For non-profit organizations, providing donors with a donation receipt is a critical part of maintaining transparency and ensuring compliance with tax regulations. A well-structured donation receipt not only acknowledges the contribution but also provides the donor with the necessary information to claim tax deductions.

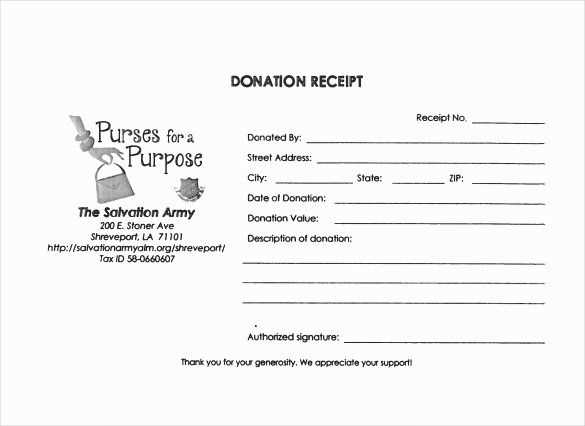

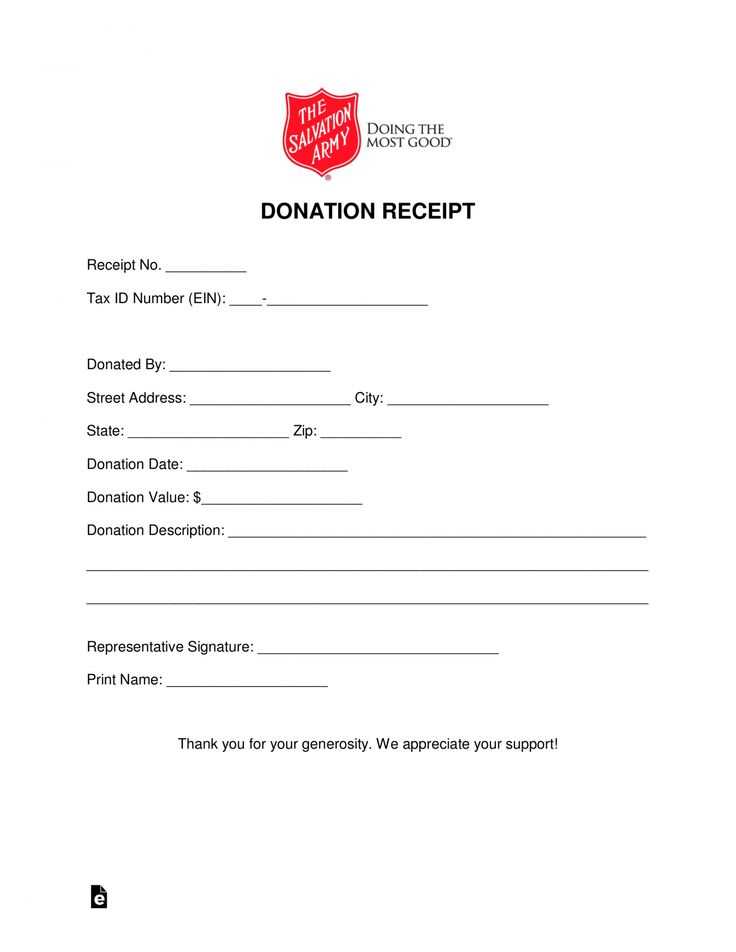

Start with a simple template that includes key details such as the donor’s name, donation amount, and the date of the contribution. If the donation is non-monetary, clearly describe the item donated and its estimated value. Always ensure that the receipt includes a statement confirming whether any goods or services were provided in exchange for the donation. This will help donors determine their eligible tax deduction.

Remember, an effective donation receipt template will be clear, accurate, and concise. Keep the language professional but accessible, and make sure the receipt can be easily personalized to reflect each donation’s specifics. By offering a transparent and easy-to-understand receipt, you strengthen the trust between your organization and its supporters while ensuring they can maximize their charitable tax benefits.

Here’s the corrected version:

Ensure that your donation receipt includes the full name and contact details of your organization. Clearly state the date of the donation and the donation amount, specifying whether it’s cash or in-kind. If the donation is non-monetary, provide a description of the donated item and its value, if applicable. Don’t forget to include a statement confirming no goods or services were provided in exchange for the donation, if true. This is required for tax-exempt donations in many regions.

Important Fields to Include:

Provide the donor’s name and address for proper record-keeping. Be specific about the donation type (monetary or non-monetary). For non-cash donations, include the estimated fair market value of the items. Also, ensure to sign the receipt with an authorized signature for authenticity.

Key Tips for Clarity:

Keep the layout clean and easy to read. Double-check for accuracy, especially the donor’s details and the amount. A well-structured receipt helps donors track their contributions, making it simpler for them to claim tax deductions.

