If you’re receiving donated equipment, it’s crucial to provide the donor with a formal acknowledgment. This serves as proof of the donation and may be necessary for tax purposes. A well-written donation receipt letter helps build trust with your donors while ensuring clarity in the transaction.

A solid receipt should include details such as the donor’s name, the description of the donated items, and the date of the donation. Be sure to specify whether the donation was a gift or a loan. If it’s a gift, the value of the equipment should be clearly stated. This can be useful for both the donor and your organization, especially during tax season.

While it’s helpful to include a brief thank-you note, it’s also important to keep the letter professional and concise. A simple yet formal format ensures that your donor knows their contribution is valued without unnecessary details.

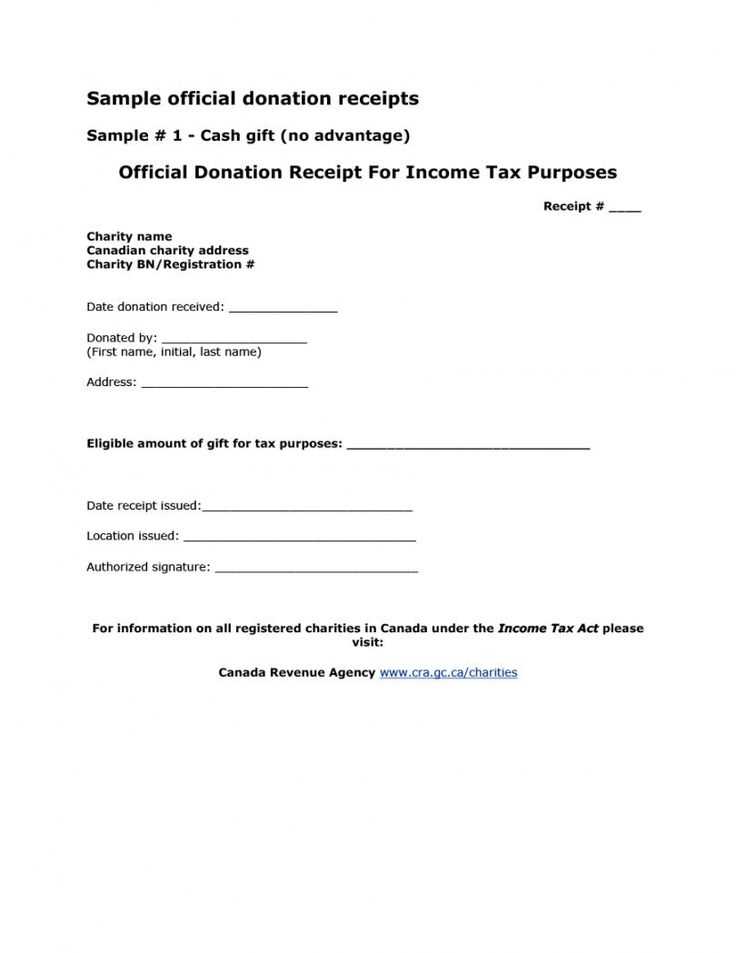

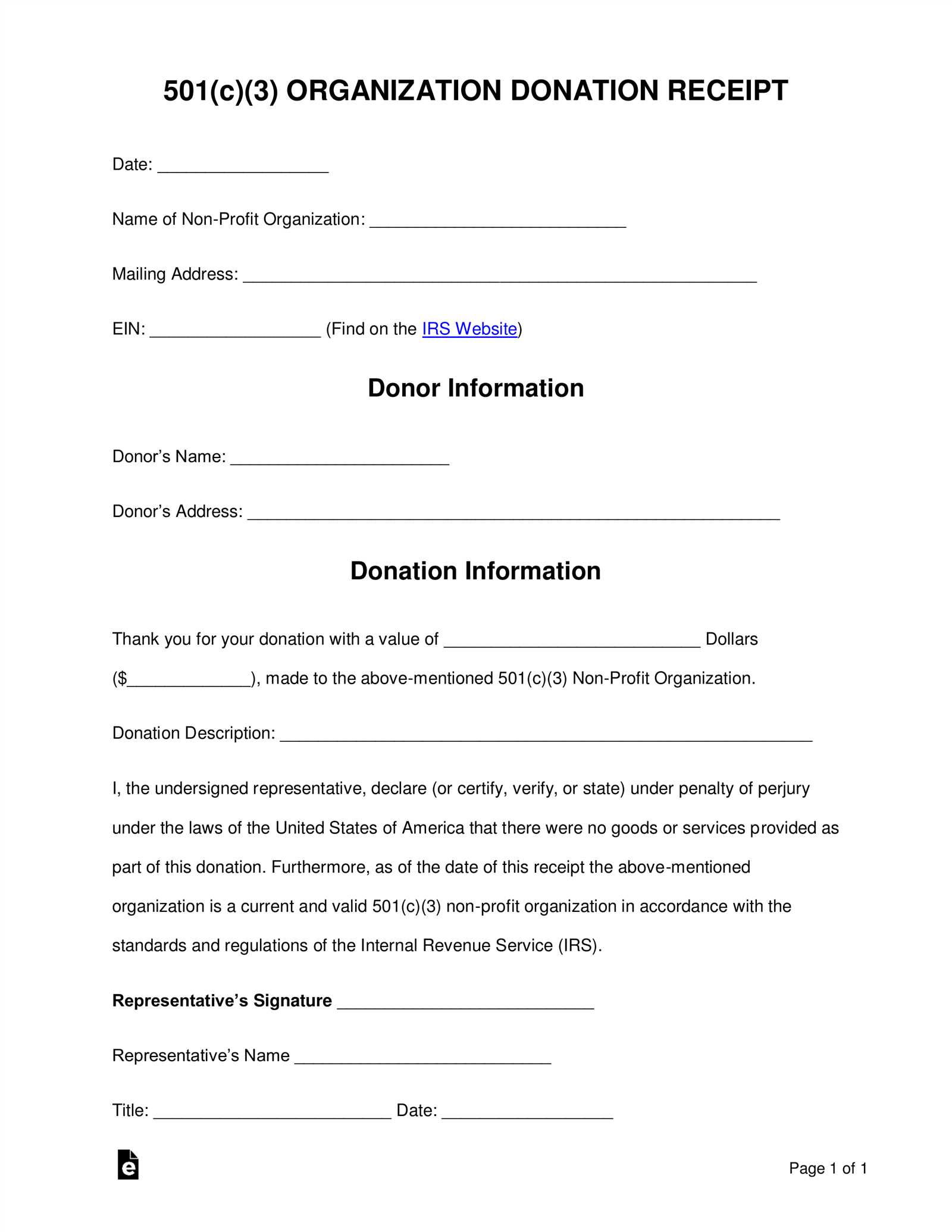

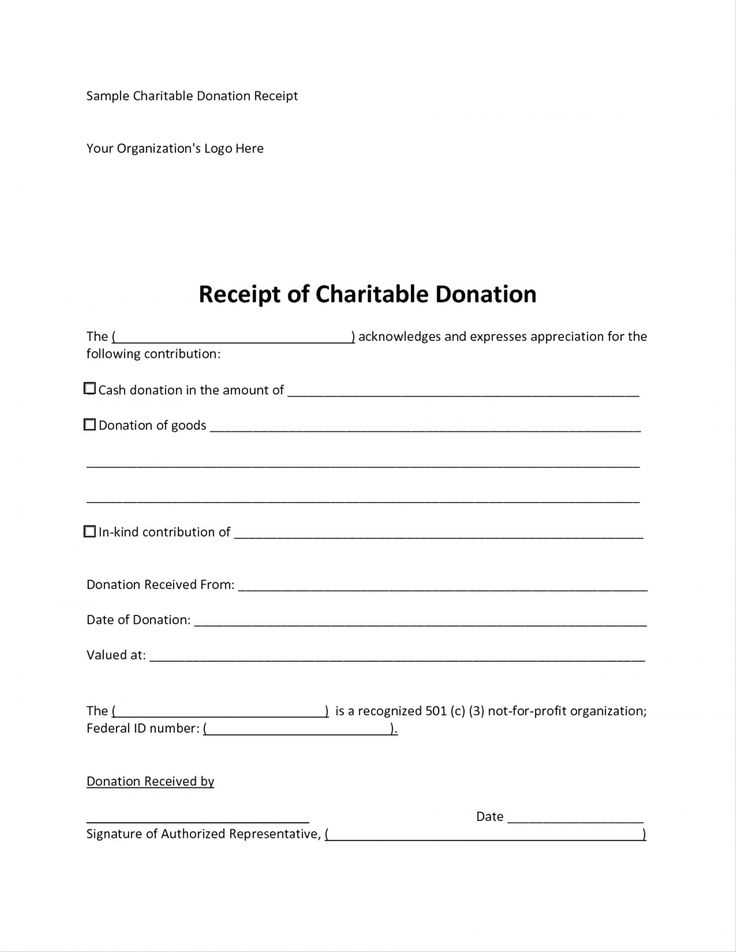

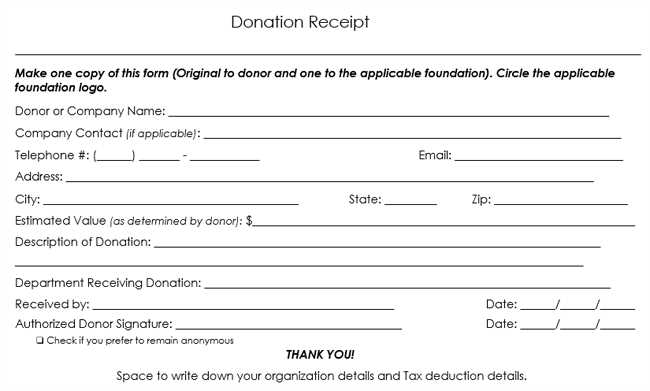

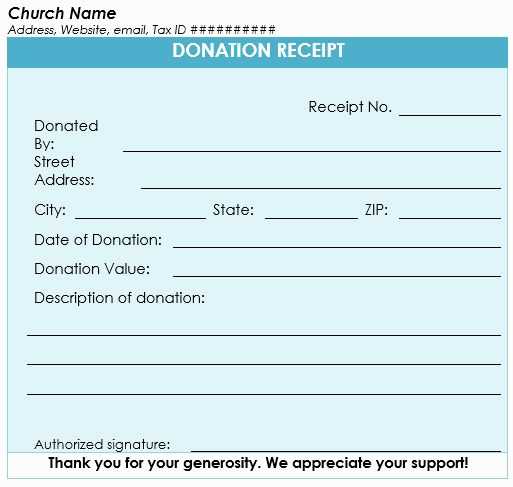

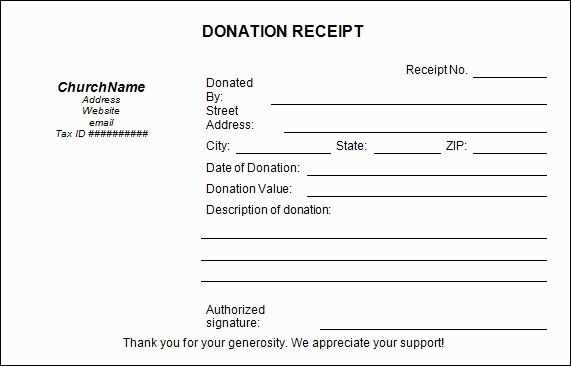

Below is a sample template you can customize to suit your needs:

Here’s the revised version:

When creating an equipment donation receipt letter, ensure it includes specific details for transparency and record-keeping. Start by including the date of donation and the name of the donor. Then, clearly describe the donated items, including their type and condition. It’s also important to state that no goods or services were provided in exchange for the donation to maintain the tax-exempt status.

