When donating equipment to a charitable organization, providing a receipt with a good faith estimate of the value is a key step in ensuring both parties are clear on the transaction. A well-structured letter helps donors claim deductions and offers transparency to the recipient. Below is a basic template to guide the creation of such letters.

Start by clearly stating the date of donation and the items donated. This will establish a formal record for both the donor and the organization. List each item with a brief description to avoid ambiguity, ensuring that each donation is accounted for.

Next, offer a good faith estimate of the value of each item. This can be based on average market values or guidelines provided by the IRS or another authority. Keep this estimate reasonable and transparent, reflecting the fair value of the equipment.

Finally, ensure that the letter includes a statement affirming that no goods or services were provided in exchange for the donation, confirming that the donor made the contribution in good faith. By including these details, the letter can serve as a valid proof for tax purposes.

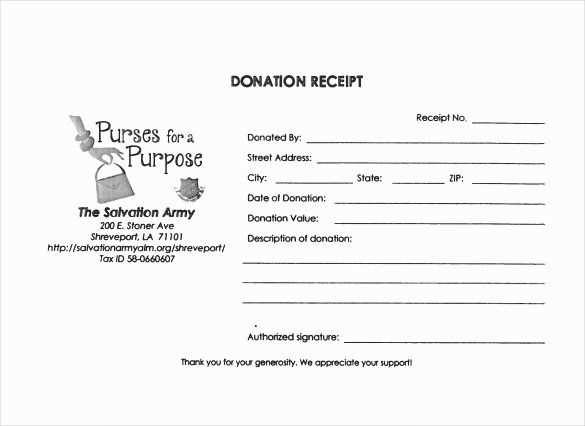

Equipment Donation Receipt Good Faith Estimate Letter Template

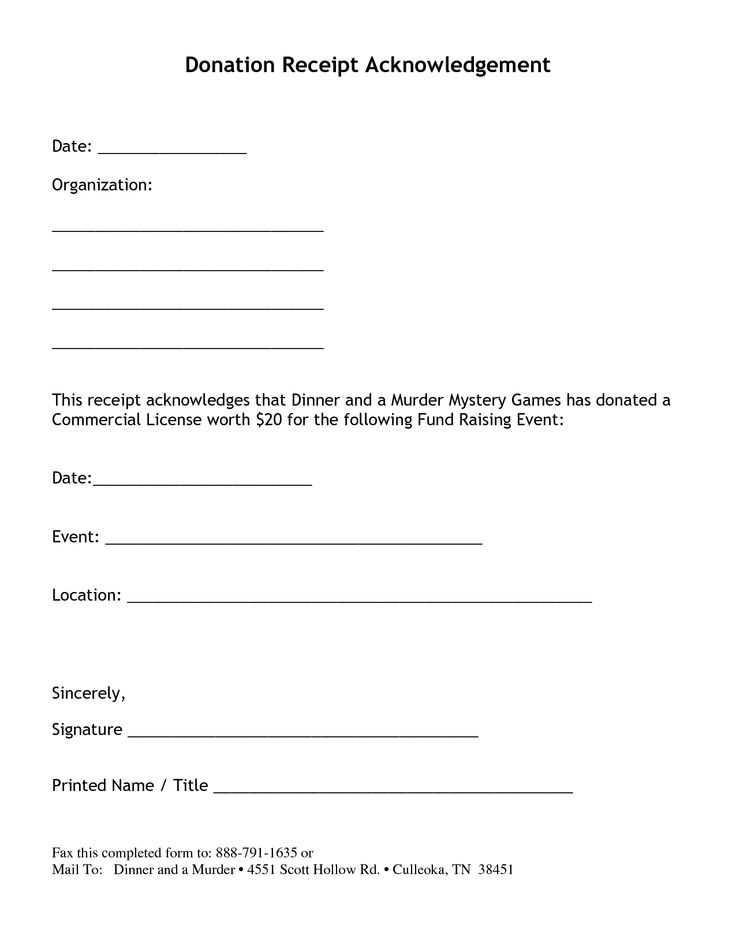

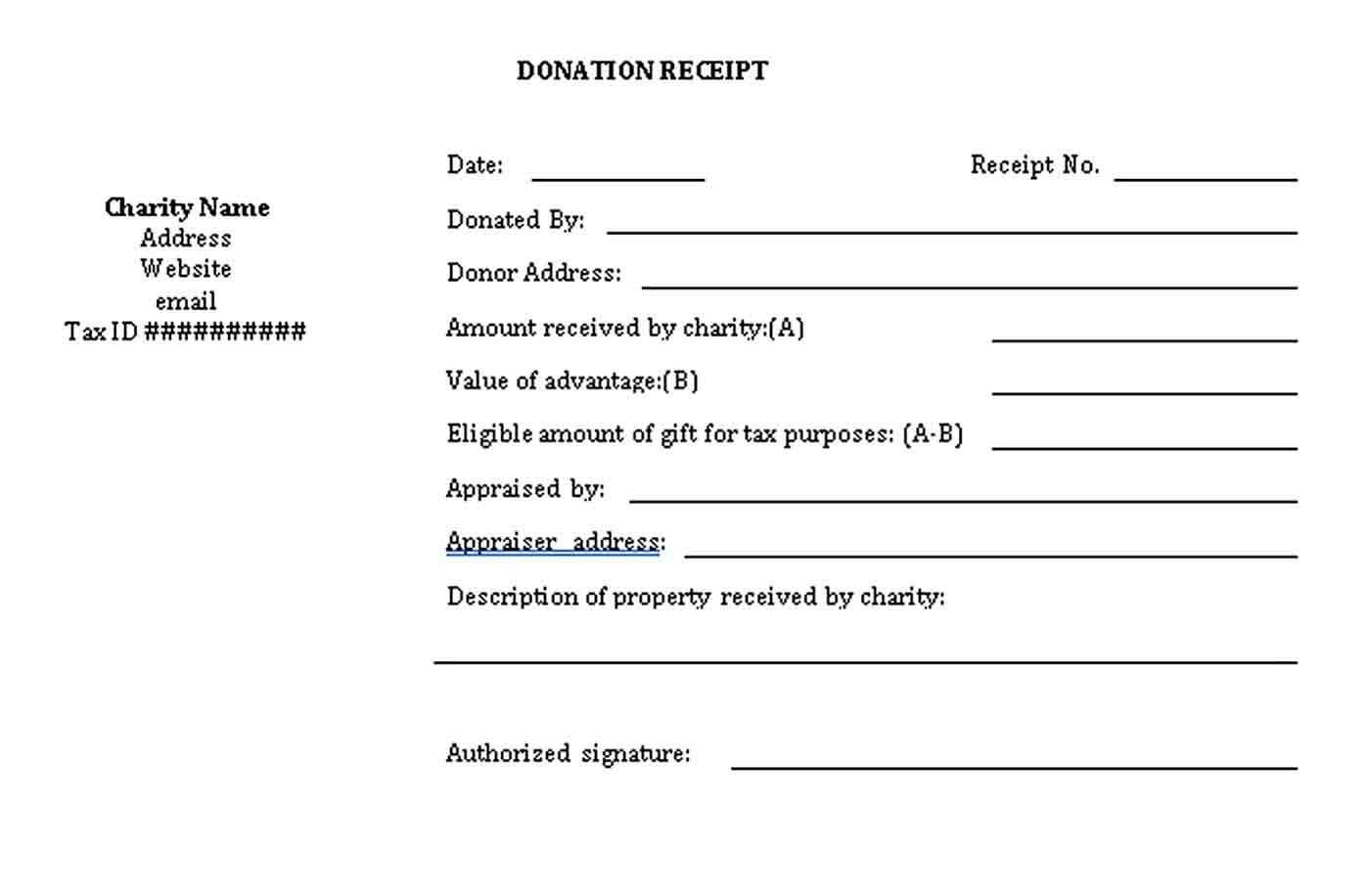

