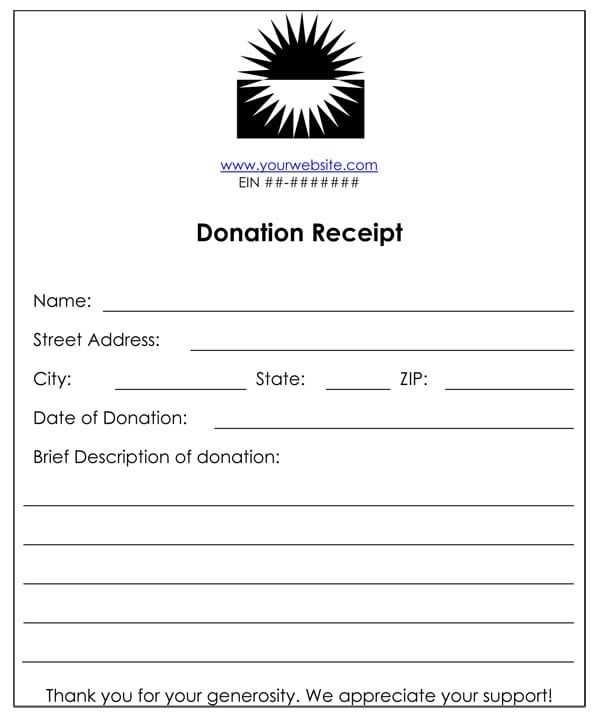

Provide your donors with a clear and professional donation receipt by using a Girl Scout donation receipt template. This template should include key details like the donor’s name, date of the donation, amount given, and the status of the donation (monetary or in-kind). Be sure to also include the tax-exempt status of your organization to help donors claim deductions when filing taxes.

Ensure your receipt template is simple to fill out and customize. Use fields for donor information, donation amount, and any additional notes that may be necessary for the donor’s records. Offering this receipt not only helps with transparency but also strengthens your relationship with your supporters by showing appreciation for their contributions.

By providing an official receipt, you’re offering donors confidence in their contributions and making it easier for them to keep accurate records. Customize the template with your organization’s logo and contact information to give it a professional touch and make your receipts easily recognizable. Make sure your template is easy to access and distribute to ensure donors can promptly receive confirmation of their generosity.

Here’s the updated version with minimal repetition:

Ensure the donor’s information is clear and easily identifiable. Include the donor’s name, address, and contact details at the top of the receipt.

Clearly state the donation amount and specify the donation’s purpose. Use exact wording to describe what the funds will be used for, such as “supporting Girl Scouts’ programs.” This avoids ambiguity and keeps the receipt straightforward.

Include a confirmation of the tax-deductible status of the donation, if applicable. Specify that no goods or services were provided in exchange for the donation to make it eligible for tax deductions.

Don’t forget to include the date of the donation and the unique receipt number for tracking purposes. This ensures your receipt is organized and verifiable for both the donor and the organization.

End with a sincere thank you for the donor’s support and a brief reminder of the impact their contribution makes. Keep it brief but personal to encourage continued giving.

