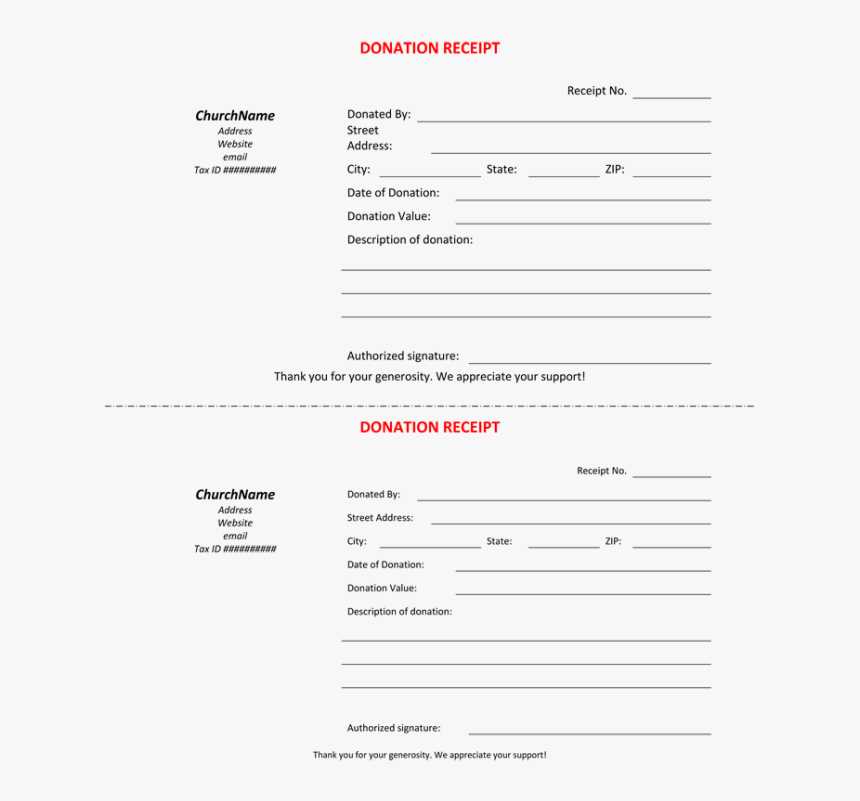

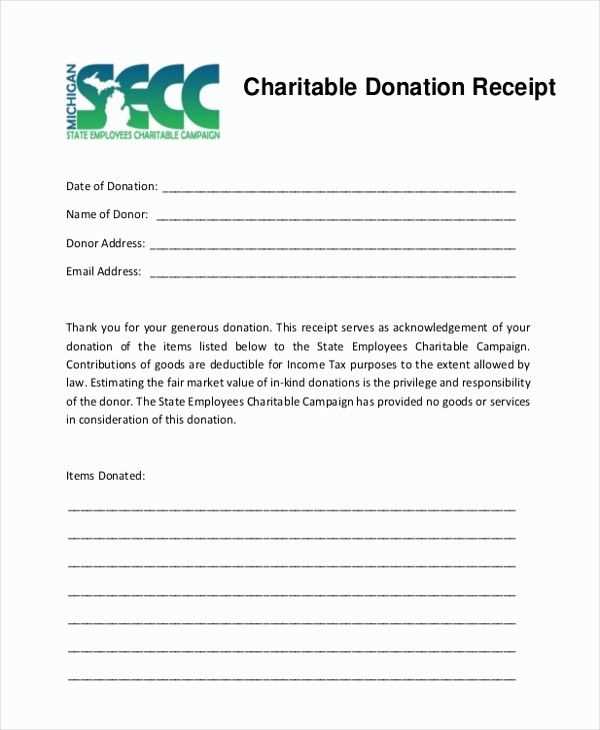

Providing a well-structured receipt for in-kind donations is crucial for both donors and recipients. A clear, detailed template ensures transparency and helps maintain accurate records for tax purposes. The receipt should include key information like the donor’s name, a description of the donated item(s), and the date of the donation.

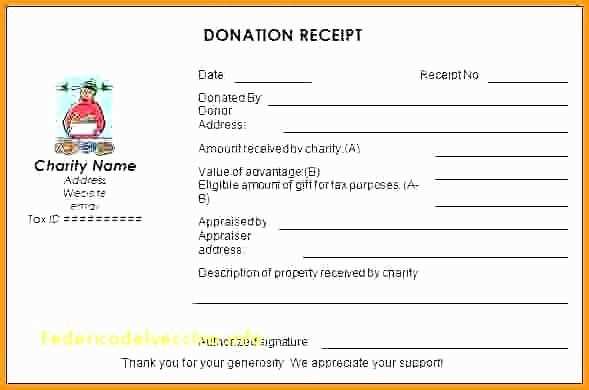

When creating a template, make sure to specify the fair market value of the donated goods, as this is needed for tax deductions. While you cannot assign a specific value to the donation, it’s important to outline any available estimates or guidelines for donors to calculate the value themselves. Include your organization’s name, contact details, and the recipient’s acknowledgment of the donation.

