If you’re making or receiving in-kind donations, it’s crucial to have a clear, accurate receipt to document the contribution for tax purposes. This receipt ensures that both parties are protected and can substantiate the value of the donated items for tax reporting. A well-crafted in-kind donation receipt will include all necessary details to meet IRS requirements and simplify the process of claiming deductions.

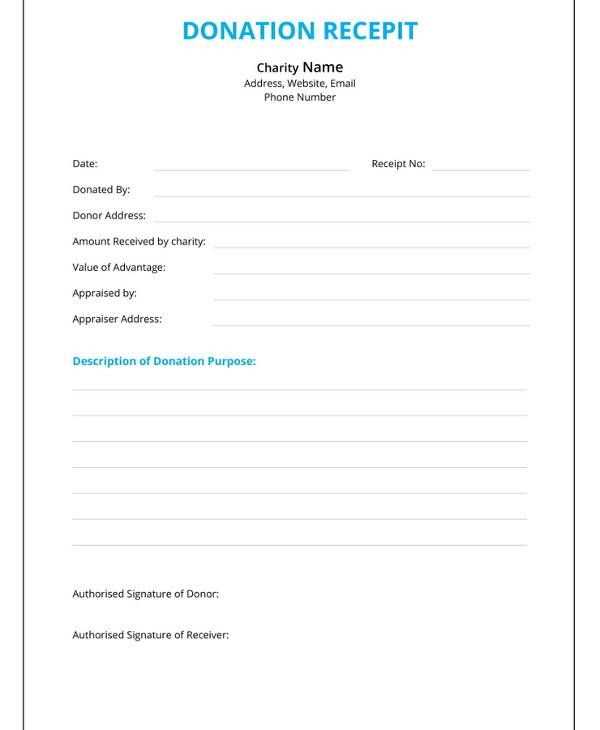

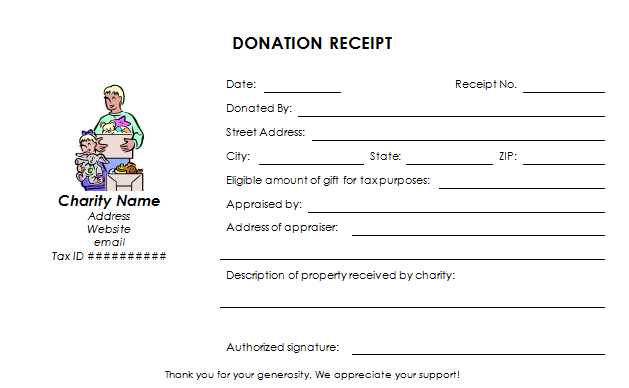

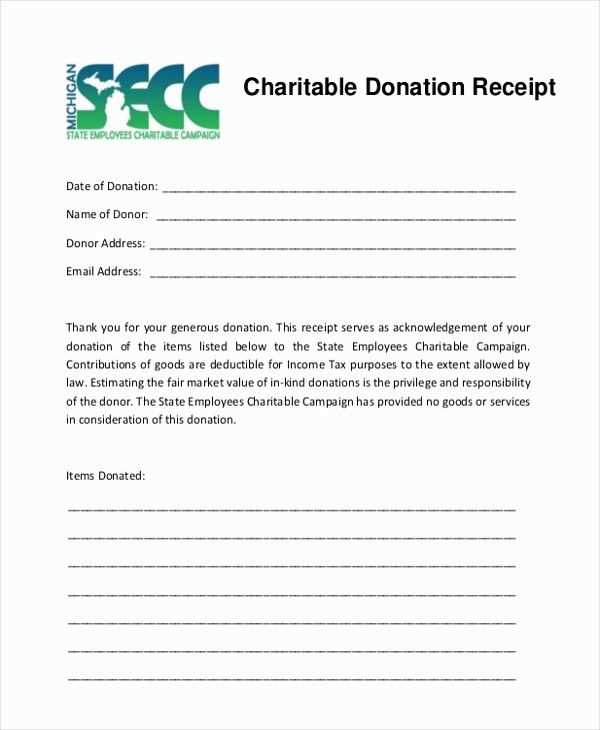

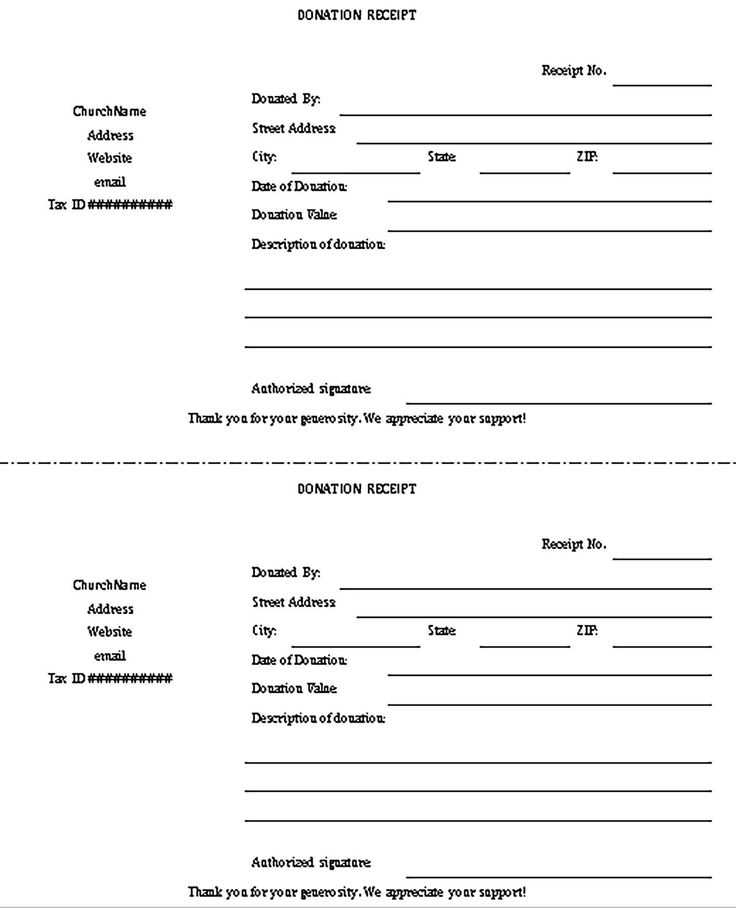

The template should outline the donor’s information, including name, address, and contact details, along with a description of the donated items. Make sure to provide a detailed account