When acknowledging in-kind donations, a clear and concise receipt is key. This document serves as an official record for both the donor and the receiving organization, outlining the items donated, their estimated value, and any relevant tax information. It helps build trust and transparency in the donation process, ensuring that both parties are on the same page.

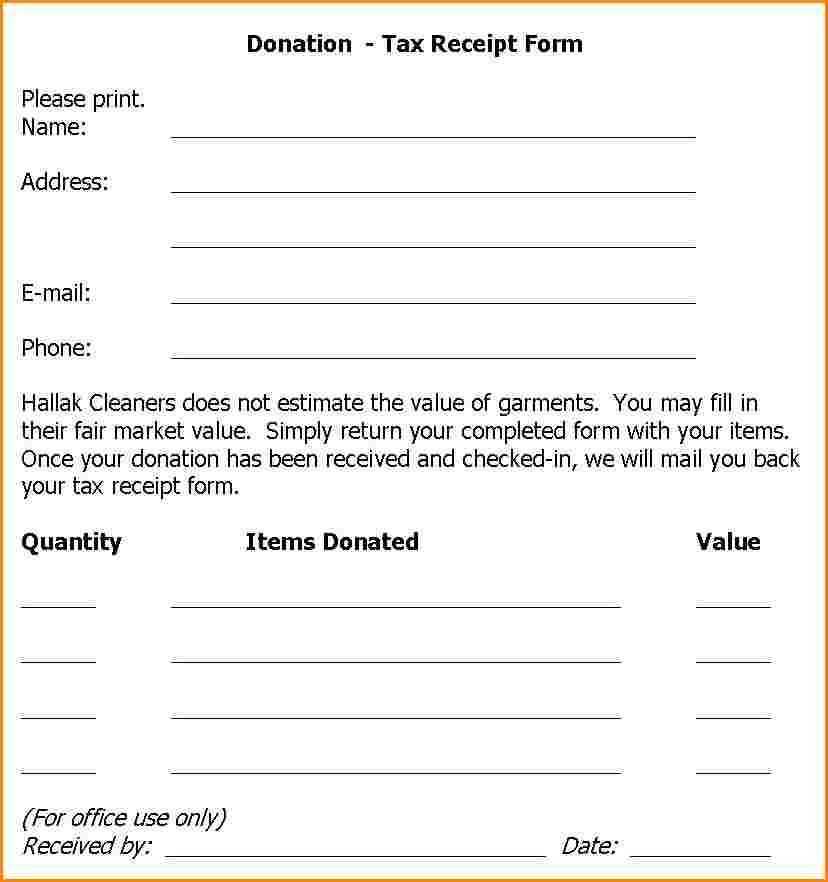

Start with the donor’s information: Include the donor’s full name, address, and contact details. This helps the recipient properly acknowledge the gift and communicate any necessary follow-up. Providing specific details such as the date of donation can also avoid confusion in the future.

Describe the donated items: List each item received along with a brief description. If the donation consists of multiple items, categorize them to keep the receipt organized. While donors are not required to list a monetary value, it is helpful to give an estimated worth for tax purposes. In some cases, you might need to include specific terms like “fair market value” based on the condition and age of the items donated.