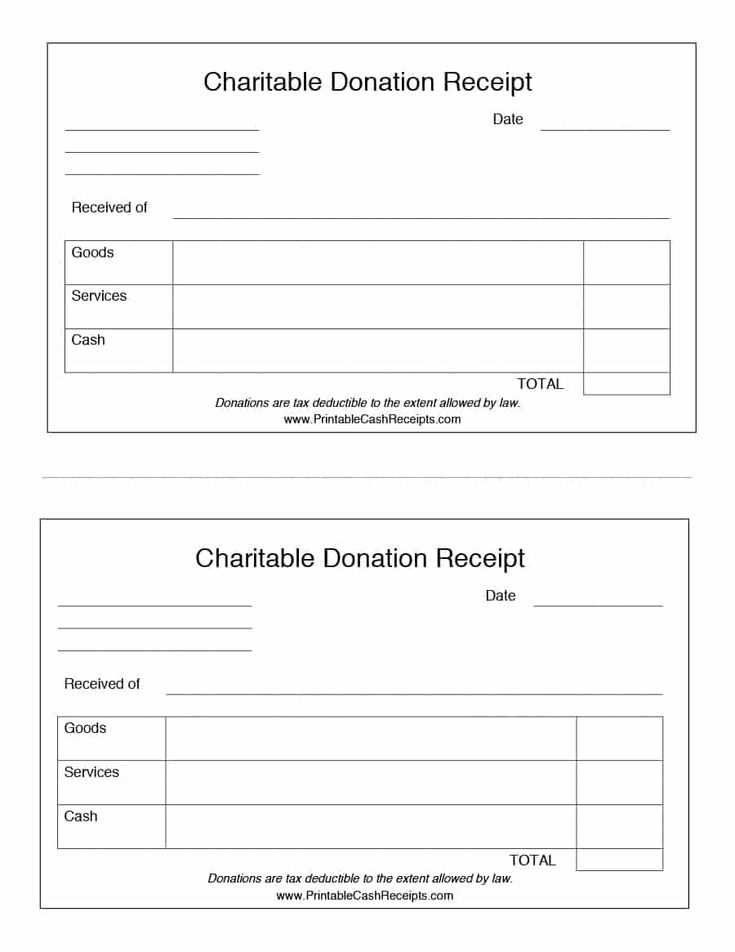

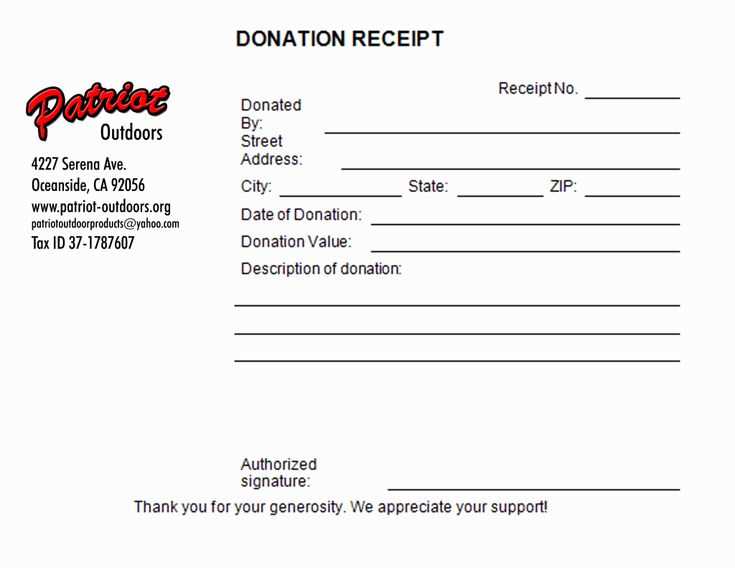

Also, ensure the template is easy to use and includes sections for both a detailed description of the items donated and the donor’s contact information. A professional, yet simple format will ensure smooth processing and provide clarity for both parties involved.

