A well-structured donation receipt can make the difference in maintaining trust with donors and ensuring smooth financial operations for your community theatre. Use a simple, clear format that outlines the essential information donors need, while maintaining compliance with tax regulations.

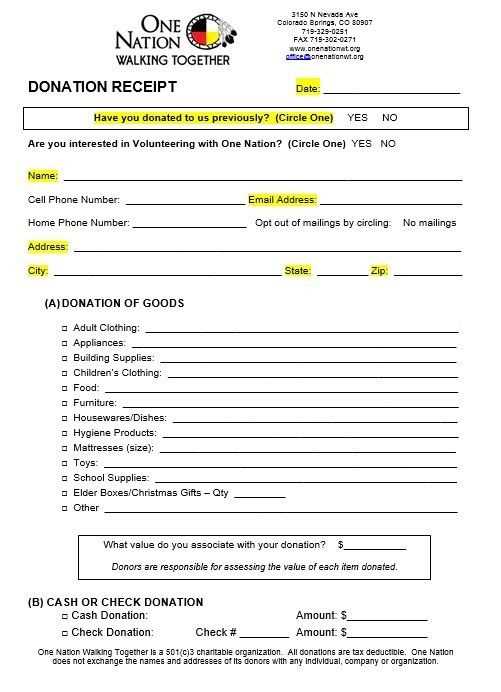

Start with the basic details: donor’s name, address, donation amount, and the date of the contribution. Clearly state whether the donation was monetary or material. If you received goods or services, include a description along with an estimated value to avoid any confusion about tax-deductibility.

Incorporate a statement affirming that no goods or services were provided in exchange for the donation, which is a common requirement for tax purposes. If any benefits were provided (such as event tickets), specify their value to maintain transparency.

Consider adding a thank-you note, which helps build long-term relationships with supporters. A personal touch can turn a one-time donor into a loyal patron of your theatre’s mission. End the receipt with your theatre’s contact details and the tax-exempt status, giving donors confidence in their contribution.

Here’s an improved version where repeated words are reduced to 2-3 times while maintaining the meaning:

Begin by clearly identifying the donor’s name, address, and donation amount. Acknowledge their contribution with a brief but warm statement, noting how their support impacts your theater’s mission. Include the specific donation type, such as monetary or in-kind, and make sure the date is prominently displayed.

For monetary donations, specify the amount and note whether it’s tax-deductible, based on your nonprofit status. For non-cash donations, provide a description of the item’s value, though donors are responsible for appraising its worth.

Ensure compliance with local regulations by including any required disclaimers, such as a statement that no goods or services were provided in exchange for the gift. This prevents any confusion and confirms your organization’s adherence to tax laws.

Final Steps:

Wrap up with a sincere thank you message and offer additional ways for the donor to stay engaged, like attending performances or joining a donor program. Keep the tone warm and appreciative, making donors feel valued and involved in your community theater’s growth.