of each item’s condition, quantity, and value. If possible, include an appraisal or method of valuation used to estimate the donation’s worth. Additionally, indicate whether any goods or services were provided in exchange for the donation, as this will affect the amount eligible for a tax deduction.

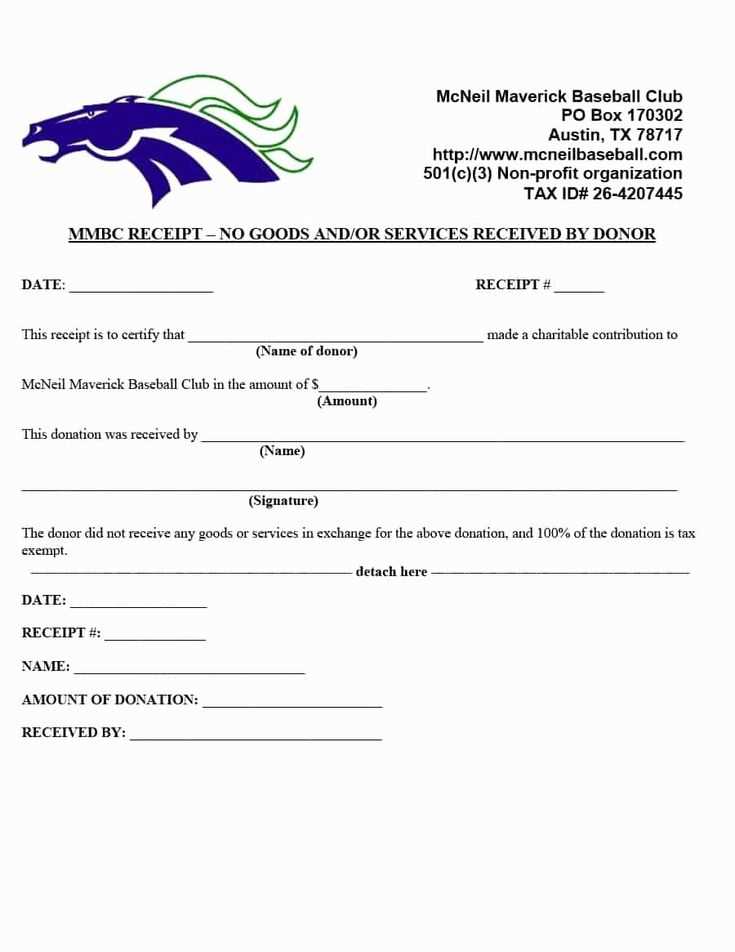

Include a statement confirming that the donor did not receive any goods or services in return, if that applies, and specify the nonprofit’s tax-exempt status. Be sure to note the date of the donation, as this will be necessary for filing taxes. Clear, concise language and accurate documentation will help avoid any issues during the filing process and make claiming deductions smoother for both the donor and the charity.

