To ensure smooth processing of an in-kind donation, it is vital to issue a formal receipt. A donation receipt serves as proof of the contribution and provides necessary details for both the donor and the receiving organization. It’s not only a helpful record for the donor’s tax purposes but also strengthens the relationship between the donor and your organization.

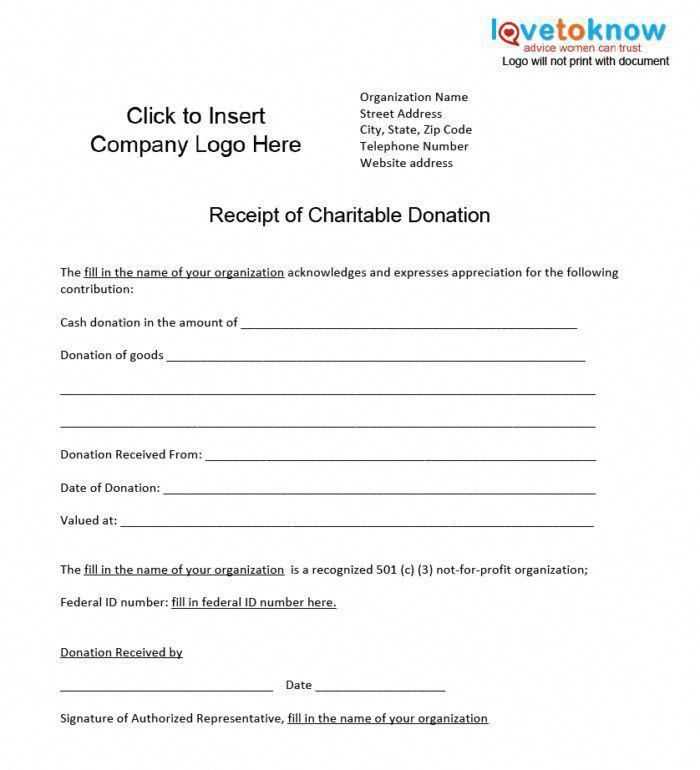

Here is a recommended structure for an in-kind donation receipt letter:

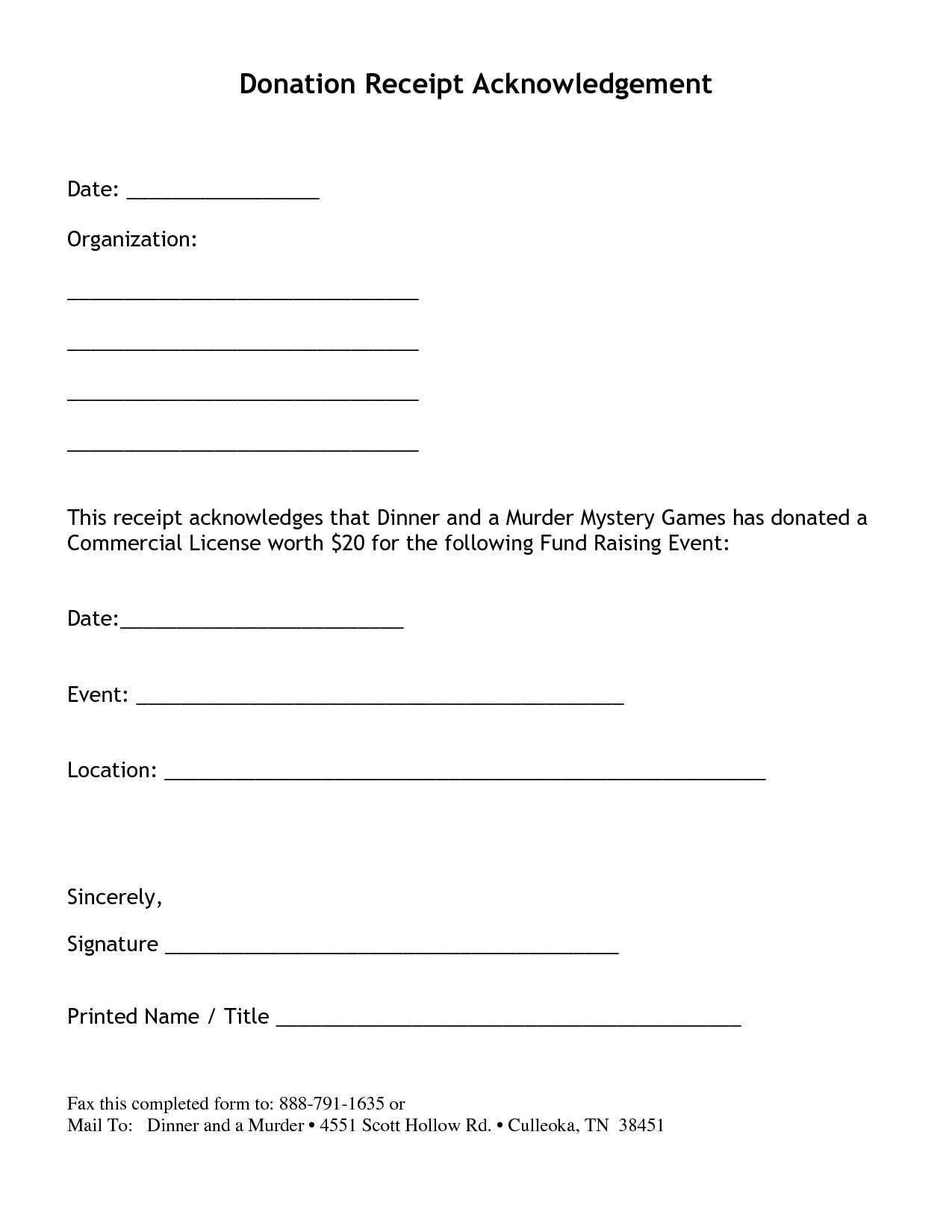

1. Acknowledgment of the donation: Begin with a clear expression of thanks to the donor. This sets a positive tone and reassures them that their gift is appreciated.

2. Description of the donated items: List each item donated with a brief description. This helps both the donor and your organization keep track of the specific items received. Include the condition of the items if necessary.

3. Value of the donation: While the organization does not determine the fair market value of the donated items, it’s helpful to provide an estimate or guidance on how the donor might assess their donation’s worth.

4. Statement of no goods or services received: If applicable, mention that the donation was made with no goods or services received in exchange. This ensures the donor can use it for tax deductions if allowed by local regulations.

Each part of the letter should be concise yet detailed enough to cover all necessary information. This structure will help maintain transparency and build trust with your supporters.

