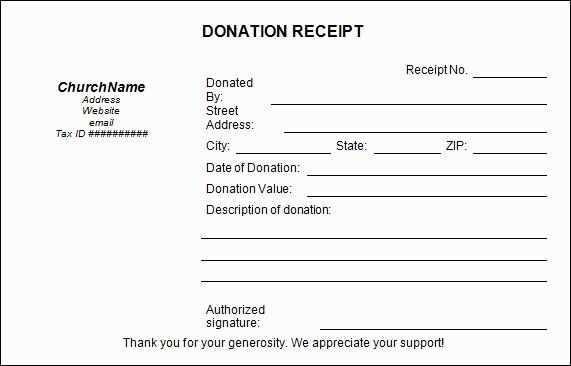

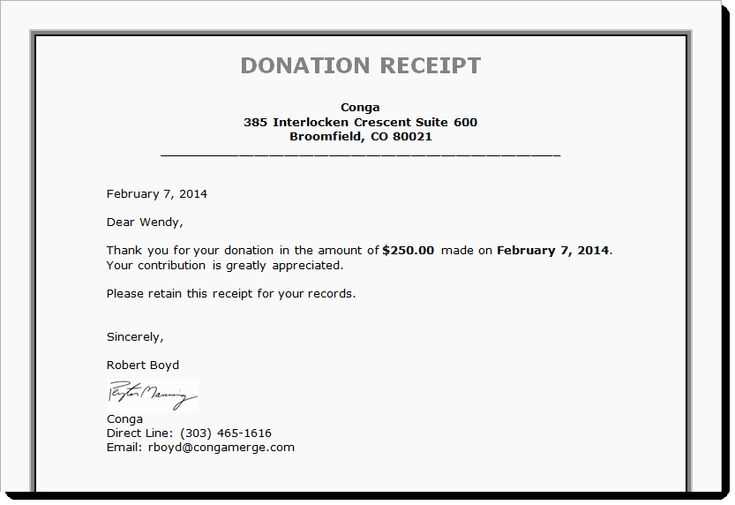

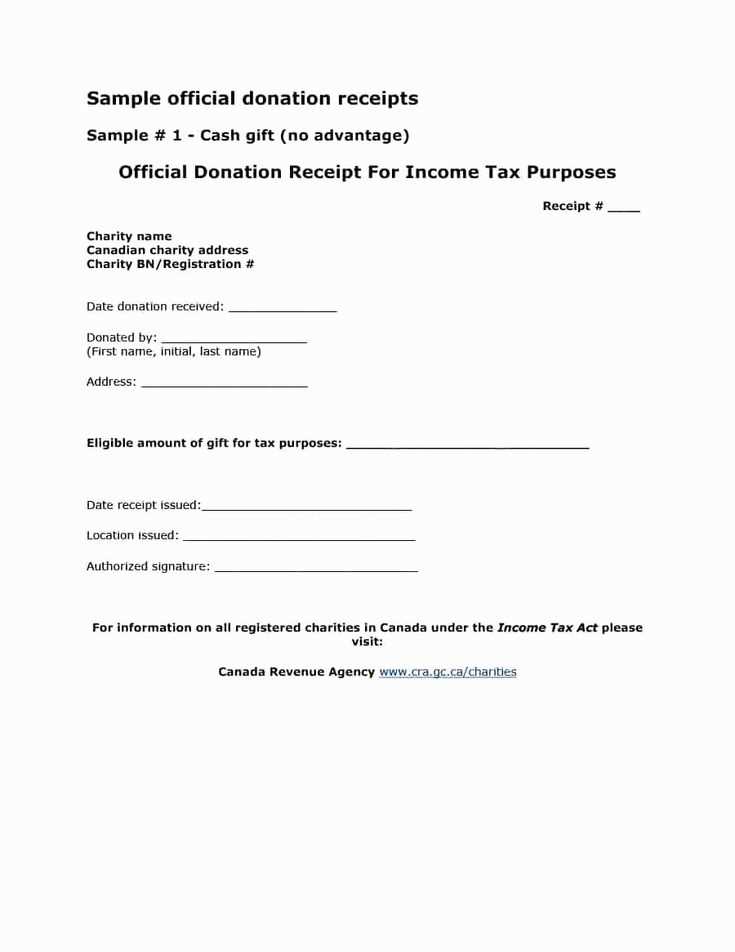

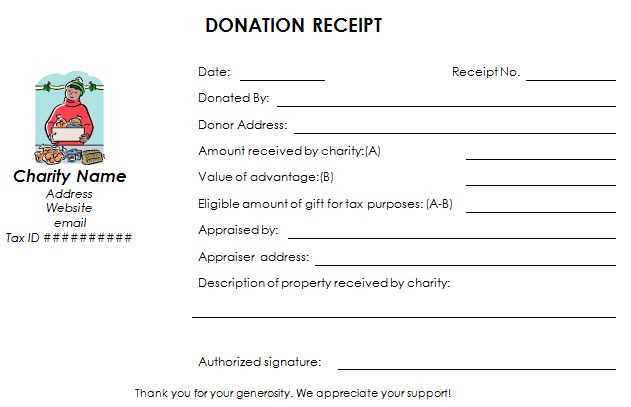

Use this non-profit donation receipt template to provide clear and professional documentation for donors. It helps maintain transparency and supports both your organization’s record-keeping and the donor’s tax deduction claims. Customize the template with your organization’s name, address, and relevant details, ensuring each donation is properly acknowledged.

