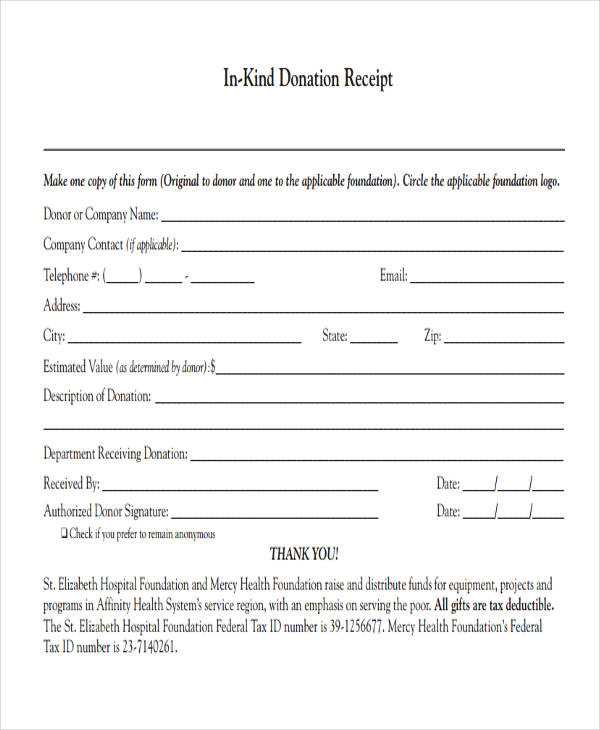

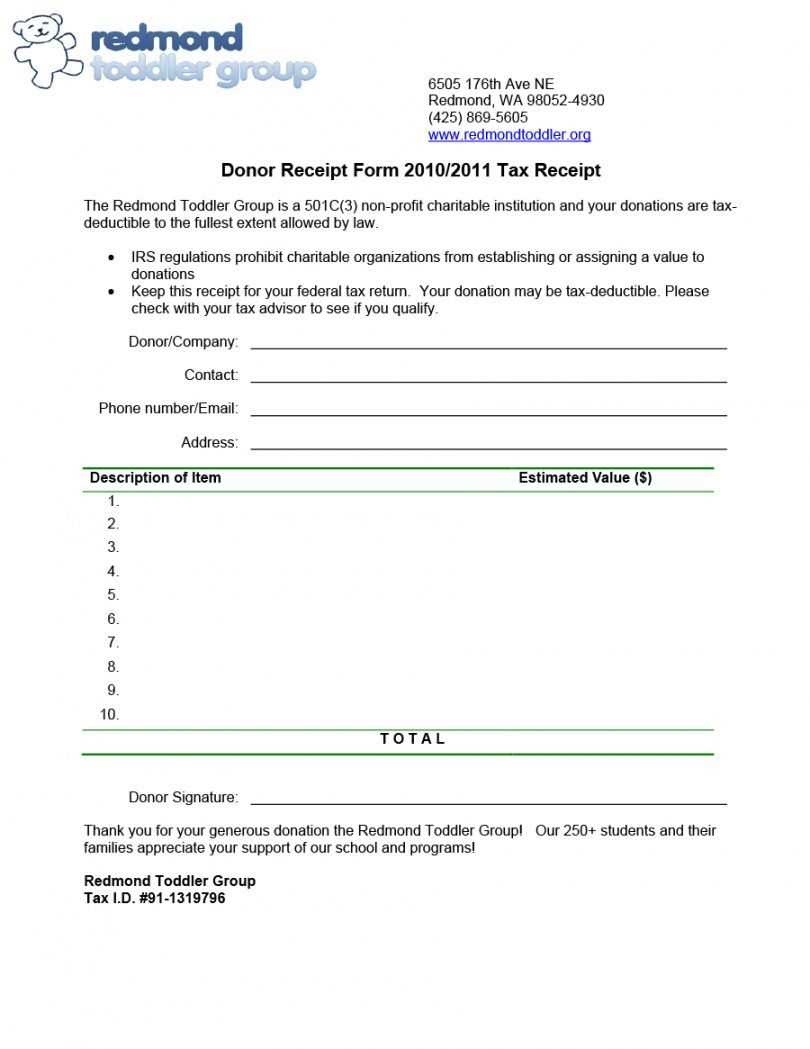

Provide a clear and concise receipt for in-kind donations to ensure donors feel appreciated and have the necessary documentation for tax purposes. A simple template can help your organization stay organized while also meeting legal requirements. Create a receipt that includes the donor’s name, the description of the items donated, and the value of those items, even if it is an estimated value.

