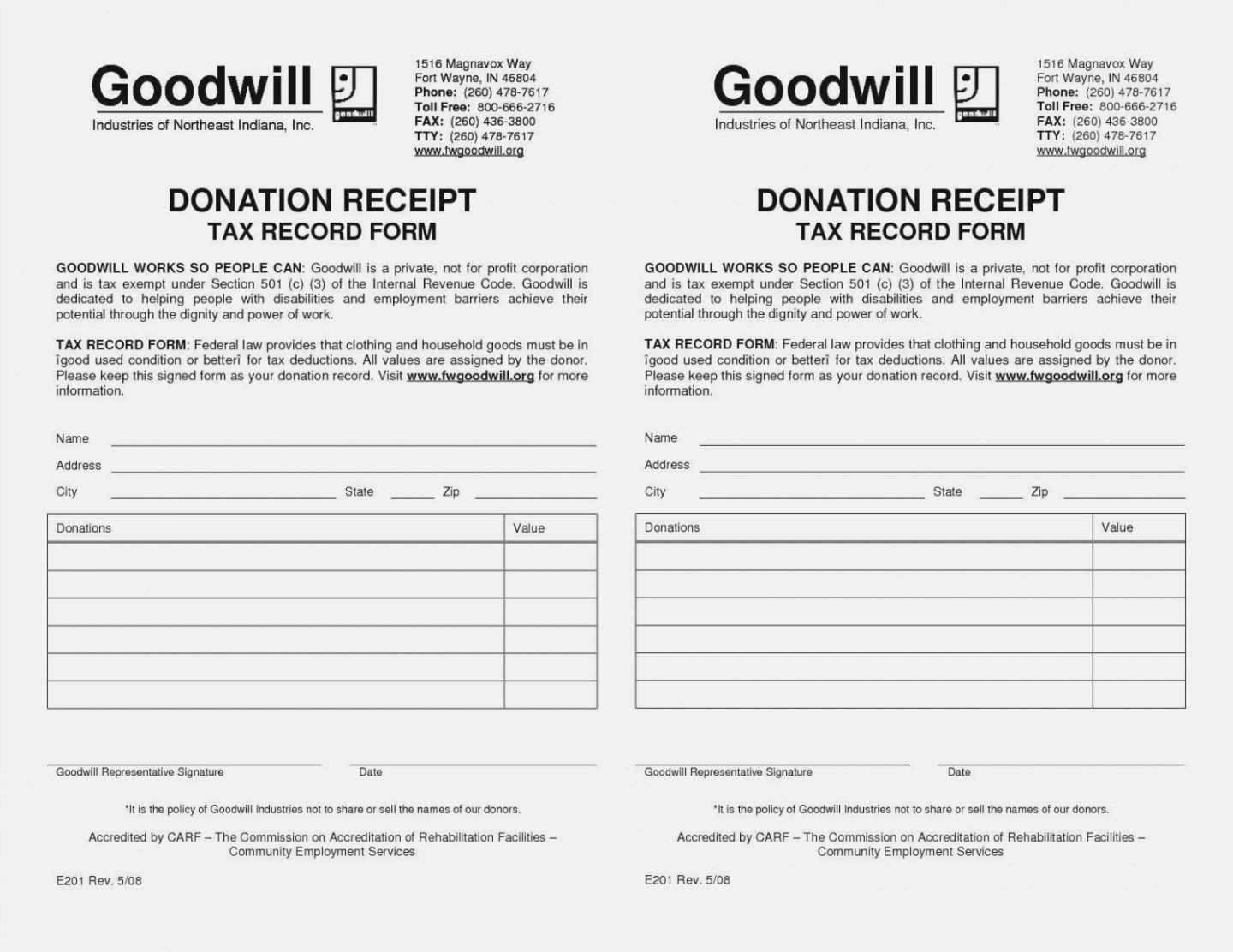

To create a proper donation receipt for Goodwill, begin by including key details like the donor’s name, address, and donation date. This will ensure the receipt is both clear and valid for tax purposes. Make sure to specify the items donated, as well as their estimated value, whether it’s clothing, furniture, or household goods. This will provide the donor with accurate information for tax deductions.

