Use a clear and simple template for your monetary donation receipts to ensure transparency and ease for both donors and recipients. A well-structured receipt provides the necessary details, including the donor’s name, donation amount, and the organization receiving the funds. This prevents confusion and ensures accurate record-keeping for tax and legal purposes.

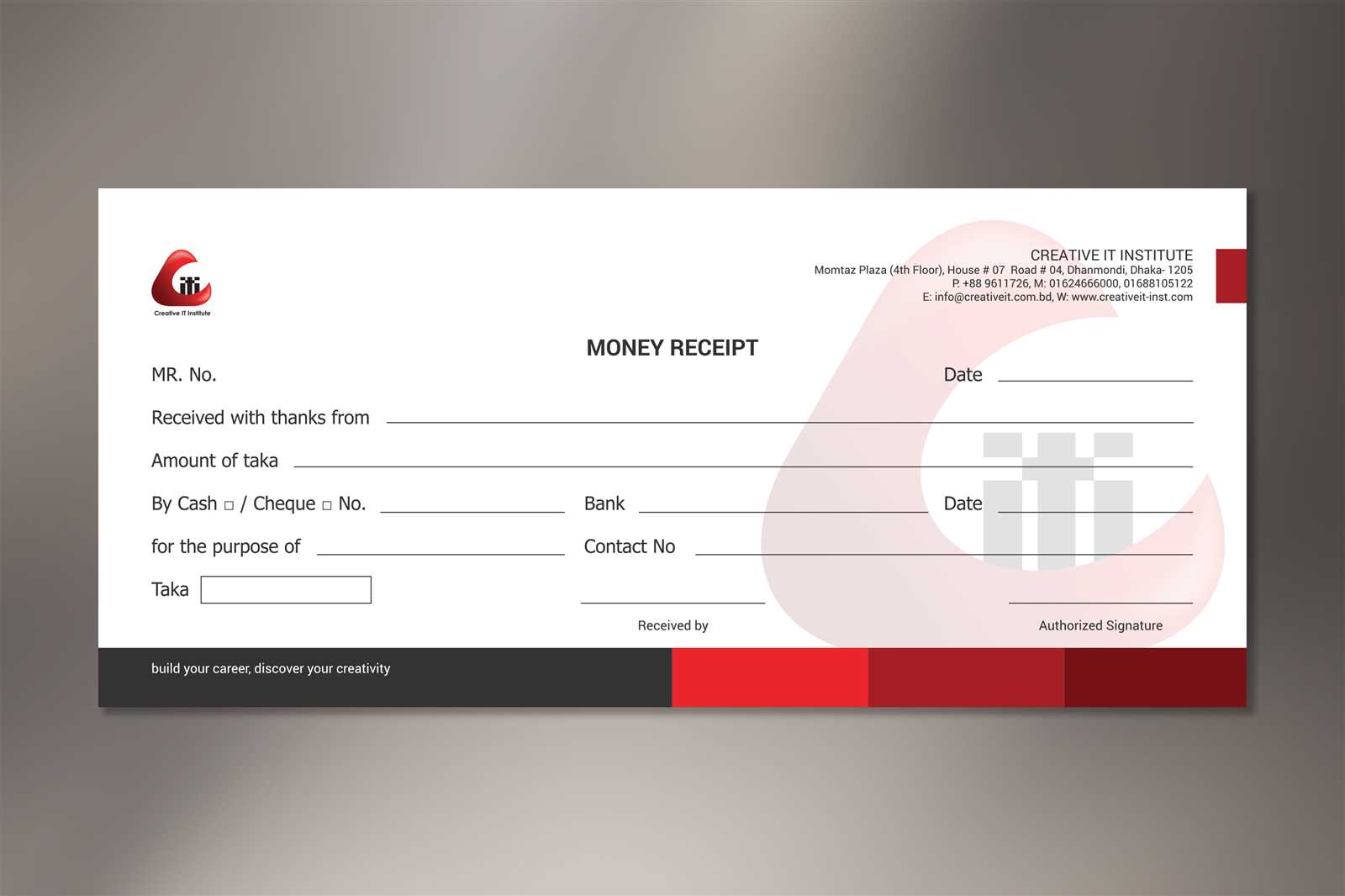

In your template, include key elements like the date of donation, the name of the donor, and a brief description of the donation. It’s important to also add your organization’s contact information and any relevant tax-exempt status or EIN numbers, so the donor can use the receipt for tax deductions if applicable.