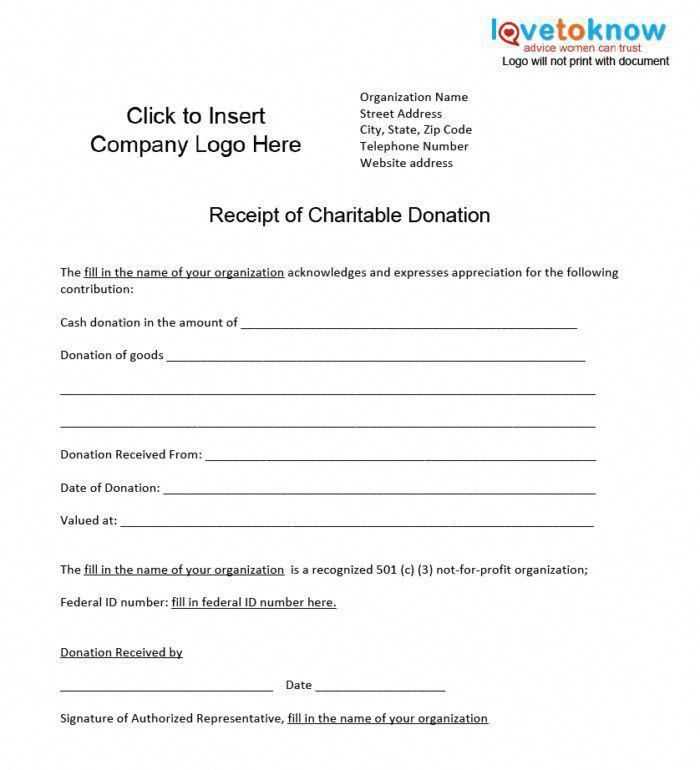

Include the organization’s details: The receiving organization should also be clearly identified with its name, address, and a contact number. Additionally, include the tax-exempt status of the organization, which reassures the donor of their right to claim a deduction where applicable.