In-kind Donation Receipt Template

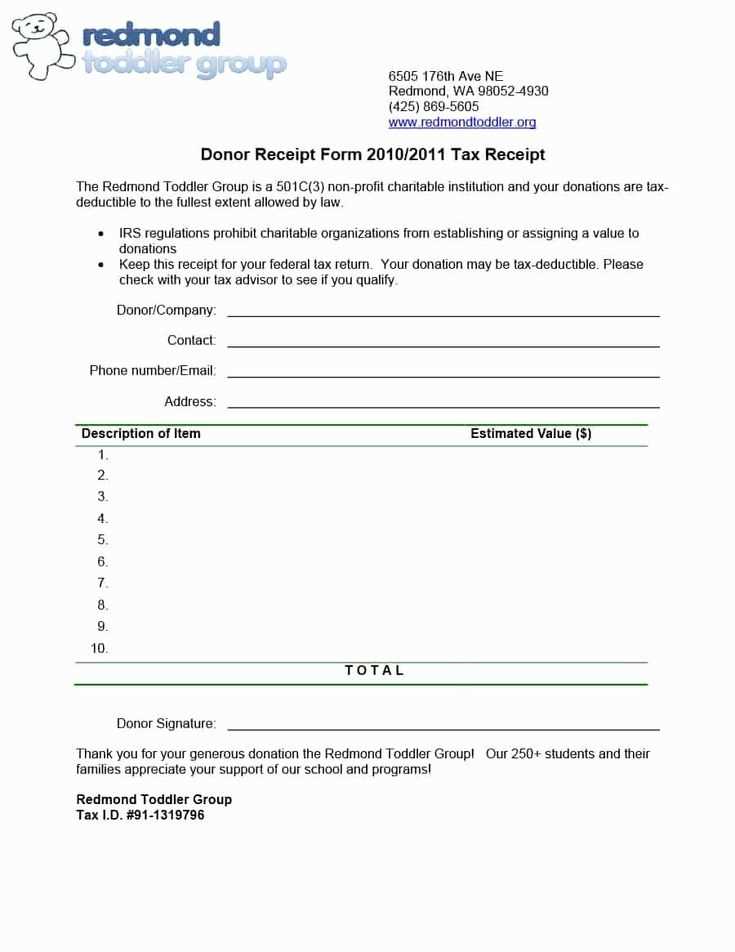

To create an accurate in-kind donation receipt, clearly list the donated items with their descriptions and fair market value. Begin by specifying the donor’s name, contact information, and the date of the donation. This provides transparency and ensures both parties have a record of the transaction.

Include a detailed description of each item donated. Be specific about the condition, quantity, and type of items to avoid confusion. Avoid using vague terms like “various goods” or “assorted items.” For example, if the donation includes clothes, specify the number and type (e.g., “5 used coats, in good condition”).

Fair Market Value: While the donor determines the value of the items, it is important to note that your organization is not responsible for evaluating them. To stay compliant, refer to relevant guidelines such as IRS publications if applicable. You can also include a reminder to the donor that it’s their responsibility to value the items accurately.

Tax Deduction Disclaimer: If your organization is a registered charity, add a statement that the donation is tax-deductible, but emphasize that the receipt itself does not assign a value. A simple note like “This receipt is provided for your records. Please consult with a tax professional for valuation and tax deduction purposes” can clarify this.

End with your organization’s contact information and an official signature, if applicable. This confirms the receipt is valid and can be used for tax purposes.

How to Create a Legally Compliant In-kind Donation Receipt

Ensure your in-kind donation receipt includes the following key details to meet legal requirements:

- Organization Information: Clearly list the name, address, and tax-exempt status of the organization receiving the donation.

- Donor Information: Include the name of the donor. While addresses are not mandatory, they can be helpful for record-keeping.

- Date of Donation: Specify the date the donation was received.

- Description of the Donated Items: Provide a detailed description of the items donated. Avoid assigning a monetary value; the donor is responsible for this.

- Statement of No Goods or Services Provided: If the donation was purely in-kind with no goods or services exchanged, include a statement confirming this.

- Value of Donation: Although your organization cannot assign a value to the donated items, the receipt must indicate that the donor is responsible for valuing their own contribution.

- Signature and Title: The signature of an authorized representative from your organization adds credibility to the receipt.

Once all elements are present, ensure the receipt is issued promptly after receiving the donation. This helps the donor claim a tax deduction and keeps your organization’s records accurate.

What Details Should Be Included for Tax Purposes?

For tax purposes, an in-kind donation receipt must include specific details to ensure it meets IRS requirements. Include the following information:

Donor and Organization Information

Clearly state the name and address of both the donor and the receiving organization. This helps verify the transaction and establishes the legitimacy of the donation for tax reporting.

Description of Donated Items

Provide a detailed description of the items donated. Avoid using vague terms like “miscellaneous” or “various goods.” Instead, list each item by type and quantity, ensuring it reflects the actual donation. You do not need to include the value of the items, but providing a clear description is necessary for tax records.

Additionally, include the date of the donation and a statement clarifying that no goods or services were provided in return for the donation. This helps maintain the tax-deductible status of the contribution.

How to Format an In-kind Donation Receipt Template for Easy Use

Use a clear and simple layout for the receipt, starting with the donor’s name and the date of the donation. Place this information at the top of the template for quick reference. Ensure that the donation description includes details like the items donated, their estimated value, and any condition notes. Use specific language for the items, avoiding general terms.

Include a statement indicating that no goods or services were exchanged for the donation, especially for tax purposes. This helps clarify the purpose of the donation and avoids confusion. Position this statement just after the donation details, ensuring it is easily noticeable.

Add your organization’s name, address, and contact details at the bottom of the receipt. This keeps the document professional and lets the donor know where they can reach you if needed. Ensure the receipt is easy to print, with appropriate margins and spacing for readability.

Include a section for the donor’s signature if applicable, particularly for larger donations. This adds an extra layer of verification and shows that the donation has been received by both parties. Keep the signature section at the bottom of the receipt for easy access.

Finally, create a section for the organization’s representative to sign, confirming the receipt of the in-kind donation. This section should match the donor’s signature section for consistency. The inclusion of both signatures gives the document a professional finish and reinforces its validity.