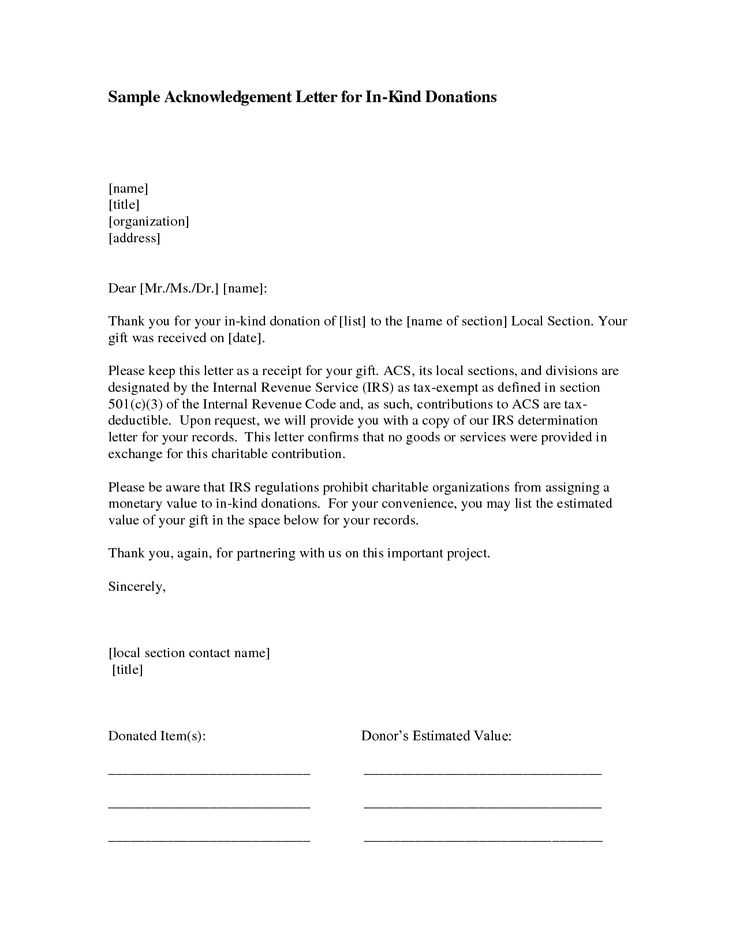

Letter Template for an In-Kind Donation Receipt

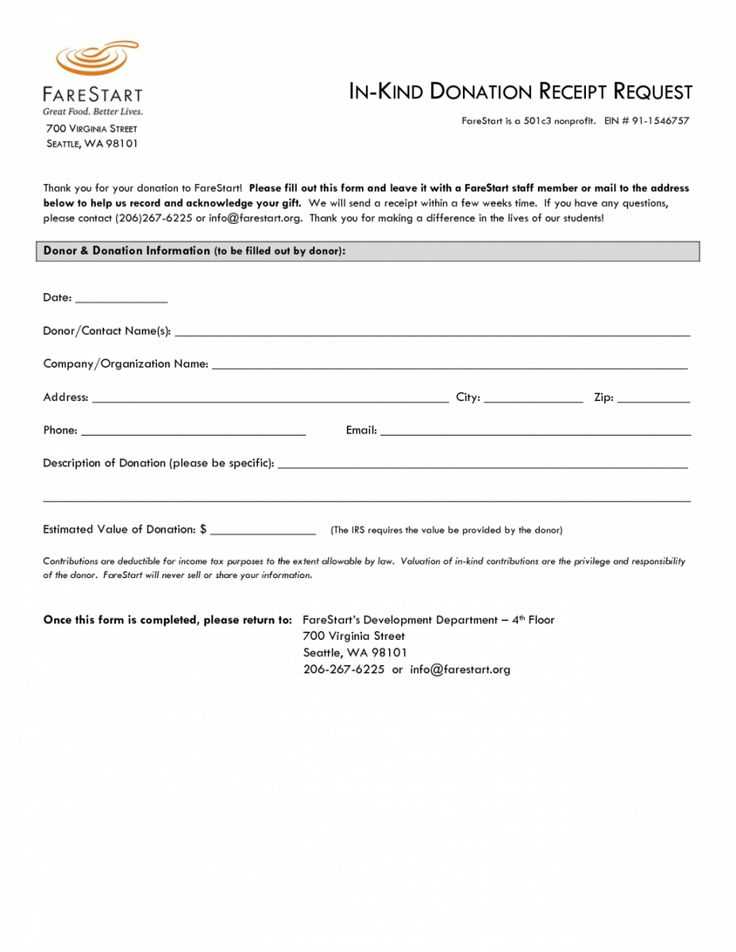

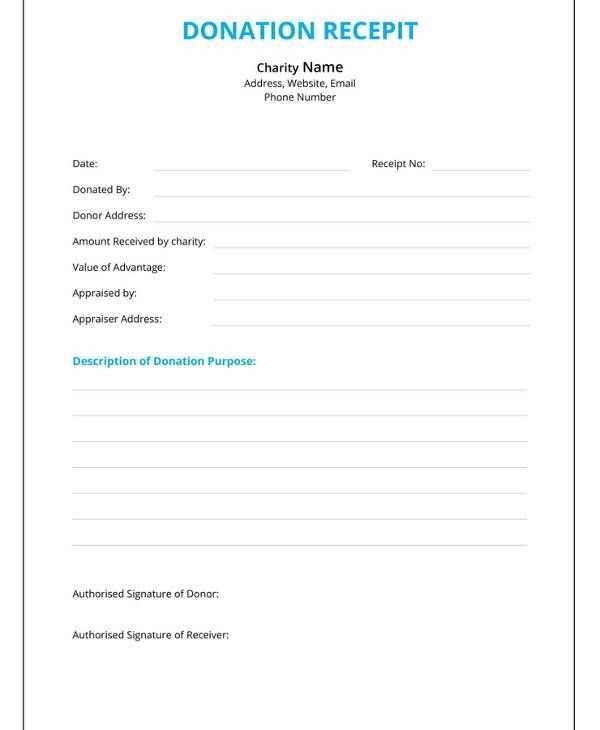

Begin with a clear heading identifying the purpose of the letter. A simple title like “In-Kind Donation Receipt” will suffice. Include the donor’s name and the date of the donation immediately following the header for easy reference.

State your organization’s name, address, and contact details at the top. This helps the donor recognize the source of the receipt and ensures accurate record-keeping.

Next, acknowledge the donation. Specify the items received and their estimated value. If you do not assign a monetary value, indicate that the donor is responsible for determining the fair market value. Avoid overestimating values to maintain transparency.

Be direct about the nature of the donation. Mention whether the donation is fully or partially tax-deductible, keeping the tone factual and clear. Clarify that no goods or services were provided in exchange for the donation if that is the case.

End with a polite thank-you note to express appreciation for the donor’s generosity. Sign off with the name and title of the authorized representative from your organization, adding their contact information in case of any follow-up.

Here’s a sample template:

[Organization Name]

[Address Line 1]

[Address Line 2]

[City, State, ZIP]

[Phone Number]

[Email Address]

Date: [Insert Date]

To: [Donor’s Full Name]

Donation Description:

We gratefully acknowledge the receipt of the following items donated by you on [Date of Donation]:

[Insert Item Descriptions]

We confirm that no goods or services were provided in exchange for this donation. You are responsible for determining the fair market value of the donation for tax purposes.

We appreciate your generosity and support.

Sincerely,

[Authorized Representative’s Name]

[Title]

[Organization Name]

How to Structure the Date and Donor Information in Your Receipt

Include the date of the donation at the top of the receipt. This helps both you and the donor maintain clear records for tax purposes. Write the date in a standard format, such as “February 11, 2025,” so it’s easy to read and understand.

The donor’s information should follow. Start with the donor’s full name. If possible, use the name provided during the donation process. Including their address is also recommended. Ensure the address is up to date, as this is required for tax documentation in many regions.

How to Format the Donor Information

List the donor’s full name on the first line. The second line should include their street address, followed by the city, state (if applicable), and zip code. If you’re dealing with international donors, include the country. Keep this information aligned to the left for clarity.

Date Placement for Accuracy

Place the date prominently at the top, preferably on the right side of the receipt. This format makes it easy to spot without confusion and avoids misplacing it when reviewing records later.

