Providing a donation receipt template is a simple but meaningful way to show appreciation for a donation. This document serves both as a thank-you note and as a necessary record for tax purposes. Ensure the receipt includes the donation amount, date, and a clear statement of the charity or organization’s details. It’s important to keep the tone of the document warm and professional, reflecting the gratitude the donor deserves.

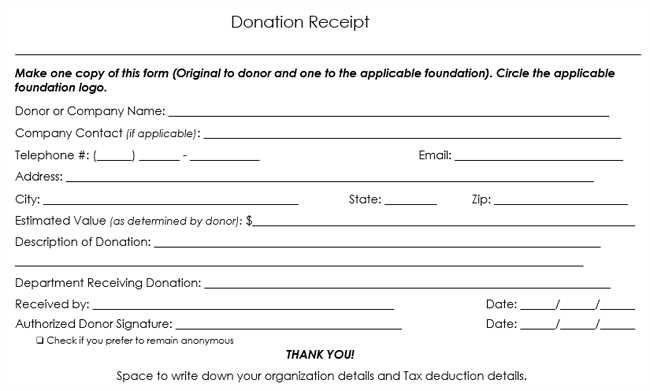

Make the template clear and easy to customize with fields such as the donor’s name, contact information, and donation type. For monetary gifts, list the exact amount given. If the donation involves goods or services, include a description of those items. If applicable, mention if no goods or services were exchanged for the donation, as this is a crucial tax detail.

Provide instructions on how the donor can use the receipt for tax filing, ensuring they know which sections to keep and which are for organizational records. A donation receipt template should be easy to generate or print for future use, offering both physical and digital options for convenience.

Here’s the corrected version:

When creating a donation receipt, it’s crucial to include specific details to make it clear and accurate. Here’s how you should structure it:

Receipt Format

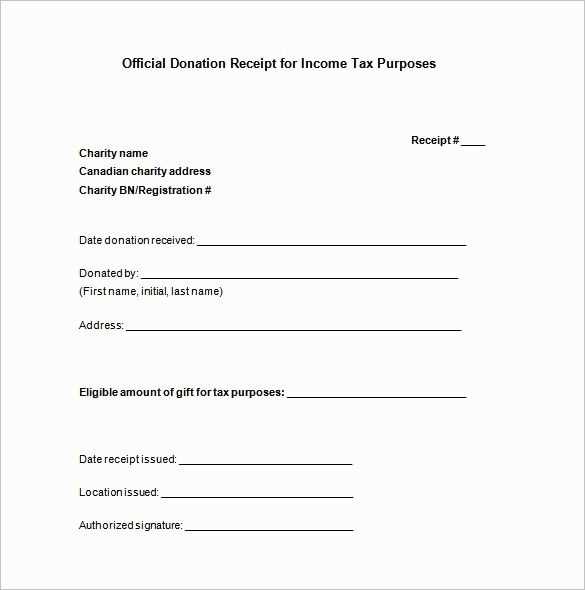

- Organization Name: Clearly state the name of your organization at the top.

- Donor Information: Include the full name of the donor.

- Donation Amount: Specify the exact amount donated, including the currency.

- Date of Donation: Mention the exact date the donation was made.

- Receipt Number: Add a unique receipt number for tracking purposes.

Additional Information

- Purpose of Donation: If applicable, describe how the funds will be used.

- Tax Deductible Status: Include a statement about the tax deductibility of the donation.

- Contact Information: Provide contact details for your organization in case the donor needs further assistance.

Make sure the format is clear and easy to read to ensure proper documentation for both the donor and the organization.

- Donation Receipt Template Overview

A donation receipt template should include key information to ensure transparency and ease of record-keeping. This document verifies the donation made and provides the necessary details for tax purposes. The template should be simple to use and adaptable to different donation types.

Key Elements of a Donation Receipt Template

The template must contain the following elements:

- Donor Information: Include the name and contact details of the person or organization making the donation.

