Creating a food donation receipt is a simple but important step for both donors and recipients. It provides a clear record of the donation, helping the donor with tax deductions and offering transparency to the recipient. The format for a receipt should be clear, concise, and legally compliant with Arizona’s donation standards. A well-structured receipt ensures both parties understand the value of the donation and avoid any misunderstandings.

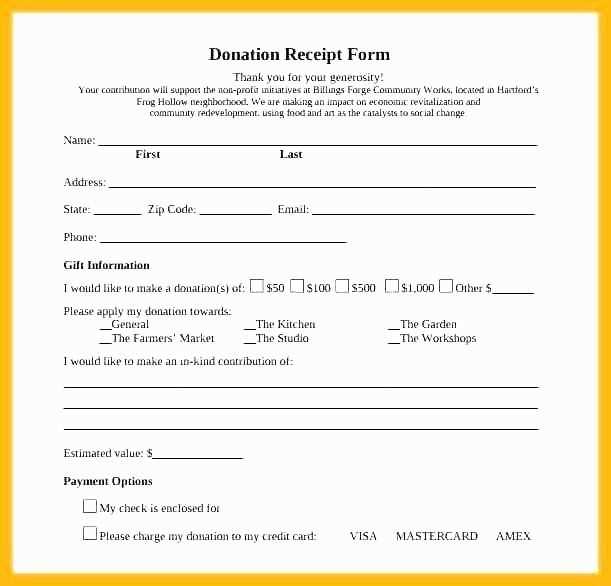

In Arizona, a food donation receipt must include specific details to be valid. Start by including the donor’s name and contact information, along with the date and location of the donation. It’s also necessary to specify the types of food donated and their approximate value, which should be based on fair market value or the donor’s own valuation. If possible, attach a description of the food, including quantity or weight. This will help make the receipt more detailed and useful for both parties.

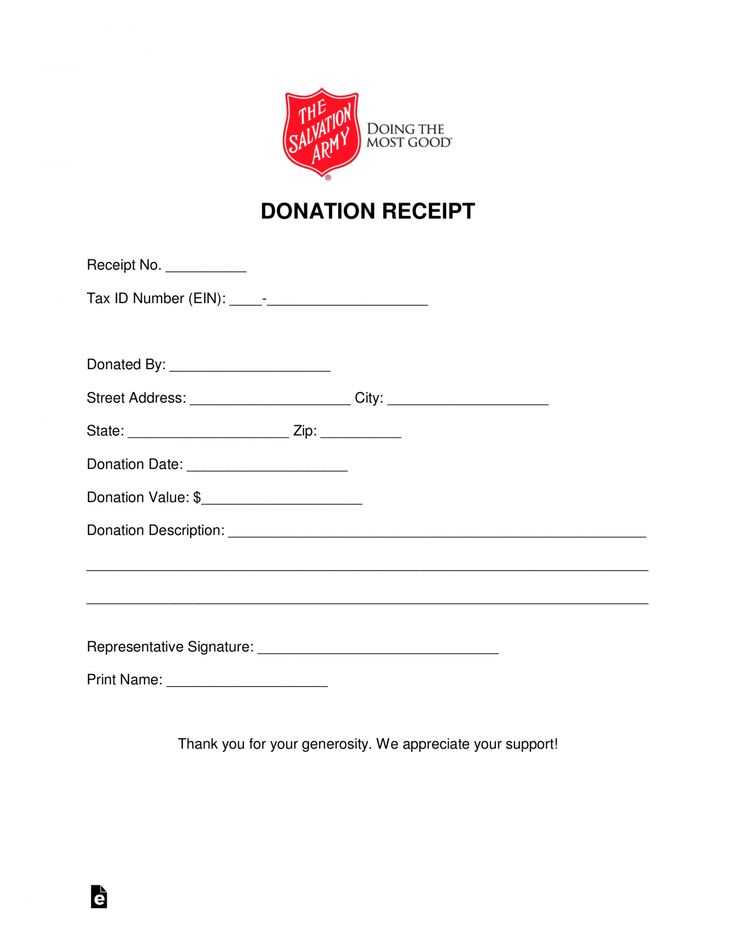

For tax purposes, it’s recommended to include a statement that the donation was made without any goods or services exchanged in return. This helps clarify that the donor is entitled to a tax deduction. The nonprofit organization should also provide its name, address, and tax-exempt status number to ensure the donor can claim their deduction accurately. In some cases, a signature from a representative of the receiving organization may also be required to validate the receipt.

