Creating a clear and precise equipment donation receipt template ensures both parties–donor and recipient–are on the same page. Use this document to confirm that items have been donated and to outline any specific details about their condition, value, or intended use.

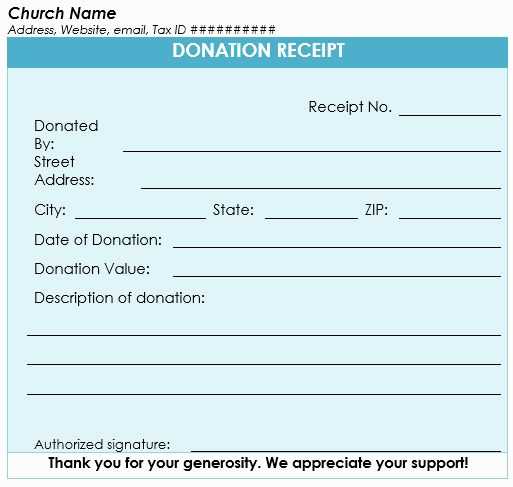

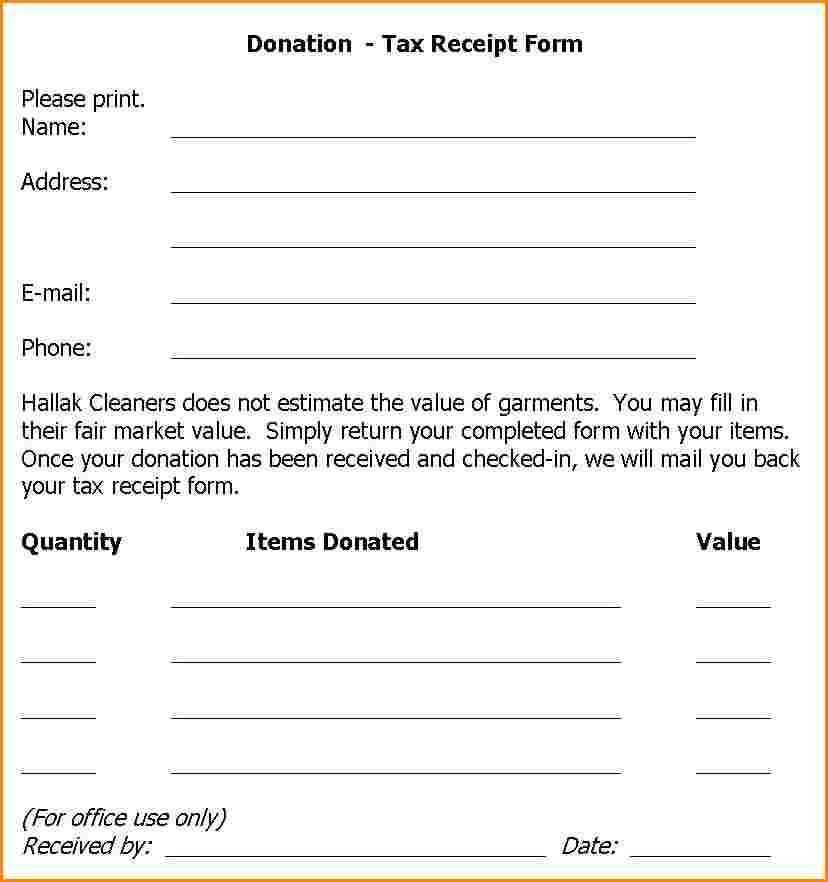

Start by including the donor’s name and contact information, along with a description of the donated items. Be specific, listing the type of equipment, its condition (new, used, or refurbished), and any serial numbers or identifying marks that might help in identifying the items later.

Next, add a section for the recipient’s acknowledgment. This part should confirm receipt of the donation and include the organization’s name, address, and contact information. Make sure the date of the donation is clearly stated, as well as any other details that are relevant to the transaction, such as the donor’s intent or restrictions on use.

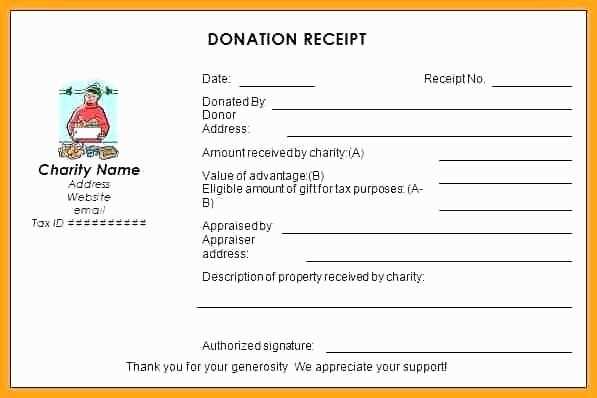

Finally, it’s important to note that some donations may require appraisals, especially if the items are of significant value. Including a placeholder for valuation, if necessary, helps provide clarity on the item’s worth and could be useful for tax purposes.