- Donation Date: Clearly state the date the donation was received.

- Donation Amount or Description: Specify whether the donation is a monetary amount or in-kind contribution. For monetary donations, include the exact dollar value; for in-kind donations, describe the items donated.

- Organization Information: Add the nonprofit’s name, address, and tax identification number (TIN).

- Statement of No Goods or Services Received: This section confirms whether the donor received any goods or services in exchange for their donation. If none were received, include a clear statement to that effect.

- Signature and Date: The receipt should include space for a signature from an authorized individual at the nonprofit and the date it was signed.

Additional Considerations

For organizations that issue many receipts, consider creating a template with placeholders for the key details that can be filled in as needed. This makes it easy to generate receipts without omitting any crucial information.

Clearly indicate the name and contact details of the organization providing the donation. Include the address, phone number, and email address, so it’s easy for the recipient to reach out if needed.

Itemized List of Donations

Break down the contribution into individual items, especially for in-kind donations. If it’s a monetary donation, state the exact amount. For non-cash donations, list the description and the estimated value based on fair market prices.

Donation Date and Acknowledgment

Clearly show the date the donation was received. Include a statement acknowledging that no goods or services were provided in exchange for the donation if that’s the case. If something was provided, make sure to state its value and ensure the donor knows that they can deduct only the amount exceeding the fair value of the received benefit.

Ensure the signature of an authorized representative of the organization is included to validate the receipt, as this is necessary for tax filing purposes.

Ensure that the receipt clearly states the name of the donor and the organization receiving the donation. Include the donor’s full address and contact details if possible, along with the organization’s registered name and contact information. Specify the donation amount, indicating whether it is a monetary contribution or in-kind gift. If it’s a cash donation, mention the exact amount, and if it’s a non-cash item, describe it in detail, including its fair market value. Be sure to add the date of the donation and note whether the donor received anything in exchange, like goods or services, which may affect tax deductions. Conclude with a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This information ensures both transparency and accuracy for record-keeping and tax purposes.

Double-check donation amounts. Ensure that both the monetary value and any non-cash items are listed accurately. For cash donations, specify the exact sum received, and for in-kind donations, provide a description along with an estimate of the fair market value.

Don’t forget to include the donor’s full name and address. This helps avoid confusion and provides the necessary information for tax deduction purposes. Ensure the spelling of names is correct and matches official records.

Avoid using vague or incomplete descriptions of the donations. If a donor contributes goods or services, list each item with a brief description. For example, instead of “clothing,” specify “5 men’s shirts, size medium.”

Ensure the donation receipt is dated correctly. The date should reflect when the donation was received, not when it was pledged. If there’s a delay between the donation and receipt issuance, make sure to adjust the date accordingly.

Don’t forget to include the organization’s tax-exempt status. Clearly mention the non-profit’s tax-exempt number or EIN to demonstrate that the receipt is valid for tax purposes.

Avoid omitting the signature. Depending on local laws, the signature of the authorized person who issued the receipt may be required. Always include this detail to avoid issues with legitimacy.

Be careful not to confuse a donation receipt with an acknowledgment letter. The former is for tax purposes, while the latter is simply an acknowledgment of the donor’s generosity.

Finally, review the entire receipt before sending it. Small mistakes can lead to confusion, delays, or legal issues later. Take time to ensure all details are accurate.

Provide a clear and concise format for the donation receipt. Include the name of the donor, the donation amount, and the date of the donation. Specify if the donation is cash or in-kind. If the donation is for a specific purpose, mention the designated fund or program. Include your organization’s name, address, and contact information to ensure the donor can verify the legitimacy of the donation.

Donation Details

List the donor’s full name, the donation amount, and the donation date. If applicable, include the donor’s contact details. For in-kind donations, provide a description of the item(s) donated, including quantity and estimated value.

Tax Deductibility Information

Clarify whether the donation is tax-deductible by including a statement of your organization’s tax-exempt status. Mention any specific tax laws or limits on deductions that apply.