Here are the corrected lines without repetitions:

To streamline your food donation receipt template, remove redundant entries by following these key steps:

1. Consolidate Donation Details

Ensure each item listed in the donation is unique, avoiding duplication. Group similar items under one heading to improve readability.

2. Clear and Concise Formatting

Use straightforward text to describe the items donated, including quantity and condition, without repeating similar descriptions for different donations.

- Food Donation Receipt Template AZ

In Arizona, food donation receipts are necessary for tax deduction purposes. They ensure transparency and provide donors with proof of their contribution. A standard receipt should contain specific details, like the date of donation, the donor’s name, the donated items, and the value of the donation. Below is an outline of what a food donation receipt template should include.

| Field | Description |

|---|---|

| Donor Name | The name of the person or organization making the donation. |

| Donation Date | The date on which the donation is made. |

| Donated Items | List the specific food items donated. Be as detailed as possible. |

| Estimated Value | The fair market value of the donated items. Donors can refer to IRS guidelines for accurate estimates. |

| Non-cash Donation | A statement confirming the donation is non-cash, as required by IRS regulations. |

| Organization Information | The name, address, and contact details of the receiving organization. |

| Signature | Signature of an authorized representative from the receiving organization. |

Use this template to create a receipt that complies with IRS rules. The donation’s value is an important part of the tax filing process, so be sure to keep an accurate record of both the items and their estimated worth. Make sure that your receipt is filled out correctly to ensure donors can claim the proper deductions.

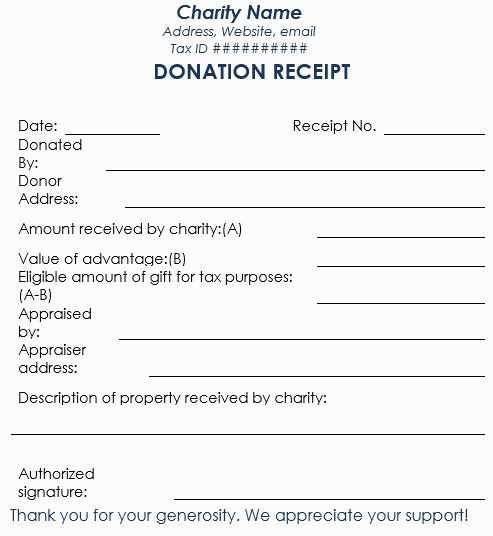

To ensure your donation receipt meets legal standards, include the following key details: donor information, description of the donated items, date of the donation, and the charity’s acknowledgment of the donation. For monetary gifts, state the amount donated and, if applicable, confirm that no goods or services were exchanged in return. The receipt must be signed by a representative of the organization.

Key Elements of a Legal Donation Receipt

| Element | Description |

|---|---|

| Donor Information | Full name and address of the donor. |

| Donation Description | Detailed description of the donated items or the amount donated, with no valuation of the items. |

| Donation Date | The exact date the donation was made. |

| Value of Donation | For non-monetary gifts, a statement that the donor is responsible for valuing the items. |

| Organization Acknowledgment | Confirmation that no goods or services were exchanged in return for the donation (if applicable). |

| Signature | Signature of an authorized representative of the charity. |

Additional Considerations

Make sure to provide a receipt for all donations above a certain threshold, as stipulated by your local regulations. Include your charity’s tax-exempt status number for the donor’s reference, as it may be required for tax deduction purposes. Regularly update your templates to stay compliant with changes in the law.

