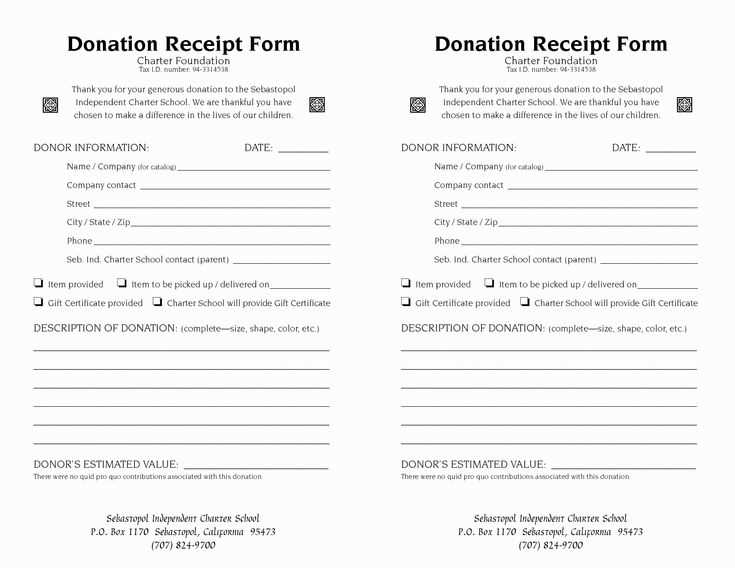

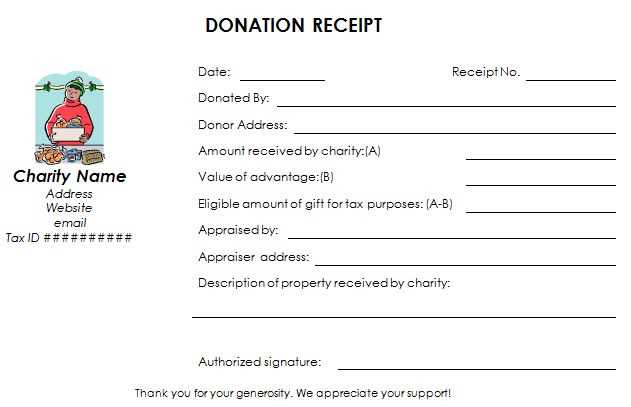

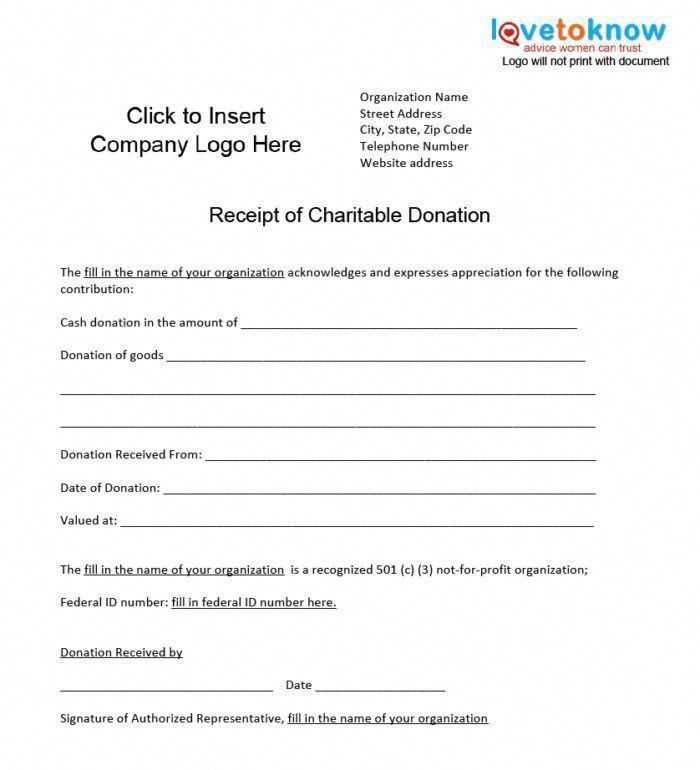

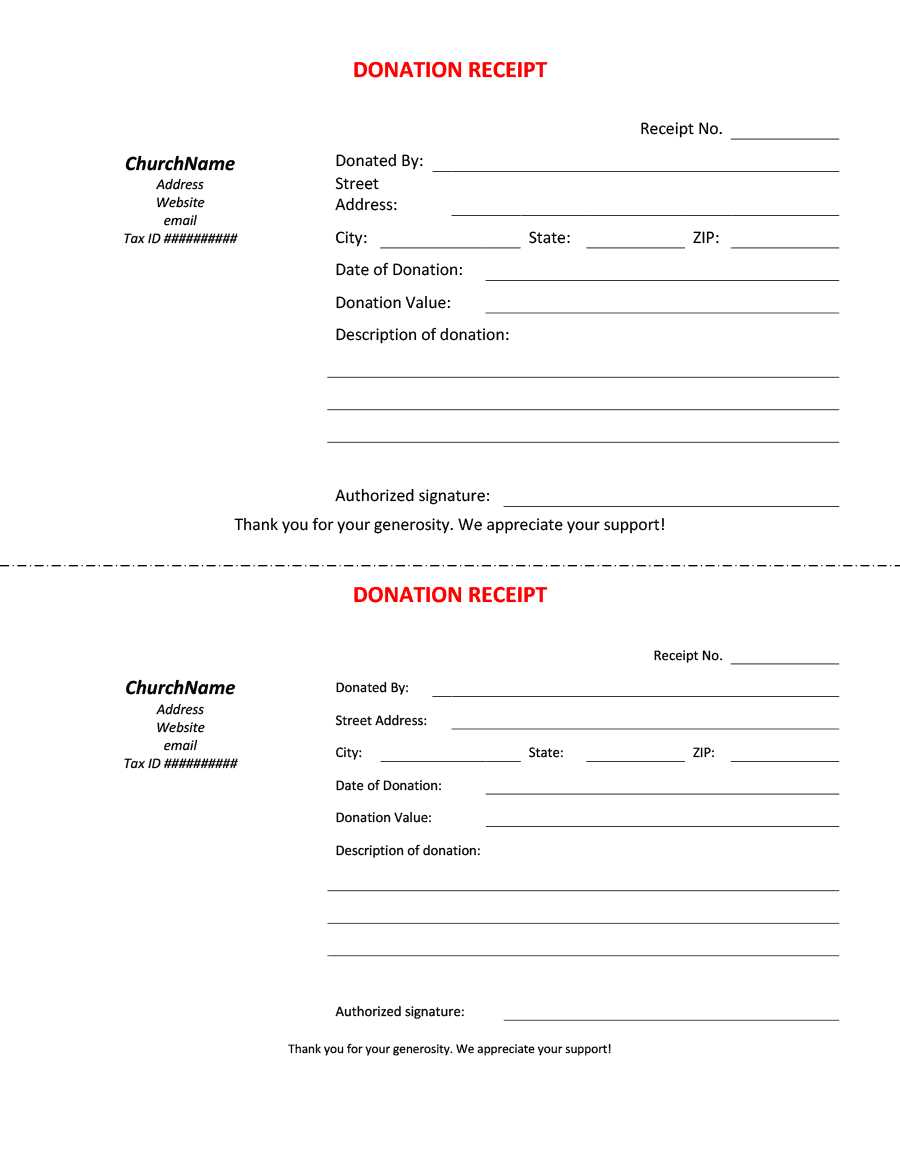

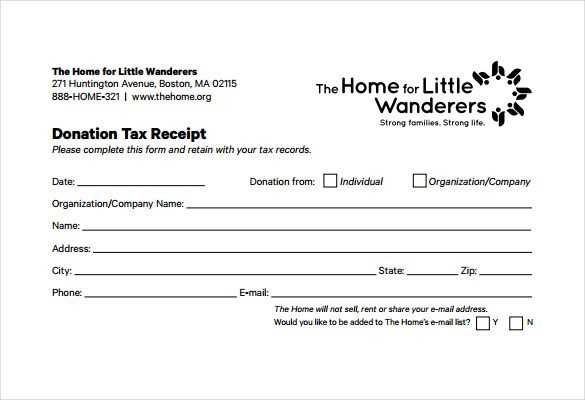

Make your donation receipts clear and simple. Provide your donors with a receipt that includes necessary information for tax purposes and proves their contribution. The key elements to include are the name of the nonprofit, the donation amount, the date, and a statement about whether the donation was made in cash or in-kind.

Be sure to acknowledge the donor’s generosity. Express gratitude in a straightforward way. You don’t need to overcomplicate it. A brief thank you, along with their contact information and the nonprofit’s details, will ensure they feel valued and appreciated.

Stay compliant with tax regulations. Include a disclaimer that confirms no goods or services were provided in exchange for the donation, or specify what was given in return. This ensures your receipt aligns with IRS guidelines for tax deductions.

Here are the corrected lines:

First, ensure the donation amount is clearly stated with the correct currency symbol. For example, instead of writing “donated $50,” use “Amount Donated: $50.” This avoids confusion and enhances readability.

Next, add the donor’s full name and address. Including the address ensures that the donation receipt is legally valid for tax purposes. For instance, “Donor Name: John Doe, Address: 123 Main St, City, State, ZIP.” This helps keep track of donations and supports transparency.

Also, specify the donation date. It’s helpful to include the exact date the contribution was made. You could write, “Date of Donation: January 15, 2025.” This ensures accuracy and aligns with official records.

Don’t forget to note the non-profit organization’s details, such as name, address, and tax identification number. “Organization Name: ABC Charity, Address: 456 Charity Blvd, City, State, ZIP, Tax ID: 12-3456789.” This gives the receipt legitimacy and ensures the donor receives the proper tax deduction.