Begin by including the name of the organization and its address at the top of the letter. Ensure the letter is printed on official letterhead to maintain professionalism.

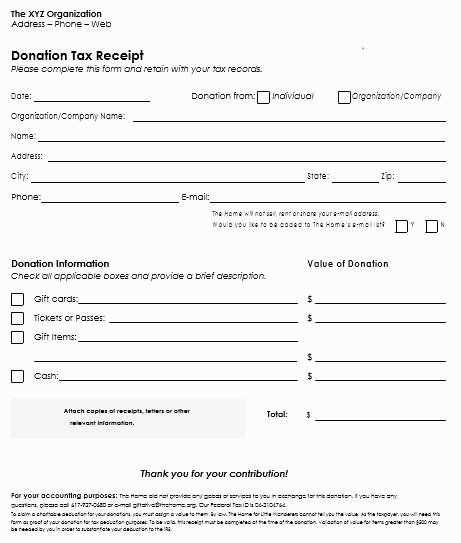

Next, write the donor’s full name and address. Clearly state that the letter serves as a receipt for the donation of equipment, including the type and quantity of items donated. Be specific about the equipment donated, listing each item along with a brief description, model number, and condition.

Provide an estimate of the fair market value for each item donated. This estimate should be based on a reliable source, such as an industry-standard pricing guide or appraiser’s valuation. The donor can use this for tax deduction purposes, so make sure the valuation is realistic and credible.

Include a statement confirming that no goods or services were exchanged for the donation, which is necessary for the donor’s tax records.

Conclude by thanking the donor for their contribution and offering contact information should they need further assistance or clarification regarding their donation.

- Organization Name

- Address

- Donor’s Full Name

- Description of Donated Equipment

- Fair Market Value Estimate

- Statement Regarding Goods/Services Exchange

- Contact Information

By following these guidelines, your equipment donation receipt will meet the necessary requirements and provide the donor with the documentation needed for tax purposes.