Here are the corrected lines with minimal repetition:

Ensure clarity and precision in your equipment donation receipt template. Avoid using redundant phrases that can confuse the recipient. For example, instead of stating “I hereby acknowledge the donation of the following items,” simplify to “Received the following items.” This reduces repetition while keeping the meaning intact.

Minimize unnecessary details

Include only the necessary details of the donation. If an item has already been described, don’t repeat its condition or value in separate lines. List items once, and avoid restating their condition unless there is a specific need for it. For instance, instead of saying, “The TV is in good condition and was checked for functionality, and it is working perfectly,” simply say, “TV, in working condition.”

Organize with clarity

Make sure to break down the donation list into categories where possible. For example, “Electronics” followed by a sublist of items under that heading. This approach keeps the receipt organized without needing to mention item categories multiple times.

- Equipment Donation Receipt Template

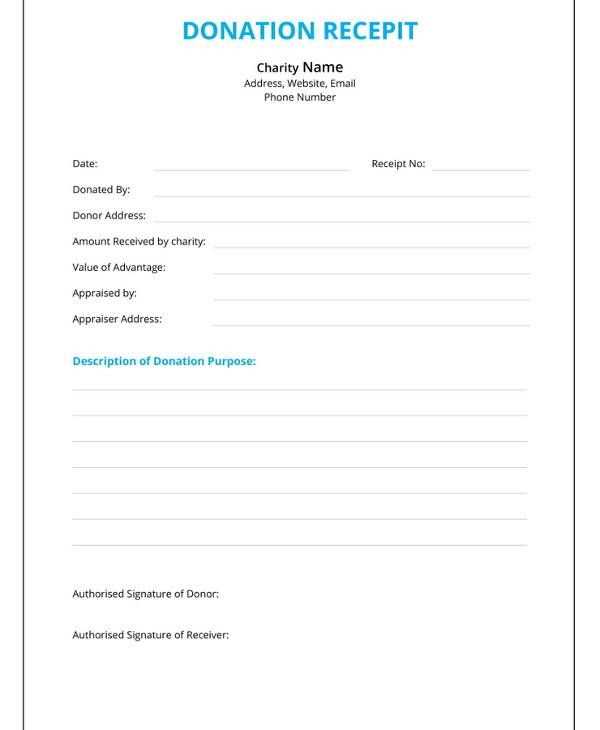

Creating a donation receipt is a straightforward process but needs to include specific details for both the donor and the recipient. Here is a simple template that outlines all the necessary elements:

- Donation Date: Include the date the equipment was donated.

- Donor’s Name: Clearly state the full name of the donor.

- Recipient Organization: Specify the organization or individual receiving the donation.

- Itemized List of Donated Equipment: List each item donated, including its make, model, and condition. If there are multiple items, use bullet points for clarity.

- Estimated Value: Provide an estimated value for each item. If the donor is unable to determine the value, suggest seeking an appraisal.

- Statement of No Goods or Services Received: Include a statement confirming that no goods or services were exchanged for the donation.

- Recipient’s Signature: The organization or authorized person should sign the receipt to confirm it was received.

- Donor’s Signature: The donor should also sign to validate the donation.

This template ensures that all necessary information is documented, creating a clear and professional receipt. Adjustments can be made based on the type of donation or requirements of the recipient organization.

Begin by including the date of the donation. This helps both the donor and the recipient track the transaction timeline. Make sure the donation amount is clearly stated, whether it’s in cash or goods. If it’s a monetary donation, specify the exact amount, and if it’s items, provide a brief description of the goods along with their approximate value.

Donor Information

List the donor’s full name and address. If applicable, include the organization’s contact details. This allows both parties to confirm the donation and helps the donor with tax deductions or record keeping.

Tax-Exempt Status and Purpose

If your organization is tax-exempt, include this status on the receipt to help the donor claim deductions. Also, clarify the purpose of the donation–whether it’s for a specific event, project, or general support. This transparency will build trust and ensure both parties understand the use of the gift.

Finally, include a statement that the donor received no goods or services in exchange for the donation (if that’s the case). This reinforces the tax-exempt nature of the transaction.

