To acknowledge in-kind donations properly, create a clear and detailed receipt that outlines the gift’s value, description, and donor’s details. This helps ensure transparency for both the donor and the recipient organization, serving as proof of the donation for tax purposes.

Include the donor’s name, contact details, and the date of the donation. Clearly describe the item(s) donated, including any relevant condition notes. Specify the estimated fair market value, based on reasonable assessment or the donor’s estimate, as this helps clarify the donation’s worth.

While it’s not mandatory for the organization to assign a monetary value to the donation, providing an estimate can help avoid confusion and ensure compliance with tax reporting requirements. For a simple, clear, and accurate receipt, make sure to list all necessary details without overcomplicating the process.

Here is the revised version of your text, ensuring that no word repeats more than 2-3 times, while maintaining the meaning and correctness:

Focus on creating a clear and concise donation receipt that reflects the nature and value of the in-kind contribution. Start by including the donor’s name, address, and contact details. Clearly state the date the donation was received and provide a brief description of the items or services given. It’s also helpful to list their fair market value, ensuring transparency and accuracy. Avoid ambiguity in describing the goods or services donated. If possible, mention any specific conditions or restrictions related to the donation, such as if it’s designated for a particular program or event.

Ensure your language is direct and straightforward, making it easy for the donor to understand. Avoid overcomplicating phrases or using unnecessary jargon. For instance, instead of vague descriptions like “miscellaneous items,” provide more specific information like “five boxes of office supplies.” Double-check all figures, especially in cases where valuation is involved, to maintain accuracy.

Finally, include a thank-you note that highlights the donor’s generosity. This shows appreciation and reinforces the impact of their contribution. End by including the name and title of the person signing the receipt, along with the organization’s details, to give the document authenticity and authority.

