A clear and concise donation receipt form is key to maintaining transparency and trust with your donors. By providing a well-organized receipt, you help your supporters track their contributions for tax purposes and reinforce their commitment to your cause. This template streamlines the process, ensuring both parties have a reliable record of the donation.

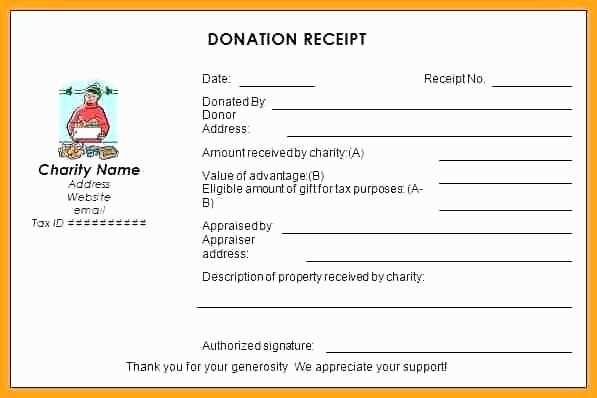

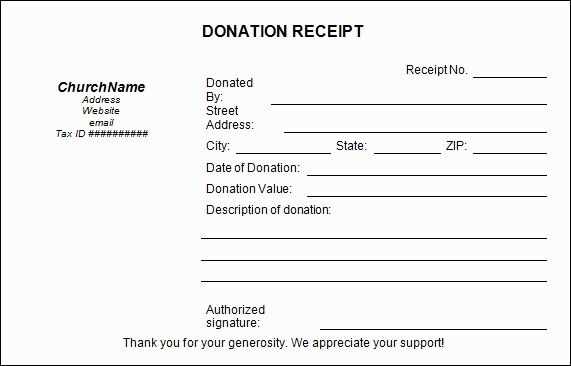

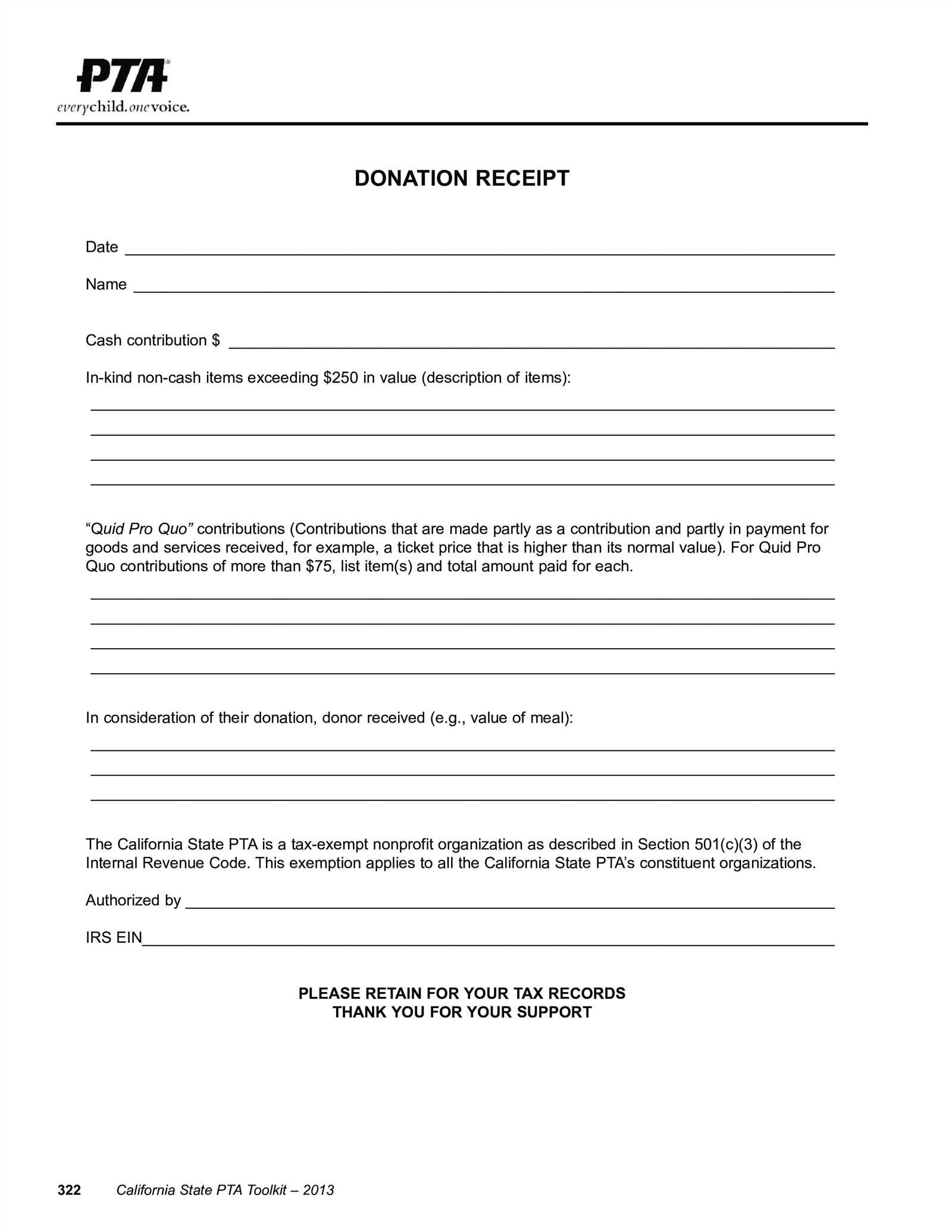

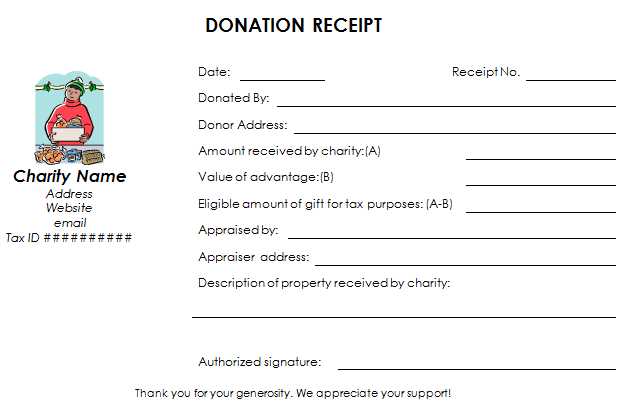

The form should include basic details such as the donor’s name, the amount donated, the date of the donation, and a brief description of the donation (cash, goods, or services). It’s also necessary to confirm if any goods or services were provided in exchange for the donation, as this impacts the tax deduction potential for the donor.

For ease of use, include a section for both the donor and the charity to sign and date the form. This ensures the document is legally valid and avoids future discrepancies. Keep the language simple and clear, focusing on the core information without unnecessary complexity.

Using this template not only simplifies administrative tasks but also strengthens relationships with your donors by showing professionalism and attention to detail in your operations. Customize the form as needed for your specific needs, and make sure to stay compliant with local tax regulations.