- Girl Scout Donation Receipt Template

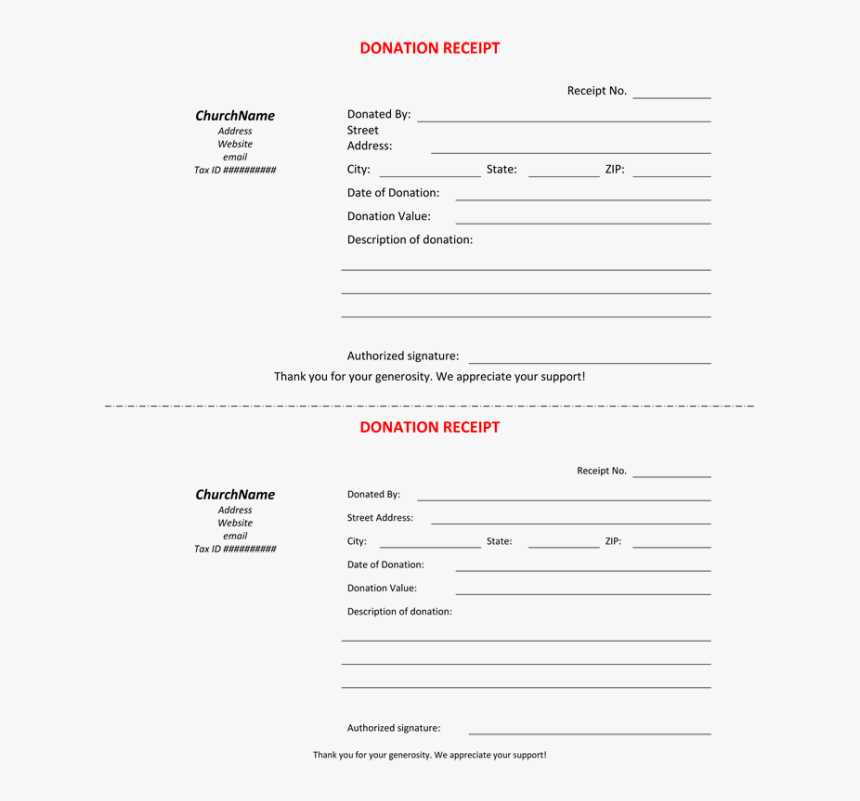

Creating a donation receipt for Girl Scout contributions is straightforward. Here’s a template to ensure all necessary details are included, making it easy for donors to keep track of their contributions for tax purposes.

The receipt should contain the following sections:

| Item | Description |

|---|---|

| Donor Information | Include the full name and address of the donor. |

| Organization Name | Clearly state the organization’s name (e.g., Girl Scouts of [Location]). |

| Donation Date | Record the date when the donation was received. |

| Amount of Donation | Note the monetary value or fair market value of goods donated. |

| Purpose of Donation | Specify if the donation is for a particular event or general fund. |

| Non-Cash Donations | If applicable, provide an itemized list of non-cash items donated. |

| Tax Exempt Status | State that the organization is a registered 501(c)(3) for tax purposes. |

| Signature | Provide space for an authorized signature from the Girl Scout organization. |

This template will streamline the process and ensure all required information is included for the donor’s record-keeping. Be sure to keep a copy for your own organization’s records as well.

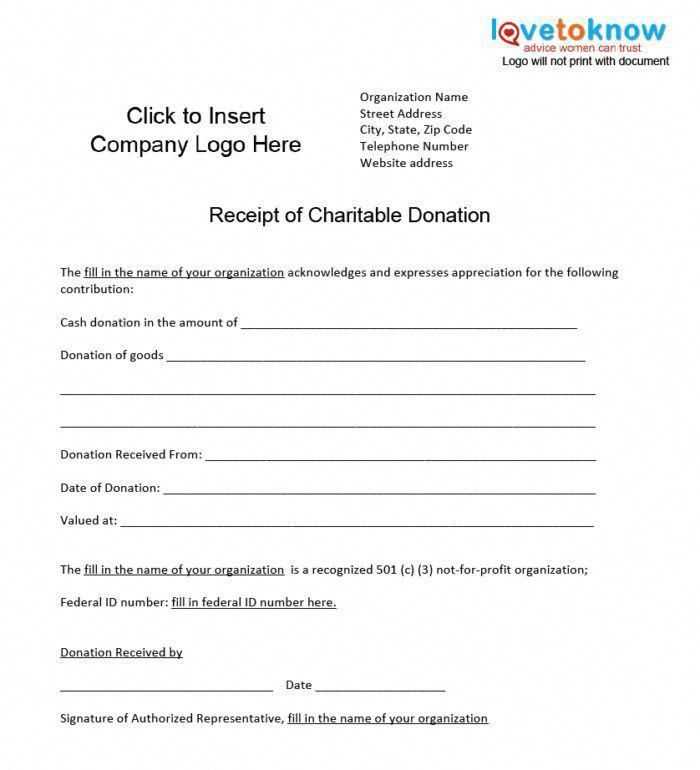

To create a customized donation receipt template for Girl Scouts, focus on including the necessary details in a clean, organized format. Start by listing the donor’s name, the date of the donation, and the donation amount or item description. If it’s a monetary donation, include the exact amount given. For non-cash donations, provide a brief description of the donated items along with their estimated value, if applicable.

Incorporate the Girl Scouts’ name, address, and tax-exempt status information clearly at the top of the receipt. This establishes the legitimacy of the organization for tax purposes. Make sure to add a statement acknowledging that no goods or services were provided in exchange for the donation if that applies. If any goods or services were given, provide a brief description of what was received.

Design the template to be user-friendly, ensuring that all required fields are clearly labeled and easy to fill out. Use a simple, professional font and layout to enhance readability. You can create the template using word processors like Microsoft Word or Google Docs, or opt for online receipt generators that allow customization with your organization’s logo and colors.

Finally, save the template in both printable and digital formats, like PDF, to provide flexibility for your donors. Regularly update the template to reflect any changes in the donation process or tax laws. By creating a well-organized and clear donation receipt, you simplify the process for both donors and Girl Scouts.