Next, include your organization’s name, address, and contact details. Mention the purpose of the donation, if relevant, to emphasize how the equipment will be used. Conclude with a thank you to the donor, acknowledging the impact of their contribution.

For example, a simple template might read:

Date: [Insert Date]

Donor Name: [Insert Donor Name]

Item(s) Donated: [Insert List of Items]

Condition: [Describe Condition]

Purpose of Donation: [Describe Purpose]

Value: [Provide Approximate Value, if applicable]

Thank You: Thank you for your generous donation! Your support helps us [describe how the equipment will benefit the organization].

Lastly, ensure that the donor receives a copy of the receipt for their records. Keep it professional, clear, and concise to avoid any confusion during tax season.

- Equipment Donation Receipt Letter Template

When acknowledging a donation of equipment, the donation receipt letter should be clear, concise, and informative. Here’s a useful template for a donation receipt letter that can be adapted for your needs:

| Section | Details |

|---|---|

| Letter Header | Your organization’s name, address, and contact details, followed by the date. |

| Donor Information | Donor’s full name, address, and contact information. |

| Salutation | Use a polite greeting (e.g., “Dear [Donor’s Name],”). |

| Statement of Donation | Describe the equipment donated (e.g., “We acknowledge the donation of a laptop model XYZ, serial number ABC123, received on [date].”). |

| Estimated Value | State whether the donation’s value was appraised or is unspecified (e.g., “The fair market value of the donated equipment is not specified by our organization.”). |

| Tax Deductibility Disclaimer | If applicable, remind the donor that the donation is tax-deductible and that the donor should consult a tax professional for further details (e.g., “This donation may be tax-deductible. Please consult your tax advisor for more information.”). |

| Thank You | Include a note of appreciation (e.g., “Thank you for your generous donation. Your support helps us achieve our mission.”). |

| Signatory | The name, title, and signature of the person acknowledging the donation on behalf of your organization. |

Here’s a sample of how this template might look in practice:

[Organization Name]

[Organization Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

[Donor’s Name]

[Donor’s Address]

[City, State, ZIP Code]

Dear [Donor’s Name],

We gratefully acknowledge the donation of the following equipment:

Item: [Item Name/Description]

Serial Number: [Serial Number]

Condition: [Condition of the item]

Date Received: [Date]

Please note that the fair market value of this equipment has not been appraised by our organization. However, your donation may be tax-deductible, and we encourage you to consult a tax professional for further details.

Thank you for your generous donation. Your support allows us to continue our work and make a positive impact in the community.

Sincerely,

[Your Name]

[Your Title]

[Signature]

This template ensures clarity and transparency when documenting equipment donations. Always customize it to fit your organization’s needs and requirements for a smooth process and proper record-keeping.

Be clear and precise when listing donated items in the receipt letter. This helps ensure that both the donor and the receiving organization are on the same page regarding the items. A proper acknowledgment helps avoid confusion and ensures tax compliance for the donor.

1. Describe the Donated Items Accurately

List each item individually with a brief description, including any relevant details such as condition, make, model, or other distinguishing features. If there are multiple similar items, group them and note the total quantity.

- Example: 10 office chairs (used, in good condition)

- Example: 5 boxes of assorted books (new, hardcover)

2. Avoid Assigning a Monetary Value

It’s important to refrain from assigning a monetary value to the donated items in the letter. The IRS requires the donor to assess the value of the donation themselves. Your letter should only confirm the items received.

3. Include a Statement of Use

Clearly state that the items are being used for charitable purposes or the specific cause they will support. This shows transparency and reinforces the donor’s contribution to the community.