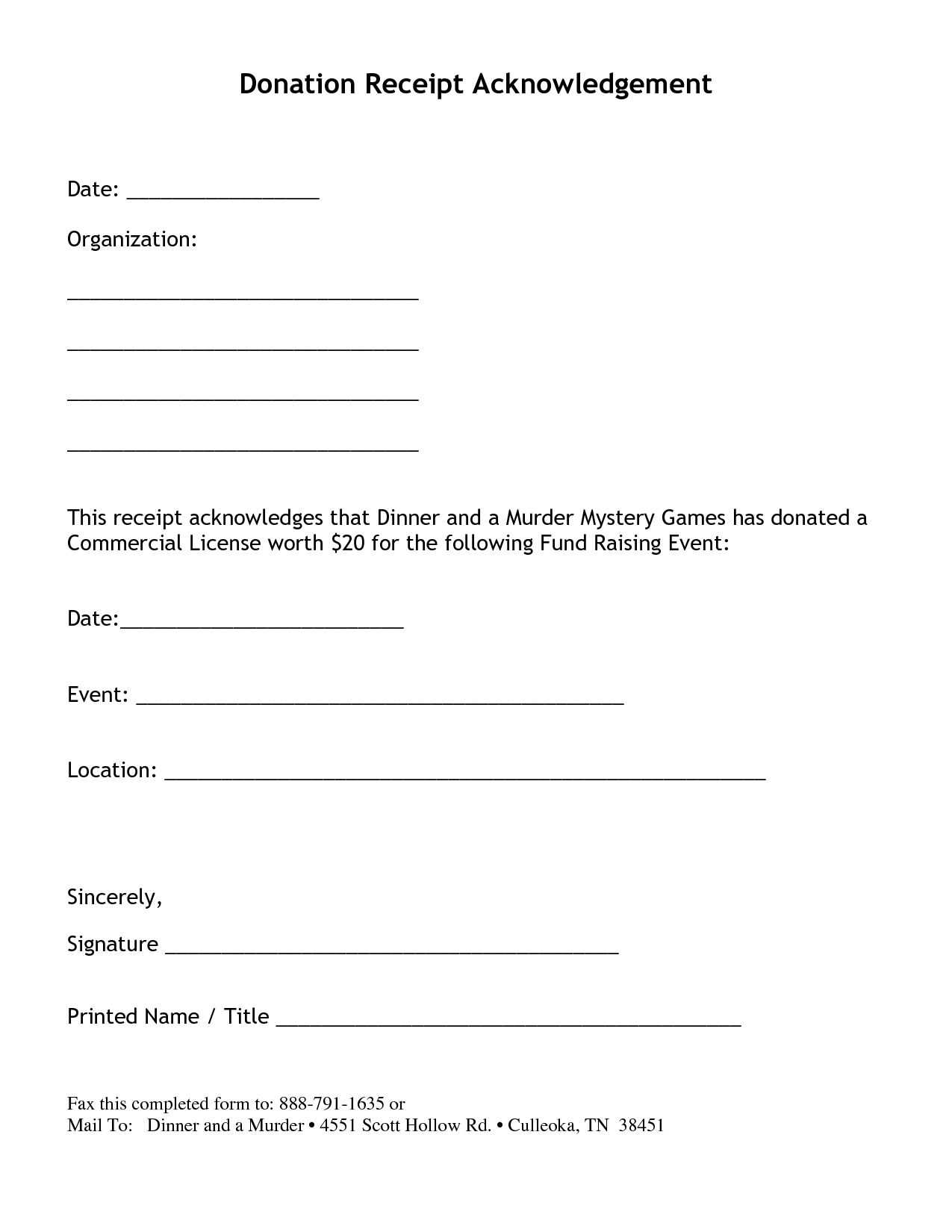

Conclude with a thank-you note: Acknowledge the donor’s contribution with a personal message of appreciation. This helps maintain a positive relationship and encourages future donations. While this may seem like a small gesture, it shows genuine gratitude for the donor’s generosity.

Here’s the revised version of the lines with minimal repetition of words:

To create a donation receipt letter with clear and concise wording, make sure each section conveys the necessary information without redundancy. Begin with a personalized greeting that includes the donor’s name. Follow with a brief acknowledgment of the donation received, specifying the type of contribution (monetary or in-kind). Include a description of the donated item, highlighting its value or purpose without over-explaining. Finish by expressing gratitude for the donor’s support and reiterating the importance of their contribution to your cause.

Make the tone friendly and professional, focusing on what was given, why it matters, and how it helps. Avoid repeating similar phrases or general statements. Keep it focused on the specifics of the transaction to maintain clarity and professionalism throughout the letter.

