For any nonprofit organization receiving clothing donations, providing a donation receipt letter is necessary for both legal compliance and donor satisfaction. A well-crafted letter ensures transparency and helps donors claim their charitable contribution for tax purposes. It’s important to include the donor’s information, a description of the items donated, and the date of the donation. This letter can be a straightforward acknowledgment or an itemized list based on the value of the donation.

Start by clearly identifying the donor’s name and address. Include a statement that specifies the donation was made voluntarily and outline the items given. If possible, provide an estimated value for each item, though it’s important to note that nonprofits should avoid placing a specific value on the donations. Instead, indicate the value is up to the donor’s discretion. Make sure to state that no goods or services were exchanged in return for the donation.

To maintain consistency and avoid confusion, always use a formal tone while remaining friendly and appreciative. A brief sentence expressing gratitude for the donor’s generosity can also add a personal touch, making the donor feel valued and motivated to continue supporting the cause.

Here’s the revised text with reduced repetition, maintaining the meaning:

To write a non-profit clothing donation receipt, keep the format simple and clear. Include the donor’s name, the organization’s name, and the donation details, such as the number of items donated or their description. Ensure the date of the donation is included. Specify whether the donation is monetary or in-kind and mention if any goods are valued for tax purposes. Make sure the letter includes a statement clarifying that the organization did not provide goods or services in return for the donation, as this is crucial for tax deductions.

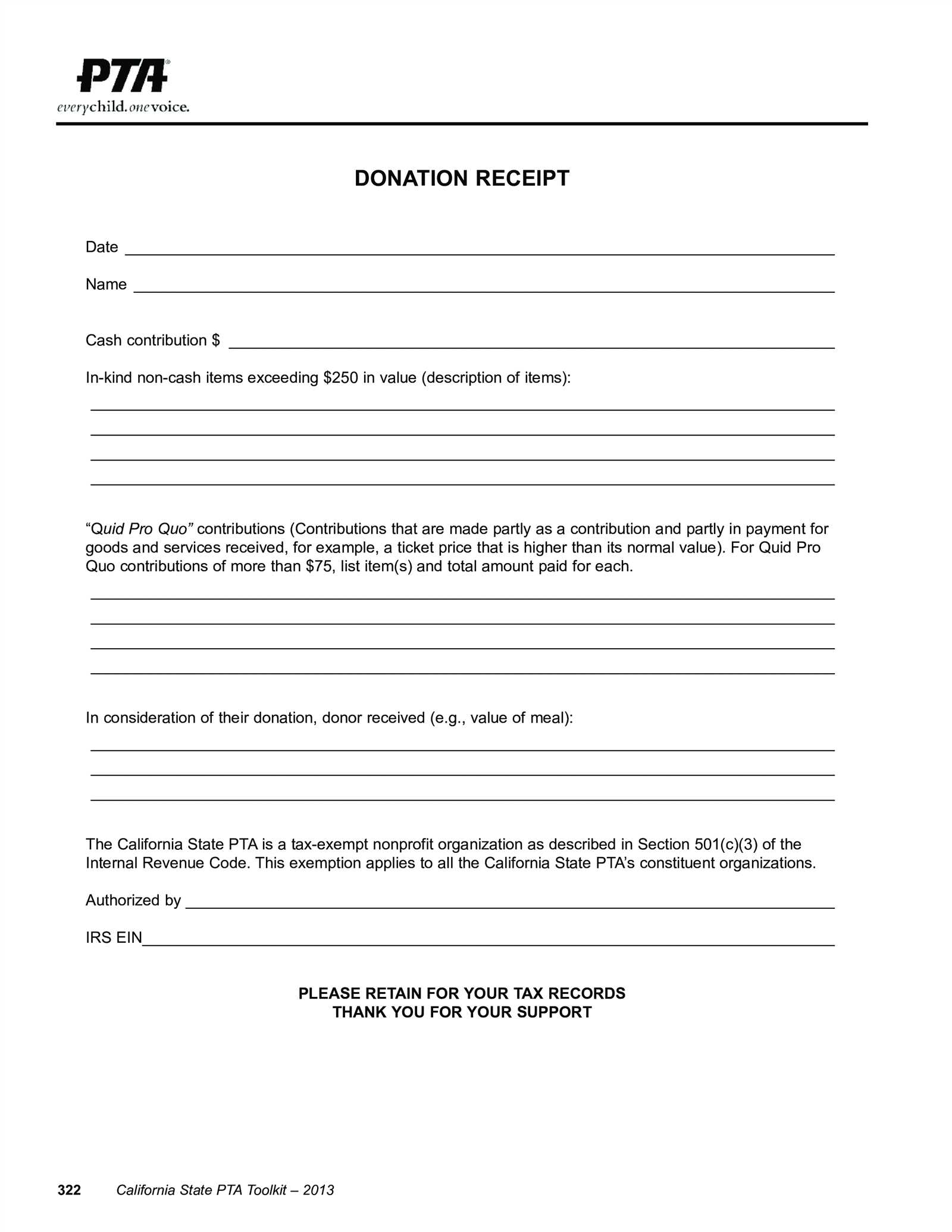

Donation Receipt Structure

- Organization Information: Full name, address, and tax-exempt status.