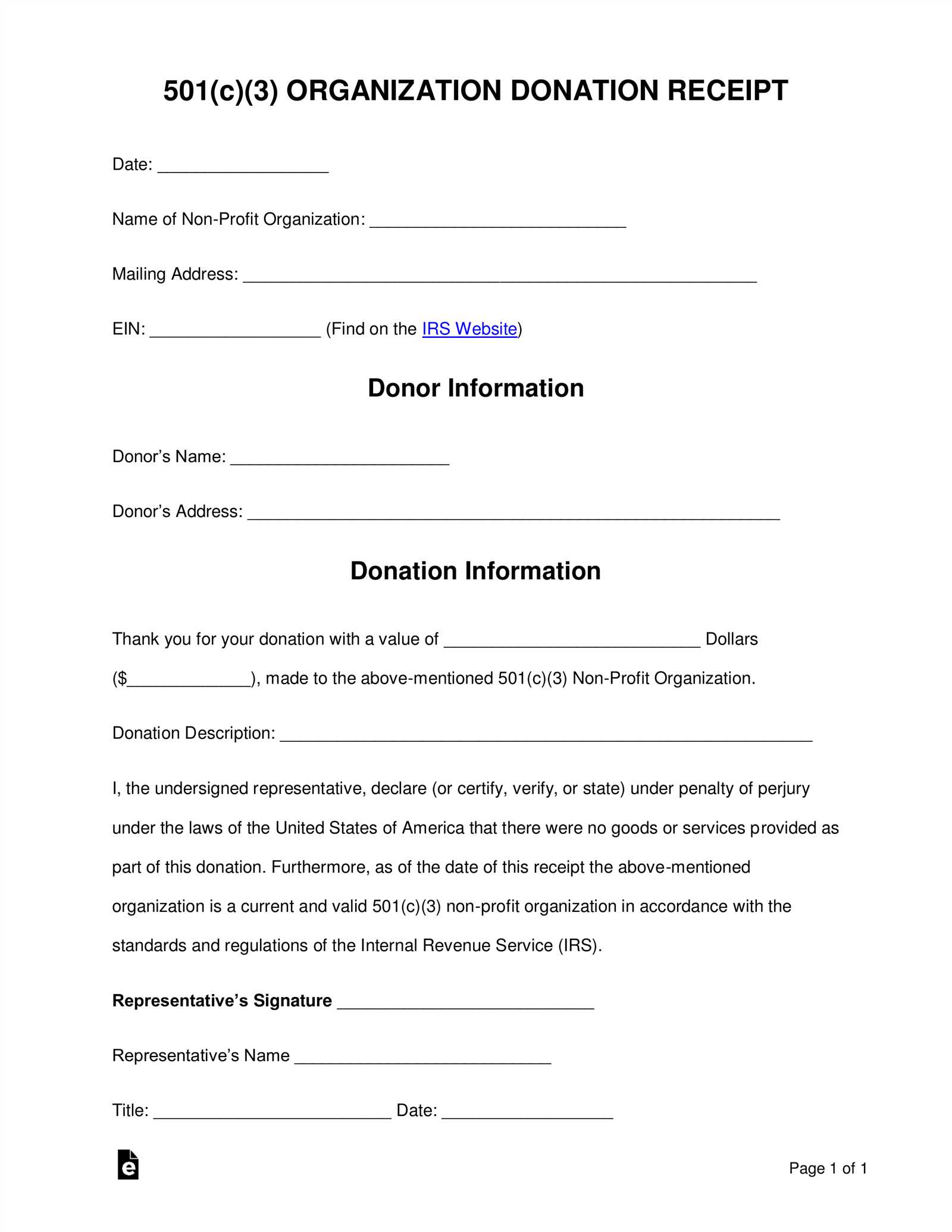

Include a statement that Goodwill did not provide any goods or services in exchange for the donation. This helps maintain transparency and avoid confusion when the donor uses the receipt for tax filings. The IRS requires this disclosure to confirm that the transaction qualifies as a charitable donation, which is critical for deduction purposes.