- In-Kind Donation Receipt Letter Template

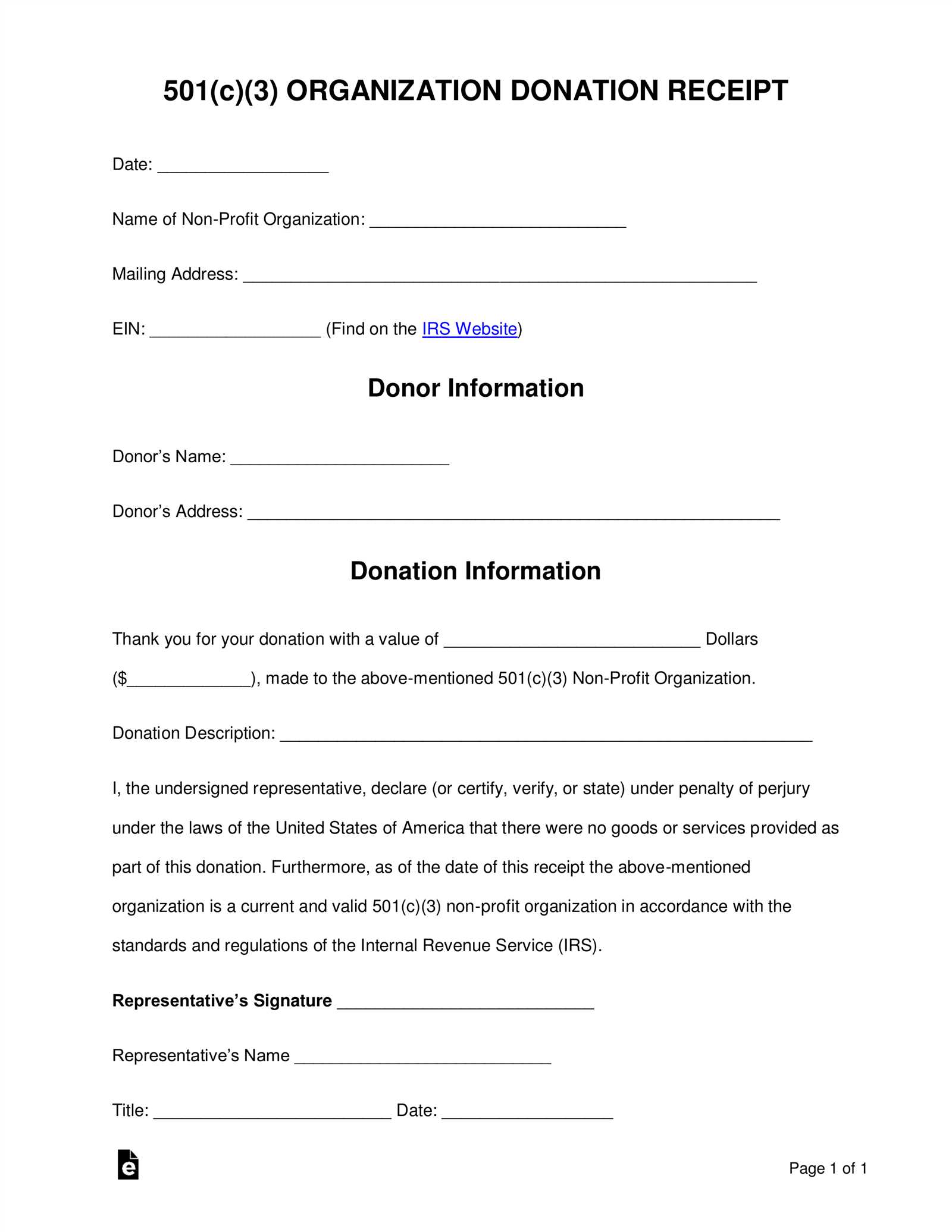

To draft a clear and professional in-kind donation receipt, begin by acknowledging the donor’s contribution and listing the items received. Include the donor’s name, date of donation, and a detailed description of the items. Specify that no goods or services were provided in exchange, if applicable, as this ensures compliance with tax regulations.

Key Elements to Include:

- Donor’s Full Name and Address: Clearly state the donor’s name and contact details to ensure proper documentation.

- Date of Donation: Always note the exact date when the donation was received to help track the contribution.

- Itemized List of Donations: Describe the items received in detail. Include quantity, condition, and any distinguishing features to help with proper valuation.

- Statement of No Exchange: Clearly mention that no goods or services were exchanged for the donation, or state what was provided if relevant.

- Nonprofit’s Name and Contact Information: Ensure your organization’s name, address, and phone number are included for the donor’s records.

Sample Template:

In-Kind Donation Receipt

Donor: John Doe

Date of Donation: January 1, 2025

Donated Items: 3 boxes of office supplies (pens, paper, binders)

Statement: No goods or services were exchanged for this donation.

Thank you for your generous contribution. Your donation will directly support our mission.

Use this structure to maintain accurate records and provide a well-documented receipt that meets legal requirements.

When acknowledging an in-kind donation, the purpose is clear: to express gratitude and ensure the donor has a record for tax purposes. By formally recognizing the contribution, you establish a transparent and accountable process for both the donor and the receiving organization.

Here are key reasons why an acknowledgment letter is important:

- Legal Compliance: Tax laws require organizations to issue acknowledgments for in-kind donations that include a description of the item(s) and their fair market value. This allows donors to claim appropriate deductions.

- Building Relationships: Acknowledging in-kind donations helps strengthen the relationship between the donor and your organization, showing appreciation for their support and fostering future engagement.

- Clear Documentation: The letter provides both parties with a clear record of the donation details, ensuring there’s no confusion about the item(s) donated and their value.

To make the most of this acknowledgment, include specific details like the condition of the items, any associated services, and an accurate value estimation. This clarity enhances the transparency and utility of the donation acknowledgment letter for both parties.

The key to a proper acknowledgment letter is clear, concise information. Include the name of the donor and the organization’s name, along with the date of the donation.

Detailed Description of the Donated Items: Describe the items received, including quantity, condition, and any unique attributes. For example, “Five new office chairs, still in the original packaging,” helps avoid confusion and makes it clear what was donated.

Statement of No Goods or Services Received: Clearly state whether the donor received anything in return for the donation. For example: “No goods or services were provided in exchange for this donation.” This is important for tax purposes.

