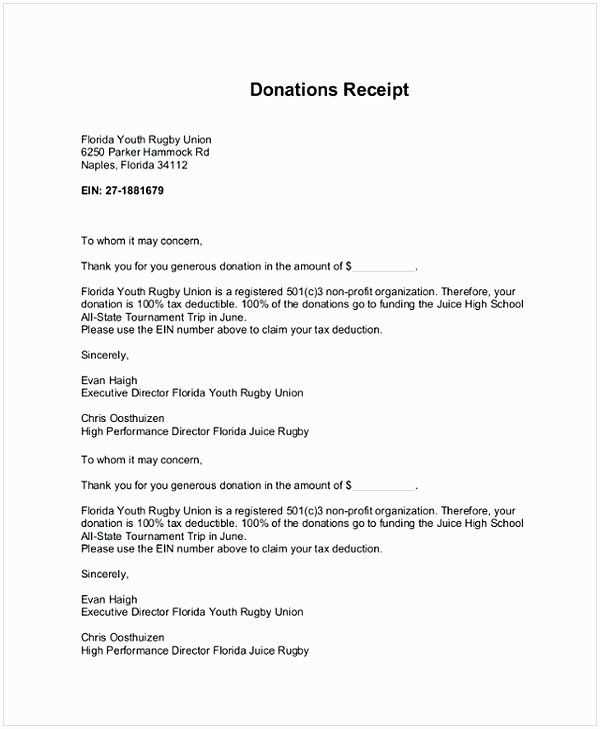

When donors make contributions to your non-profit organization, a donation receipt letter is a critical way to show appreciation and ensure compliance with tax regulations. Use this template to craft a letter that clearly acknowledges the donation, provides necessary details, and maintains a professional yet warm tone.

Start by thanking the donor for their support. Personalize the message by referencing the specific donation amount and purpose, ensuring the donor feels valued. Include the donor’s name, donation date, and tax-deductible status clearly in the letter. Be concise, yet precise in detailing the value of the donation, especially if the gift includes both monetary and non-monetary items.

Lastly, make sure the letter includes a statement confirming no goods or services were exchanged in return for the contribution, or note the fair market value of any goods or services received, if applicable. This is necessary for tax purposes. With these elements, your receipt letter will be both informative and appreciative, leaving donors with a positive impression of your non-profit’s professionalism.

Here is the revised version:

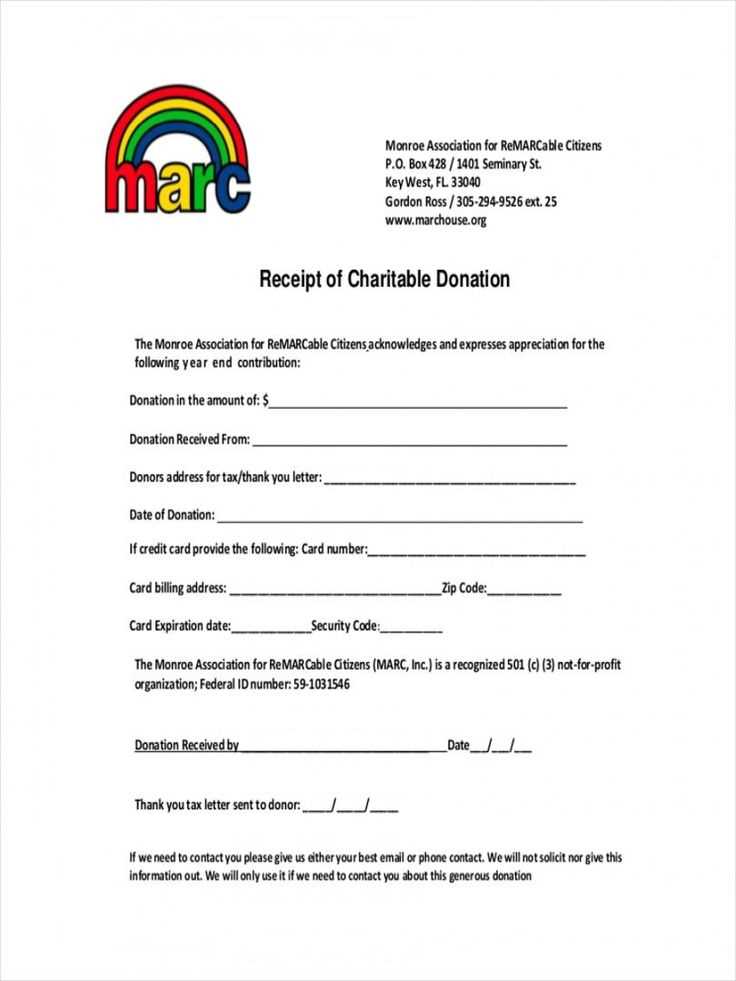

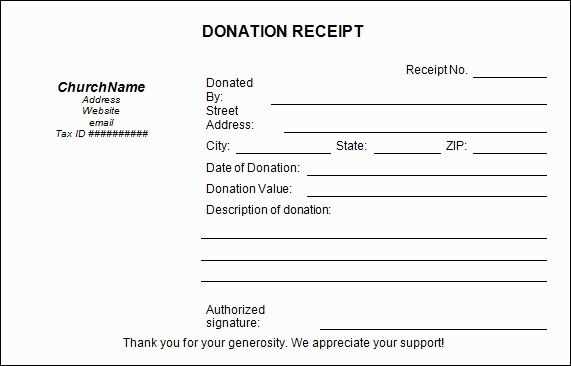

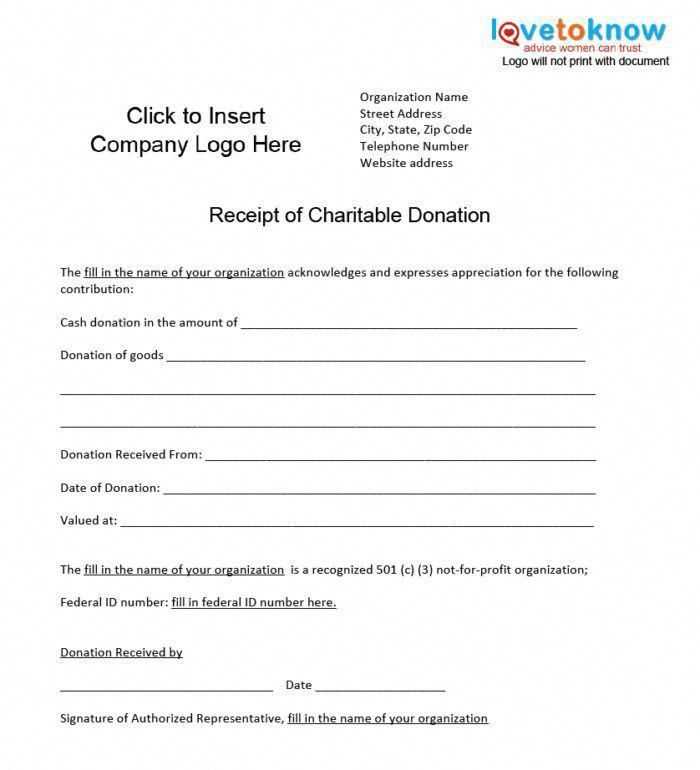

Make sure the donation receipt clearly includes the donor’s full name and address. This helps ensure that the donor can use the receipt for tax purposes without any issues. Add the name of your nonprofit organization along with its address and tax-exempt status. Always specify the amount of the donation and note if the donation was monetary or non-monetary.

If the donation is non-monetary, provide a brief description of the item(s) donated. However, avoid assigning a value to the donated goods–this should be left to the donor’s discretion. Also, mention if any goods or services were provided in exchange for the donation, such as a ticket to an event or a small gift. If this applies, include an estimate of the fair market value of these items to ensure the donor’s records are complete.

Keep the date of the donation clear, as this is crucial for tax reporting. Ensure the receipt is signed by an authorized representative of your nonprofit organization, and provide a clear contact point should the donor have any questions. This can be a phone number or email address.

Finally, ensure that the receipt does not imply any goods or services of significant value were exchanged for the donation unless clearly stated. A simple, accurate, and professional format is always best when providing this document.

- Nonprofit Donation Receipt Letter Template

To maintain accurate records and ensure compliance with tax regulations, include these elements in your nonprofit donation receipt letter:

Key Components of a Donation Receipt

Your donation receipt letter should contain the following:

- The nonprofit’s name, address, and EIN (Employer Identification Number).

- The donor’s name and address.

- The date of the donation and the amount donated (for cash donations) or a detailed description of the donated items or services.

- A statement about whether any goods or services were provided in exchange for the donation, and if so, the estimated value of those goods or services.