- Non Profit Donation Receipt Template for Community Theatre

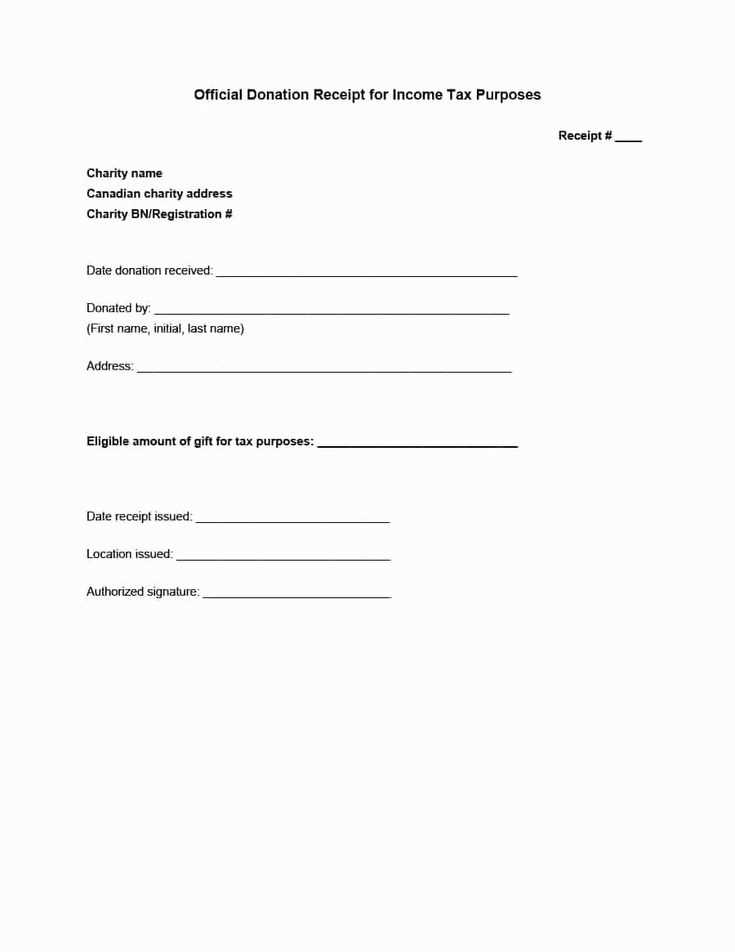

For a community theatre, providing a clear and accurate donation receipt is crucial for both tax purposes and maintaining donor relationships. A well-structured receipt template ensures transparency and helps donors claim tax deductions for their contributions. Below is a template outline tailored for a non-profit community theatre organization:

1. Theatre Name and Logo

At the top of the receipt, include the full name of your community theatre and its logo. This reinforces your theatre’s identity and makes the receipt easily recognizable.

2. Donation Acknowledgment

Clearly state that the donation has been received, such as “This is to acknowledge your donation to [Theatre Name].” Include the date the donation was received for accurate record-keeping.

3. Donor Information

Include the donor’s full name, address, and contact details. This ensures the receipt is personalized and can be used for any future communications or tax filings.

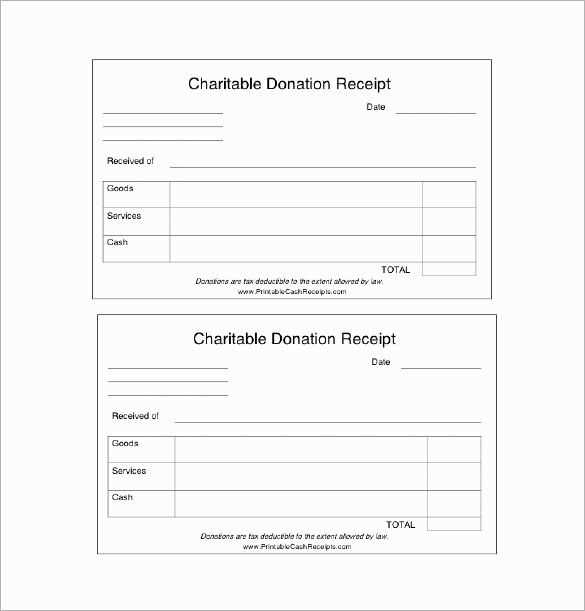

4. Donation Amount and Description

List the exact amount donated. For non-cash donations, provide a description of the donated items and their estimated value. If the donation is monetary, simply state the dollar amount.

5. Acknowledgment of No Goods or Services

If no goods or services were provided in exchange for the donation, include the following: “No goods or services were provided in return for this donation.” This is a key point for IRS compliance.

6. Theatre’s Non-Profit Status

State your theatre’s tax-exempt status, including the organization’s federal tax ID number. Example: “We are a 501(c)(3) tax-exempt organization, and your donation is tax-deductible as allowed by law.”

7. Authorized Signature

Include a space for the signature of an authorized representative from the theatre. This adds a personal touch and shows that the donation has been officially recognized.

8. Additional Information (Optional)

You may also want to add a thank-you note or include information on how the donation will be used in your theatre’s programs. It builds goodwill and keeps donors informed about the impact of their contributions.

With this template, your community theatre will be able to provide donors with a professional, compliant donation receipt that reflects the impact of their generosity.

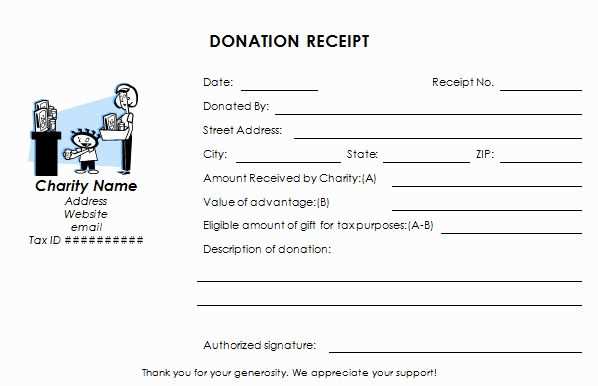

Begin by including the organization’s name, address, and contact information at the top of the receipt. This ensures that the donor knows who issued the receipt and how to reach you for future inquiries. Next, include the donor’s name and address to confirm who made the contribution. It’s also helpful to have the donor’s contact number or email if available.