Estimated Fair Market Value: If applicable, include the estimated value of the items. For non-cash donations, an approximation based on fair market value should be stated. This helps the donor in tax filings.

Tax-Exempt Status of the Organization: If your organization has tax-exempt status, be sure to include this information. For example: “XYZ Charity is a 501(c)(3) organization, and donations are tax-deductible to the full extent of the law.”

Gratitude and Acknowledgment: Always express thanks for the donation. Even in a brief note, showing appreciation strengthens relationships and encourages future support.

Begin by researching the current market value of each item. Check online marketplaces, auction sites, and local stores for similar items in new or used condition. This will give you a realistic price range for valuation.

If the item is a collectible or antique, consider consulting an expert for an appraisal. They can provide a more precise value based on rarity, condition, and demand. For high-value donations, it’s advisable to obtain a written appraisal for tax purposes.

Take note of the condition of the items. Minor wear or tear reduces the value, while items in excellent condition may be worth more than the average market value. If you’re unsure about an item’s condition, consider having it professionally assessed.

For donated items like clothing or electronics, it’s helpful to reference a guide like the IRS Donation Value Guide. These resources list average prices for commonly donated goods, which can help in assigning a fair value to each item.

Always record detailed descriptions and keep accurate documentation, including photographs if necessary. This ensures the valuation process is transparent and can be substantiated if required for tax purposes.

Ensure that your organization complies with the IRS guidelines when issuing a receipt for in-kind donations. The IRS mandates that the acknowledgment letter must include specific details about the donation. This includes a description of the donated goods or services, without stating their value. Do not assign a monetary value to the donated item in the receipt, as this is the responsibility of the donor for tax purposes.

Required Information

The letter must clearly state the organization’s name and tax-exempt status, usually indicated by the 501(c)(3) status. Additionally, the date of the donation, as well as a statement confirming that no goods or services were provided in exchange for the donation, must be included. If any goods or services were exchanged, the organization must disclose their fair market value.

Record-Keeping Requirements

For donations exceeding $250 in value, the donor must provide a written acknowledgment from the charity. This is critical for the donor’s tax deduction claim. Ensure that your organization keeps accurate records of all donations and acknowledgment letters for future reference in case of IRS audits.

Start by being specific about the donation. Avoid vague statements like “Thank you for your generous donation.” Instead, clearly describe the item or service received, including its value if applicable. This shows transparency and helps the donor track their contribution for tax purposes.

Another common mistake is not providing the necessary details for tax deduction purposes. Always include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This prevents confusion and ensures compliance with tax regulations.

Don’t forget to personalize the message. Using generic templates without addressing the donor by name or acknowledging the specific donation can make the acknowledgment feel impersonal. Adding a personal touch can strengthen the relationship between the organization and the donor.

Avoid using overly formal language that feels stiff and disconnected. A friendly yet professional tone is more engaging and will make the donor feel valued. Keep the message clear and concise, avoiding excessive jargon or legal terms that may overwhelm the reader.

| Common Mistake | How to Avoid It |

|---|---|

| Vague Donation Description | Provide specific details of the donated item or service and its value. |

| Lack of Tax Information | Include a statement confirming that no goods or services were exchanged for the donation. |

| Impersonal Language | Personalize the message with the donor’s name and mention the specific donation. |

| Overly Formal Tone | Use a friendly, professional tone that makes the donor feel appreciated. |

How can I assist you today with your project?

To create an in-kind donation receipt letter, begin by including the name of your organization, the date of the donation, and the description of the donated items. Clearly list the items or services donated with their respective value. Avoid specifying the dollar amount unless the donor has provided a valuation or has agreed to an estimated value for tax purposes.

- Include the donor’s full name and address for proper documentation.

- Provide a brief description of the donated items or services. Be specific, listing quantities and types of goods or services.

- State that no goods or services were provided in exchange for the donation, if applicable. This ensures the receipt is suitable for tax purposes.

- End the letter with a sincere thank you note to the donor for their generosity.

Ensure the receipt is signed by an authorized representative of your organization. This adds credibility and validity to the document.