- A signature from an authorized person representing the nonprofit.

Sample Template

Dear [Donor’s Name],

Thank you for your generous donation of [amount or item description] on [date]. Your support is vital to our mission of [brief description of nonprofit mission].

This contribution is tax-deductible, and no goods or services were exchanged for it. Please keep this receipt for your tax records.

If you need further details, feel free to contact us at [contact information].

Thank you for your continued support!

Sincerely,

[Your Name]

[Your Title]

[Nonprofit Name]

[Nonprofit EIN]

Customize this template to suit your needs, and ensure that all information is accurate for both your nonprofit and the donor’s tax filings.

Ensure the receipt is clear and easy to read. Start by including the nonprofit’s name, address, and tax-exempt status. Clearly state the donation’s amount, whether it’s in cash, check, or in-kind. Provide a description of the donated items if applicable. Specify the date of the donation and the name of the donor. If the donation is a non-cash gift, include a description and estimated value of the donation.

Key Information to Include:

- Nonprofit organization name and contact information

- Tax-exempt status or EIN (Employer Identification Number)

- Donor’s full name

- Donation date

- Donation amount (or description of in-kind items)

- Whether the donation was a cash, check, or non-cash gift

- Signature or authorized representative’s signature

Formatting Tips:

- Make the donation amount stand out to avoid confusion.

- For non-cash donations, include a description of the items and their estimated value.

- Keep language simple and direct, avoiding legal or complicated terms.

Providing clear and accurate donation receipts helps ensure donors have the necessary documentation for tax deductions and supports transparency for the nonprofit organization.

Include the donor’s full name and address to ensure the receipt is properly attributed. If the donation is made by an organization, list its name and address as well. The donation amount must be clearly stated–whether monetary or non-monetary–and should reflect the exact contribution given, including a description for non-cash items.

The date of the donation is crucial for tax purposes. Make sure it’s clearly marked. If the donor receives any goods or services in exchange, this should be indicated with a fair market value assessment. Specify that no goods or services were provided if the donation is fully tax-deductible.

It’s important to include the name of the nonprofit organization and its tax-exempt status. The IRS requires this detail to validate the receipt. Also, provide contact information for the nonprofit to facilitate any follow-up queries from the donor.

For donations of $250 or more, a statement of acknowledgment should be present, confirming the receipt of the donation. This helps the donor claim tax deductions.

Avoid vague language when stating the donation amount. Be specific and list the exact figure donated. For example, instead of “a generous donation,” write “a donation of $500.” This provides clarity for both the donor and the nonprofit organization.

Double-check the date and ensure it matches the actual donation date. Mistakes in this section could create confusion for tax purposes.

Ensure the donor’s name is accurate and matches the legal name for tax reporting. Incorrect names can result in issues with the donor’s tax deductions.

Clearly state that the letter is a receipt for tax purposes, but avoid including any statements about the value of donated goods or services unless an official appraisal was done. This helps prevent misunderstandings about the donation’s tax deductibility.

Do not forget to mention if any goods or services were provided in exchange for the donation. This is a necessary part of the IRS guidelines and must be clearly stated. If no goods or services were exchanged, make that clear as well.

Avoid leaving out contact details for the nonprofit organization. Always include the nonprofit’s full name, address, phone number, and website. This gives the donor a way to reach out if they have questions or need further documentation.

Make sure your letter does not use informal or overly casual language. Professional tone is important for all official receipts, even if the donor is a regular contributor.

Remove Redundant Words While Maintaining Meaning and Grammar

To make your donation receipt letter clear and concise, eliminate any repetitive words that don’t add value. Focus on delivering the necessary information without over-explaining. For example, instead of saying “We greatly appreciate and thank you for your generous donation,” simply say “We appreciate your generous donation.” This keeps the message strong and avoids redundancy.

Check for phrases that repeat the same idea. For instance, “We are extremely grateful and deeply thankful” can be shortened to “We are grateful.” This approach ensures that each word serves a purpose and keeps the letter professional.

Pay attention to word choice. Opt for precision over wordiness. Instead of writing “We would like to inform you that we have received your donation,” say “We have received your donation.” It’s more direct and to the point.

By reviewing your letter for excess verbiage and rephrasing repetitive structures, you enhance readability and create a more impactful message. Keep your communication straightforward to convey gratitude clearly without unnecessary fluff.