A clean, concise format helps convey professionalism and builds trust. Ensure that all sections are easy to understand and clearly visible. Consider adding a thank-you note to personalize the experience and show appreciation for the donor’s contribution.

Here are the corrected lines:

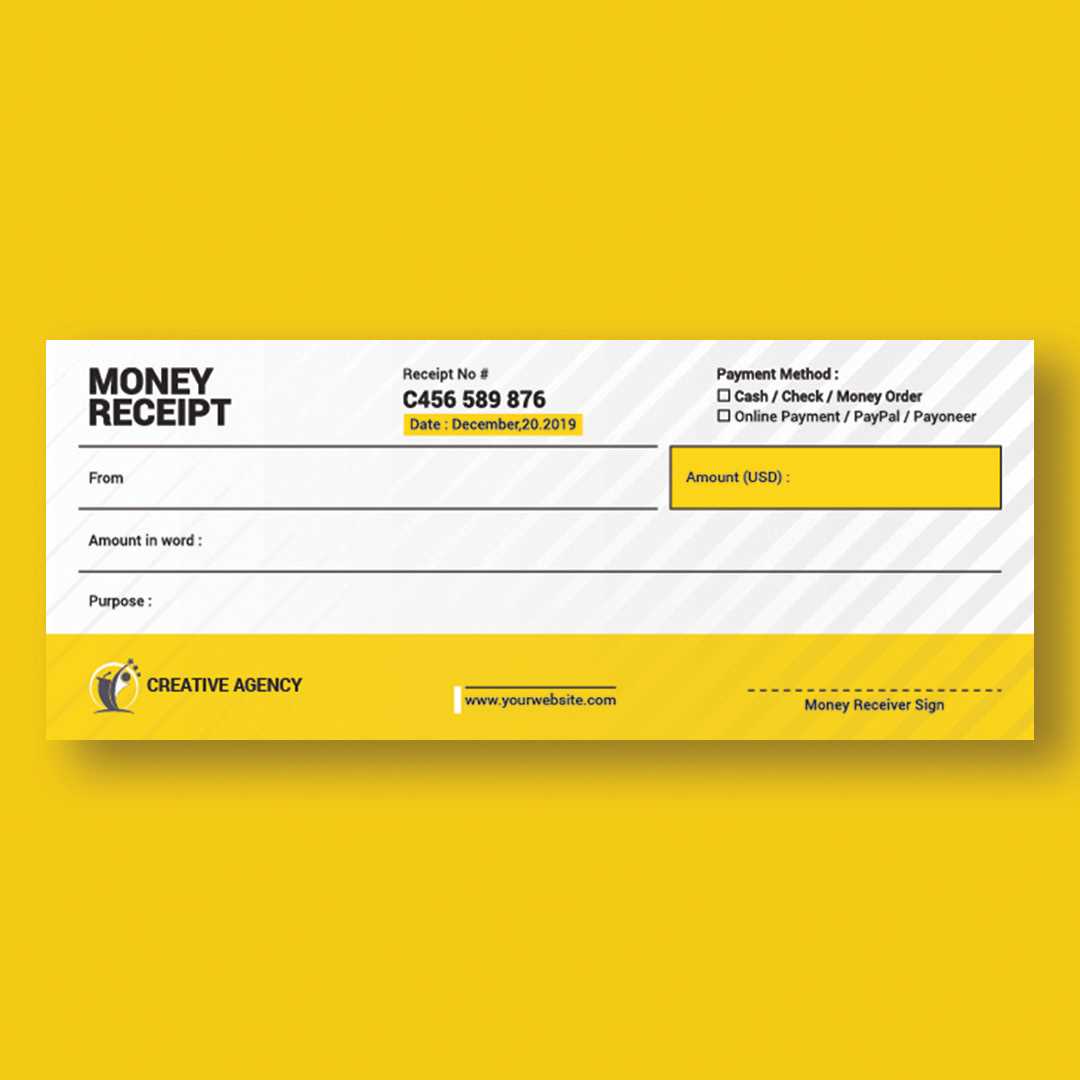

Ensure your donation receipt template includes clear fields such as the donor’s full name, donation amount, date of donation, and the charity’s name. This is crucial for transparency and record-keeping.