Start by including the donor’s name, the amount donated, and the date of the donation. For non-cash donations, describe the items and their fair market value. If your organization is registered with tax authorities, remember to include the required legal information, such as your tax-exempt status and tax ID number.

Lastly, make sure to sign the receipt personally or have an authorized person from your team sign it. Keep copies of all receipts for your records and provide one to the donor as confirmation of their generous contribution. A well-organized donation receipt system builds trust with your supporters and ensures compliance with legal requirements.

Here is the revised version with minimal repetition:

Ensure that the receipt clearly states the donor’s name, the donation amount, and the date of the donation. Include a unique receipt number for easy reference. Specify the organization’s name and its tax-exempt status, along with the contact information. If applicable, state whether the donation was monetary or in-kind, and if any goods or services were provided in exchange.

For in-kind donations, provide a description of the donated items rather than assigning a value. If you do value donations, ensure the value is fair and accurate. Acknowledge the donor’s generosity and thank them for their support. Include a statement about tax-deductibility if applicable, and mention that no goods or services were provided in exchange for the donation, if true.

To make the process smoother, have a standardized format that can be easily customized. This will save time for both the organization and the donor, especially during peak donation periods. Keep all records organized and accessible for future reference or audits.

- Non-profit Donation Receipt Template Guide

Begin by including the name and contact information of your non-profit organization at the top of the receipt. This provides the donor with clear details for any future reference or inquiries.

Next, list the donor’s name and address. Ensure the information is accurate to avoid any confusion when it comes to tax reporting or acknowledgment purposes.

Include the date of the donation, as well as the amount donated. If the donation is monetary, specify the exact sum. If the donation consists of goods or services, describe them and estimate their fair market value.

Clearly state whether the donation was tax-deductible. Include a statement that confirms no goods or services were provided in exchange for the donation, or if there were, specify the value of those goods or services.

Finally, include your organization’s tax identification number (TIN). This is important for the donor’s tax records, ensuring the donation is properly accounted for in their tax filings.

Begin with clear information at the top of the receipt, such as your non-profit’s name, address, and contact details. Include a section for the donor’s name and address. These details are necessary for tax records and ensure accurate documentation.

Specify the donation amount, and provide a breakdown if applicable (e.g., cash, check, or in-kind donation). If it’s a recurring donation, mention the frequency and total contribution for the year.

Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This is a requirement for tax-exempt status under IRS guidelines.

Incorporate a donation receipt number for organizational tracking and reference. This helps you keep records of donations and can be useful for both the donor and your organization’s accounting purposes.

End with a signature from an authorized person within the organization, along with the date of the donation. This serves as proof of the transaction and adds legitimacy to the receipt.

| Receipt Information | Details |

|---|---|

| Non-Profit Name | [Your Non-profit Name] |

| Non-Profit Address | [Your Address] |

| Donor Name | [Donor Name] |

| Donation Amount | [Donation Amount] |

| Receipt Number | [Unique Number] |

| Date of Donation | [Date] |

| Signature | [Authorized Signature] |

Include the donor’s name and address at the top of the acknowledgment. This ensures the receipt is personalized and easy to reference in their records.

Clearly state the date of the donation. This helps the donor track their contributions and serves as proof for tax purposes.

Provide a description of the donated item or amount. If it’s a monetary donation, specify the amount; for in-kind donations, describe the items received.

Include your organization’s name, address, and tax identification number. This verifies the legitimacy of the donation and is necessary for the donor’s records.

If any goods or services were provided in exchange for the donation, list them and provide an estimate of their value. This ensures transparency and meets IRS requirements.

State whether the donation is tax-deductible. Include a statement such as “No goods or services were provided in exchange for this donation” if applicable.

Include your signature or the name of an authorized representative. This adds a personal touch and confirms the authenticity of the acknowledgment.

Focus on clarity and accuracy. Ensure all relevant details are visible, such as donor information, donation amount, date, and organization details. Omitting any of these can lead to confusion and lack of proper documentation for the donor.

Avoid clutter. Too much information in a small space can make it difficult for the recipient to read or understand. Stick to the key points and present them in a clean, organized layout.

Don’t forget to include a clear description of the donation type. Whether it’s a cash donation, in-kind, or a specific cause, always provide a brief explanation to avoid ambiguity.