- Donor Information: Donor’s name and address.

- Donation Details: A brief description of the items donated, including quantity or approximate value, if applicable.

- Date: Date the donation was received.

- Value: Either the value of the donation or a statement explaining that the donor is responsible for determining the value.

- Statement: A note indicating no goods or services were exchanged for the donation.

Key Tips for Writing the Receipt

- Keep the language clear and concise. Avoid unnecessary details.

- If providing a value estimate, mention that it is the donor’s responsibility to determine the exact worth.

- Make sure the receipt is signed by a representative of the organization.

- Nonprofit Clothing Donation Receipt Letter Template

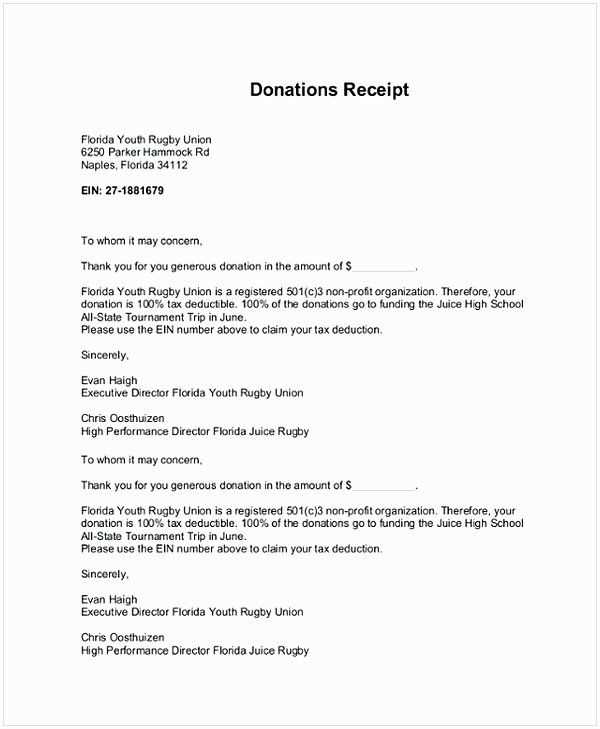

To create a donation receipt letter for clothing contributions, ensure the format is clear and organized. Begin with your nonprofit’s name, address, and contact information at the top of the letter. Clearly state the letter’s purpose by including a title such as “Donation Receipt” or “Clothing Donation Receipt” right beneath the nonprofit’s details.

Include the donor’s name and address, followed by the date of the donation. Acknowledge the specific items donated and, if possible, include an estimate of their fair market value. However, avoid assigning dollar amounts as this is the donor’s responsibility. Clearly state that no goods or services were provided in exchange for the donation, which is a requirement for tax purposes.

For example, your letter might say: “This letter serves as confirmation of your donation of clothing to [Nonprofit Name]. The following items were received: [list of items]. No goods or services were provided in exchange for this contribution.” Make sure the letter is signed by an authorized representative from the nonprofit, such as the Executive Director or Donation Coordinator.

Finally, add a thank-you note at the bottom, expressing appreciation for the donor’s support, which can strengthen relationships and encourage future donations.

To write a donation letter for clothing, keep it clear and concise. Begin with a personalized greeting, addressing the donor by name, if possible. This adds a personal touch to the letter and makes the donor feel recognized.

Include the Donation Details

Clearly list the clothing items donated. Be specific–mention categories such as jackets, shoes, or children’s wear. If possible, include an approximate value for each item, or a general estimate of the total donation amount. You don’t need to list every item, but a brief summary is helpful for tax purposes.

Acknowledge the Donor’s Generosity

Thank the donor sincerely for their contribution. Let them know how their donation will make a positive impact. For example, “Your clothing donation will directly help families in need, providing warmth and support during the winter months.” Be sure to mention any future opportunities for donations, encouraging ongoing support.

Conclude with your contact details and a polite closing, such as “Thank you again for your generosity and support.” Sign off with your name and title (if applicable). Make sure the letter is dated for reference.