Here are the revised lines without repetition, maintaining the meaning:

Make sure the receipt clearly states the donated items, including quantity, condition, and their estimated value. This helps both parties stay on the same page regarding the donation details.

Include the donor’s name and contact details as well as the organization’s name and contact information. This ensures accurate record-keeping and transparency.

The description of the donated goods should be precise, avoiding any ambiguity. The clearer the description, the easier it will be to assess the donation’s value.

The date of donation should be clearly mentioned. This helps in determining the proper tax deduction period and ensures the donation is recorded properly for both the donor and the organization.

| Item Description | Quantity | Condition | Estimated Value |

|---|---|---|---|

| Old Books | 10 | Good | $50 |

| Clothing | 5 pieces | New | $100 |

Ensure the donor understands that they may be required to provide additional documentation for tax purposes, especially for large donations. This protects both the donor and the receiving organization.

Finally, the receipt should specify whether the donation is tax-deductible, which is a key consideration for donors. This will help avoid confusion later on.

- In-kind Tax Donation Receipt Template

For a smooth and legally compliant donation process, it’s important to use a precise In-kind Tax Donation Receipt template. This receipt should clearly outline all necessary details, ensuring transparency and simplifying the donor’s ability to claim deductions.

Key Elements of an In-kind Donation Receipt

First, the receipt should include the donor’s full name and address. This verifies the identity of the individual making the donation. Include the date of the donation, as this is crucial for tax purposes.

Provide a description of the donated items. Be specific–mention the type of goods, their condition, and their estimated fair market value. Avoid vague terms like “miscellaneous items” or “assorted donations,” as these can raise questions during audits.

Acknowledging Non-Cash Donations

It’s necessary to state that the organization did not provide any goods or services in exchange for the donation, unless it’s a quid pro quo donation. This clears up any potential confusion about tax deductions. For example, if the donor received a meal in exchange for the donation, this must be indicated.

Lastly, ensure the receipt includes the organization’s name, address, and tax-exempt status. This confirms the recipient is a legitimate charitable entity and eligible to receive tax-deductible donations. This piece of information adds validity to the receipt for both the donor and the tax authorities.

Include the donor’s full name and address. This ensures proper documentation for both the donor and the organization. Include the date of donation and a description of the items received. If the donation is in-kind, provide a detailed list of the items, including quantities and conditions, to ensure clarity and transparency. If possible, assign an estimated value for each item. While donors may estimate value, provide guidance on fair market value to avoid discrepancies.

Clearly state whether any goods or services were provided in exchange for the donation. If so, subtract their value from the total donation amount to reflect the actual charitable contribution. This is important for tax purposes, as the donor can only claim the value of the donation minus the value of any goods or services received in return.

Lastly, include the organization’s tax-exempt status and contact information for easy verification. This helps ensure that the receipt is valid for tax deduction purposes. Double-check the details before sending the receipt to avoid errors that could cause complications later on. An accurate receipt not only supports the donor’s tax filing but also enhances the credibility of the organization.

Make sure to include the name and address of the organization that received the donation. This ensures clarity on who the donation was made to and provides necessary details for the donor’s records.

Clearly state the donor’s name and address. Accurate identification is necessary for tax purposes and can help avoid any confusion in case of an audit.

Describe the donated items or services in detail. Include specific information like the quantity and condition of items donated, as well as their estimated fair market value. This is crucial for the donor’s tax deductions.

Note the date of the donation. This will allow the donor to properly record it for the applicable tax year.

If the donation involves cash or check, specify the amount donated. Include a breakdown if the donation consists of multiple checks or cash payments.

If the donation is not of cash or tangible goods but of services, include a disclaimer stating that the value of services is not tax-deductible.

Include a statement about whether the donor received any goods or services in exchange for the donation. If they did, list these items or services and provide an estimate of their fair market value. This affects the amount that can be deducted for tax purposes.

Finally, provide the organization’s tax-exempt status, including the IRS determination letter number if applicable. This assures the donor that their donation qualifies for tax deductions under the law.

Ensure the donation receipt includes accurate descriptions of the donated items. Failing to provide clear and specific details can lead to confusion or errors when donors claim their deductions. List each donated item separately, including quantity and condition, if applicable.

Never forget to mention the value of the donation. If the donor does not provide an estimated value, clarify that they are responsible for determining the value of their donation. For in-kind donations, it’s especially important to include the fair market value of each item to avoid misunderstandings with the IRS or other authorities.

Double-check the date of the donation. Without an accurate date, the receipt may not align with tax records. Make sure the donation receipt matches the date the items were received by the organization, not the date it was issued or processed.