The equipment donation receipt should clearly reflect the details of the donation, making it easy for both the donor and the recipient organization to reference. Below are the key elements that should be included:

1. Donor Information

Include the name, address, and contact details of the donor. This helps the organization to send tax receipts or further correspondence if needed. Ensure that all fields are accurate and up-to-date.

2. Description of Donated Equipment

Provide a detailed description of each item being donated. This should include the type of equipment, model numbers, and any relevant specifications. For valuable items, you may also include the serial number.

3. Date of Donation

Clearly state the date the donation was made. This is important for both record-keeping and tax deduction purposes.

4. Condition of the Equipment

Note the condition of the donated equipment. Is it new, used, or refurbished? This can impact the valuation for tax deductions and informs the recipient organization about the usability of the item.

5. Estimated Value of the Donation

If applicable, include an estimated value for each item based on current market prices. This is especially important for tax purposes. If the organization is not providing a valuation, the donor should be informed that they are responsible for determining the value.

6. Acknowledgement of No Goods or Services in Return

The receipt should clearly state that the donor received no goods or services in return for the donation, ensuring the donation qualifies for tax deduction.

7. Signatures

Both the donor and the representative from the organization should sign the receipt. This adds authenticity and serves as confirmation from both parties.

8. Organization Information

Include the full name, address, and contact details of the recipient organization. This establishes the legitimacy of the organization and provides the donor with a reference for tax documentation.

9. Tax-Exempt Status

If the organization is a tax-exempt entity, include a statement that verifies this status. This is vital for the donor when claiming any deductions.

10. Additional Notes

Allow space for any additional information that may be relevant, such as special instructions or comments about the donation. This can include whether the items are restricted to specific uses or need further processing.

Example Template

| Element | Details |

|---|---|

| Donor Information | Name, Address, Contact Info |

| Description of Donated Equipment | Type, Model, Serial Numbers |

| Date of Donation | Specific Date |

| Condition of Equipment | New, Used, Refurbished |

| Estimated Value | Donor’s Valuation or Market Price |

| Acknowledgement of No Goods or Services | Statement of No Return |

| Signatures | Donor and Organization Representative |

| Organization Information | Name, Address, Contact Info |

| Tax-Exempt Status | Statement of Tax-Exempt Status |

| Additional Notes | Special Instructions or Comments |

Ensure the donation receipt includes the donor’s name, address, and a detailed description of the donated items. This will make the acknowledgment valid for tax purposes. If the donation includes goods or property, it’s necessary to state whether any goods or services were provided in return, and if so, estimate their fair market value. A clear description of the non-cash donation is essential for IRS compliance.

In the case of monetary donations, include the exact amount donated, as this is required for the donor to claim tax deductions. If the donation exceeds a specific threshold, the donor must receive a written acknowledgment that meets the IRS requirements. For instance, contributions over $250 require a detailed receipt that outlines the amount of the donation and confirms no goods or services were exchanged.

Organizations must issue a receipt for donations of $250 or more within a reasonable time frame to allow donors to file their tax returns. If goods or services were provided in exchange, the organization must note this on the receipt, reducing the value of the donation that is tax-deductible.

Keep detailed records of all donations to avoid complications during tax audits. Documentation must be precise and should be available for review should the IRS request it. This includes maintaining a record of all donated items, their value, and donor information for at least three years after the donation year.

Lastly, consult with a tax advisor or legal expert to ensure that your organization’s acknowledgment process fully complies with tax laws, as regulations can vary by jurisdiction. This will help maintain the integrity of both the donation acknowledgment and the tax deduction process.

Items to Include in a Donation Receipt

Ensure that the donation receipt includes specific details to make it valid and clear. A well-organized receipt helps both the donor and the recipient organization keep accurate records.

- Date of Donation: Clearly state the date when the donation was received.

- Donor Information: Include the donor’s full name, address, and contact information.

- List of Donated Items: Itemize the equipment donated, with brief descriptions of each item. This should include the condition of the items where possible.

- Value of Donation: Provide an estimated value of the donated items, either based on a fair market value or the donor’s estimation.

- Tax-exempt Status: Include a statement confirming that the organization is tax-exempt, if applicable.

Example Format for Receipt

- Date: February 10, 2025

- Donor: John Doe, 123 Main St, Anytown, USA

- Items Donated:

- Desktop Computer – Used, Good Condition

- Flat-screen Monitor – Used, Fair Condition

- Office Chair – Used, Good Condition

- Estimated Value: $350

- Tax-exempt Status: This organization is recognized as a tax-exempt charity under IRS 501(c)(3).

Keep the donation receipt clear, accurate, and organized for both parties’ records. Double-check all details before issuing the receipt.