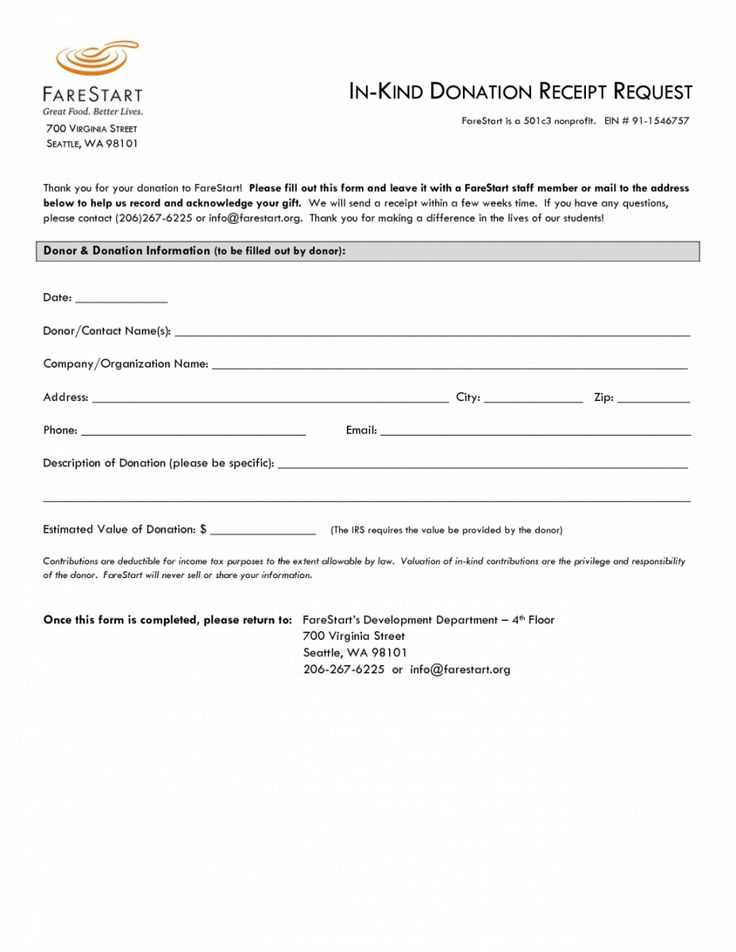

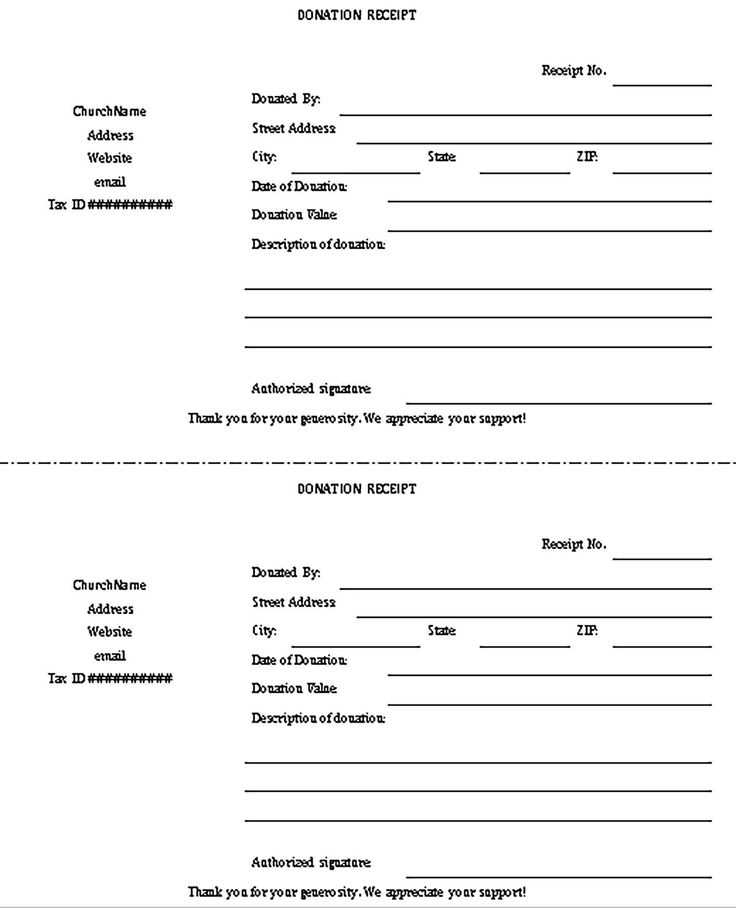

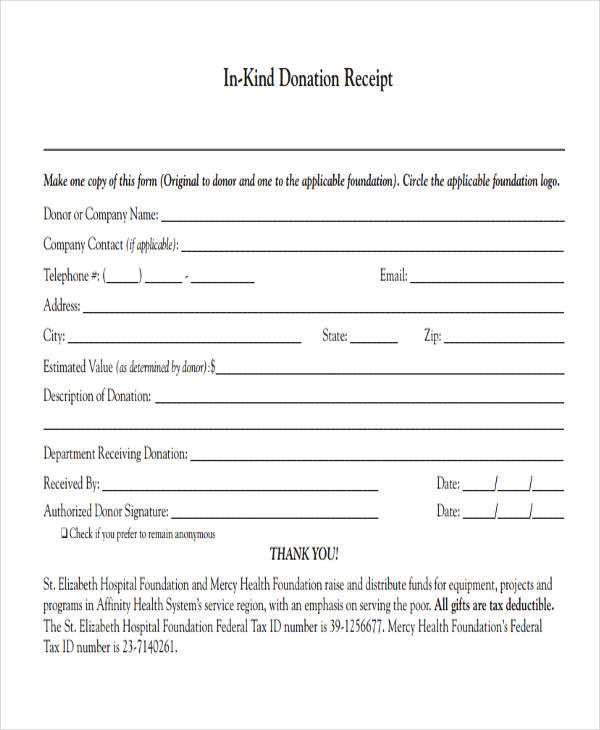

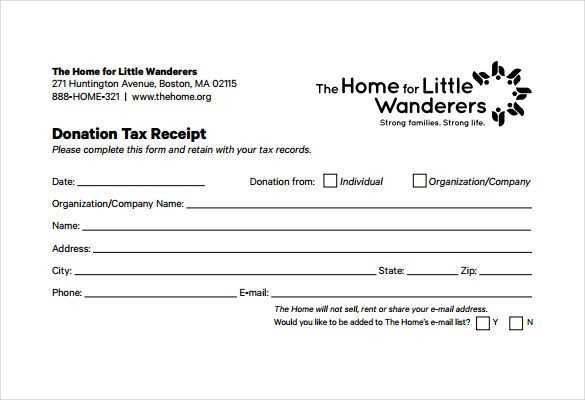

- In-Kind Donation Receipt Template

Creating an accurate in-kind donation receipt is key for both the donor and the receiving organization. It serves as a legal document for tax purposes and helps maintain clear records of donations. Use the following template for your receipts to ensure clarity and proper documentation.