- Fundraising Event Donation Receipt Template

Provide donors with a clear, concise receipt that includes all required information for tax purposes. A donation receipt should confirm the contribution, outline the amount donated, and provide the organization’s details. Here’s a template for your reference:

Receipt Date: [Insert Date]

Donor’s Name: [Donor Name]

Donation Amount: [Amount Donated]

Non-Cash Donations (if applicable): [Description of Donated Goods or Services]

Organization Name: [Organization Name]

Organization Address: [Organization Address]

Tax ID Number: [Insert Tax ID]

Event Name (if applicable): [Event Name]

Note: This receipt acknowledges the donation for tax purposes but does not assign a value to any non-cash donation. The donor is responsible for determining the value of donated goods or services for tax reporting.

Signature of Authorized Representative: [Authorized Signature]

Thank you for your support!

To ensure a fundraising donation receipt complies with legal standards, include specific details required by tax authorities. A receipt must confirm that the donation is tax-deductible, and the donor should have clear documentation for filing purposes. Below is a template with the necessary components:

Key Elements of a Legal Donation Receipt

| Required Information | Description |

|---|---|

| Organization’s Name and Address | Include the full legal name of your organization and its contact information. |

| Donor’s Name | Include the full name of the individual or entity making the donation. |

| Date of Donation | Provide the exact date when the donation was received. |

| Donation Amount | Clearly state the amount of the donation, whether cash or a non-cash contribution. |

| Tax Deductibility Statement | Include a statement confirming that no goods or services were provided in exchange for the donation, making it fully deductible. Example: “No goods or services were provided in exchange for this donation.” |

| Organization’s Tax ID Number | Provide the official tax identification number for your nonprofit organization. |

Best Practices for Receipt Distribution

Send receipts promptly after a donation is made to maintain transparency and avoid complications during tax filing. If a donation is greater than $250, include a statement on the receipt verifying that the donor did not receive any goods or services in exchange. For non-cash donations, an itemized description of the items must be provided, but it is not the responsibility of the organization to assign a value to the donated goods. That responsibility lies with the donor.

A donation acknowledgment template should reflect both clarity and professionalism. Key details must be included to ensure the donor receives all necessary information for tax purposes and to express appreciation.

1. Donor Information

- Full name of the donor

- Donor’s contact information (address, phone number, or email)

2. Donation Details

- Date of the donation

- Amount or value of the donation

- Method of donation (cash, check, credit card, etc.)

- Specific purpose (if designated, e.g., event funding, project support)

3. Organization Information

- Name of the organization

- Tax-exempt status or EIN number (if applicable for tax deduction purposes)

- Contact details of the organization (phone number, email, physical address)

4. Acknowledgment Statement

- Personalized thank you message

- Expression of how the donation will be used

- Reaffirmation of the impact the donor’s contribution will have

5. Tax Information

- Clarify whether any goods or services were provided in exchange for the donation

- If applicable, state the amount that qualifies as a tax-deductible donation

Customize your donation receipt template by adjusting it based on the donation type and specific event needs. This ensures clear communication with donors and meets legal or organizational requirements.

- Monetary Donations: For cash or online contributions, include the amount donated, the payment method, and any applicable transaction fees. If the donor made the payment via a credit card or through an online platform, specify that information in the receipt.

- Goods or In-Kind Donations: If the contribution is a non-monetary item, describe the item(s) in detail. Acknowledging the fair market value of goods will provide transparency and help both you and the donor when it comes to tax filings.

- Event Tickets or Sponsorship: When donations are linked to event participation, specify the type of donation–whether it’s for purchasing tickets, sponsoring a specific event activity, or making a general contribution. For sponsorships, note the sponsorship level or benefits associated with the contribution.

- Recurring Donations: If donations are made regularly, such as monthly or annually, the receipt should include the frequency of the donation, total amount for the period, and date of the next scheduled donation.

- Matching Gifts: For donations that are matched by employers, include a section where the employer’s information can be noted. You may also want to list the amount expected from the employer for clarity.

Adjust your template based on the specifics of each donation type to enhance transparency and ensure that you are meeting all the necessary legal requirements. Personalization helps build trust with donors while keeping everything organized for your team.

Donation Receipt Template

Provide clear and concise donation receipts to ensure your donors feel appreciated and have proper documentation for tax purposes. A well-structured receipt template should include the donor’s name, donation amount, date of contribution, and your organization’s details. Be specific about the type of donation (monetary or in-kind) and its value if applicable.

Basic Template Format

Start with a header that includes your organization’s name and contact information. Then, list the donor’s name, the donation date, and the amount donated. Include a brief description of the donation, whether it’s a monetary gift or an item. Ensure the receipt clearly states that no goods or services were exchanged for the donation, if applicable, to comply with tax laws.

Legal Considerations

Make sure the template adheres to IRS guidelines, especially if your organization is a nonprofit. Include a statement that confirms your organization is tax-exempt, and remind donors to consult their tax professional for questions regarding their donation deductions.