A well-structured electronic donation receipt simplifies record-keeping for donors and ensures compliance with tax regulations. The key elements include the donor’s name, donation amount, date of contribution, and a statement confirming no goods or services were received in exchange. Adding an organization’s tax ID and digital signature enhances credibility.

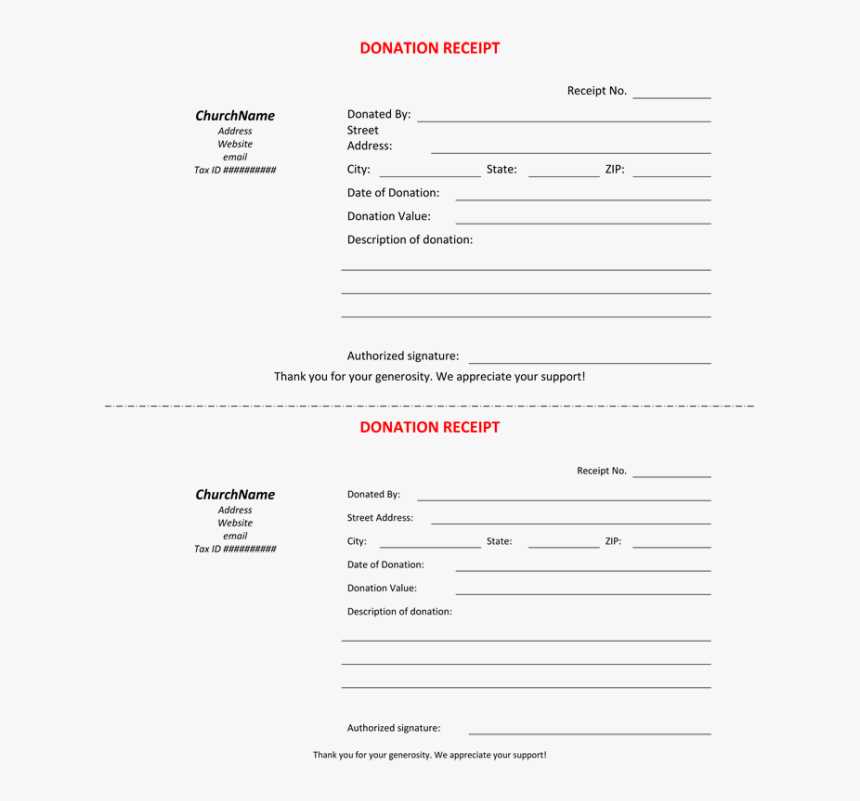

Using a standardized template saves time and reduces errors. A clear layout with predefined fields ensures consistency, whether receipts are sent via email or downloaded from a donor portal. Automating receipt generation through a nonprofit CRM or accounting software minimizes administrative workload.

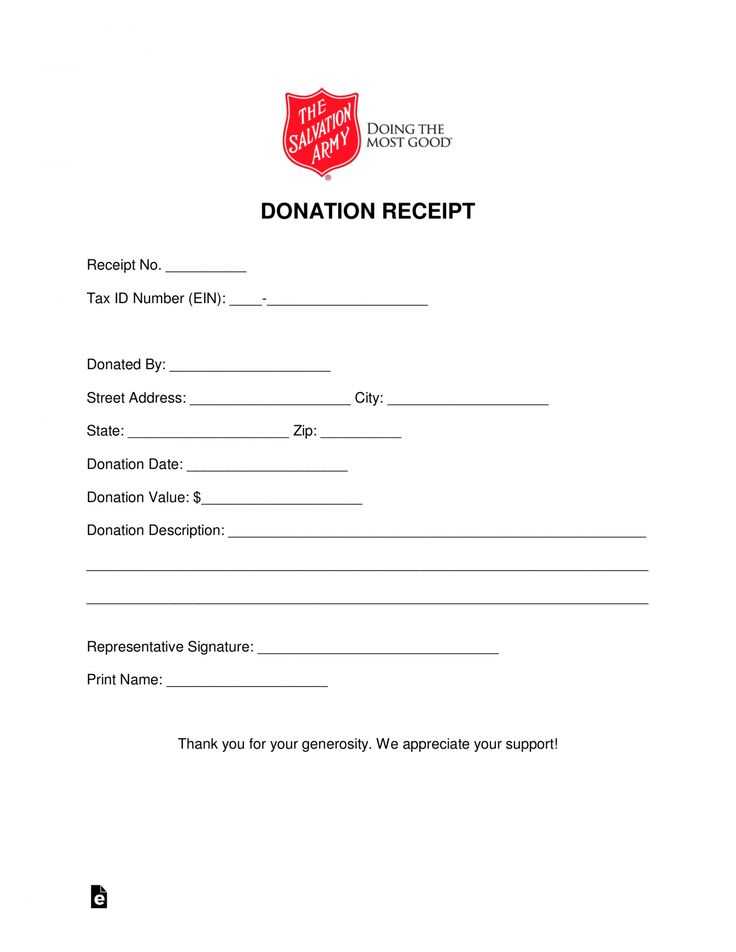

Customizing the template with branding elements, such as a logo and official letterhead, improves professionalism. Including a short thank-you message strengthens donor relationships and encourages future contributions. If applicable, specifying how funds will be used increases transparency and trust.