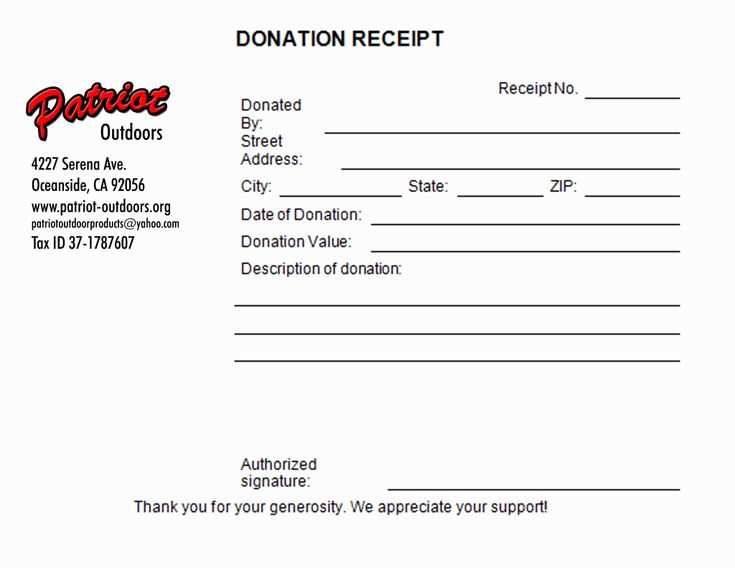

Ensure these key details are included in the receipt:

- Donor’s Name: The full name of the person or organization making the donation.

- Donation Amount or Value: Specify the amount for monetary donations or an item description and estimated value for non-cash gifts.

- Date of Donation: The exact date the donation was received.

- Girl Scout Organization’s Details: Include the name, address, and tax-exempt status of the organization.

- Itemized Description: For non-cash donations, list each item and an estimated value.

- Goods or Services Statement: Indicate if any goods or services were provided to the donor in exchange for the donation.

- Receipt Number: Assign a unique receipt number for easy tracking.

- Tax-Exempt Status: Confirm the organization’s 501(c)(3) status for tax deduction eligibility.

These elements help ensure the donation receipt is accurate and meets all necessary requirements for both parties.

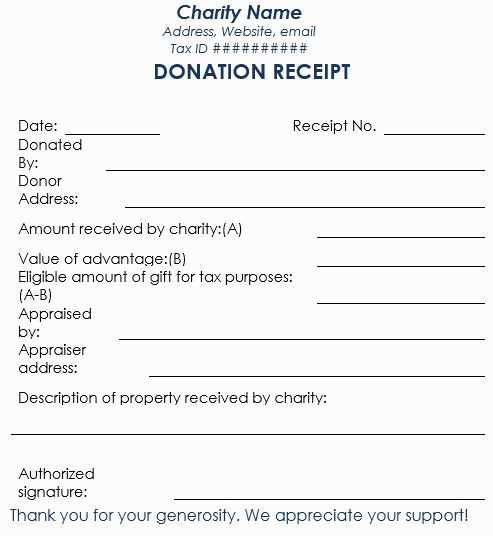

To claim a tax deduction for a donation to the Girl Scouts, you need an official donation receipt that meets IRS requirements. The receipt should clearly state the following:

- The name of the Girl Scouts organization.

- The date and amount of the donation.

- A description of the donated items, if applicable (e.g., goods, supplies, or services).

- A statement that no goods or services were received in exchange for the donation, if that’s the case.

- The organization’s tax-exempt status (usually noted with a 501(c)(3) number).

For cash donations, it’s essential to have documentation that shows the donation amount, such as a bank statement or check. For non-cash donations, like items or services, an accurate valuation must be included. Keep all receipts and supporting documents in your tax records.

Without these specific details, the IRS may not accept the donation for tax deduction purposes, so always ensure the receipt is complete and accurate.

Creating a Girl Scout Donation Receipt Template

When designing a donation receipt template for Girl Scouts, ensure that the document contains essential information like the donor’s name, donation date, amount, and purpose. A clear structure allows for easy reference and helps maintain transparency. The template should also feature a section for the Girl Scout organization’s contact information, ensuring that donors can reach out for any inquiries or tax-related concerns.

Required Details

Include these core elements:

– Donor’s full name and contact info.

– Date of the donation.

– Donation amount or description of in-kind contributions.

– A statement confirming that no goods or services were exchanged in return for the donation, if applicable.

– A thank-you message expressing gratitude for their support.

Tax Deduction Confirmation

Be sure to add a line confirming that the Girl Scout organization is a recognized nonprofit, and that donations may be tax-deductible. This will reassure donors about their contributions’ status and encourage future support.