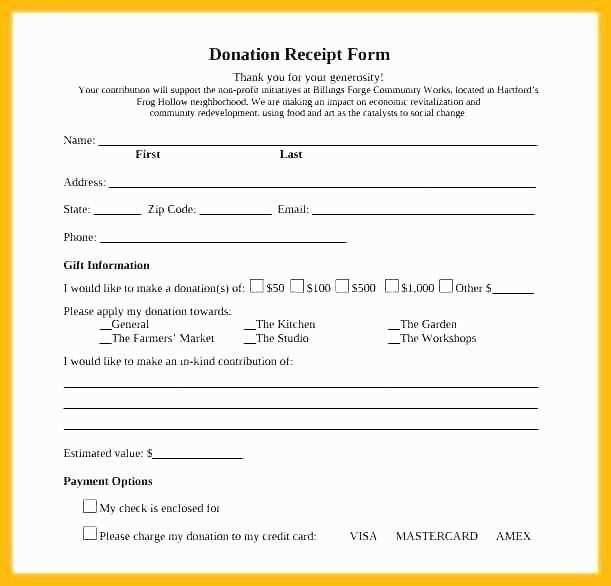

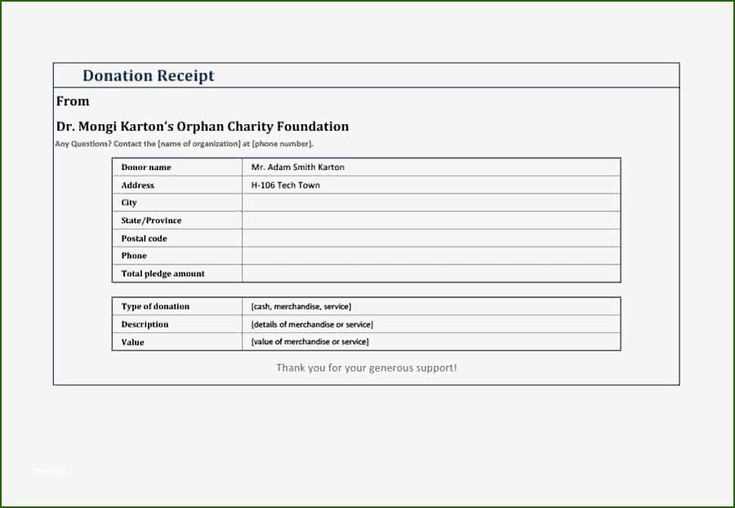

To create a well-structured NGO donation receipt template, start by including all necessary donor and organization information. Ensure that each receipt includes the donor’s full name, donation amount, and the date of the donation. Specify the organization’s name, address, and contact details as well, making sure they are easy to find. This transparency helps both parties track donations and maintain accurate records.

Clear Description of Donation is another important element to include. Specify whether the donation is monetary or in-kind. If it is in-kind, provide a brief description of the donated item(s) with their estimated value. This clarity helps donors when claiming tax deductions, as it shows the value of their contribution.

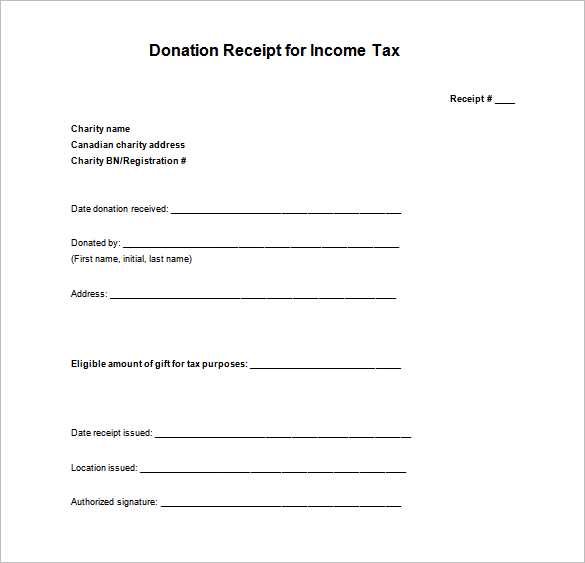

Tax Exemption Details should be explicitly mentioned if your NGO is registered for tax-exempt status. A statement confirming the non-receipt of goods or services in exchange for the donation can also be added. This information is necessary for the donor to claim any available tax benefits.

