Create a clear and professional donation tax receipt using a Google Docs template. This approach ensures your donors receive proper documentation for their charitable contributions, which is necessary for tax purposes. It’s easy to customize the template to suit your organization’s branding and specific donation details.

To get started, access the template directly from Google Docs. Make sure to input the donation amount, donor information, and date of donation. You can also include any additional fields required for your organization’s reporting needs, such as a description of the donation or whether it was monetary or non-monetary.

Customize the template with your organization’s name and logo to ensure the document is easily recognizable. This not only helps with legal compliance but also adds a personal touch to the receipt, showing your appreciation for the donor’s generosity.

Once you’ve made all necessary adjustments, you can save and share the template with your donors either digitally or as a printed document. This method streamlines the donation acknowledgment process while keeping everything organized and accessible in Google Docs.

Here is the improved version with word repetitions minimized:

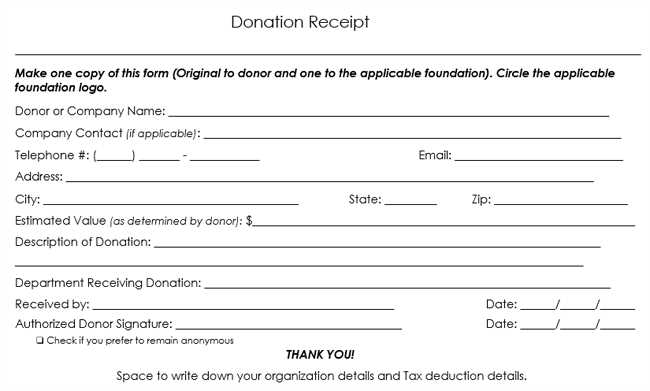

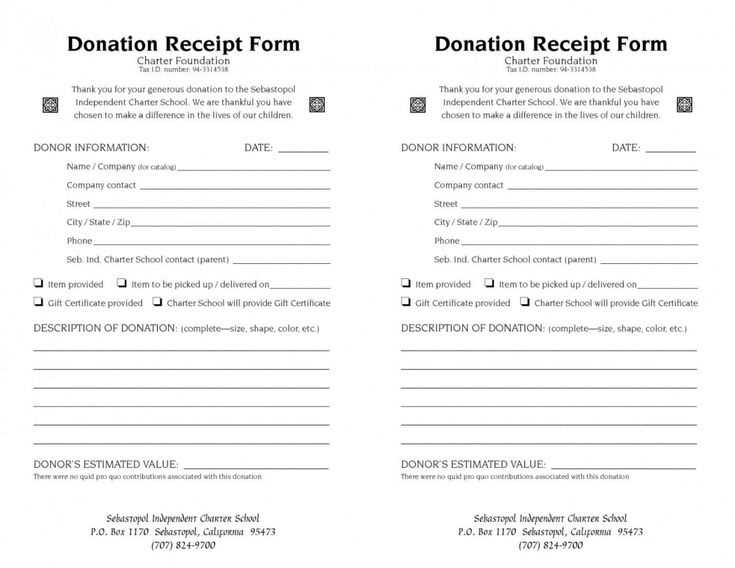

Design your donation tax receipt template in Google Docs by focusing on clear sections that are easy to understand. Start with the donor’s information, including their full name, address, and donation details. Include the donation amount, date, and a description of the item or service donated. Make sure to add a thank-you message that acknowledges their generosity and provides reassurance about the donation’s tax-deductible status.

Clear Section Headers

Use simple headers like “Donor Information,” “Donation Details,” and “Acknowledgment.” This ensures that each section is easy to find and helps streamline the process. In the “Acknowledgment” section, include a brief message confirming that the donation is tax-deductible and the nonprofit’s tax-exempt status.

Customization Options

Customize the template by adding your organization’s logo and contact information at the top. This adds professionalism and builds trust with donors. You can also use bullet points or numbered lists to present important details clearly and concisely.