- Example: These items will be used to furnish classrooms in our new community center.

4. Include the Date of Donation

Always list the date when the donation was received. This helps keep an accurate record for both the organization and the donor, especially for tax purposes.

5. Acknowledge the Donor’s Generosity

End the letter by thanking the donor for their generosity. A simple, heartfelt statement of appreciation can go a long way in maintaining a positive relationship.

- Example: Thank you for your kind contribution to our cause. Your generosity is deeply appreciated.

To ensure your equipment donation receipt is clear and legally sound, include these key details:

1. Donor Information

Start by listing the donor’s full name, address, and contact information. This helps both parties for tax purposes and follow-up communications.

2. Description of Donated Equipment

Provide a detailed list of the equipment donated, including brand, model, and any distinguishing features. This description helps establish the value and nature of the donation.

3. Date of Donation

Specify the exact date the donation was received. This date is important for the donor’s tax deduction purposes, especially when filing returns.

4. Estimated Value of the Donation

If possible, include an estimated value for the donated items. While the organization may not assign a precise market value, it’s helpful to provide a general range or rely on the donor’s assessment if applicable.

5. Statement of Non-Compensation

Clarify that the donor is not receiving any goods or services in exchange for the donation. This is critical for tax-exempt organizations to comply with IRS guidelines.

6. Signature and Date

Both the donor and the organization should sign and date the receipt. This verifies the transaction and ensures both parties have agreed to the terms of the donation.

Adjusting an equipment donation receipt template to fit different types of contributions helps ensure accuracy and clarity for both the donor and the receiving organization. Tailor the details based on the nature of the donation, whether it’s office furniture, electronics, or medical devices.

Office Equipment Donations

When receiving office equipment like desks, chairs, and computers, include the following details in the receipt:

- The specific type of equipment donated (e.g., “2 office desks, 3 ergonomic chairs, 5 desktop computers”).

- Condition of the equipment (e.g., “Used, in good working condition” or “New, still in original packaging”).

- Estimated fair market value based on similar items, or state that the donor is responsible for providing the valuation if required by tax regulations.

Electronics Donations

For donations like laptops, printers, or other electronics, customize the receipt by including:

- Brand, model, and serial number for tracking purposes.

- Condition of the item (e.g., “Used, fully functional” or “New, unopened”).

- Any additional accessories or software included (e.g., chargers, software licenses, etc.).

Medical Equipment Donations

Donating medical equipment such as wheelchairs, hospital beds, or diagnostic tools requires specific information:

- Detailed description of the equipment (e.g., “1 electric hospital bed, 2 manual wheelchairs”).

- Condition and whether the equipment has been inspected for safety and functionality.

- If applicable, include any required certifications or compliance with health and safety standards.

By adjusting the template to the specifics of the equipment being donated, you not only provide clear documentation but also ensure the donor can accurately claim any tax benefits associated with the donation. Always consult with a tax professional to confirm proper valuation and documentation guidelines specific to your location and the type of donation.

Receipt Template for Equipment Donation

Clearly state the donor’s information, including full name and address, followed by the date of the donation. Next, provide a description of the donated equipment, listing key details such as type, condition, and any relevant model numbers or specifications. Be specific about the quantity and, if applicable, the value of each item donated. Avoid vague descriptions; clarity helps both parties in case of future inquiries.

Confirm the receipt of the donation by stating the total number of items received. Mention the organization or individual receiving the items, and note the purpose for which the equipment will be used, if applicable. If the donation is tax-deductible, include a disclaimer about the donor’s responsibility for valuation. Finally, express gratitude to the donor for their contribution and highlight how their support will benefit the recipient.

End the letter with your contact information for any follow-up or clarification, and include a space for both parties to sign, ensuring both acknowledgment and completion of the donation process. The donor should retain a copy for tax or record-keeping purposes.