Lastly, add a statement acknowledging the donation was made without any goods or services exchanged. For example, “No goods or services were provided in exchange for this donation.” This clarifies the nature of the donation for tax purposes.

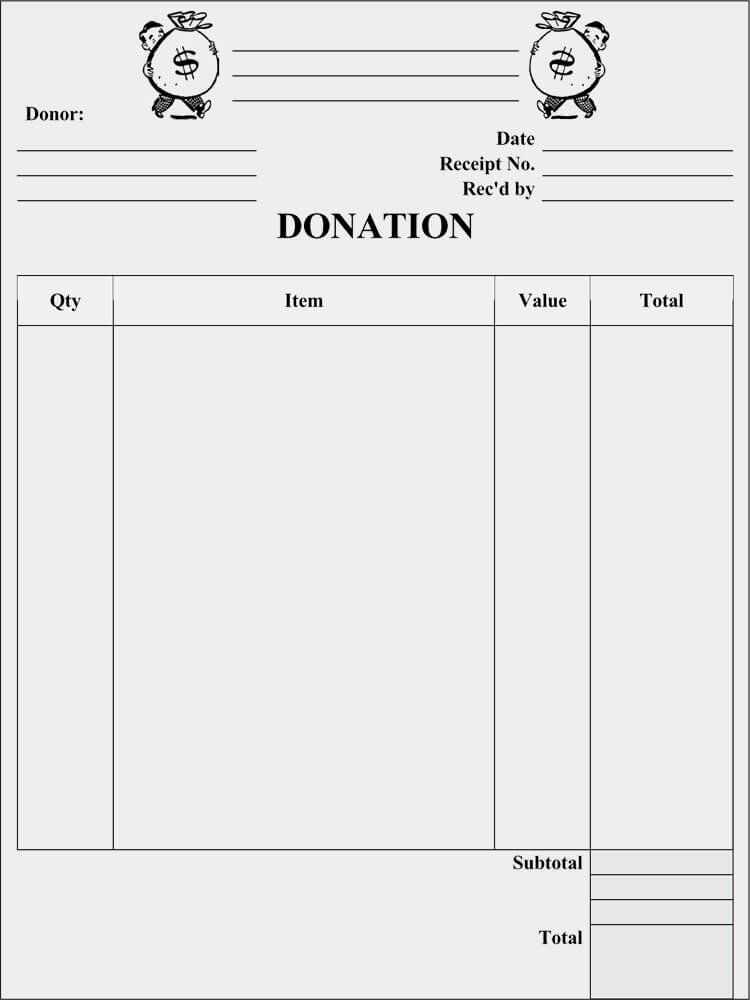

Non-Profit Donation Receipt Template

How to Format a Donation Acknowledgment

Required Legal Details for Receipts

Customizing a Template for Various Donations

What to Include for Tax Deductibility

Common Errors to Avoid in Donation Receipts

How to Automate Receipt Creation

Begin by ensuring your donation receipt template contains specific elements. Each receipt should clearly indicate the donor’s name, the organization’s name, the donation amount, and the date of the contribution. The receipt must also include a statement confirming whether the donor received any goods or services in exchange for their donation. If no goods or services were exchanged, include a phrase like “no goods or services were provided in exchange for this contribution.”

How to Format a Donation Acknowledgment

For a clear acknowledgment, use a straightforward and readable layout. Start with the donor’s name, followed by the organization’s details, including its tax-exempt status. Be concise in describing the donation amount and, if applicable, include any relevant information about the goods or services received. Lastly, end the receipt with the signature or official seal of the authorized person within the organization.

Required Legal Details for Receipts

Ensure compliance with tax laws by including essential legal details in your receipt. Clearly state the organization’s full name and its 501(c)(3) tax-exempt status. Donors should have a statement confirming whether any benefits were provided in exchange for the donation. Additionally, for donations of $250 or more, include the exact amount of the contribution and a statement about the goods or services received.

Customizing a donation receipt template helps maintain clarity while accommodating different types of donations. For non-cash donations, include a detailed description of the items received and estimate their value if applicable. When receiving stock or property, include specifics on the market value of the donation at the time it was made.

For tax deductibility, the receipt should list the organization’s tax-exempt status and confirm that the donation qualifies as tax-deductible. This helps donors when they file their taxes. Be sure the receipt is clear, accurate, and formatted in a way that can be easily referenced during tax season.

Avoid common errors like omitting the donor’s name or providing incorrect donation amounts. Also, make sure to avoid missing signatures or failing to mention the lack of goods and services exchanged, especially if no benefits were given. Double-check all entries to ensure accuracy before issuing receipts.

Automating the receipt creation process can save time and reduce errors. Use donation management software or an automated system that generates receipts based on donor information. This system should include all necessary fields, such as donation amounts, donor names, and tax-exempt status, and generate receipts promptly after a contribution is made.