By following these guidelines, you’ll create a user-friendly donation receipt that’s both functional and professional.

- Donation Tax Receipt Template Google Doc

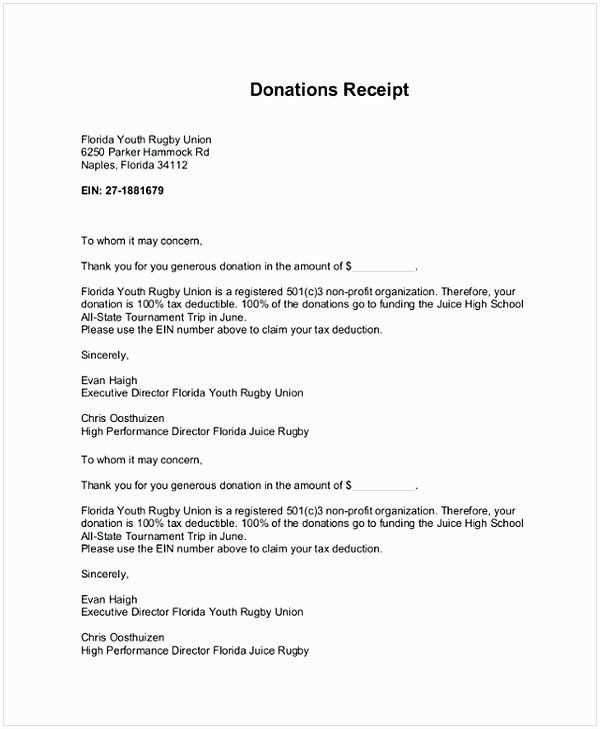

To create a donation tax receipt using Google Docs, start by selecting a simple and clear layout. Choose a professional-looking template that includes all necessary details like the donor’s name, donation date, amount, and your nonprofit’s tax-exempt status. The template should also have a section for your organization’s contact details and a statement indicating that the donation is tax-deductible according to the relevant tax laws.

Customize the template to include your organization’s logo and adjust the font and spacing for readability. Add specific instructions for donors, such as the purpose of the donation or any relevant tax information they may need. Once the document is tailored to your needs, save it and share it with your donors via email or print it for physical distribution.

To create a straightforward donation tax receipt template, follow a few key steps. The goal is to ensure clarity and compliance with tax regulations.