- Donor Information: Include the donor’s full name, address, and contact information to clearly identify them.

- Organization Details: List the organization’s name, address, and tax-exempt status number to confirm its legitimacy.

- Date of Donation: Record the specific date when the donation was made to avoid confusion in tax records.

- Description of Items: Provide a brief but detailed description of the donated items, including quantities and condition. Avoid assigning a monetary value to the items.

- Value of Donation: If applicable, note that the donor is responsible for determining the value of the items donated.

- Statement of No Goods or Services Provided: Include a statement confirming that no goods or services were provided in exchange for the donation (unless applicable).

- Signature and Date: Both the donor and the authorized representative of the organization should sign and date the receipt for authenticity.

This template should be customized according to the specific needs of your organization and local regulations. Keeping these key elements in place ensures transparency and compliance for both the donor and the receiving party.

For legal compliance, an in-kind donation receipt must include key details that ensure both the donor and the receiving organization are protected during tax reporting. Here’s how to format your in-kind donation receipt properly:

1. Include the Organization’s Details

The receipt should list the legal name of the nonprofit, address, and contact information. This is essential for tax reporting and verification purposes.

2. Clearly State the Description of Donated Items

Provide a detailed description of the donated items, including quantities, conditions, and any distinguishing features. Avoid estimating the value of the items; it’s the donor’s responsibility to do so, as the nonprofit cannot assign a value to the in-kind donation.

| Item Description | Quantity | Condition |

|---|---|---|

| Winter Coats | 5 | New |

| Books | 20 | Used |

3. State the Date of the Donation

Record the date when the donation was received. This date is important for the donor’s tax filing purposes and for the nonprofit’s records.

4. Acknowledge No Goods or Services Were Received

If the donor did not receive any goods or services in exchange for their contribution, include a statement to that effect. This confirms that the donation is truly in-kind and that the donor is eligible for the tax deduction.

5. Include a Statement for Tax Deduction Purposes

Ensure that the receipt includes a note indicating that the donor may be eligible for a tax deduction. Include this disclaimer: “No goods or services were provided in exchange for this gift.” This helps the donor claim their tax deduction properly.

To ensure that your in-kind donation receipt is complete and compliant, include the following elements:

| Element | Description |

|---|---|

| Donor Information | List the full name and address of the donor to identify them clearly. |

| Organization Details | Include your organization’s legal name, address, and tax-exempt status (e.g., 501(c)(3) number) to validate the receipt. |

| Date of Donation | Record the exact date the donation was received for proper tracking. |

| Description of Donated Item(s) | Provide a clear description of the items donated, ensuring the donor’s contribution is unambiguous. |

| Fair Market Value (FMV) | If the donor has not provided the value, note that it is their responsibility to estimate the value, but offer guidance on how to do so. |

| Statement of No Goods or Services Received | State whether the donor received any goods or services in return for the donation, as this affects their tax deduction. |

| Signature of Authorized Representative | Have a representative from your organization sign the receipt to authenticate it. |

These components help ensure clarity for both the donor and the organization, making the receipt a valid record for tax purposes.

Be specific and clear in detailing the items donated. Avoid vague descriptions such as “miscellaneous items.” Instead, list each item separately with a brief but precise description, including condition where applicable. This transparency ensures both the donor and the recipient understand the value of the items provided.

- Provide Itemized Descriptions: Instead of grouping items together, list each one individually with a short description. For example, “3 gently used children’s winter coats” is better than “clothing items.”

- Indicate the Condition: Clearly state the condition of each item, such as “new,” “gently used,” or “needs repair.” This helps the donor understand the expected value and ensures accurate reporting for tax purposes.

- Avoid Overstating Value: Never assign a value to the donated items unless you are authorized to do so. It’s better to leave the valuation blank or note that it is up to the donor to determine the worth.

- Use Specific Terminology: Replace general terms like “furniture” with more precise descriptions, such as “wooden dining table” or “leather sofa,” to avoid ambiguity.

- Include Quantities: When possible, mention the number of items donated. For example, “2 boxes of kitchen utensils” provides a more accurate picture than just “kitchenware.”