Avoid vague wording. A receipt that simply states “donation received” without specifying the items or their value can lead to issues during an audit. Be clear and transparent to ensure both parties understand what is being documented.

Ensure your receipt includes the nonprofit’s full name, address, and tax-exempt status. Lack of this information makes the receipt incomplete, potentially causing problems when the donor attempts to claim their deductions.

Don’t forget to sign the receipt. An unsigned receipt may not be accepted by tax authorities, which could invalidate the donor’s ability to use it for tax purposes. Always make sure a representative from your organization signs and dates the receipt.

Assign a fair market value (FMV) to each item donated. This is the price the item would sell for in its current condition in a retail setting. To determine FMV, check online resale platforms like eBay, thrift stores, or donation guides that give estimates based on item categories. For items like clothing, refer to resources like the Salvation Army or Goodwill to estimate their value.

For donated items that are used or in less-than-new condition, subtract the cost of repairs or cleaning that may be needed. For example, if an appliance is in working condition but slightly outdated, research its FMV considering its age and wear. The IRS recommends using a value based on similar items in a comparable condition.

Keep detailed records of all donations. This includes receipts, photos, and descriptions of each item. For higher-value donations, get an appraisal from a qualified expert to ensure accurate reporting. The IRS requires this for donations over $5,000.

If you are donating large quantities of items, list each separately, providing descriptions, estimated values, and any supporting evidence like receipts or appraisal certificates. For donations of vehicles, boats, or other significant property, the IRS has specific forms and guidelines for reporting their value.

Tax donation receipts must meet specific legal requirements to be valid for tax deduction purposes. The following guidelines ensure your receipts are compliant with the law:

1. Donation Acknowledgment

- The receipt must clearly state that the donation is a charitable contribution.

- It should include the name and address of the nonprofit organization receiving the donation.

- The date of the donation must be included on the receipt.

- The description of the donated item(s) or service(s) must be specific enough to identify them clearly.

2. Valuation of In-Kind Donations

- If the donation is non-cash (in-kind), the receipt must provide a detailed description of the item(s) donated.

- While nonprofits are not required to estimate the fair market value, it is helpful to provide this information for donor reference.

- If a donor values the item(s), they must have a reasonable basis for the valuation and the nonprofit should not provide an estimate on the receipt.

3. Confirmation of Goods and Services

- If the donor received any goods or services in return for their donation, the receipt must specify the fair market value of those items.

- If the donation is a partial contribution (e.g., a donation where the donor receives something in return), the receipt must note the value of the donation that is tax-deductible.

4. Nonprofit’s Tax-Exempt Status

- The receipt must include the nonprofit organization’s tax-exempt status, usually noted by its 501(c)(3) designation in the U.S.

- Nonprofits must include their IRS-issued tax identification number (TIN) or Employer Identification Number (EIN) on the receipt.

5. Specific Requirements for Donations Over $250

- For donations over $250, the receipt must provide a statement confirming that no goods or services were exchanged for the contribution or describing what was received in return.

- Donors are required to obtain a receipt for any in-kind donation exceeding $250 to claim deductions.

These key points ensure that donation receipts meet legal standards and are recognized by tax authorities, making it easier for donors to claim deductions. Ensure all required details are accurately included in each receipt to avoid complications.

Distribute receipts quickly after receiving donations. This helps donors track their contributions and ensures compliance with tax regulations. Aim to send out receipts within 48 hours of the donation, ideally through email or printed formats, depending on donor preferences.

Provide Detailed Information

- Include the donor’s name, donation date, and the amount or value of the in-kind gift.

- For non-cash donations, describe the items donated and their estimated fair market value.

- List the organization’s name, address, and tax-exempt status for verification purposes.

Maintain Clear Documentation

- Keep records of each receipt issued for future reference and auditing.

- Ensure receipts comply with tax regulations by including appropriate disclaimers about the charitable nature of the donation.

- Use a consistent format for all receipts to avoid confusion and to streamline record-keeping.

Donation Receipt: What to Include

Ensure your in-kind donation receipt includes the donor’s name, the date of the donation, and a detailed description of the donated items. Clearly state that no goods or services were provided in exchange for the donation. If a service was provided, specify the fair market value. Make sure to record the organization’s name, address, and tax-exempt status. This documentation will support the donor’s tax deduction claim.

If possible, add the estimated value of the donation based on current market prices. For non-cash gifts, the donor should be aware that they are responsible for determining the value of the item. Encourage donors to consult a professional appraiser if necessary. Keep a copy of the receipt for your records.

For items that are difficult to value (e.g., artwork or antiques), avoid providing an estimated value unless you are a qualified appraiser. The more specific and transparent the receipt, the easier it will be for the donor to use it for tax purposes.