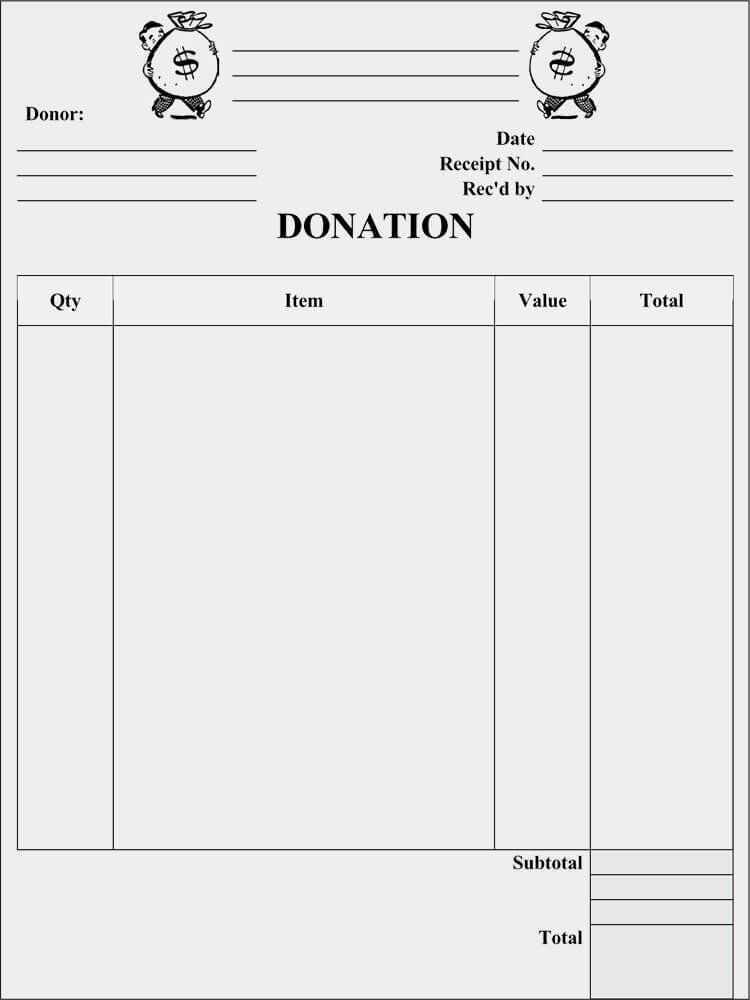

A food donation receipt should clearly list key details to ensure it is both accurate and useful. Here are the specific elements that should be included:

- Donor Information: The name and contact information of the person or organization making the donation.

- Recipient Information: The name of the organization or charity receiving the donation, along with their contact details.

- Donation Date: The exact date when the food was donated. This helps track the donation for both parties.

- Description of Donated Items: A clear, itemized list of the food donated. This should include the quantity and, if possible, the estimated value of each item. For perishables, note any special handling requirements.

- Donation Value: A description of how the value of the food is determined. For non-perishable items, this could be based on market value; for perishable items, it might include any reasonable estimate considering condition and usage.

- Signature: The signature of the authorized representative from the receiving organization to verify the donation.

Optional Information

- Tax Deduction Information: If applicable, a note that the donation may be tax-deductible, and details on how to claim it, as per local tax laws.

- Donor’s Notes: Any special requests or notes from the donor, such as specific usage for the donated food.

Ensure your donation receipt template includes all relevant information specific to Arizona law. Arizona requires that the receipt clearly state whether the donation was tax-deductible. Include the organization’s name, address, and federal tax ID number (EIN) to comply with IRS regulations.

Specify the type of goods donated, whether it’s food, clothing, or other items. Be detailed about the quantity or estimated value of the items if possible. This helps donors claim deductions more effectively. Arizona tax law also mandates that if goods are donated in exchange for goods or services, the receipt should mention the value of those goods or services provided in return.

For food donations, it’s important to note whether the items are intended for personal use or charitable purposes. In Arizona, food donated for charitable purposes can often be deducted, but this must be reflected in the receipt. If the food is given to a 501(c)(3) organization, make sure the receipt identifies the specific charitable use.