The template should also specify whether the donation is in cash, check, or another form of payment. Clarifying the type of donation helps maintain proper financial tracking.

Include a statement confirming that no goods or services were exchanged for the donation, if applicable. This is vital for the donor’s tax purposes.

Clearly outline the tax-exempt status of your organization, along with its IRS registration number if necessary. This provides reassurance to donors and ensures compliance with tax regulations.

| Field | Recommendation |

|---|---|

| Donor Name | Include the full name of the donor. |

| Donation Amount | Clearly state the total donation amount. |

| Date of Donation | Ensure the exact date is provided. |

| Payment Type | Specify the form of payment (e.g., cash, check, online transfer). |

| Tax Exempt Status | Include your charity’s tax-exempt status and IRS number if required. |

- Monetary Donation Receipt Template

Provide clear and concise details in your receipt to ensure transparency and accuracy. The template should include the donor’s name, the donation amount, and the date of the transaction. Add the name and contact information of your organization, as well as a statement confirming the donation’s purpose, whether it’s for a specific project or general support. Also, include a unique receipt number for easy tracking.

Make sure to include the IRS-approved language if your organization is tax-exempt, indicating that no goods or services were provided in exchange for the donation. This keeps your documentation compliant with tax regulations. You can format the receipt as a simple, clean document to ensure the donor can easily use it for tax purposes.

If the donation is non-monetary, such as goods or services, include a description of the items and an estimated value. Always keep a copy of each receipt for your records, and send a copy to the donor for their reference.

Begin by including your organization’s name and address at the top. Make sure it’s easily recognizable. Follow this with the donation date and a unique receipt number for reference.

Clearly state the donor’s name and address. This helps verify the legitimacy of the donation and ensures the donor is properly credited.

Describe the donation: whether it’s monetary, in-kind, or another form. For monetary donations, note the exact amount given, and if the donation is non-cash, provide an estimated value.

Specify that no goods or services were exchanged for the donation, unless applicable. This is required for tax purposes. If there were goods or services, list them and their fair market value.

Conclude with a statement confirming the donor’s tax-deductible status, referencing the relevant tax law or guidelines as applicable.

For clarity, consider adding your organization’s tax identification number or registration details. This helps provide legal assurance.

- Organization Name and Address

- Donor’s Name and Address

- Donation Amount or Description

- Statement on Goods or Services

- Tax Identification Number (Optional)

Receipts for monetary donations must meet specific legal criteria to be valid. Include the name and address of the charitable organization, the amount donated, and the date of the donation. Ensure the receipt clearly states whether the donation is tax-deductible. If the donation involves goods or services in exchange for the contribution, the receipt should specify the fair market value of those items.

Donation Acknowledgment

For donations over a certain amount (usually $250 or more in many jurisdictions), a written acknowledgment is required. This acknowledgment must confirm the donation amount and state whether any goods or services were provided in return. If services or goods were provided, their value must be stated separately.

Retention of Records

Donors should retain receipts for tax purposes. Charitable organizations are obligated to keep detailed records of all donations they receive, including receipts issued. These records may be requested by tax authorities to verify the legitimacy of donations claimed by donors. Ensure that all receipts are stored securely and in compliance with local record-keeping regulations.

To ensure clarity and legality, include the following key details in a donation receipt:

Donor Information

Include the name and address of the donor. This helps verify the donor’s identity and may be necessary for tax purposes. Be sure to also include the donor’s email if you plan to follow up with a thank-you message or tax-related updates.

