Creating a donation receipt template that is both clear and professional can help streamline your organization’s process of acknowledging contributions. This template should include key details such as the donor’s name, the amount donated, and the date of the contribution.

Ensure the receipt includes a statement confirming the donation is tax-deductible, if applicable. This information helps the donor when filing their taxes and ensures your organization maintains transparency in its operations.

Be sure to customize the template to include your organization’s name and contact details, along with a brief thank-you note expressing gratitude for the donation. This adds a personal touch while keeping the receipt professional and informative.

By using a simple, organized donation receipt template, you can easily keep track of contributions and provide donors with a document they can use for their records.

Donations Receipt Template: Practical Guide

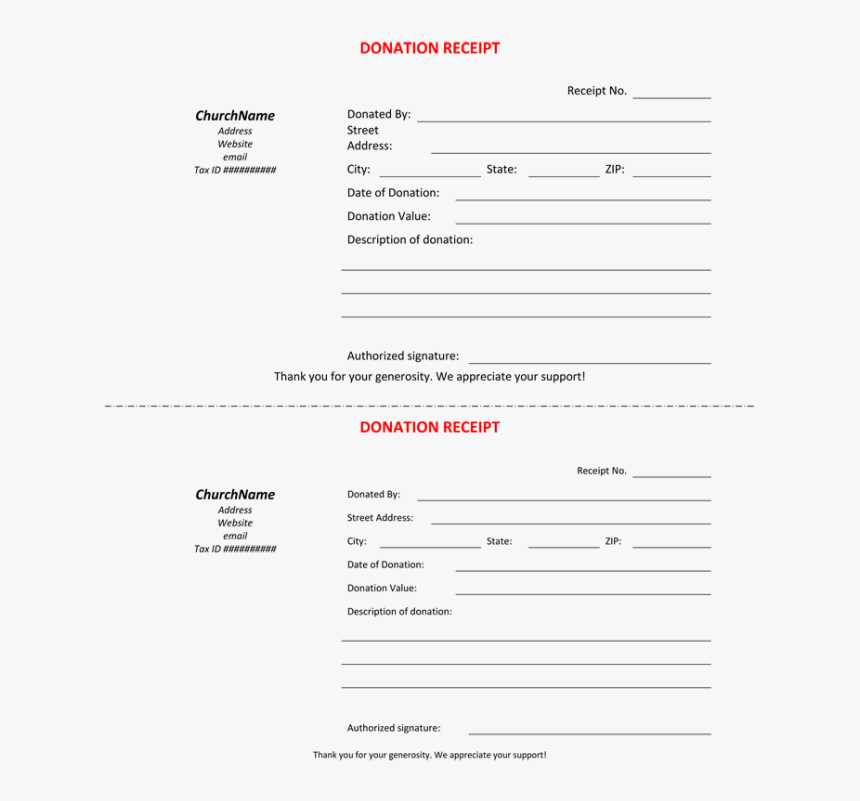

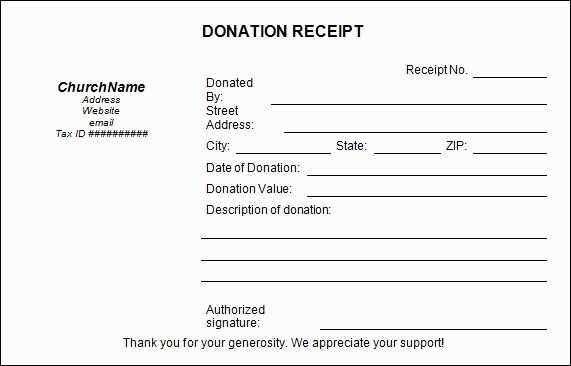

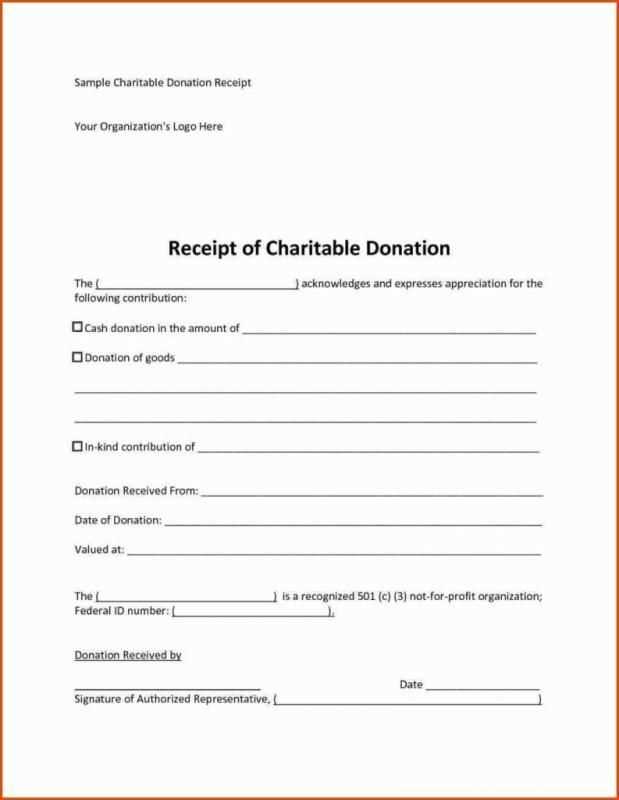

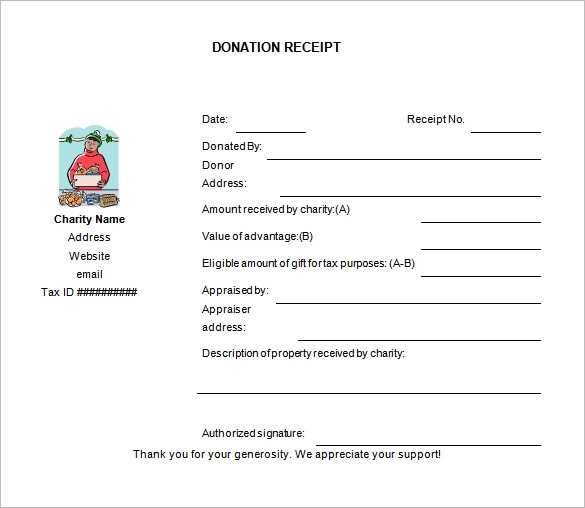

Start with clear details: include the donor’s name, address, and the date of the donation. Specify the amount of money or describe the item donated. Be transparent about the nature of the gift, whether it’s monetary, goods, or services. Acknowledge whether any goods or services were exchanged for the donation, as this impacts tax-deductible status.

Template layout: Ensure the receipt includes the name of your organization, its address, and tax identification number. Keep it simple but thorough. If the donation is monetary, include the exact amount. If it is non-monetary, include a description of the item(s), and if possible, the value.

Provide a section that confirms no goods or services were exchanged, if applicable. This is crucial for donors seeking tax deductions. If goods or services were exchanged, itemize them and their value. A well-structured donation receipt ensures the donor can properly claim their deductions.

Other considerations: Incorporate your organization’s logo for professional branding. Offering multiple ways to reach you (phone, email) helps maintain clarity and trust. Keep your receipts consistent for each donation and issue them promptly, making sure they are dated correctly.

How to Design a Clear and Professional Receipt

Keep the layout simple. Use a clean, easy-to-read font, and make sure the font size is appropriate for clarity. The receipt should be well-structured, guiding the reader through the necessary information without overwhelming them. Begin with the organization’s name, contact details, and logo at the top to ensure easy identification.

Include Relevant Details

List the donation amount clearly and break it down if applicable, showing individual contributions if necessary. Add the date and time of the donation, as well as the donor’s name and address (if required by tax regulations). This information ensures transparency and helps the donor confirm the transaction easily.

