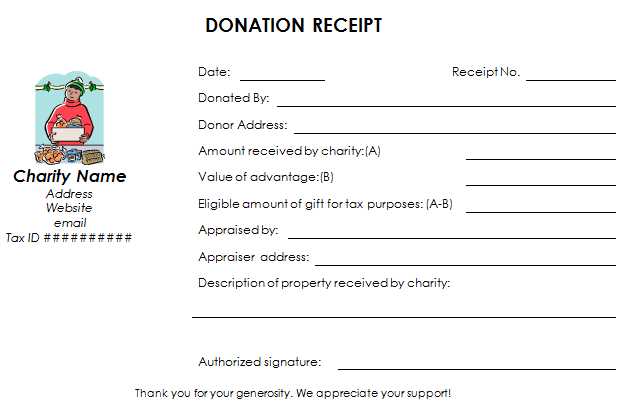

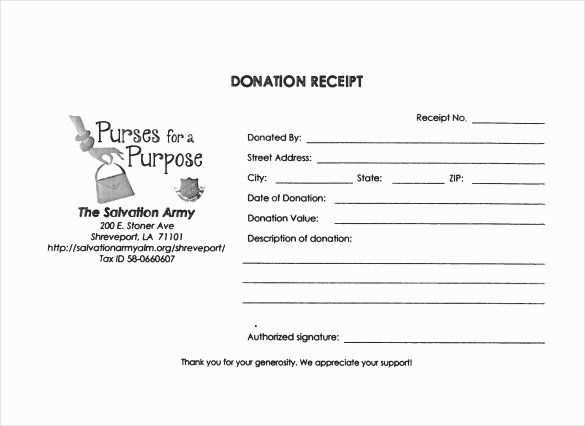

To create a valid and clear donation receipt, include key details such as the donor’s name, the date of donation, a description of the donated items, and their estimated value. This will help ensure both the donor and the recipient have a record of the transaction. The receipt should also contain the name of the charity or organization, along with its contact information, to confirm its legitimacy.

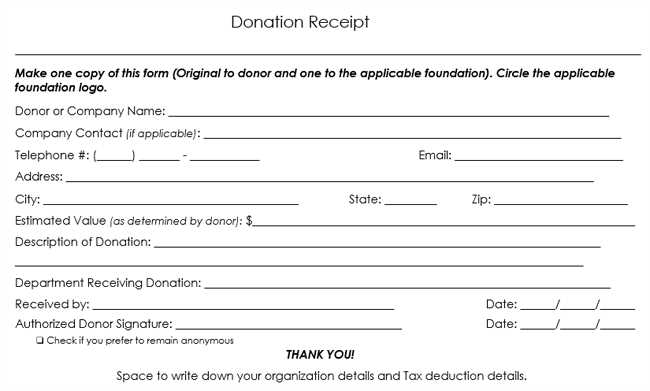

Start with the donor’s name and contact details. It is vital to have accurate identification of the person making the donation. Follow this with a clear description of each item donated. Providing an estimated value for each item, if possible, will assist with tax deductions or future reference. If you’re unsure about values, consult a professional for estimates or refer to commonly accepted ranges for similar items.

Don’t forget to add the organization’s information. This includes the organization’s name, address, and tax identification number, which is essential for documentation purposes. Always mention whether any goods or services were provided in return for the donation, such as raffle tickets or event access.

Keep the format simple and organized. A clean layout helps both the donor and the recipient easily review the document. Make sure the date of the donation is prominently displayed, as this ensures the receipt’s accuracy and relevance.

Corrected Lines:

Ensure the donor’s full name and address are correctly listed on the receipt. Avoid abbreviations for street names and cities to ensure clarity. Each item donated should have a clear description and value estimation, with the total value of the donation listed at the end.