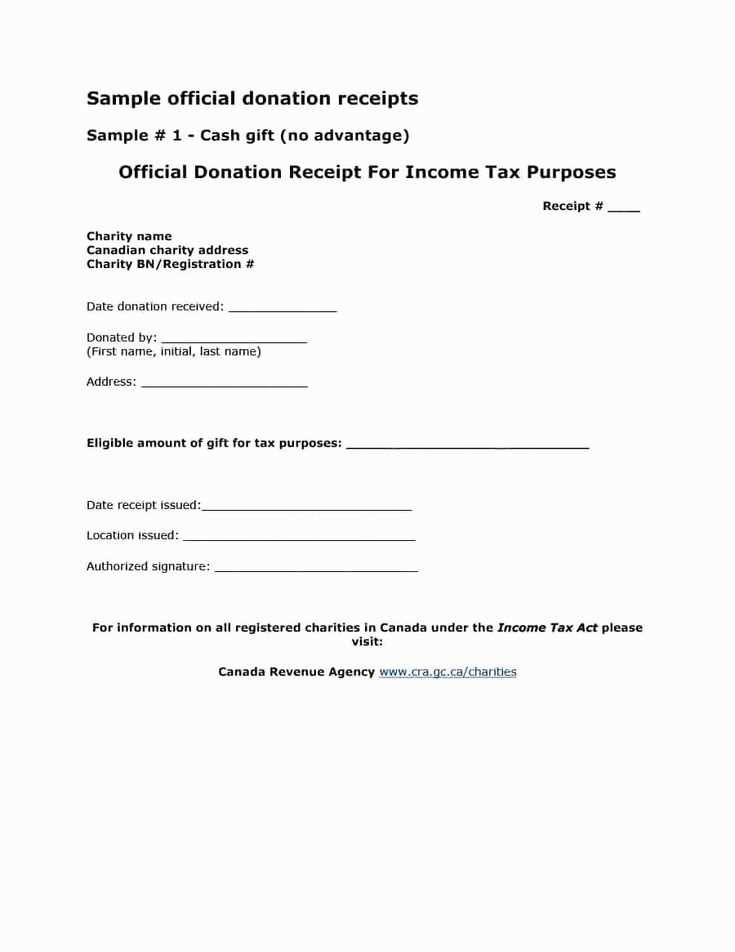

Nonprofit organizations must meet specific legal requirements when issuing donation receipts. These guidelines ensure transparency and compliance with tax regulations. Here’s what every nonprofit should include in their donation receipts:

| Requirement | Details |

|---|---|

| Organization’s Name | Include the full legal name of the nonprofit as registered with the IRS or local authorities. |

| Donor’s Name | Accurate identification of the donor helps to ensure proper tax reporting. |

| Date of Donation | Clearly indicate the exact date of donation to comply with the IRS deadlines. |

| Amount or Description of Donation | If the donation is cash, specify the amount. For goods, include a description, but not the value. |

| Statement of No Goods or Services Received | If the donor received nothing in return for the donation, include a statement confirming this. |

| Nonprofit’s Tax-Exempt Status | Include the IRS tax-exempt status, such as “501(c)(3)” for U.S.-based organizations. |

| Taxpayer Identification Number (TIN) | List the nonprofit’s TIN or Employer Identification Number (EIN) for tax reporting purposes. |

These components ensure that the receipt is valid for tax deduction purposes. Nonprofits should issue receipts for donations exceeding $250, while smaller donations may not require detailed documentation unless requested by the donor. Always check with a tax professional for compliance with current laws.

Clearly describe each item with specific details to ensure accurate recognition and potential tax deductions. Include the type of clothing, size, color, material, and condition. This information helps recipients understand what is being donated and can be valuable for organizations managing the donations.

Clothing Types

- Specify the type: shirt, pants, jacket, dress, etc.

- Describe the intended gender or age group: men’s, women’s, children’s, unisex.

Condition of the Items

- Be honest about the condition: new, gently used, or worn. This ensures transparency and can impact how the donation is received or processed.

- Avoid vague terms like “good condition” or “like new.” Use measurable descriptions, such as “no visible wear,” “slightly faded,” or “one small tear in the seam.”

Additional Details

- Indicate if the clothing is season-appropriate (e.g., winter coat, summer dress).

- If applicable, mention any unique features, such as brand names, special fabrics, or alterations made to the garment.