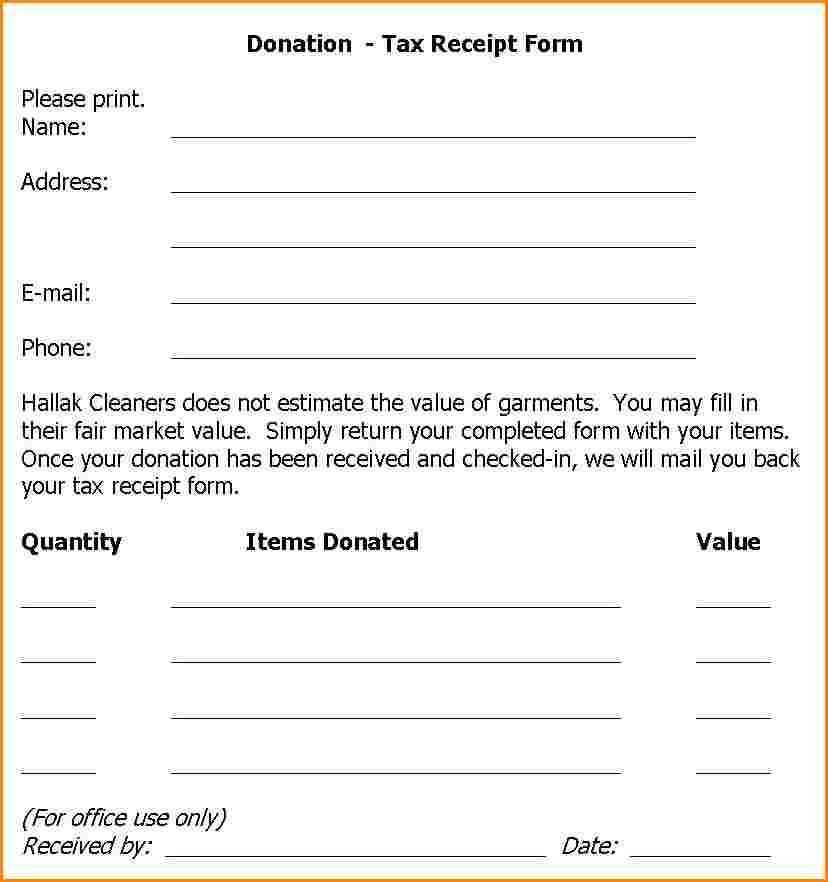

Key Elements to Include When Describing Donated Goods or Services

Clearly identify the type of donation. Specify whether it is a physical item, service, or cash equivalent. For physical items, include the brand, model, and condition (e.g., new, gently used). For services, describe the nature of the service, its duration, and any special terms attached to it.

Provide a detailed description of the quantity or volume of the donation. This could be the number of items, hours of service, or the monetary value if it’s a service-based donation.

Be specific about any restrictions or conditions tied to the donation. For example, if a product is being donated with an expiration date or if the service is only available during certain hours, include those details.

Include the fair market value of the donated goods or services if applicable. If the donation is non-tangible, such as a service, estimate the value based on similar services in the market.

Finally, acknowledge the donor’s contribution by expressing gratitude and noting the impact of their donation. This adds a personal touch and reinforces the importance of the donation.

Legal Considerations and Tax Deduction Details for Donors

Donors should be aware of the legal framework surrounding charitable contributions to ensure they comply with regulations and benefit from tax deductions.

- Tax-exempt Status: Ensure the organization receiving the donation is registered as a tax-exempt entity under IRS code 501(c)(3). Only donations to such organizations are eligible for tax deductions.

- Documentation Requirements: Keep a copy of the donation receipt issued by the charity. The receipt should include the organization’s name, the donor’s name, the date of the donation, and the amount or description of the items donated.

- Non-Cash Donations: For donated goods, the fair market value must be established. If the value exceeds $500, the donor must complete IRS Form 8283.

- Deduction Limits: Generally, charitable deductions cannot exceed 60% of a donor’s adjusted gross income (AGI). However, specific limits depend on the type of donation and the organization.

- Itemized Deductions: Donations must be itemized on the donor’s tax return for a deduction to be claimed. Ensure the value of the contribution is accurately documented and substantiated.

- Cash Contributions: Donors giving cash or checks must obtain a written acknowledgment from the charity, particularly for contributions over $250. The acknowledgment should confirm the amount of cash donated and any goods or services received in return.

- Tax Filings: Donors must claim their deductions on the appropriate IRS forms. Consult a tax advisor to ensure proper filing, especially for larger or complex donations.

By following these guidelines, donors can make sure they are maximizing their charitable contributions while staying compliant with tax laws.