For digital security, encrypting PDF receipts and using verified email domains prevent fraud and unauthorized alterations. Cloud storage solutions allow easy access to past records, ensuring compliance with retention policies. A well-designed electronic donation receipt is more than a formality–it’s a valuable tool for building long-term donor confidence.

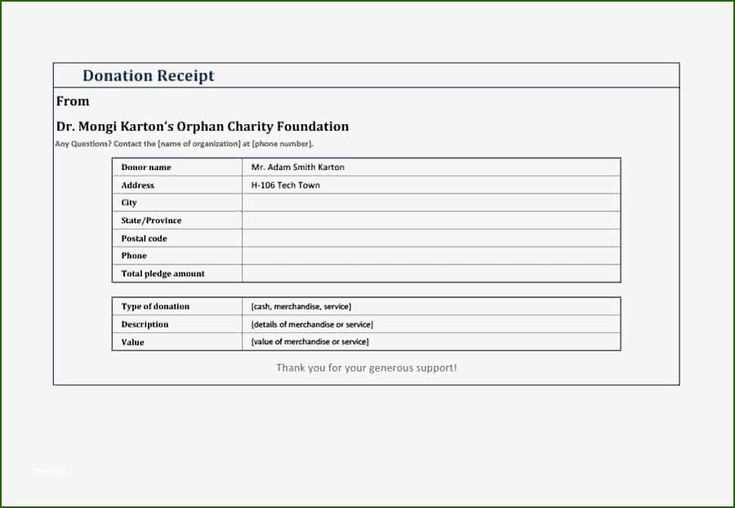

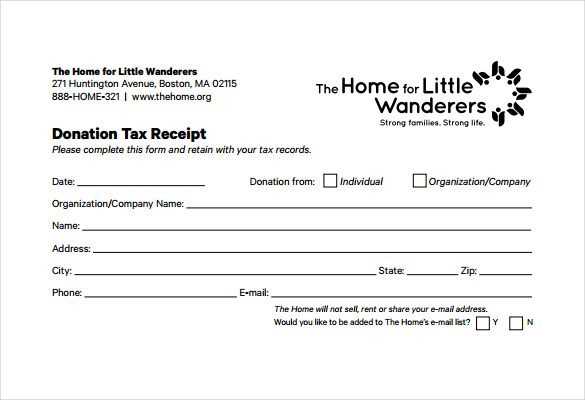

Electronic Donation Receipt Template

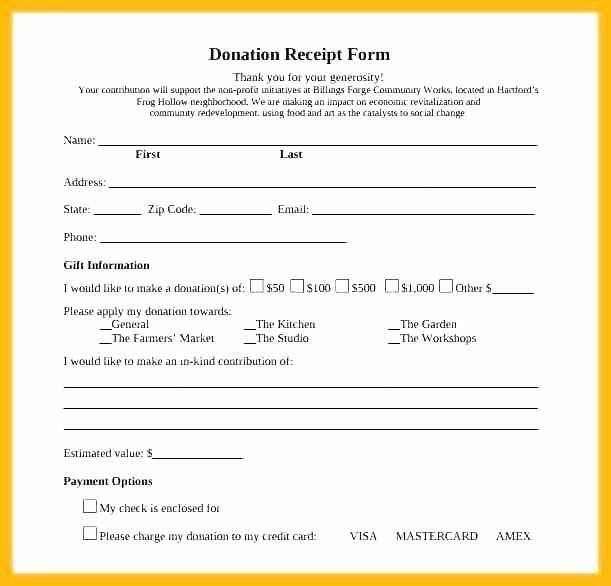

Use a clean and simple template for electronic donation receipts. It should clearly state the amount donated, the date of the donation, and the name of the recipient organization. Ensure your template includes the following key details:

- Donor’s Information: Full name or business name, contact details (email or phone number).

- Donation Details: Amount, currency, payment method (e.g., credit card, PayPal, bank transfer), and the purpose of the donation (if applicable).

- Organization’s Information: Name, address, and tax identification number.