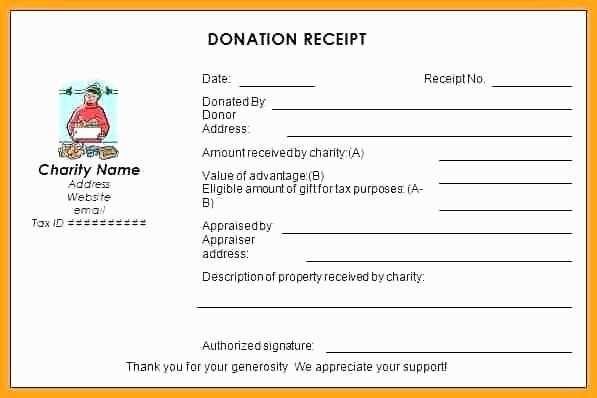

How to Include Donor Information on a Donation Letter

Donor information is key to making your donation letter valid and trustworthy. It establishes who is giving and helps your organization track and acknowledge the gift. Begin by clearly stating the donor’s full name, either as an individual or the organization name. Include the donor’s address to ensure the donation receipt is sent correctly and that tax deduction records are accurate.

Full Name and Contact Details

Make sure the donor’s full name appears at the top of the letter. This is particularly important if the donation is made by an individual or family. If it is a business or a group, include the official name and the name of a contact person. Add an email address and phone number to enable easy communication for confirmation or questions related to the donation.

Date of Donation

It is crucial to document the date the donation was made. Whether the donation occurred on the same day or earlier, specify the exact date so the donor can properly claim their deduction when filing taxes. This date must match the date of receipt in your records.

Including accurate donor information helps ensure transparency and proper documentation for both the donor and your nonprofit. Make it a priority to maintain this detail for each contribution.

Accurate documentation is key to maximizing the tax benefits for donors. The donation receipt letter must include the correct legal name of the nonprofit organization and its tax-exempt status. Make sure to verify the charity’s IRS 501(c)(3) status, which confirms its eligibility for tax-deductible donations.

Clearly describe the items or cash donated, along with their estimated fair market value (FMV). If the donation consists of goods, it’s helpful to note the general condition of the items. For example, “gently used clothing” or “new electronics” gives a clearer picture for both the donor and the IRS.

If the donor receives any goods or services in return for the donation, such as event tickets or promotional gifts, the value of those items must be deducted from the total donation amount. Include this information in the receipt to ensure transparency and proper tax calculations.

Don’t forget to include the date of donation and a statement confirming that no goods or services were provided in exchange for the contribution, unless applicable. This will further solidify the integrity of the letter for tax purposes.

Lastly, always provide a signed copy of the donation receipt, as the IRS requires this for claiming tax deductions. By following these steps, you can help ensure the donation letter is both accurate and compliant with tax requirements.

Adjust your receipt format based on the donation type and purpose to ensure accuracy and clarity. For clothing donations, specify the number of items donated, their condition (new, gently used, or worn), and if possible, provide a general description of the clothing (e.g., “5 coats, assorted sizes”). This helps donors remember what they contributed and ensures the donation is correctly documented for tax purposes.

For Monetary Donations

If a donor contributes money in exchange for clothing or goods, the receipt should clearly state the monetary value donated, including the date and amount. Indicate that no goods or services were provided in exchange for the donation to maintain transparency. Mention any applicable tax-exempt status of your organization to help donors understand their tax deductions.

Special Donations (Corporate or Large-Scale Donations)

In cases of corporate or bulk donations, the receipt should include the name of the donating company and the total value of the items or monetary contribution. It’s crucial to mention whether the donation is in-kind or a direct monetary gift. For bulk donations, consider listing categories of items (e.g., “100 boxes of clothing”) to clarify the scope of the donation.

Adjust the tone and format as needed for the donor’s level of involvement and the scale of the contribution, ensuring all necessary details are included for both legal and tax purposes.

Donation Receipt Letter Template

Ensure your donation receipt includes all necessary details to provide transparency and clarity to the donor. The letter should contain the following elements:

- Donor’s Name: Clearly state the name of the individual or organization who made the donation. This ensures they can easily identify the receipt.

- Date of Donation: Specify the exact date the donation was made. This is crucial for the donor’s tax records.

- Itemized List of Donations: Provide a detailed breakdown of the items donated. Include descriptions and estimated values where possible.

- Statement of Non-Monetary Contribution: Mention that the items donated are non-cash contributions, which helps the donor during tax filing.

- Organization Details: Include the name, address, and tax-exempt status of your organization. This adds legitimacy to the receipt.

- Signature of Authorized Representative: A signed letter from someone with authority within the organization will reinforce the validity of the receipt.

This format not only ensures that all necessary information is included but also helps to maintain proper records for tax purposes. Keep your receipts clear and to the point, making sure the donor feels acknowledged and appreciated for their contribution.