Key Elements to Include

To create a simple money donation receipt, ensure you include the following core details:

- Donor Information: Include the name, address, and contact details of the person donating.

- Donation Amount: Clearly state the amount of money donated, as well as the currency.

- Donation Date: Specify the date the donation was made.

- Organization Information: Mention the name, address, and contact details of the organization receiving the donation.

- Receipt Number: Add a unique receipt number for tracking purposes.

- Tax Status: Indicate whether the donation is tax-deductible, along with the organization’s tax-exempt status or EIN (Employer Identification Number).

- Purpose of Donation: Mention the specific cause or project funded by the donation (optional, but useful for transparency).

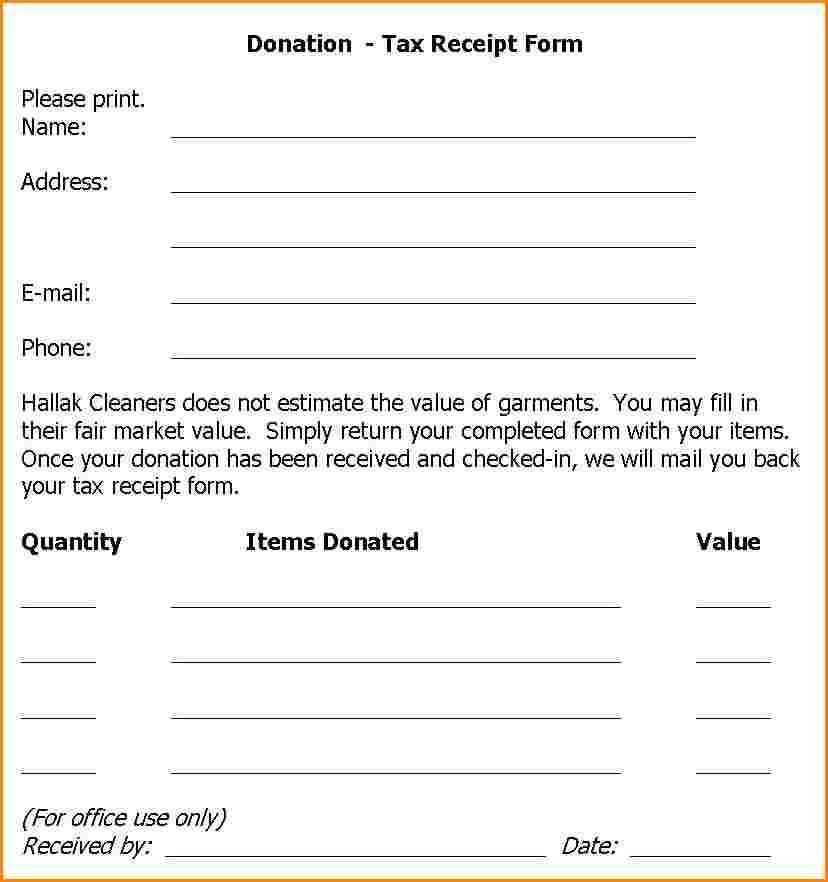

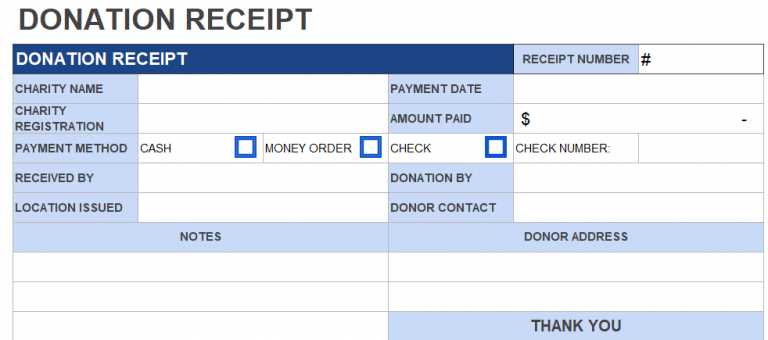

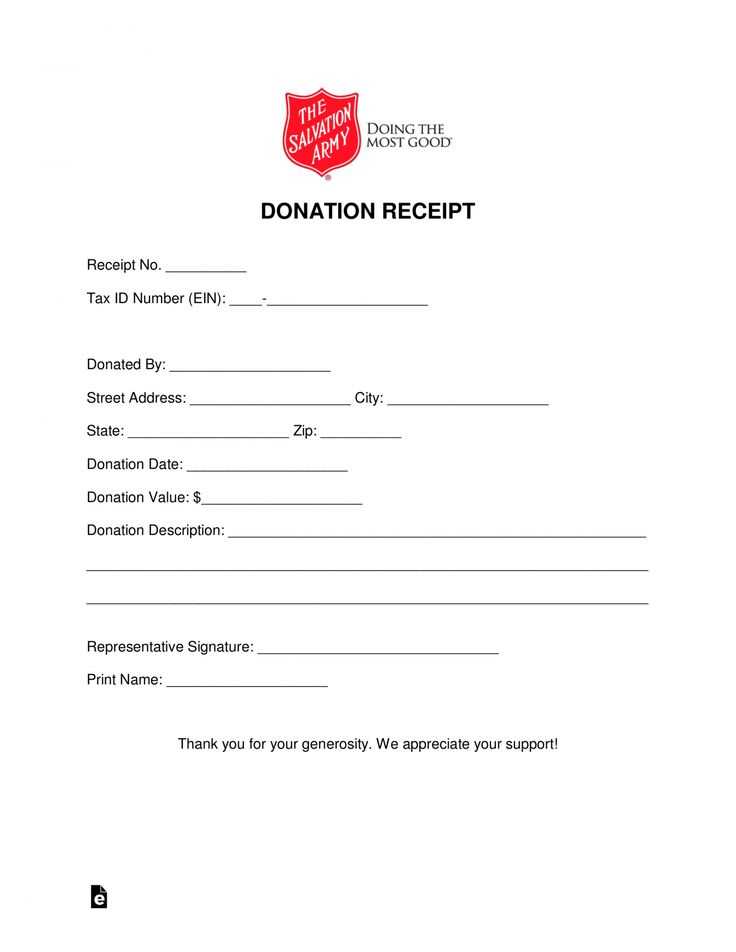

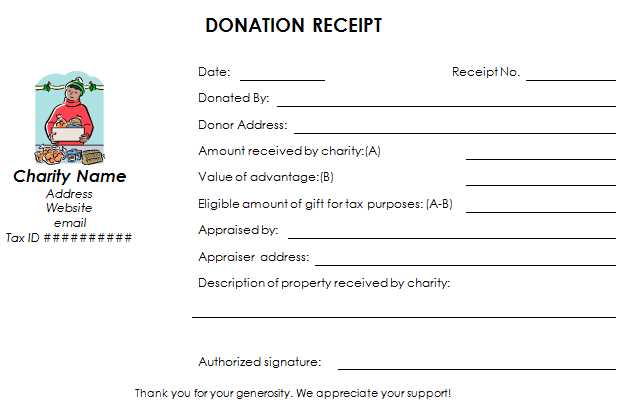

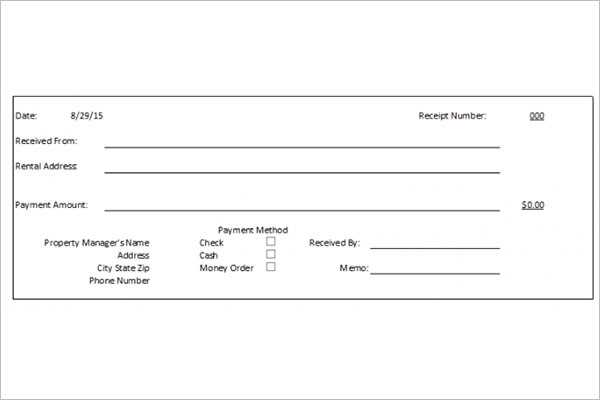

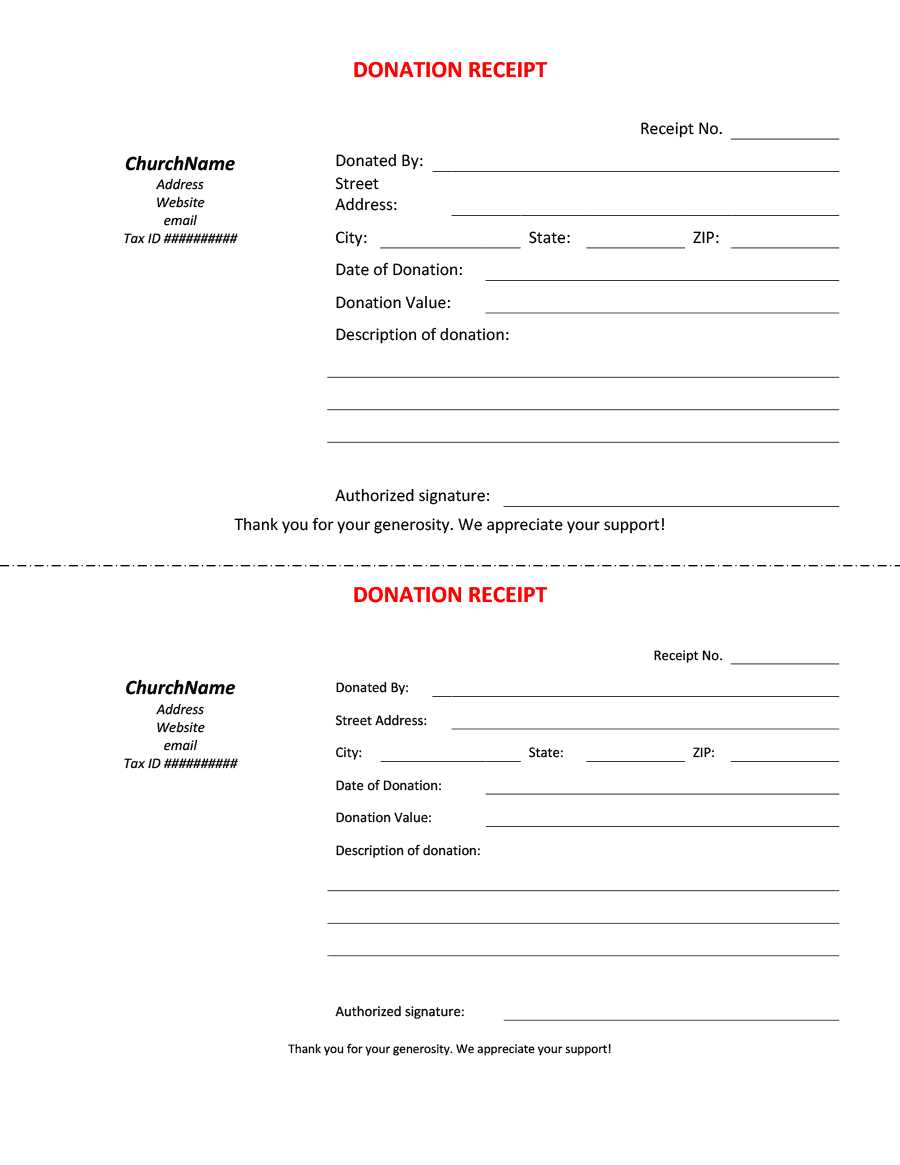

Template Example

Here’s an example layout for your donation receipt template:

Donation Receipt Receipt Number: [Unique ID] Date of Donation: [MM/DD/YYYY] Donor Information: Name: [Donor's Full Name] Address: [Donor's Address] Phone: [Donor's Phone Number] Email: [Donor's Email Address] Donation Information: Amount Donated: [Amount] [Currency] Purpose: [Optional, e.g., General Fund] Received By: Organization Name: [Organization's Name] Address: [Organization's Address] Phone: [Organization's Phone Number] Email: [Organization's Email Address] Tax Exemption: [Include EIN or Tax-Exempt Status Info] Thank you for your generous contribution!

Use this template as a foundation and customize it as needed. It’s helpful to provide a space for both your signature and the donor’s, especially when the donation is significant or requires further validation.

Money Donation Receipt Template

To create a simple and functional donation receipt template, include key elements such as the donor’s name, the date of the donation, the amount donated, and a statement that the organization is a tax-exempt entity. Make sure to list any goods or services provided in exchange for the donation, as this affects tax-deductible status. Keep the layout clean and easy to read, and ensure all necessary information is present for transparency.

How to Create a Basic Donation Receipt Template

A basic template should include the following sections: the name of your organization, the donor’s details (name, address), the date of the donation, the amount donated, and a description of the donated items or services. It’s also important to include your nonprofit’s tax-exempt status number and a statement about the nature of the donation, such as whether it’s tax-deductible.

Incorporating Tax-Deductible Information into a Receipt

Include a clear statement regarding the tax-deductible status of the donation. For instance, “No goods or services were provided in exchange for this contribution,” or if applicable, specify what was received in return. Additionally, include the organization’s tax-exempt status number and the IRS or local tax authority’s acknowledgment for deductions.

Designing a Professional and Clear Layout for Donation Receipts

A professional layout should prioritize readability. Use clear fonts and break the text into sections. Add your organization’s logo at the top, followed by donor information, donation details, and tax-deduction disclaimers. Make sure the layout is not cluttered and maintains a formal yet approachable tone.