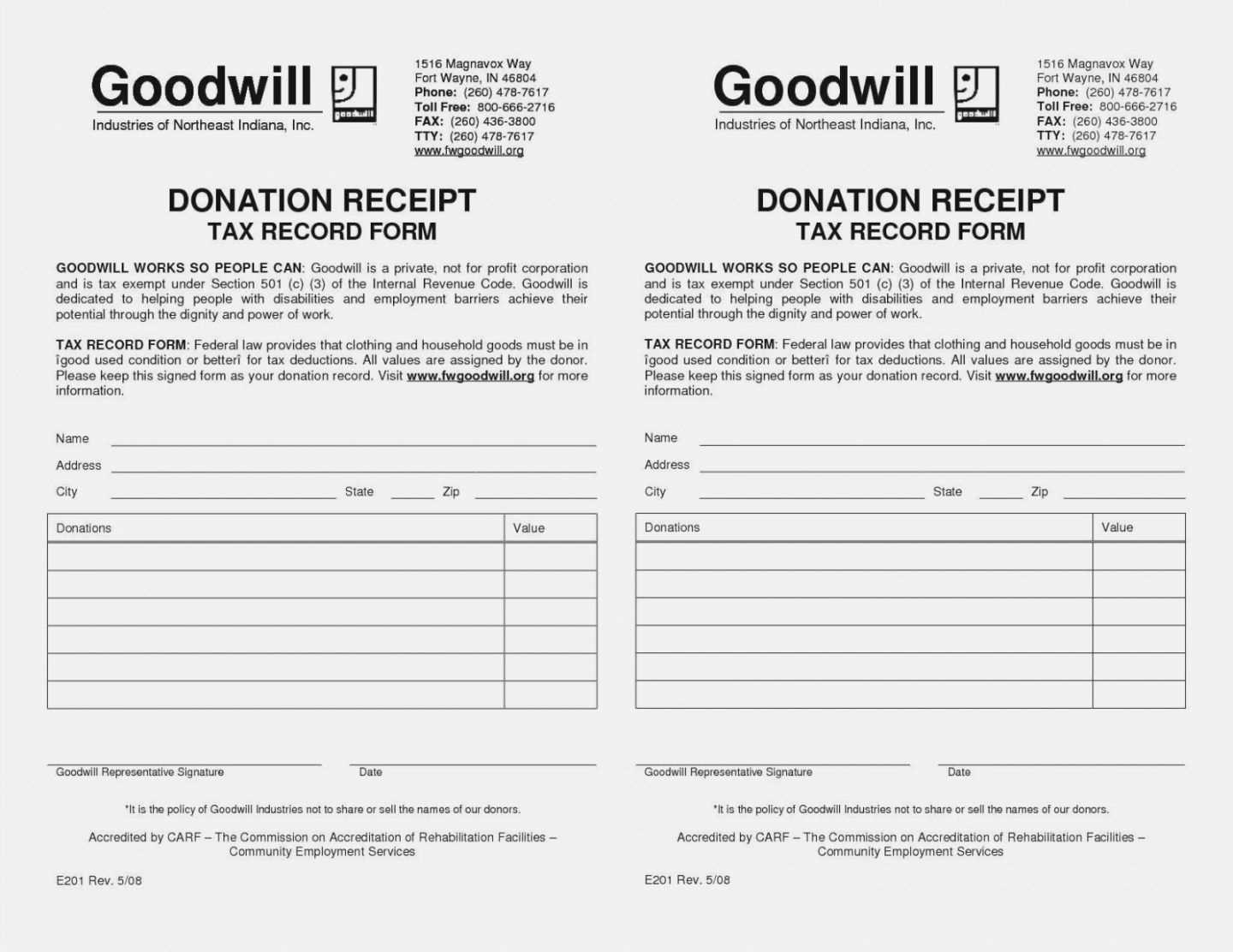

Focus on clarity: Include specific details about the donation, such as the quantity and condition of each item. This helps prevent misunderstandings and ensures everything is accounted for. A well-structured receipt should also acknowledge the donor’s generosity without overcomplicating the form.

Be transparent with values: While donors are responsible for determining the value of their donation, providing an estimated range for commonly donated items (like clothing) can be helpful. Consider offering a guideline or recommendation for valuing clothing based on general market standards.

Remember: Keep your receipts simple but thorough, with clear sections to outline all necessary information. This makes the process easier for both the donor and your organization.