Ensure your donors receive accurate and organized year-end receipts by using a clear and straightforward donation receipt template. This template will provide all necessary details for tax deductions, keeping both your organization and donors in compliance with tax regulations.

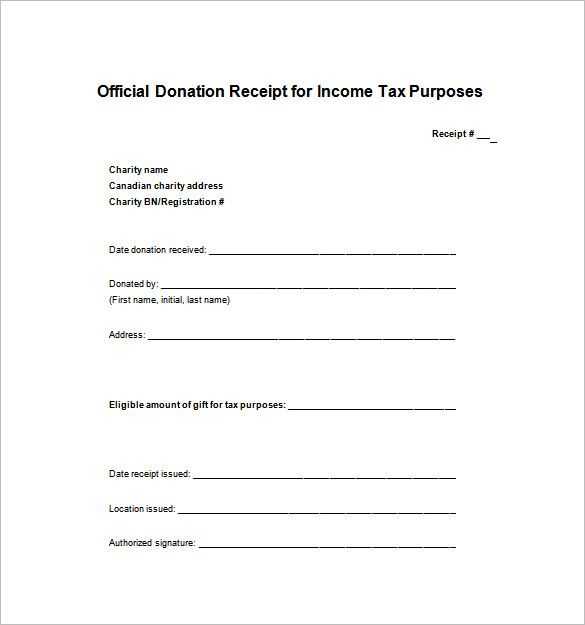

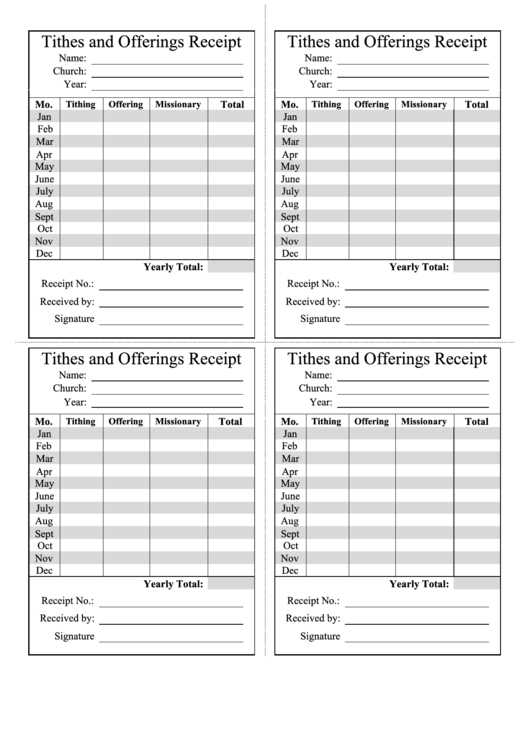

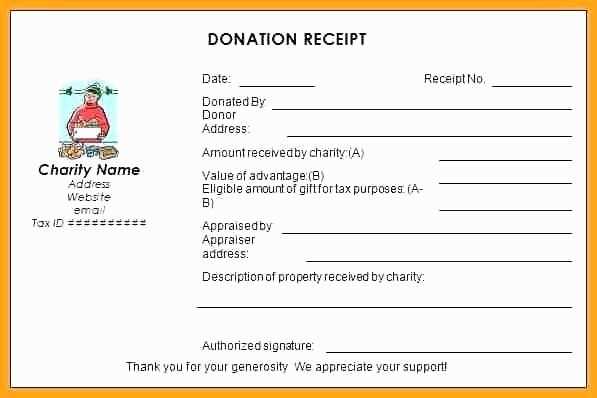

Include basic information such as the donor’s name, donation amount, and the date of the contribution. It’s also important to specify whether the donation was monetary or non-monetary. For non-monetary gifts, a brief description and estimated value should be included.

Donors also appreciate a thank-you note that acknowledges their generosity and explains how their contribution has made a difference. This helps maintain a strong relationship and encourages future support.

Finally, keep the format simple and easy to follow, avoiding unnecessary jargon. A clear, professional receipt will reflect well on your organization and streamline tax filing for both parties.

Here’s an improved version:

Provide a clear breakdown of the donation, including the donor’s name, date, and amount donated. Keep it simple and direct. Make sure the donation receipt includes the organization’s details, such as name, address, and tax ID number, for legal and tax purposes. Use a professional and neat layout to make it easy for donors to read and save.

Receipt Formatting Tips

Ensure that all text is legible, and use a well-organized structure with appropriate sections. List the donation amount in both numerical and written forms. Include any necessary disclaimers, such as that no goods or services were received in exchange for the donation, to maintain clarity and compliance with tax regulations.

Provide Contact Information

Always include a contact number or email in case the donor has questions. This adds a layer of transparency and trustworthiness, making it easy for them to reach out if needed.

- End of Year Donation Receipt Template Overview

To create a clear and accurate end-of-year donation receipt, include essential details that comply with IRS requirements. This ensures that the donor can easily use the receipt for tax purposes. Below are the key components to include in your template.

Required Information for the Donation Receipt

Your receipt should have the following items:

- Organization’s Name: Clearly state the name of your nonprofit organization.