Include Donation Details

- Date: Clearly state the date the donation was received. This helps with both your records and the donor’s tax filing.

- Amount: Specify the exact monetary value of the donation. If the donation is in kind (e.g., goods or services), provide a brief description.

- Payment Method: Note how the donation was made (cash, check, online, etc.). If the donor paid by check, include the check number for reference.

- Purpose of Donation: If applicable, mention if the donation is designated for a specific project or general fund.

Sign and Authenticate

Include a signature line at the bottom of the receipt. The person authorized to issue receipts should sign, confirming that the donation was received. It’s also a good idea to include your organization’s tax-exempt status, if applicable, to reassure donors about the legitimacy of their tax-deductible contributions.

Remember to keep copies of all receipts issued. This will ensure your records are organized and that you can provide donors with any needed documentation for tax purposes.

Ensure the receipt includes the name of your nonprofit organization. This should match the legal name registered with the IRS. A clear description of the donation, including the amount and type (cash, check, or in-kind), is essential for tax records. If applicable, note any goods or services received in exchange for the donation, as this affects the deductible amount.

Include the date of the donation. This will confirm the timeframe for the donor’s tax year. For in-kind donations, provide a description of the donated items along with their estimated fair market value. Avoid assigning a value to non-cash donations; instead, leave this to the donor’s discretion unless you have an appraisal.

State the nonprofit’s tax-exempt status. A statement like “Tax-exempt under section 501(c)(3) of the Internal Revenue Code” can clarify this for donors. Make sure to list your organization’s EIN (Employer Identification Number) to verify your nonprofit status to the IRS.

