Use a well-structured donation tax receipt form to provide donors with clear proof of their contributions while ensuring compliance with tax regulations. A properly formatted receipt helps organizations maintain transparency and allows donors to claim deductions without issues.

Include key details such as the donor’s name, contribution amount, and date of donation. The receipt should also specify whether the donation was in cash or another form, along with a brief description if applicable. If the donation exceeds a certain threshold, some jurisdictions may require additional verification, such as the organization’s tax-exempt status and an official signature.

For added convenience, design the form in a fillable digital format, making it easy for donors to receive and store receipts. Whether printed or electronic, ensure that every receipt includes a disclaimer stating that no goods or services were provided in exchange for the donation, unless applicable.

Avoid common errors like missing donor information, incorrect dates, or incomplete tax ID details. Using a pre-approved template reduces mistakes and speeds up the process, benefiting both the donor and the organization.

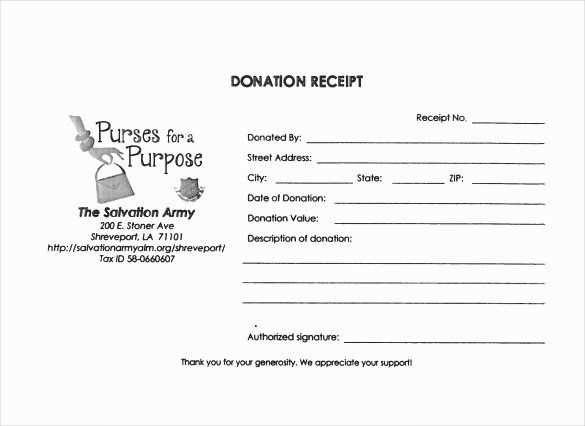

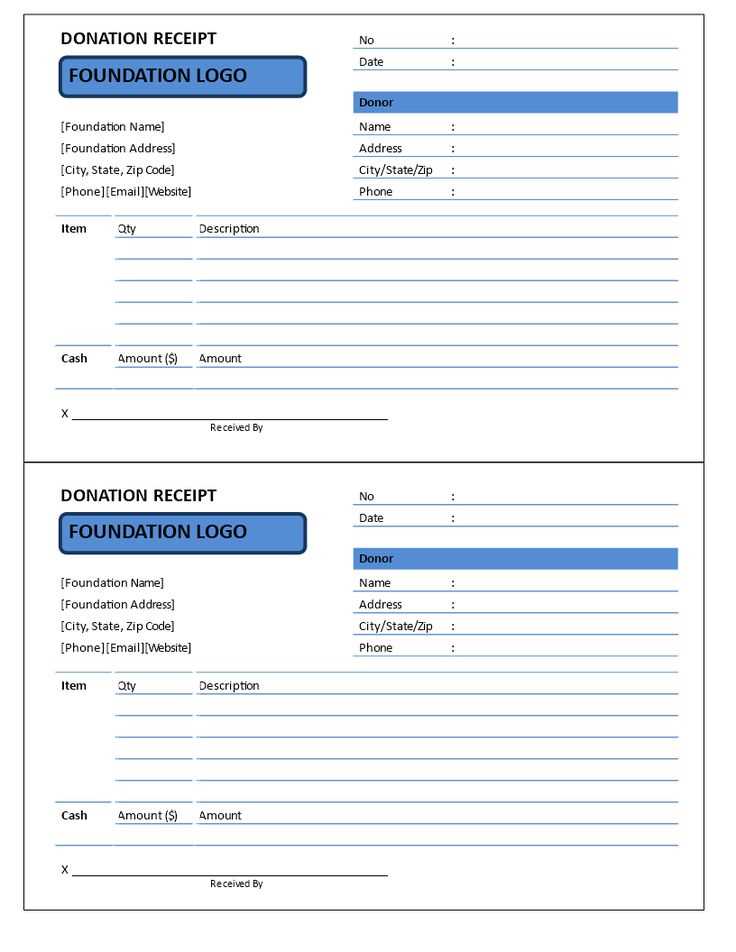

Donation Tax Receipt Form Template

Ensure your donation receipt includes all necessary details to meet tax requirements and provide clarity for donors. A well-structured template should cover key information in a clear format.