Provide a Thank You Note

End the receipt with a brief, personalized thank you message. Acknowledge the impact of their donation and reinforce the positive experience. This adds a human touch and makes the receipt more than just a record–it becomes part of the donor’s connection with your organization.

Key Legal Requirements for Donation Receipts

Donation receipts must include the donor’s name, the donation amount, and the date of the contribution. Ensure that the receipt clearly states whether the donation is monetary or non-monetary. For non-monetary donations, provide a brief description of the items donated.

Fair Market Value of goods donated should be estimated for tax reporting. For donations exceeding a specific value, it is required to include a statement indicating that no goods or services were provided in exchange for the donation.

For tax purposes, ensure that the receipt includes the legal name and address of the receiving organization. If applicable, provide the organization’s tax-exempt status, such as 501(c)(3) for US-based entities. The tax-exempt number is also necessary for certain jurisdictions.

Special Note: Include a disclaimer on receipts for donations made in exchange for raffle tickets, auction items, or event participation. Such donations must clearly specify that the amount is not fully deductible, as it represents payment for goods or services.

Finally, keep records of donations for at least seven years in case of audit or other regulatory checks. Providing accurate and clear receipts will support both the donor’s and the organization’s compliance with legal requirements.

Customizing Donation Receipts for Different Organizations

Tailor donation receipts to reflect your organization’s unique identity. The design, language, and details should align with your mission and the type of contributions you receive.

Design Considerations

Ensure the receipt matches your organization’s visual style. Use your logo, brand colors, and fonts consistently. For example, a charity focused on children may choose bright colors and playful fonts, while a foundation focused on the environment might opt for earthy tones and clean typography.

Details to Include

- Organization’s Information: Include your organization’s name, address, and tax identification number for transparency.

- Donation Details: Clearly list the donation amount, date, and method (e.g., check, credit card, online transfer).

- Legal Disclaimers: Add necessary statements for tax purposes, such as whether the donation is tax-deductible and any limits on deductions.

- Thank You Message: Personalize the receipt with a brief thank you note to acknowledge the donor’s generosity.

For larger organizations, receipts may also include specific project information, highlighting where the funds are going. This can build trust and engage donors in the impact of their contribution.