- Donation Acknowledgment: A statement confirming the receipt of the donation, clarifying that no goods or services were provided in exchange (if applicable).

- Receipt Number: A unique identifier for record-keeping purposes.

- Thank You Note: A short, sincere acknowledgment of the donor’s support.

Ensure the receipt is formatted clearly for easy reading and includes the donor’s information and the amount in a prominent location. Customize the template for each donation, and send it promptly to the donor via email or an online platform. This shows your appreciation and maintains transparency for tax purposes.

If applicable, include a link or reference to the organization’s tax-exempt status to help donors claim deductions. It’s helpful to use a PDF format for professional presentation and easy storage.

Key Elements to Include in an Electronic Donation Receipt

Ensure your electronic donation receipt covers these critical components to guarantee clarity and compliance:

| Element | Description |

|---|---|

| Donor Information | Include the donor’s name, address, and contact details, ensuring the information matches their records for tax purposes. |

| Donation Date | Specify the exact date when the donation was made to avoid any discrepancies during tax filing. |

| Donation Amount | Clearly state the amount donated, whether a fixed sum or a percentage. Break down any in-kind contributions if applicable. |

| Organization Information | Provide your organization’s name, address, and tax identification number (TIN) for transparency and accountability. |

| Purpose of Donation | If the donation is designated for a specific program or cause, mention it explicitly to avoid confusion. |

| Nonprofit Status | State that the organization is a registered 501(c)(3) nonprofit (or relevant local equivalent) to confirm the tax-deductible status of the donation. |

| Donation Acknowledgment | Include a note thanking the donor for their support. This personal touch also helps with relationship building. |

| Receipt Number | Assign a unique receipt number to each donation for tracking and record-keeping purposes. |

| Disclosure Statement | If no goods or services were exchanged for the donation, include a statement to that effect, confirming full deductibility. |

These elements create a clear, professional receipt that is both legally sound and informative for donors.

Best File Formats and Delivery Methods for Digital Receipts

PDF is the most reliable format for electronic donation receipts. It preserves formatting, ensuring recipients can easily view the document on various devices without alterations. PDFs are universally accepted, easily printed, and allow for secure encryption to protect sensitive information.

Top File Formats for Donation Receipts

- PDF: Best for compatibility, security, and easy printing. It ensures the integrity of the document and can include features like password protection or digital signatures for authentication.

- CSV: Ideal for bulk donation receipts, especially for organizations that process large numbers of donations. CSV files are easily processed by spreadsheet software and can be automated for large-scale operations.

- TXT: Useful for simple, text-based receipts without the need for complex formatting. This format can be sent as an attachment or included in an email body for quick access.

- HTML: Great for providing interactive or branded receipts. An HTML receipt can be viewed directly in a web browser, allowing for dynamic elements like links or images.

Effective Delivery Methods

- Email: Sending receipts directly via email remains the most efficient way. Include the file as an attachment or embed the content in the email body for immediate access.

- SMS: For quicker, more mobile-friendly deliveries, sending receipts through text message is a convenient option. A link to a cloud-based file or an inline view of the receipt works best.

- Cloud Storage Links: For large organizations or donors with specific needs, sending a download link to a cloud-based file (e.g., Google Drive, Dropbox) allows recipients to retrieve receipts at their convenience.

- Automated Systems: Implementing an automated process for receipt delivery ensures that receipts are sent promptly and without error. This method can be used for both PDF and CSV formats, saving time for both donors and organizations.

Legal and Tax Compliance Considerations for Donation Receipts

Donation receipts must comply with local legal and tax regulations to ensure that donors can claim their contributions on tax returns. Each country or region may have specific rules governing the details required on donation receipts, including the donor’s name, the amount donated, and the nonprofit organization’s tax-exempt status. Always confirm the required elements with the relevant authorities to avoid issues with tax deductions.

Required Information on Donation Receipts

Include the nonprofit’s name, address, and tax-exempt status number. Specify whether the donation was monetary or in-kind. If it’s an in-kind donation, describe the donated items and their estimated value. If a benefit was received by the donor (such as goods or services in exchange for the donation), this must also be clearly stated, along with the fair market value of the benefit.

Specific Tax Implications

For tax purposes, the value of the donation and any associated benefits must be reported correctly. Ensure that donors receive the correct documentation to claim tax deductions. If the donation exceeds a certain amount, you may need to include additional details, such as a statement confirming that no goods or services were provided in exchange for the gift. Always check with local tax authorities for the required thresholds and documentation guidelines.

By adhering to these requirements, you not only ensure the integrity of your receipts but also support your donors in maximizing their tax benefits. Keep all records organized and ready for verification in case of an audit.