- Donor Information: Full name, address, and contact details.

- Organization Details: Legal name, tax identification number, and registered address.

- Donation Description: Amount given or itemized list of goods/services donated.

- Contribution Date: The exact date of the donation.

- Tax-Exempt Status: Confirmation that the organization is eligible to issue tax-deductible receipts.

- Statement of No Goods/Services: If applicable, a note stating that no benefits were received in exchange.

- Authorized Signature: Representative’s name and signature to validate the receipt.

Using a standardized format avoids errors and ensures compliance. A simple table layout or a structured PDF template can help maintain consistency. Double-check local tax laws for specific wording or additional requirements.

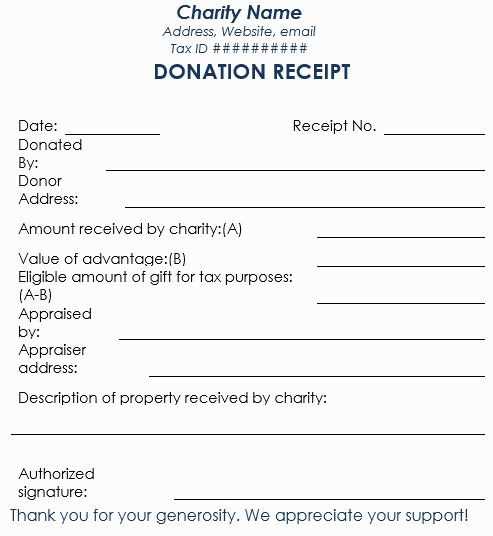

Required Information for a Valid Receipt

A legally compliant donation receipt must include key details to ensure transparency and eligibility for tax deductions. Missing or incorrect information can make a receipt invalid, so accuracy is essential.

Donor and Organization Details

Include the donor’s full name and, if applicable, their address. The organization must provide its legal name, address, and tax identification number to confirm its status as a registered nonprofit.

Donation Description and Value

Clearly specify the donation type–cash, goods, or services. For non-cash contributions, include a detailed description but avoid assigning a value; the donor is responsible for valuation. If no goods or services were provided in return, explicitly state this, or specify the fair market value of any benefits received.

Ensure the receipt is dated and signed by an authorized representative. Keeping digital and physical copies helps both the donor and the organization maintain accurate records.

Formatting Guidelines for Compliance

Include the donor’s full name and mailing address exactly as provided to ensure accurate recordkeeping. Double-check for typos, as incorrect details can cause compliance issues.

Specify the donation date in a consistent format (e.g., MM/DD/YYYY). Avoid ambiguous notations that may lead to misinterpretation.

List the donation amount clearly. If non-cash contributions are involved, describe the item and its estimated fair market value. Do not include appraisals unless explicitly required by regulations.

State whether the donor received any goods or services in exchange. If nothing was provided, include a declaration such as: “No goods or services were received in exchange for this donation.”

Use concise, legally accepted language. Avoid unnecessary embellishments that might complicate verification.

Ensure the organization’s name and tax identification number appear at the top of the receipt. These details confirm eligibility for tax deductions.

Include a signature from an authorized representative. Digital signatures are acceptable if they meet electronic record-keeping standards.

Common Mistakes and How to Avoid Them

Missing Essential Details

Omitting key information, such as the donor’s full name, donation date, or the organization’s tax ID, can make the receipt invalid. Always verify that all required fields are complete before issuing the document.

Incorrect Valuation of Donations

Providing an inaccurate value for donated goods or services can lead to compliance issues. Instead of estimating the worth, describe the donation and let the donor determine its value for tax purposes.

Tip: For cash contributions, specify the exact amount given. For non-cash donations, include a detailed description without assigning a monetary value.

Consistency and accuracy prevent errors that could delay tax processing or trigger audits. Double-check each receipt to ensure compliance with legal requirements.