How to Draft a Good Faith Estimate for Donated Equipment

Begin by clearly identifying the donor and recipient. Include their full names, addresses, and contact details. This helps to establish the legitimacy of the donation and the context for the estimate.

Provide a Detailed Description of the Donated Equipment

List the equipment being donated with specific details, such as brand, model, condition, and any other relevant information. The more precise the description, the easier it will be to estimate the value. This should also include any accessories or parts that come with the equipment.

Estimate the Fair Market Value

Research comparable items to determine the fair market value (FMV). Check reliable sources such as auction sites, resale stores, or equipment dealers. You can also use a third-party appraisal service for more accuracy. Be honest about the condition of the item to avoid over- or under-estimation.

Be Transparent About the Estimate by mentioning whether the value is based on used or new equipment prices. This transparency is key for both the donor and the recipient to understand how the value was calculated.

Finally, ensure the estimate includes a clear statement that the donor has provided the information in good faith, and that both parties understand it is an approximation.

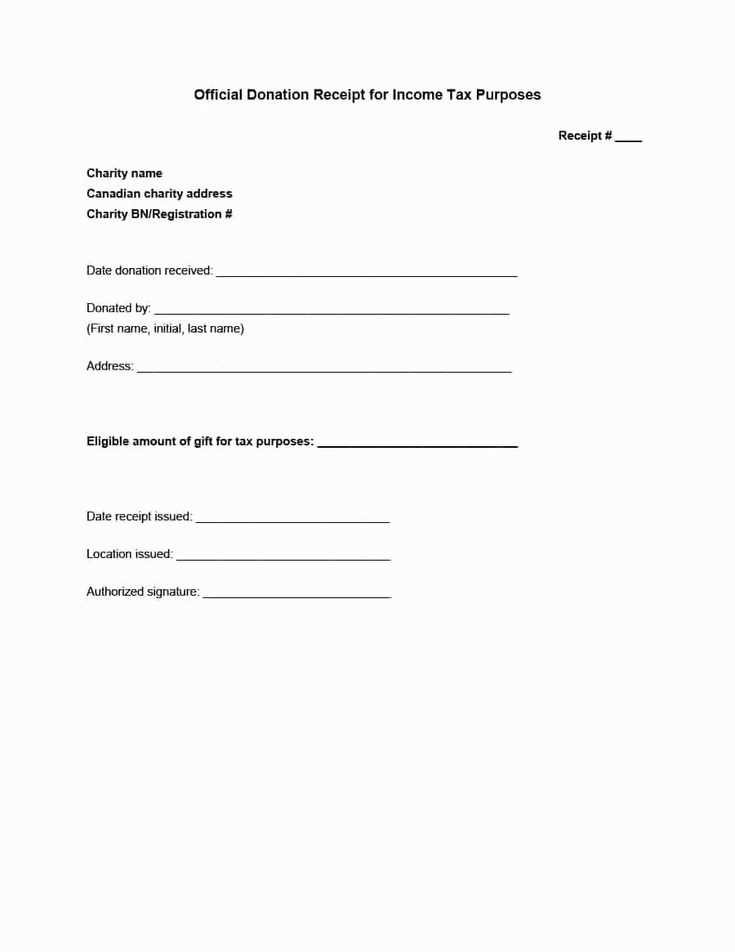

What Information to Include in a Donation Receipt for Tax Purposes

Include the name and address of the organization receiving the donation. This helps confirm the recipient and ensures the donor can identify the charity for tax filings.

Provide the date of the donation. This is necessary to record the specific time of the donation for the donor’s records and tax purposes.

Describe the donated items or the nature of the donation. If it is a non-cash donation, list the items donated along with their condition. For cash donations, specify the amount given.

Value of the Donation

If the donation is non-cash, include a good faith estimate of the value of the donation. It’s important to note that the donor may be responsible for determining the fair market value, but the receipt should reflect a reasonable estimate provided by the organization.

Statement of No Goods or Services Received

For donations over $75, include a statement that the donor did not receive any goods or services in exchange for the donation, or specify what, if any, goods or services were provided.

How to Validate the Estimated Value of Donated Equipment

Begin by reviewing the fair market value (FMV) of the donated equipment. FMV represents the price an item would sell for in the open market, considering its age, condition, and utility. Research the current selling price of similar items in online marketplaces or local retail stores to gauge an accurate estimate.

Check Online Marketplaces and Retail Listings

Search for similar equipment on websites like eBay, Craigslist, or Amazon. Compare the listings to understand the current market rate. Be sure to take note of the condition of the items–newer or better-maintained equipment should be valued higher. If possible, use recent sales as a benchmark for your estimate.

Consult Professional Valuation Guides

Professional valuation guides can offer a helpful framework for determining the value of donated items. Many guides offer pricing based on equipment type, age, and condition. These sources can provide a solid basis for your estimate, especially for more specialized equipment.

If you are unsure about the value, consider consulting an expert in the field or a professional appraiser who can help assess the donation’s worth accurately.