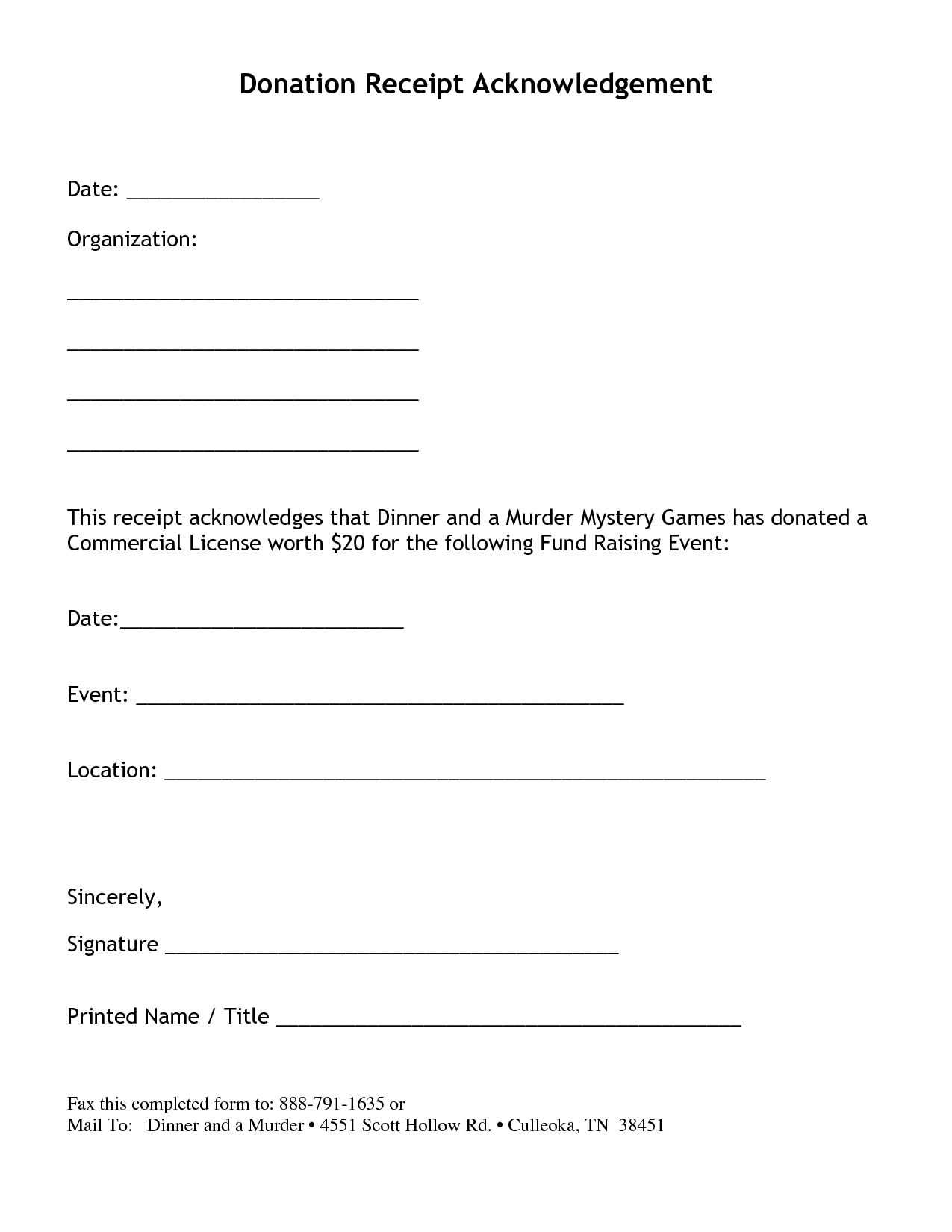

For larger donations or those with specific details, issue a separate acknowledgment letter. This letter can provide more in-depth information about the donation’s value, especially if it exceeds a certain threshold (e.g., $250) or if goods or services were exchanged. Donors can use this letter to substantiate their tax deduction.

Choose colors and fonts that represent your theatre’s identity. The tone of your brand should be clear in every visual element. For example, if your theatre has a classic, elegant vibe, opt for muted tones and serif fonts. For a more contemporary feel, use vibrant colors and sans-serif fonts. Match the design style with the artistic focus of your performances.

Incorporate your logo and other brand elements consistently. This helps create familiarity and reinforces the theatre’s image. Keep the layout clean and easy to navigate. A clutter-free template ensures donors can find what they need without distraction.

Use imagery that aligns with your theatre’s productions. Select photos or icons that showcase the art and performances, but avoid overloading the template with too many images. Balance is key in keeping the design professional and focused.

Make sure your template works across devices. Many donors may access their receipts on mobile phones, so a responsive design is necessary. Check the layout and font sizes to ensure readability on smaller screens.

Lastly, align your tone with your theatre’s mission. If your theatre is known for being quirky and avant-garde, use unconventional design choices. If it’s more formal, stick with a traditional layout. Keep the message personal but professional, with clear details about the donation amount, date, and purpose.

Nonprofit organizations must adhere to specific legal guidelines when issuing donation receipts. These receipts are not only a way to acknowledge contributions, but they also ensure that donors can claim tax deductions. Every nonprofit should be aware of the minimum details required for valid receipts.

Key Information on Donation Receipts

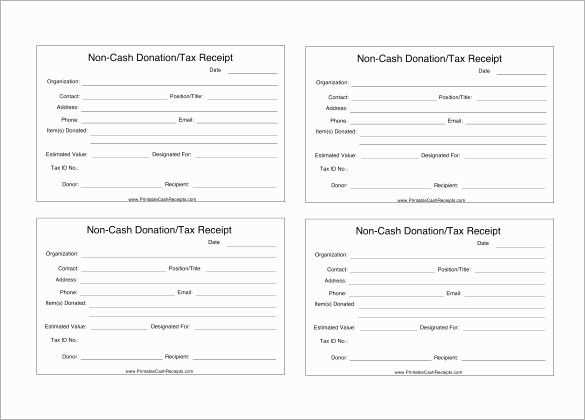

Receipt requirements vary by jurisdiction, but at a minimum, they should include the following: the nonprofit’s legal name, address, and tax-exempt status, the donor’s name, the date of the contribution, and a clear description of the donation (whether cash or non-cash). For non-cash donations, an estimate of the fair market value should be included, though the donor is responsible for valuing these items.

Special Considerations for Non-Cash Donations

When a donor provides goods or services, the receipt must reflect this. Nonprofits cannot assign a value to goods donated, but they can confirm the items received. The donor is responsible for determining the fair market value. Additionally, if the donor receives something in return (like a ticket to an event), the receipt must specify the value of the goods or services provided, and only the remaining amount can be considered a deductible donation.