Ensure the donation amount is displayed clearly. Mistakes in this section can lead to misunderstandings or disputes. Use bold text or a larger font for the amount to make it stand out.

Don’t leave out tax-exempt status. Donors need this information for their tax filings. Clearly state whether your organization is tax-exempt and include any relevant IRS or registration numbers, if applicable.

Always double-check the formatting. A poorly aligned or hard-to-read receipt can undermine the professionalism of your organization. Consistent font sizes, well-organized sections, and properly aligned text are key to creating a positive impression.

| Mistake | Why to Avoid | How to Fix |

|---|---|---|

| Missing Donation Details | Leads to confusion and lack of proper documentation. | Include donor name, donation amount, and the date of donation. |

| Overcrowded Layout | Can overwhelm the recipient and make the receipt difficult to read. | Use white space and organize information clearly. |

| Unclear Donation Type | Creates uncertainty for both the donor and organization. | Provide a short description of the donation type (cash, in-kind, etc.). |

| Unclear Donation Amount | Could lead to disputes over the actual amount donated. | Use bold or larger text for the donation amount for better visibility. |

| Missing Tax-Exempt Information | Donors need this for tax purposes. | Clearly state your tax-exempt status and any relevant IRS registration numbers. |

| Poor Formatting | Can detract from the professional image of your organization. | Ensure consistent fonts, aligned text, and organized sections. |

For cash donations, simply include the donation amount and the date. Specify that no goods or services were exchanged in return for the gift to ensure it meets IRS guidelines for tax deduction purposes.

For in-kind donations, detail the items received along with their estimated value. Ensure you provide a brief description of the donated goods and indicate if any services were exchanged. The donor is responsible for determining the value, but your receipt should state that you did not appraise the items.

If the donation is a recurring one, include the frequency and start date of the contribution, as well as any end date, if applicable. Clearly note the total amount donated during the specified period to simplify record-keeping.

For volunteer hours, describe the number of hours donated and the associated hourly value, if applicable. Some organizations assign a dollar value to volunteer work, so make sure to outline that value on the receipt to support any claims made by the donor for tax purposes.

Non-profit organizations must comply with specific legal requirements when issuing donation receipts. These requirements ensure donors have proper documentation for tax purposes and that the organization adheres to federal and state laws.

What to Include in a Donation Receipt

- Organization’s name and tax-exempt status, including IRS determination letter number if applicable.

- Donor’s name and the donation amount.

- Date of the donation.

- Statement that no goods or services were provided in exchange for the donation (if applicable).

- Description of any goods or services provided, if any, and their estimated value.

- Signature of an authorized representative of the non-profit.

IRS Guidelines for Acknowledging Donations

- For donations of $250 or more, the IRS requires a written acknowledgment from the organization.

- If goods or services were provided, the receipt must state their fair market value.

- For non-cash donations exceeding $500, donors must complete IRS Form 8283.

Failure to meet these requirements can result in issues for both the donor and the non-profit, including the inability to claim tax deductions. Make sure to review the latest IRS guidelines to stay compliant.

Organize donation records by using clear categories and tags. This approach helps locate information quickly and ensures consistency across records.

- Use cloud-based storage platforms to back up all donation data. These platforms offer security and accessibility from any location.

- Ensure that all receipts include key details such as donor name, donation amount, date, and purpose of the donation. This information is crucial for both record-keeping and compliance purposes.

- Label and file receipts in chronological order to streamline the retrieval process during audits or tax preparation.

- Implement a naming convention for digital files that includes relevant keywords such as the donor’s name and the donation date. This will help in fast searches and avoid confusion.

- Set up automated reminders for updating records periodically, especially after significant donations or end-of-year tax filing deadlines.

- Use software with built-in encryption to protect sensitive donor information from unauthorized access.

- Regularly back up donation records to ensure no data loss in case of system failures or technical issues.

- Provide secure access to records based on roles. Limit access to sensitive information to only those who need it to maintain privacy and security.

- Track donation trends over time to gain insights into donor behavior and optimize future campaigns.

Non-profit Donation Receipt Template

To create a donation receipt for a non-profit, follow these key steps:

- Include the name and contact details of the non-profit organization.

- State the donor’s name and address clearly.

- Specify the date of the donation and the amount contributed.

- Include a description of the donated items, if applicable (e.g., in-kind donations).

- Clearly state whether the donation was monetary or goods, and include the fair market value for in-kind donations.

- Provide a statement indicating if the donation is tax-deductible (e.g., “This donation is tax-deductible to the extent allowed by law.”).

- Thank the donor for their contribution and support.

- Ensure the receipt includes the authorized signature of the non-profit representative.

Additional Considerations

- Make the receipt easy to read and professionally formatted.

- Ensure the donor’s details are accurately captured to avoid discrepancies.

- For larger donations, consider providing additional documentation for tax purposes.