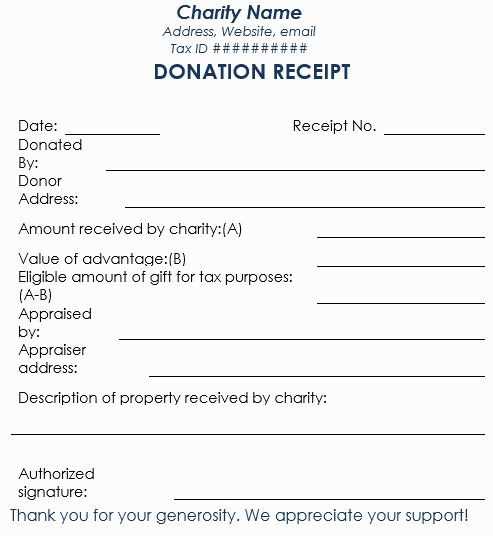

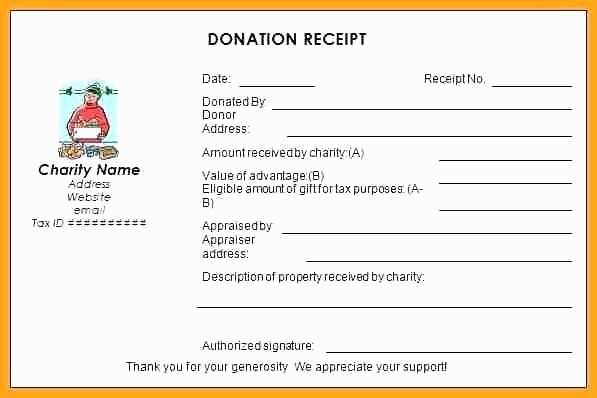

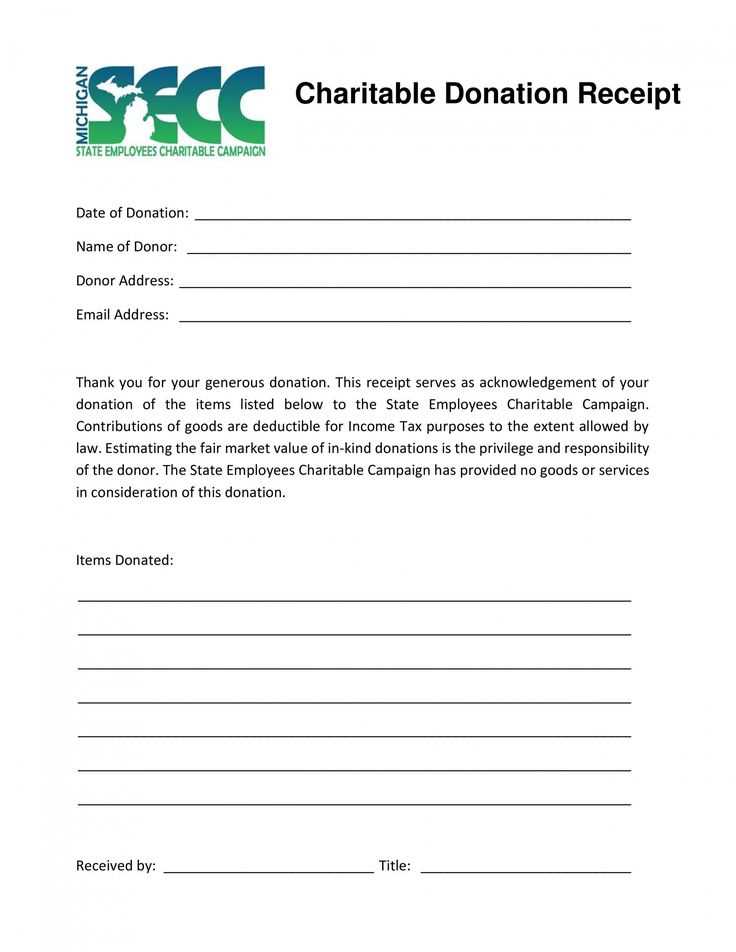

When it comes to the format, use a simple structure that is easy to read. Place the organization’s name and contact details at the top, followed by a section for the donor’s information and donation details. Keep the template concise, while ensuring it contains all the necessary information for legal and financial purposes.

Here’s the corrected version:

When creating a Goodwill charitable donation receipt, make sure to include all necessary details for the donor’s tax records. The receipt should clearly state the name of the donor, the date of the donation, a description of the items donated, and their fair market value. Avoid using vague terms like “miscellaneous items”–be specific to prevent confusion later. If possible, include a statement that no goods or services were provided in exchange for the donation.

The template should also include the name of the organization, its tax-exempt status, and contact information. This makes the receipt valid for tax purposes. Make sure that the donation value is determined using Goodwill’s guidelines, as this helps the donor to report the correct amount on their taxes.

Keep in mind, the template should be easy to read and contain all the required information without overwhelming the donor with unnecessary details. Simplicity is key while still covering all legal requirements for both the donor and the organization. Remember, a properly filled out receipt will save time and effort during tax season.

Goodwill Charitable Donation Receipt Template

To create a valid donation receipt for Goodwill, make sure it includes specific details to satisfy IRS requirements. Use a straightforward format that is easy to understand. Here’s what needs to be in the template:

How to Create a Valid Donation Receipt for Goodwill

The receipt should list the name of your organization (Goodwill), the date of the donation, a description of the items donated, and the donor’s name and address. If you received goods, make it clear whether the items were accepted as non-cash contributions. If the donor claims any significant value for the donated items, include a disclaimer that the value is determined by the donor, not the organization. It’s also important to provide a statement confirming whether any goods or services were provided in exchange for the donation.

Key Information to Include on a Donation Receipt

Here are the key details you should include on every Goodwill charitable donation receipt:

- Organization Name and Tax ID Number – Clearly state the full name of Goodwill and its tax-exempt status (e.g., 501(c)(3)).

- Donor’s Information – Include the donor’s full name and address.

- Donation Details – Provide a description of the donated items or services. Do not assign a monetary value, but note the number and type of items donated (e.g., “3 bags of clothing, 1 box of books”).

- Date of Donation – The date when the donation was made.

- Statement of No Goods or Services – Include a clear statement confirming whether any goods or services were provided in exchange for the donation. If none were, state that fact.

Common Mistakes to Avoid When Issuing Receipts for Donations

Avoid these common pitfalls:

- Incomplete Information – Missing the donor’s address or omitting the donation date can cause problems later on.

- Incorrect Valuation – Donors are responsible for valuing their own items. Avoid listing any dollar amounts or assigning value to donated goods.

- Failure to Confirm Goods/Services – Don’t forget to include a statement about whether anything of value was exchanged for the donation.