When tailoring donation receipts for theatre contributions, it’s key to reflect the nature of each donation type. Different types of donations require specific details to ensure both transparency and proper tax documentation for donors. Below are the steps to customize receipts for various donation categories.

1. Monetary Donations

For cash and credit card donations, receipts should include the amount given, the date of the donation, and a clear statement that no goods or services were provided in exchange for the contribution. It’s crucial to specify whether the donation is unrestricted or designated for a particular fund or project within the theatre.

| Item | Details |

|---|---|

| Amount | $500 |

| Date | January 15, 2025 |

| Donation Type | Unrestricted Monetary Donation |

| Tax Deduction Note | No goods or services were provided in exchange for this donation. |

2. In-Kind Donations

For non-cash donations such as costumes, props, or equipment, include a detailed description of the item(s) donated and their estimated fair market value. It’s also helpful to include the donor’s acknowledgment that the value is an estimate unless a professional appraisal has been done.

| Item | Details |

|---|---|

| Donation Description | Costumes (10 pieces) |

| Estimated Value | $800 |

| Donation Date | January 20, 2025 |

| Tax Deduction Note | The donor has provided an estimated value of $800 for the items donated. |

3. Pledged Donations

If a donor commits to a future contribution, such as a monthly gift or a multi-year pledge, the receipt should specify the total pledge amount, the schedule for the donations, and the first donation received. Each subsequent payment should be documented with a separate receipt.

| Item | Details |

|---|---|

| Pledge Amount | $5,000 |

| Payment Schedule | Monthly payments of $250 |

| First Payment Date | January 25, 2025 |

| Tax Deduction Note | The first payment of $250 has been received; subsequent payments will be documented separately. |

To ensure supporters receive their donation receipts quickly, set up an automated system that generates receipts immediately after each donation is made. This reduces delays and prevents backlogs. Use donation platforms or accounting software that integrate receipt generation, so they can be sent directly to the donor’s email or physical address right after the transaction.

- For online donations, use automatic email receipts that are triggered immediately after the donation is processed. Ensure that the email includes all the necessary details, such as the donor’s name, donation amount, date, and a tax-deductible statement.

- If you handle physical receipts, designate a team member or volunteer to manage the printing and mailing process. Prioritize this task to minimize the time between the donation and receipt distribution.

- Consider batch processing receipts for donations made during events or campaigns. Set a deadline for these processes (e.g., 48 hours after the event) and use mail merge to efficiently create and send multiple receipts at once.

Stay organized with a tracking system to confirm receipt delivery. For email receipts, check open rates and follow up with any donors who may have missed their receipt. For physical receipts, track the mailing dates to ensure prompt delivery.

Clear and swift receipt distribution boosts donor confidence and helps maintain strong relationships with your supporters. Keep communication lines open and always be prepared to assist with any issues or questions regarding receipts.

Donation Receipt Template for Community Theatre

Ensure your donation receipts are clear and meet nonprofit standards. This helps maintain transparency with your supporters and keeps you compliant with regulations. A well-structured receipt provides a record for donors and for tax reporting. Here’s a template to get started:

Key Information to Include

- Organization Name: Clearly state your theatre’s name.

- Donor Information: Include the donor’s name, address, and contact details.

- Donation Details: Specify the amount, type of donation (monetary or in-kind), and date of contribution.

- Tax Status: Indicate your organization’s tax-exempt status, such as 501(c)(3) in the U.S.

- Value of Goods/Services: If applicable, mention the value of any goods or services provided in exchange for the donation (if there was any). Ensure the donor is aware of the value of their tax-deductible donation.

- Receipt Number: Include a unique receipt number for record-keeping.

Template Example

- Organization Name: [Your Theatre’s Name]

- Donor Name: [Donor’s Full Name]

- Donation Amount: $[Amount Donated]

- Date of Donation: [Date]

- Donation Type: [Monetary/In-kind]

- Tax-Exempt Status: [501(c)(3) Tax-Exempt Status]

- Goods/Services Received: [Value, if applicable]

- Receipt Number: [Unique Receipt Number]

Provide your donors with a copy of the receipt for their records and future tax filing. This template ensures you meet nonprofit accounting standards while keeping your community theatre’s operations smooth and transparent.