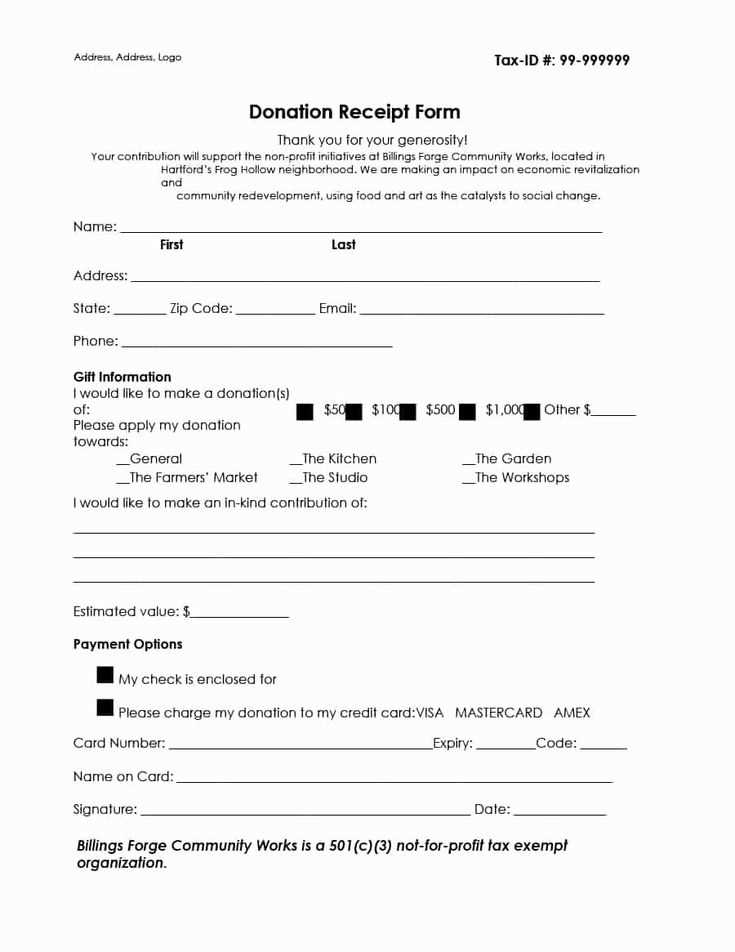

1. Include Donation Details

Start with the donor’s full name, address, and contact information. Include the date of the donation, the donation amount, and the method of payment (e.g., cash, check, or credit card). For non-monetary gifts, describe the item(s) donated and provide a fair market value estimation.

2. Provide Organization Information

List the name, address, and tax-exempt status of your organization. Include your IRS or relevant tax authority identification number. This helps establish the legitimacy of the receipt and confirms the donor’s ability to claim the donation as a tax deduction.

Make sure to clearly state whether any goods or services were provided in exchange for the donation. If so, include a description and a fair value of those goods or services. If nothing was exchanged, mention that the donation was 100% tax-deductible.

Ensure consistency by using clear, readable fonts like Arial or Times New Roman for the text. Keep the font size between 10 and 12 points for clarity.

Align the text to the left for easy reading, especially for itemized sections. You may center headings such as “Donation Receipt” and “Donor Information” to create a clean, organized look.

Key Sections to Include

- Header: Add your organization’s name, logo (if applicable), and contact details at the top.

- Donation Details: List the date of donation, donor’s name, donation amount, and any other relevant information.

- Thank You Message: Include a short appreciation message to the donor.

- Tax Information: Specify whether the donation is tax-deductible and any related details.

Spacing and Margins

- Use 1-inch margins on all sides for a professional layout.

- Ensure that there is enough space between each section, making the document easy to scan.

For itemized donations, use bullet points or a table format for clarity. Tables should have clear borders and adequate space between rows for readability.

Finally, use consistent formatting throughout the document, such as bold for headings and italic for emphasis, to help guide the reader through the receipt smoothly.

Tailor your donation tax receipt template to accommodate different donation types with these straightforward steps. Whether it’s a one-time monetary donation, a recurring contribution, or a gift-in-kind, the receipt must reflect the specifics clearly.

Monetary Donations

- For cash or check donations, include the exact amount donated along with the donation date and the donor’s details. Avoid rounding off the amount, as it’s important for tax purposes.

- If the donation is in a foreign currency, specify the conversion rate used to determine the equivalent value in your local currency.

- Include a section confirming that no goods or services were provided in exchange for the donation if applicable.

Recurring Donations

- For monthly or yearly donations, clearly indicate the donation frequency, amount per donation, and the total amount donated within the year. This helps donors keep track of their contributions for tax filing.

- Consider adding an “auto-renew” field if the donor has opted for automated payments.

Gift-in-Kind Donations

- Provide a space for describing the donated item(s). This should include a brief description and, where possible, the estimated market value of the gift.

- Highlight whether a professional appraisal was used to determine the value, especially for high-value items.

These adjustments will ensure your template suits the specific needs of each donor, simplifying the donation acknowledgment process and aiding in proper tax documentation.

