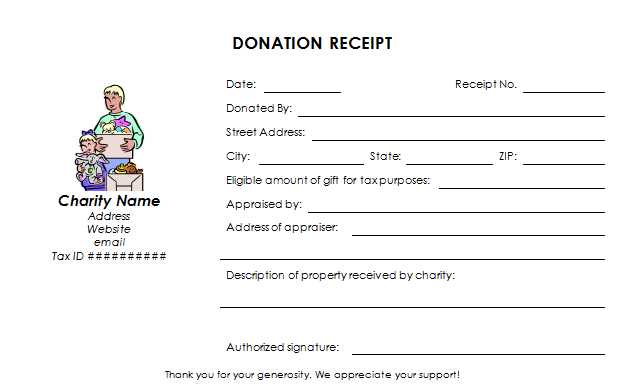

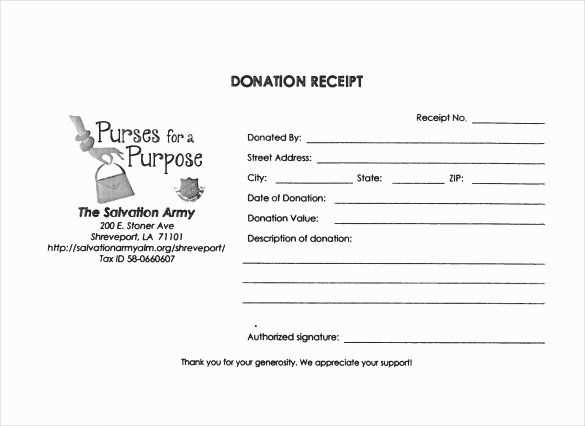

Creating a donation receipt for a library is straightforward and highly beneficial for both the donor and the institution. A well-structured receipt not only confirms the transaction but also provides necessary tax documentation for donors. Make sure to include the library’s name, donation date, item description, and estimated value. Clear and precise details ensure the receipt serves its purpose.

Start with the library’s name, address, and contact information at the top of the receipt. Then, list the donor’s name and contact details. This helps both parties maintain a record of the donation. Clearly state the items donated, whether they are books, multimedia materials, or financial contributions, and provide an estimated value. Including a statement that no goods or services were exchanged for the donation can simplify tax filing for donors.

Acknowledge the donor’s generosity with a brief message or note of thanks. This adds a personal touch and encourages future donations. Finally, remember to include a signature or the name of the librarian handling the donation to authenticate the receipt. This makes the receipt official and reliable.

Here’s the corrected version:

When creating a library donation receipt template, make sure to include all key details: donor’s name, address, donation date, itemized list of donated items, and their estimated value. Keep the layout clean and straightforward, with clear sections for each part of the information.

Key Details to Include

Start with the donor’s full name and address at the top, followed by the date of donation. List each item separately, providing a short description and an estimated value. Make sure to specify if the donation is monetary or physical items. It’s also helpful to mention any special conditions, like whether the items were donated in bulk or as part of a specific collection.

Signature and Acknowledgment

End the receipt with a section for the library’s signature and a note of acknowledgment. This will confirm the donation was received and that the donor’s contribution is appreciated. Don’t forget to add a statement that the library is a tax-exempt organization if applicable, allowing the donor to use the receipt for tax purposes.