- Tax-Exempt Status: Mention your tax-exempt number or 501(c)(3) status.

- Donation Date: Specify the exact date when the donation was made.

- Donation Amount: Clearly list the value of the contribution made by the donor.

- Type of Donation: Specify whether the donation was monetary, in-kind, or a combination.

- Statement of No Goods or Services Provided: Indicate if no goods or services were provided in exchange for the donation. If they were, provide a description and the fair market value.

Template Example

| Organization Name | Tax-Exempt Number | Donation Date | Amount/Description |

|---|---|---|---|

| XYZ Nonprofit | 123-4567890 | December 15, 2024 | $200 Cash Donation |

| XYZ Nonprofit | 123-4567890 | December 20, 2024 | 2 Bags of Clothing (Fair Market Value: $50) |

Using this straightforward template ensures your receipt contains all the necessary information for your donors to claim their donations properly during tax filing. Customizing this format according to your nonprofit’s specific needs will enhance clarity and compliance with IRS guidelines.

Begin by clearly identifying the donor and the organization. Include the full name and address of both parties. Specify the date of the donation and ensure it’s accurate. List the type of donation–whether it’s monetary or non-monetary–and provide the value of the gift. If it’s a non-monetary gift, describe the item or service donated with as much detail as possible.

Next, include a statement that confirms the donor received no goods or services in return for the donation, unless applicable. If goods or services were provided, mention the fair market value of these items. Also, if there were any special conditions or restrictions related to the donation, those should be addressed clearly.

End the receipt with a formal statement of appreciation. This demonstrates recognition of the donor’s contribution, strengthening the relationship. Make sure the receipt is signed by an authorized representative of the organization, and add any necessary contact information for follow-up questions.

Ensure that your donation receipt includes specific details required by law to maintain its validity. A legally sound donation receipt should list the donor’s full name, the organization’s name, and the donation date. Also, include the amount donated, or if the donation is non-monetary, a description of the items donated.

Donation Value and Fair Market Assessment

For in-kind donations, the receipt must include an accurate assessment of the fair market value of the items. This protects both the donor and the charity in case of tax audits. Make sure that both parties agree on the valuation, as inaccurate descriptions or estimated values may raise concerns.

Nonprofit Status and Tax Information

The donation receipt should clearly state the nonprofit status of the organization. This can be indicated by including the charity’s tax identification number (TIN) or the IRS-issued exemption number. Donors rely on this information for claiming tax deductions. Ensure that your receipt specifies whether the donation is tax-deductible under local laws.

Lastly, confirm that the receipt states no goods or services were exchanged for the donation, unless a benefit was provided, in which case, the value of the goods or services should be detailed. Failure to include this may prevent donors from claiming tax deductions for their contributions.

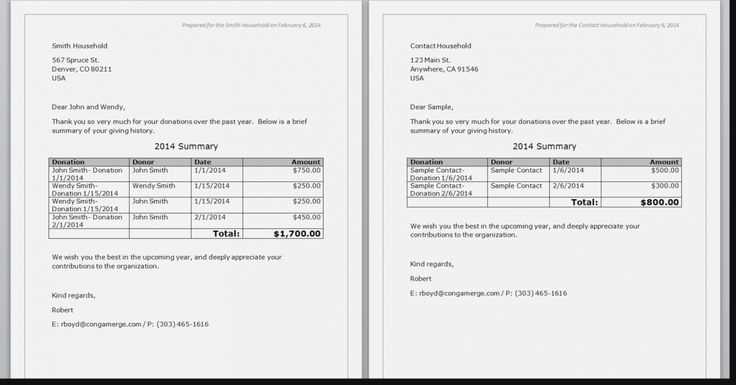

Tailor your receipts based on donor type to build a stronger connection and show appreciation for their contributions. Adjusting the tone and level of detail can make the donation feel more meaningful.

Major Donors

- Include personalized messages acknowledging their significant impact on your mission.

- Highlight the total amount donated and mention any specific initiatives their funds are supporting.

- Provide details on the outcomes their donation helps achieve, with clear, quantifiable goals where possible.

Monthly/Recurring Donors

- Show gratitude for their ongoing commitment by emphasizing the long-term value of their contributions.

- Detail how their consistent support enables you to plan and execute projects more effectively.

First-Time Donors

- Express appreciation for their initial support, encouraging them to stay engaged with your cause.

- Offer a clear call-to-action to stay involved, whether through future donations, volunteering, or attending events.

By customizing the receipts, you reinforce the donor’s connection with your organization and motivate continued support.

Ensure your donation receipt template includes a clear section for listing the total donation amount. This should be prominently displayed to avoid any confusion. Specify the date of the donation to maintain an accurate record for both the donor and your organization.

Detail the Donor Information

Include the full name and address of the donor. If they are a business, use the company name and official address. It’s important to double-check these details for accuracy, as they are vital for tax reporting.

State the Nonprofit Status

Clearly indicate your nonprofit status on the receipt. Include your tax-exempt number or 501(c)(3) status, which is necessary for the donor to claim the tax deduction. This ensures transparency and credibility for both parties.