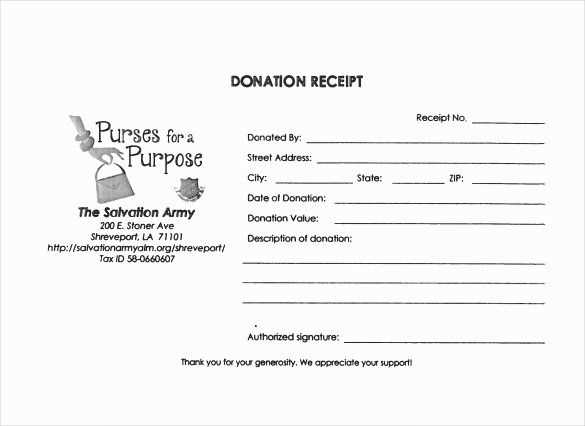

A donation receipt should include specific details to make it valid for tax purposes and provide transparency. First, include the name and address of the charitable organization. This confirms the donation’s recipient. Be sure to add the donation date and the amount donated, whether it’s cash, goods, or services.

Receipt Number and Donor Information

Assign a unique receipt number for tracking and organizational purposes. Include the donor’s name and contact information, such as address and phone number, to ensure clarity on who made the donation. If the donation is anonymous, include a code or identifier instead.

Description of Donation Type

Clearly describe the donation. For cash donations, state the amount. For non-cash items, provide a description and estimated value. If the donation includes services, list them and, if applicable, the fair market value. Also, specify whether the donation is tax-deductible.

To share or download your donation tax receipt template from Google Docs, follow these straightforward steps:

- Sharing the Template: Open the template in Google Docs. Click the “Share” button in the top right corner. You can choose to share via email by entering the recipient’s email address, or generate a shareable link by selecting “Get shareable link.” Ensure the recipient has the proper permissions (view, comment, or edit).

- Downloading the Template: In the same Google Docs document, click “File” in the top menu. From the drop-down menu, hover over “Download” and select the desired file format, such as Microsoft Word, PDF, or plain text. The file will be saved to your device for offline use.

- Adjusting Share Settings: If you want to restrict access, click the “Share” button and select “Advanced” to customize permissions. You can make the document view-only, or limit it to specific people.

These methods provide easy options for distributing or saving your template securely and efficiently.

Keep accurate records of all donations. Maintain detailed logs of donor information, amounts, and dates to avoid discrepancies during audits. This ensures you can provide clear documentation when requested by tax authorities.

Include the correct wording on your donation receipts. Specify that the contribution is tax-deductible and include your tax-exempt number. Avoid vague language that could create confusion or lead to potential compliance issues.

Check tax laws regularly. Stay up to date with the latest changes in tax regulations to ensure your donation receipts remain in compliance with current rules. Regularly consult with tax professionals or legal advisors to keep your processes aligned with the law.

Ensure proper valuation of non-cash donations. When donors provide property, goods, or services, accurately appraise their value and document the appraisal process. This prevents disputes regarding the value of a donation and strengthens your organization’s compliance position.

| Action | Benefit |

|---|---|

| Track all donation details | Prevents discrepancies during audits |

| Use clear tax-deductible language | Avoids confusion about eligibility |

| Review tax law changes regularly | Ensures continued compliance |

| Accurately value non-cash donations | Reduces risk of disputes over valuation |

For creating a donation tax receipt template in Google Docs, it’s best to use a clean layout that covers all necessary details without overcomplicating the design. Follow these tips to ensure your template meets the required legal and practical standards:

Key Elements to Include

| Section | Details |

|---|---|

| Donor Information | Include the donor’s full name, address, and contact information. |

| Donation Details | List the amount donated, the date of donation, and any item description if applicable. |

| Tax Identification Number | Provide your organization’s tax ID number for proper record-keeping and legitimacy. |

| Statement of No Goods or Services | Clearly state that no goods or services were provided in exchange for the donation. |

| Signature | Include a space for an authorized signature from your organization. |

Formatting Recommendations

Use a simple font like Arial or Times New Roman for easy readability. Keep the template under one page, with clear headings for each section. This ensures that donors can easily find the information they need, and it gives your organization a professional appearance.