Finally, always include a statement that no goods or services were provided in exchange for the donation, if that’s the case. This will help donors when it comes time to file taxes in Arizona, where specific rules apply to charitable giving.

To calculate the fair market value (FMV) of donated goods, you’ll want to determine what the item would sell for in a typical marketplace. Follow these steps:

- Check online marketplaces: Visit websites like eBay, Craigslist, or Facebook Marketplace to find similar items and compare prices based on condition, brand, and age.

- Use appraisal guides: For more specialized items, consider using appraisal guides specific to the type of goods you’re donating. These guides can give you a range of values based on various factors.

- Consult donation value guides: The IRS provides a list of typical values for commonly donated items. These can be helpful for estimating the FMV when no specific sales data is available.

- Assess the condition: The value of your donation will change based on its condition. Items in excellent condition are valued higher, while those with wear and tear will be worth less.

- Factor in the location: Market conditions can vary by region. Make sure to adjust the FMV based on your location and the typical demand for that item in your area.

Once you’ve gathered enough data, assign a reasonable value within the range you’ve found. Keep a record of how you determined the FMV for future reference or tax purposes.

Always ensure that donation receipts accurately reflect the donor’s contribution. A frequent error is misreporting the donation’s value, especially with non-cash items like food. If you’re issuing receipts for donated food, make sure to assess the fair market value and note it clearly on the receipt. Avoid estimating values that could lead to discrepancies or audits down the line.

Another mistake is failing to provide sufficient donor details. Always include the donor’s name, address, and contact information. Without these, receipts lack the necessary documentation to prove the donation. Double-check for any typos or missing information before issuing receipts to ensure they’re legitimate and valid for tax purposes.

Do not neglect to include the organization’s name and tax-exempt status on the receipt. This is a legal requirement for nonprofit organizations, helping donors claim deductions. Without this information, donors may face difficulties during tax filing.

Make sure to clearly state the date of the donation. Many errors stem from overlooking this detail, which can result in confusion when donors file their taxes. Provide an accurate and specific date, whether the donation was made in person or online.

Don’t forget to include a statement about whether the donation was in cash or goods. Receipts for food donations should specify that no goods or services were provided in exchange for the donation, especially if it’s a tax-deductible gift. This helps avoid misunderstandings about the transaction’s nature.

To claim food donations for tax deductions in Arizona, you need to keep thorough records. This includes documenting the date, value, and recipient organization. The IRS allows deductions for food donations made to qualified charitable organizations, but accurate tracking is key.

1. Record Donation Details

- Date of donation: Always note when the food was donated.

- Value of donation: Use fair market value (FMV) for donated food. Research the average value of common items if you aren’t sure.

- Recipient organization: Make sure the charity is a qualified 501(c)(3) organization. Get their contact details, such as name and address.

2. Get a Receipt from the Charity

Request a written acknowledgment from the charity. It should confirm the nature and quantity of the food donated. A receipt from the charity will help substantiate your claim in case of an IRS audit.

3. Use IRS Forms for Reporting

- Form 8283: If your donation exceeds $500 in value, report it using this form.

- Form 1040: Deduct the total value of your donations on your tax return. Attach Form 8283 if applicable.

Maintaining detailed records and receipts will ensure you can maximize your tax deduction for food donations in Arizona. Always check current IRS guidelines or consult a tax professional to ensure you’re following the most up-to-date requirements.

When creating a food donation receipt, it’s important to include the exact items donated along with their estimated value. The template should provide space for the donor’s name, date of donation, and a detailed description of the items donated. This ensures transparency and helps both the donor and the recipient organization maintain accurate records.

Key Information to Include

Make sure to clearly list the food items donated. Include quantities, brief descriptions, and the condition of the items (e.g., new, sealed, perishable). If the donor provides a value for the donation, include that as well for tax purposes.

Formatting Tips

Keep the receipt format simple but professional. Use a clear font and avoid clutter. Space between sections will make it easy to read and understand. Always check that the total value of the donation is accurate before finalizing the document.

Tip: Use an online tool to create your template or adjust a standard document to match your needs. Keep a copy of the receipt for your records and provide one to the donor as soon as possible.