Donation Details

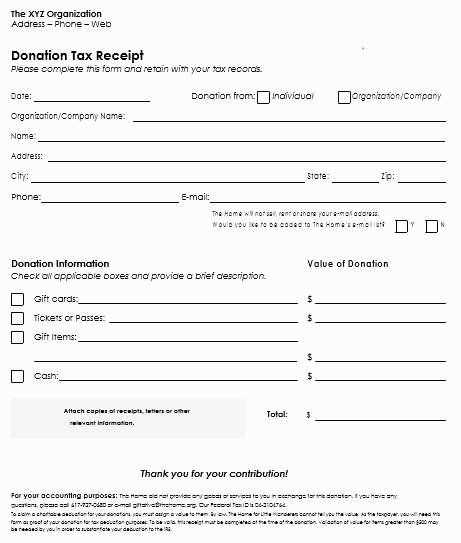

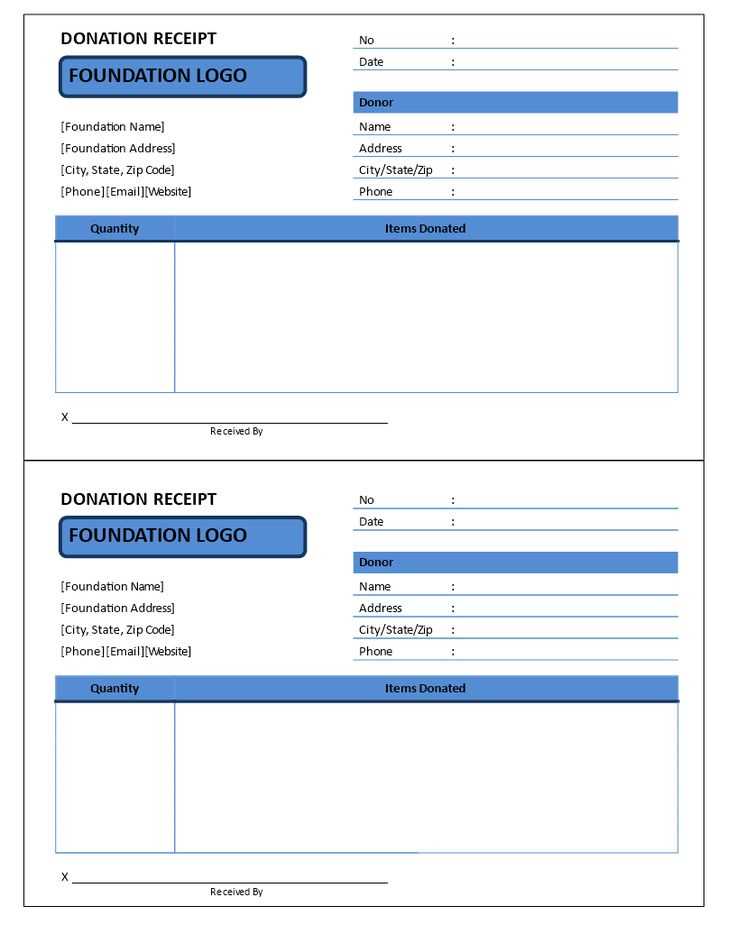

Include a table that organizes the information for easy reference:

| Item Description | Quantity | Estimated Value |

|---|---|---|

| Books (Box of 10) | 1 | $50 |

| Winter Coats (2) | 2 | $100 |

Final Amount

Ensure the final amount reflects the total value of all donated items. Add any necessary remarks, such as the condition of the items or special instructions. Double-check the accuracy of the donor’s contact information.

- Item Donation Receipt Template

A well-structured receipt for item donations should clearly detail all relevant information. Make sure to include the donor’s full name, contact information, and the date of donation. Specify the items donated, providing a brief description of each one along with their condition if possible. If the donor requests an estimate of the items’ value, ensure that the estimated value is based on fair market value standards, though note that it should be stated that the organization does not assess value for tax purposes.

Include a statement clarifying that no goods or services were provided in exchange for the donation, which is required for tax deduction purposes. The receipt should also feature the name of the receiving organization, its address, and a signature or authorization from the organization. Ensure that the donor receives this receipt promptly after the donation for their records.

To help streamline the process, consider creating a template with these details pre-filled, allowing quick customization as needed. This way, every donation receives accurate documentation without unnecessary delays.

Begin by including the name and address of your organization at the top of the receipt. Clearly state that the receipt is for an item donation. This establishes transparency and helps both parties in the transaction.