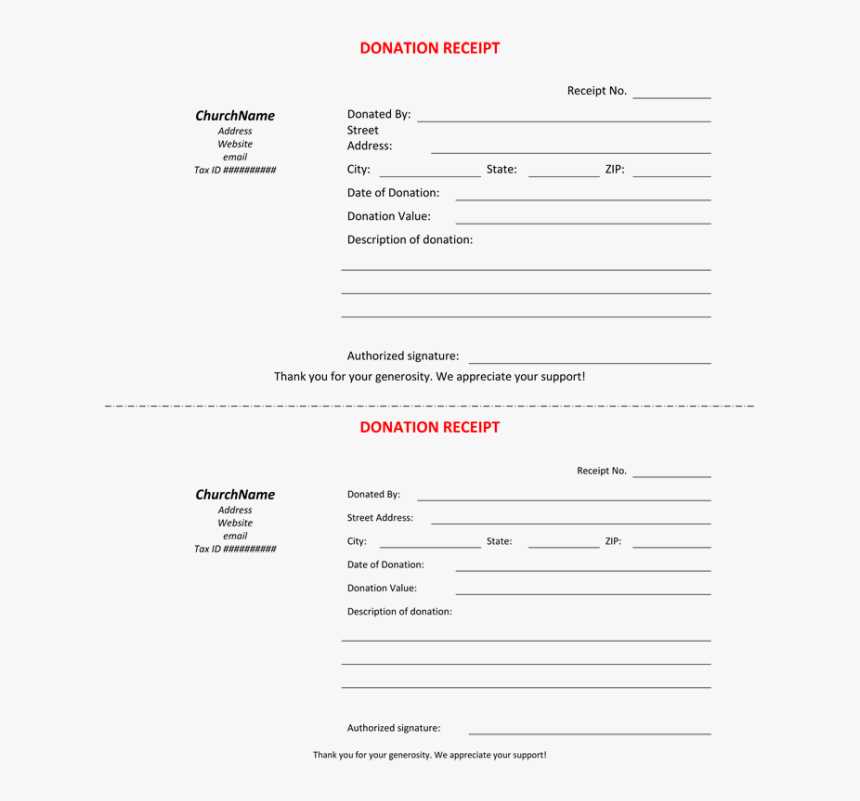

Finally, signature or authorization from the authorized person in the organization adds legitimacy to the receipt. Make sure this section is included at the bottom of the receipt template, confirming its authenticity. Adjust the layout to ensure that all sections are easy to read and understand.

Creating a Legally Compliant Donation Receipt

To ensure your donation receipt meets legal requirements, include specific details to satisfy tax reporting standards. First, clearly state the name and contact information of your organization, including its tax-exempt status and registration number. This lets donors verify the legitimacy of the entity receiving the donation.

Specify the donor’s name and the date of the contribution. For cash donations, include the exact amount donated. For non-cash donations, describe the items donated along with their fair market value. If the donor receives goods or services in return, note that as well, and provide a fair estimate of their value. Deduct this value from the total contribution to calculate the tax-deductible amount.

Ensure the receipt includes a statement confirming that no goods or services were exchanged, if that is the case. If any goods or services were provided, clearly describe them and state the value, so donors can determine the portion of their contribution that is tax-deductible.

Provide a formal declaration that the donation is tax-deductible. If applicable, mention any special rules that may affect the donor’s ability to claim a deduction, such as restrictions on the value of donations that exceed certain thresholds.

Finally, always ensure your receipts are dated and signed by an authorized representative of the organization. This shows compliance with legal and tax reporting requirements, helping both your organization and donors maintain proper records.

Designing a Clear and Professional Template

Keep the layout simple and clean. Use a clear font such as Arial or Times New Roman, and ensure text is legible by using an appropriate size, typically 10-12pt. Include essential details like the donor’s name, donation amount, date, and a reference number for easy tracking.

Structure the Information Logically

Arrange the key information in sections. Start with the donor’s details, followed by donation specifics, and conclude with your NGO’s information. This helps the recipient easily locate what they need without searching through cluttered text.

Branding and Trust

Include your logo and any relevant certifications or accreditation marks. This enhances trust and establishes credibility. Use your brand colors, but avoid overwhelming the recipient with too many design elements. Stick to a professional and cohesive color scheme.

Customizing the Template for Different Donation Types

Tailor your donation receipt template based on the type of contribution to ensure accuracy and clarity. For cash donations, include the donor’s name, the amount donated, and the date of the donation. Make it clear that no goods or services were provided in exchange for the donation.

For in-kind donations, specify the item or service donated, its estimated value, and any relevant details. If the value of the donation exceeds a certain threshold, provide a disclaimer indicating that the donor is responsible for determining the item’s value.

For online donations, ensure your template includes a unique transaction ID and payment method used. This adds a layer of verification and ensures transparency. It’s also helpful to include a reminder that the donor can contact the organization for any discrepancies or further clarification.

When handling recurring donations, clearly note the frequency of the donations and the total amount donated for the year. This helps the donor track their contributions for tax purposes.

For donations received via a third party, such as through a fundraising platform, note the platform’s name and include any fees associated with processing the donation. Be transparent about how much the organization actually receives after the deduction.

Finally, always remember to update the template to reflect changes in tax laws or organizational practices. This keeps the template compliant and useful to your donors.