- Avoid Jargon: Stick to common language that both parties can understand. Avoid using specialized or technical terms that might confuse the donor.

To assign a fair market value (FMV) to donated goods, start by researching the item’s condition and market demand. FMV is the price a willing buyer would pay and a willing seller would accept in an open market, without pressure. For items in new or like-new condition, refer to current retail prices or comparable listings online. For used items, adjust the value based on wear and tear.

Check Similar Listings

Search online marketplaces or thrift stores to find items identical or similar to the donated goods. Compare prices of goods in similar condition to get a fair idea of their FMV. Keep in mind, charity stores may price items lower, but the FMV should reflect what the item could be sold for in an average marketplace.

Use Standard Valuation Guides

Several nonprofit organizations and the IRS offer standard valuation guides to help assign FMV to commonly donated items. These guides offer a range based on condition, providing an easy reference point. Examples include clothing, electronics, and furniture. Make sure to select the value that matches the item’s condition most accurately.

For some goods, like vehicles or jewelry, consider using professional appraisers or third-party services for an accurate FMV estimate. In all cases, keep detailed records and receipts to support your valuation in case of an audit.

When donating in-kind items, understanding the tax implications helps ensure compliance and maximizes potential deductions. In-kind donations, unlike cash gifts, involve tangible goods or services, which can have specific tax treatment. The fair market value of the donated items is usually deductible, but only if the donation is made to a qualified charitable organization.

Fair Market Value and Documentation

To claim an in-kind donation on your tax return, you must determine the fair market value (FMV) of the items donated. FMV is the price a willing buyer would pay and a willing seller would accept for the goods in an open market. It’s important to keep detailed records of the donation, including receipts, descriptions, and photographs of the items. The charity may provide a receipt but won’t typically assign a value–this responsibility falls to you.

Non-Cash Contributions Deduction Limits

The IRS limits non-cash contributions based on your adjusted gross income (AGI). For donations to public charities, the deduction limit is typically 50% of your AGI, but for in-kind donations of appreciated property, the limit is usually 30%. If the value of your in-kind donations exceeds the limit, you can carry forward the excess amount for up to five years.

Understanding these aspects allows for accurate filing and ensures you receive the maximum allowable deduction for your in-kind contributions.

Tailor donation receipts to reflect your organization’s identity. Include your organization’s name, logo, and mission statement at the top to immediately establish the context of the receipt. This approach not only adds authenticity but reinforces your cause’s values.

1. Define the Donation Purpose

Clearly state the specific purpose of the donation. If your organization runs multiple projects, specify the fund or program that the donation supports. Donors appreciate knowing where their contributions are directed, as it strengthens their connection to the cause.

2. Include Relevant Tax Information

Ensure all required tax information is included. For non-profits, this means specifying the organization’s tax-exempt status and including the IRS tax ID number. Some donors may need these details for tax deductions, so it’s important to provide them upfront.

3. Customize Receipt Amount and Itemization

- If the donation is in-kind, describe the donated items or services with estimated values to help the donor assess the donation’s worth.

- For cash or check donations, clearly list the exact amount donated.

Providing clear itemization ensures transparency, especially for larger or non-monetary donations.

4. Adjust Receipt Layout for Different Donation Types

- For one-time donations, use a straightforward layout with minimal details.

- For recurring donations, consider adding a section that outlines the donation schedule and any additional benefits, such as membership perks or newsletters.

Adapting the layout according to the donation type ensures clarity for the donor.

5. Personalize the Thank-You Message

Include a personalized thank-you note that acknowledges the donor’s specific contribution. This is especially impactful for larger donations or long-term supporters. Mention their support by name and reference any impact their donation will have on your organization’s work.

Let me know if you’d like further adjustments!

To provide clarity for donors and simplify the donation process, it’s helpful to use a clear format for in-kind donation receipts. Specify the exact items donated, their condition, and an estimated value. Each receipt should include the donor’s name, address, and the date of the donation.

Clear Itemization

List each item separately, including a brief description and the approximate value. Avoid vague descriptions like “miscellaneous items” and focus on specifics. If applicable, mention any special conditions, such as whether the items were new or gently used.

Value Estimation

Provide a reasonable valuation for the items donated. While you’re not required to assign a precise dollar amount, offering an estimated range based on similar items in the market helps ensure transparency. Always check IRS guidelines for appropriate methods of valuation.

Let me know if you’d like further adjustments!