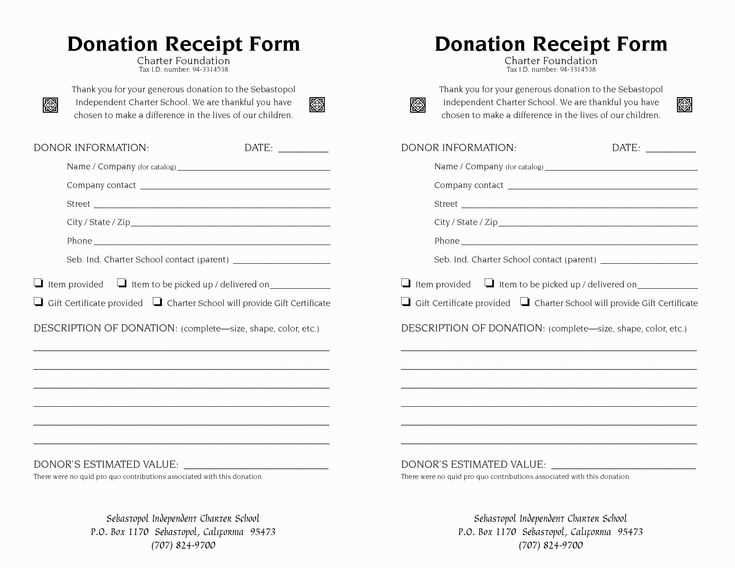

Include the Date of Donation

Make sure to note the exact date the items were donated. This helps both the donor and the organization with record-keeping, especially for tax purposes.

List the Donated Items

Detail the items donated, including a brief description and quantity. Avoid assigning a monetary value unless the organization has an official procedure for doing so. This prevents any confusion in the future and ensures accuracy in the records.

Conclude by including the donor’s name and contact information, followed by the signature of an authorized representative from the organization. Keep the receipt concise and clear for easy reference.

Each donation receipt should be clear and complete to ensure both the donor and recipient have all necessary details. Include the following key elements:

- Donor’s Name: Include the full name of the donor to identify the contribution.

- Donation Date: Record the specific date the donation was made.

- Item Description: List all items donated, with enough detail for both parties to understand what was given.

- Condition of Items: If relevant, note whether items are new or used.

- Estimated Value of Donation: Provide a reasonable value for the items based on similar market items or an agreed-upon amount.

- Organization’s Name and Address: Ensure the receipt includes the name and contact details of the organization receiving the donation.

- Tax Identification Number: For tax purposes, include the organization’s tax ID number.

- Statement of Goods or Services Received: If the donor receives something in return, indicate the value of any goods or services provided.

- Thank You Statement: A brief acknowledgment of the donor’s generosity helps maintain a positive relationship.

Ensure these elements are clear and easily accessible on the receipt to avoid any confusion and provide all necessary documentation for tax or record-keeping purposes.

Donation receipts must comply with local tax laws to be valid for the donor’s tax deduction. Include the following key details to meet these legal standards:

1. Donor Information

Clearly list the name and address of the donor. This ensures the donation is properly credited for tax purposes and links the donor to the receipt.

2. Donation Description

Describe the donated items, including quantities and a brief description of their condition. Avoid estimating the value unless it’s a monetary donation, which requires an exact amount. If non-cash donations are involved, provide a fair market value or guidance on how the donor can assess it.

Ensure that your nonprofit provides a statement confirming no goods or services were exchanged in return for the donation, or clearly state any value of goods or services that were given, if applicable.

3. Nonprofit Details

Include your organization’s name, address, and tax-exempt number (if applicable). This helps identify the organization and proves it’s eligible to provide tax receipts. Ensure this information is accurate to avoid complications during tax filing.

When creating a donation receipt, ensure that the format is clear and includes key information. Include the name of the donor, a description of the donated items, and the value of each item. For consistency, use a numbered list for itemized donations.

- Donor’s Name: Include the full name of the person or organization making the donation.

- Description of Donated Items: Provide a brief description of each item received, including quantity if applicable.

- Value of Donations: List the fair market value for each item. This can be based on condition, brand, or other relevant factors.

- Date of Donation: Clearly state the date the items were donated. This helps with record-keeping for both the donor and recipient.

- Organization’s Details: Include the full name, address, and contact information of the organization receiving the donation.

By adhering to this structure, you’ll ensure that the donation receipt is both accurate and useful for tax purposes. Keep the formatting simple and professional to avoid confusion.