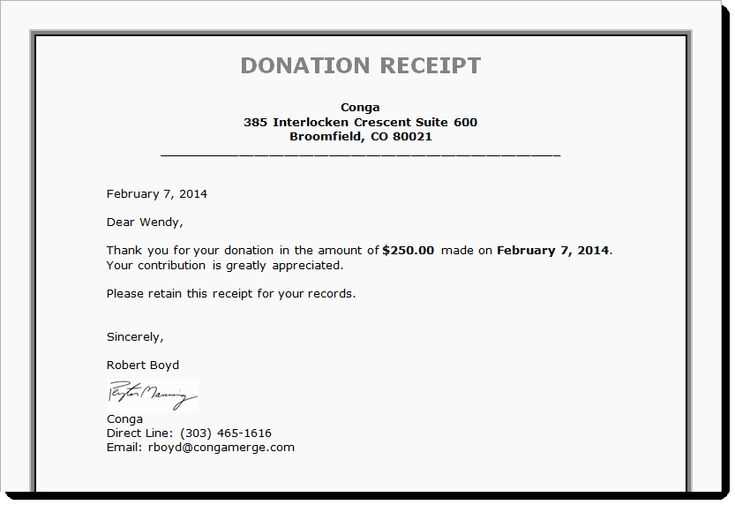

Provide a clear and concise donation tax receipt to your donors using a simple, well-structured template. This not only helps build trust but also ensures compliance with tax laws. The receipt should include essential details such as the donor’s name, donation amount, date of the donation, and the organization’s tax-exempt status.

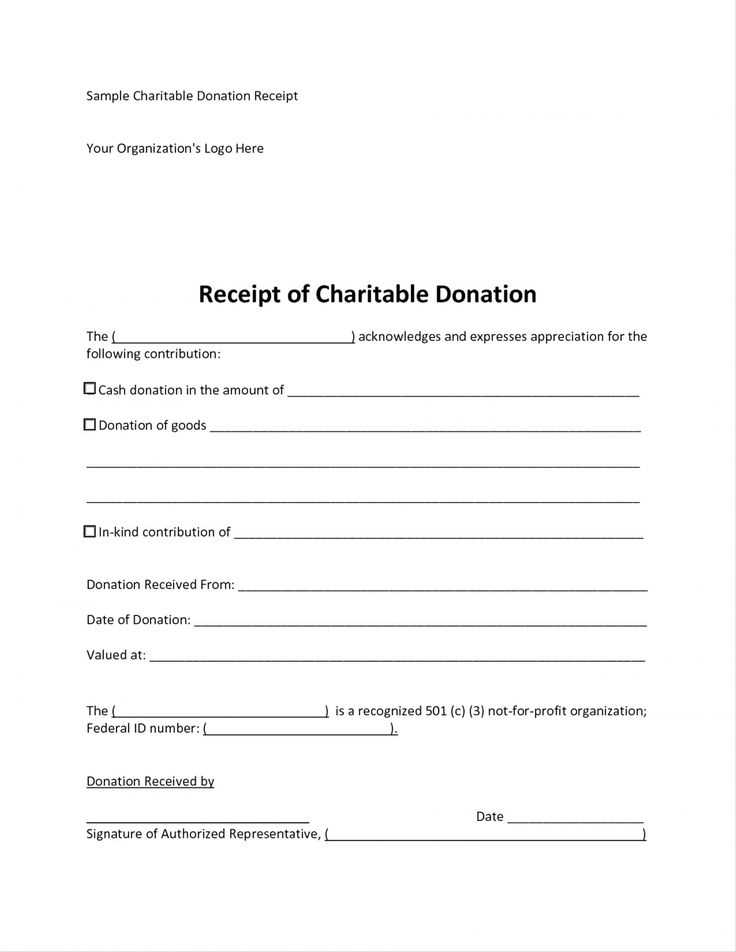

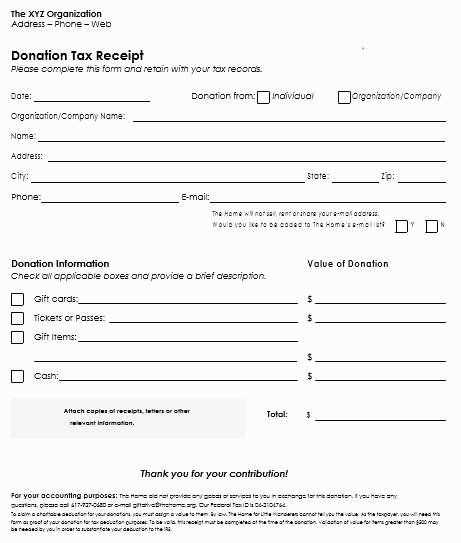

Ensure that the receipt specifies whether the donation was in cash or property. For non-cash donations, an accurate description of the items and their fair market value is necessary. For larger donations or property contributions, you may need to include additional information, such as the method of valuation, to meet IRS requirements.

Include your non-profit’s name, address, and EIN (Employer Identification Number) to verify the legitimacy of the organization. If the donation is tax-deductible, make it clear by including a statement like: “Your donation is tax-deductible to the extent allowed by law.”

Lastly, ensure that the donor receives their receipt in a timely manner. This provides them with the necessary documentation for tax filing and strengthens your relationship with supporters. A well-prepared tax receipt reflects your organization’s professionalism and commitment to transparency.