Donation Amount and Date

Clearly state the exact amount donated and the date the donation was made. This provides a clear record for both the donor and your organization and helps avoid confusion in the future.

Organization Details

List the name, address, and contact information of your organization. This ensures the donor knows exactly who is receiving the funds, which is especially important for tax deductibility.

Tax Status Information

If your organization is tax-exempt, make sure to include your tax-exempt status and EIN (Employer Identification Number). This allows the donor to use the receipt for tax deduction purposes.

Donation Description

Provide a brief description of the donation, including whether it was a monetary gift or non-cash donation (e.g., goods or services). For non-monetary donations, a detailed description of the items is necessary.

Signature or Authorized Stamp

If applicable, include a signature or an official stamp from your organization to validate the receipt. This adds a level of authenticity to the document.

To make a donation receipt truly personalized, focus on including key information relevant to the donor and the donation itself. Each detail can reinforce the relationship with the donor and provide necessary tax documentation.

Include Accurate Donor Information

Start by ensuring the donor’s name and contact details are correct. This includes the full name, address, and email, if available. This not only helps in keeping records straight but also allows for easy communication in the future.

Clear Donation Amount and Date

- List the exact donation amount, including any specifics such as the donation type (e.g., cash, check, in-kind).

- Include the date of the donation for tax reporting purposes. Ensure the date is accurate to avoid discrepancies when the donor files their taxes.

Include Tax Information

Clearly state whether the donation is tax-deductible. Provide the organization’s tax ID number (TIN) and a statement confirming the receipt for tax purposes. This will help donors use the receipt for their tax returns.

Optional Customization: Thank You Note

Personalizing the receipt with a brief thank-you message shows appreciation and strengthens the relationship with the donor. A simple “Thank you for your generous support” goes a long way.

Double-check all the details on the receipt. A common mistake is leaving out the name of the donor or the donation amount. Always ensure the donor’s information is accurate to avoid confusion.

Incomplete Date or Receipt Number

Omitting the date or receipt number is another frequent error. Each receipt must have a unique number and a clear date of donation to provide proper tracking and reference.

Incorrect Donation Amount

Ensure the correct amount is listed on the receipt. Simple math errors or rounding mistakes can lead to disputes later. Always verify the donation amount before issuing the receipt.

Lastly, make sure your organization’s details are up to date. Missing or outdated contact information can lead to confusion, especially if the donor needs to get in touch for any reason.

Free receipt templates can be found in various online platforms such as Canva, Google Docs, and Microsoft Word. These templates offer simplicity and are perfect for small donations or personal use. They usually come in basic formats, with sections for donor name, amount, and date. Customization is often limited but sufficient for informal needs.

Paid receipt templates, on the other hand, often provide advanced features, including more design options, customizable fields, and integration with accounting software. These templates are ideal for businesses or organizations that need to generate receipts frequently and require more professional presentation and functionality. Websites like Template.net and Envato Elements offer these templates for a subscription fee, ensuring that the receipts align with legal and professional standards.

Both free and paid options serve different needs. If you’re working on a small scale, a free template might be sufficient. However, for larger organizations, investing in a paid template ensures better accuracy, customization, and functionality.

Start by organizing your monetary donation receipt with key elements. Include the name and contact information of the organization receiving the donation. This ensures transparency and helps the donor easily verify the transaction. Specify the amount donated and whether it was cash, check, or another method. If applicable, state any goods or services provided in exchange for the donation, as this may affect the tax deduction status.

Clear Description of Donation

Clearly state the purpose of the donation, particularly if it is intended for a specific fund or project. Mention any restrictions on how the funds can be used, if relevant. Providing this clarity will help both the donor and the organization track the donation’s impact.

Tax Deduction Information

If the donation is tax-deductible, include the appropriate language, such as a statement indicating no goods or services were provided in exchange for the gift, if that is the case. Be sure to include the organization’s tax-exempt number if applicable, ensuring the receipt meets IRS requirements.

Make sure to include the date of the donation, the signature of an authorized representative, and any other relevant legal disclaimers. These elements help make the receipt a valid document for tax purposes.