Library Donation Receipt Template

How to Design a Basic Template for Donation Receipts

Legal Considerations When Issuing Donation Receipts

Customizing the Receipt Template for Different Types of Donations

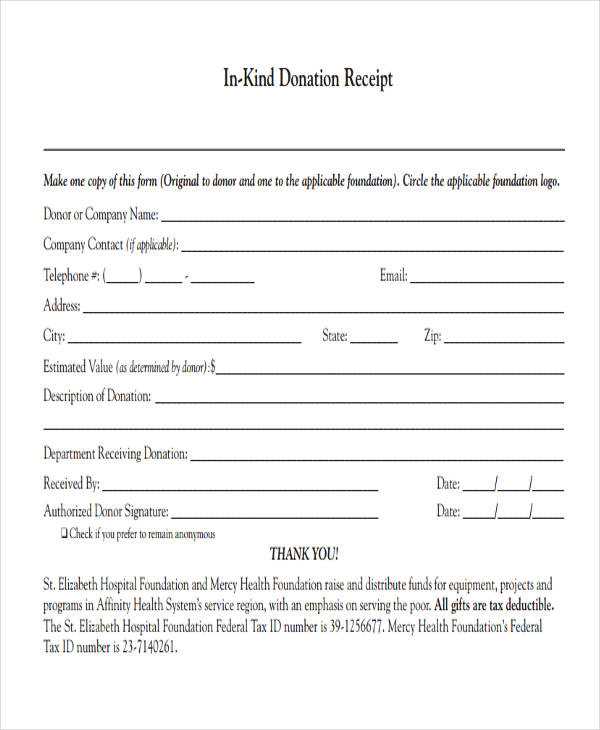

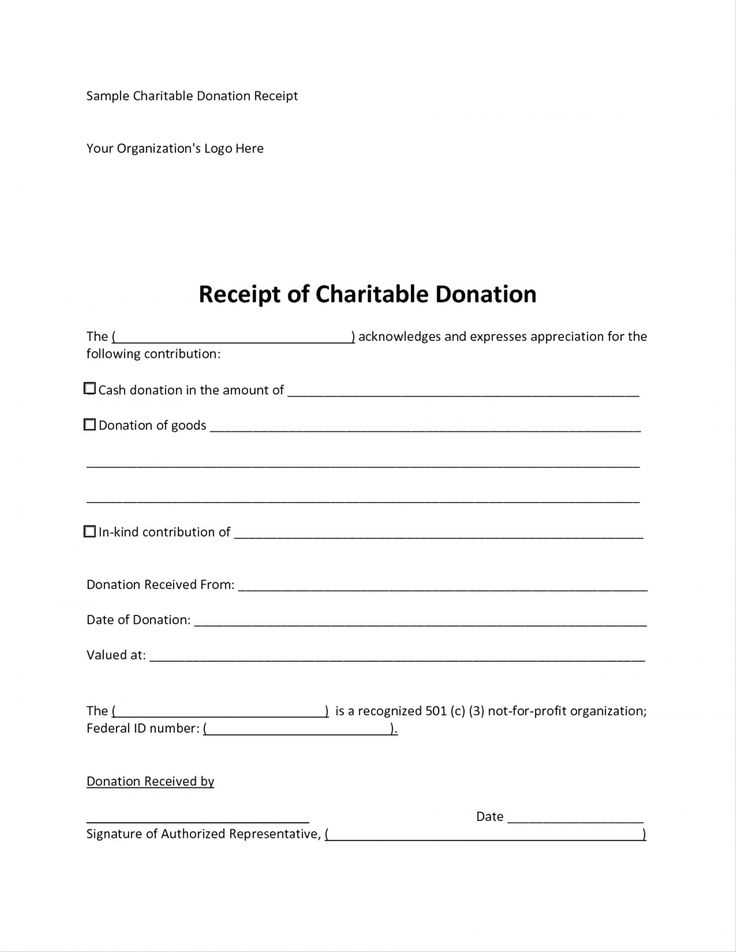

Design a simple and clear template for donation receipts. Include the library’s name, address, and contact details at the top. The donation amount should be listed prominently along with the date of the contribution. Specify whether the donation was monetary or an in-kind contribution (books, equipment, etc.). If it’s an in-kind donation, provide a description of the items donated.

Legal Aspects of Donation Receipts

Donation receipts must adhere to specific tax regulations. For a receipt to be valid for tax deduction purposes, include the donor’s name, donation amount, and a clear statement that no goods or services were provided in exchange for the donation, if applicable. If goods or services were provided, the receipt must describe them and estimate their fair market value. Always ensure the library’s tax-exempt status is clearly stated, as this impacts the donor’s ability to claim deductions.

Customizing the Receipt for Different Donation Types

Different types of donations require different details on the receipt. For cash donations, simply note the amount and date. For non-cash donations, include descriptions and valuations where possible. If the donation is restricted (for example, funds for a specific program or project), indicate this clearly. Adjust the language and format based on whether the donation is a one-time or recurring contribution, as well as whether it supports a general fund or a specific cause within the library.