. Each category has specific details that donors and tax authorities expect.

- Monetary Donations: Include the donor’s name, donation amount, date, and payment method. If applicable, specify whether the contribution is tax-deductible.

- In-Kind Donations: Describe the donated items, their estimated fair market value, and a brief note on how they will be used. Avoid assigning a dollar value unless legally required.

- Recurring Donations: Indicate the frequency of contributions, the total amount given during the period, and any relevant subscription details.

- Event-Based Donations: Note the event name, ticket price (if applicable), and any portion that qualifies as a deductible donation.

- Corporate Sponsorships: Outline the sponsor’s name, contribution type (cash, services, or goods), and any benefits received in return, such as advertising space.

Ensure all templates follow legal requirements and include your organization’s name, tax ID (if needed), and a clear acknowledgment of the donation. A concise, well-structured receipt reinforces transparency and encourages future contributions.