Non Profit Donation Tax Receipt Template Guide

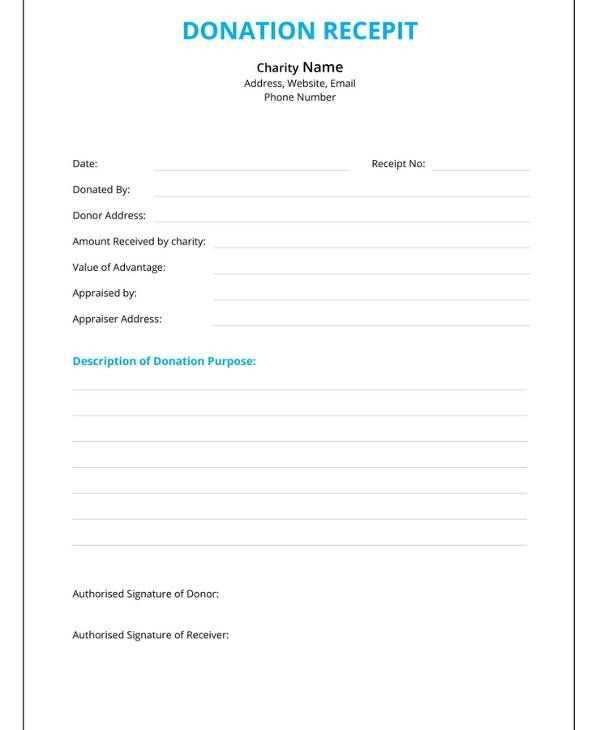

A non-profit donation tax receipt must include specific details to be valid for tax purposes. Here’s a guide on what to include in your template:

- Organization’s Name and Contact Information: Ensure the full name of the non-profit is clearly visible. Include the address, phone number, and email for any follow-up inquiries.

- Donor’s Information: Include the name and address of the donor. For organizations, list the name of the representative along with their title.

- Date of Donation: Clearly state the date the donation was made. This is essential for record-keeping and tax purposes.

- Donation Amount or Description: If the donation is cash, specify the dollar amount. For non-cash donations, provide a detailed description of the items, including their estimated value if possible.

- Non-profit’s Tax ID Number: This number (also known as EIN) is required for donors to claim tax deductions. It should be easily accessible on the receipt.

- Statement of No Goods or Services Provided: If the donation was made without any goods or services provided in exchange, include a statement to that effect. For donations where something was exchanged, the fair market value of the goods or services should be listed.

- Signature and Title of Authorized Person: A signature from an authorized individual (such as the executive director or finance officer) is necessary to validate the receipt.

- Receipt Number: Assign a unique number to each receipt for tracking and accounting purposes.

Make sure your template is clear, concise, and includes all the required information to ensure it meets tax requirements and helps donors claim their deductions accurately.

How to Include Required Information in a Tax Receipt

Ensure that your tax receipt contains specific details to comply with regulations and provide transparency. Start with the donation amount or value of the gift, clearly indicating whether it was a cash or in-kind donation. For non-cash donations, include a brief description of the item(s) donated.

Donation Date and Donor Details

Record the date of the donation and the full name of the donor. This helps verify the transaction for tax purposes. If applicable, include the donor’s address and contact information to allow for follow-up or verification requests.

Organization Details and Statement

Include your organization’s name, address, and tax-exempt number. State that the donor received no goods or services in exchange for the donation, unless applicable. If any goods or services were provided, include their value and describe them clearly.

Customizing a Template to Meet Legal and Donor Needs

Adapt your donation receipt template to ensure it meets both legal requirements and donor expectations. Begin with including the required legal information, like the nonprofit’s name, tax ID number, and a clear statement of the donation’s tax-deductible status. For U.S.-based nonprofits, the IRS mandates that receipts for donations over $250 include a description of the goods or services provided in exchange for the donation, if applicable.

Make sure the donor’s name, donation amount, and the date of the contribution are clearly listed. This will help donors track their giving for tax purposes. Additionally, you may include a space for donors to opt for recurring donations, which could require more specific wording depending on the country’s tax laws.

For better donor relations, customize the receipt to reflect the personal nature of their support. Adding a thank-you note or acknowledgment of the specific cause supported can enhance the donor’s experience. Ensure this text is brief yet warm and appropriate for various donation levels.

Finally, consider incorporating a clear privacy statement regarding how donor information will be used. This transparency helps build trust and ensures compliance with privacy regulations. Customizing your template not only streamlines your processes but also strengthens the connection with your supporters while staying legally compliant.

Common Mistakes to Avoid When Creating Donation Receipts

Failing to include the donation amount is a common mistake. Make sure the amount of money donated is clearly stated, especially for cash donations. This is essential for the donor’s tax records.

Another common error is not including the organization’s details. Ensure the nonprofit’s name, address, and tax identification number (TIN) are present. These details validate the receipt and make it legally acceptable.

Be clear about the type of donation. Whether it’s a cash donation, goods, or services, specify the nature of the contribution. If it’s in-kind, describe the donated items with as much detail as possible, including their fair market value if applicable.

Leaving out the date of donation is another pitfall. Always include the exact date of when the donation was received. This helps donors comply with tax requirements and can prevent disputes over the timing of their charitable contribution.

Not acknowledging whether anything of value was given in return is another mistake. If the donor received something in exchange for their donation, like a gift or a ticket to an event, the receipt should clearly state the value of what was provided. This ensures the donor knows what portion of their contribution is tax-deductible.

For donations of goods or services, an accurate description is critical. If you’re listing goods donated, include a general description, such as “used furniture” or “clothing.” Avoid assigning a specific value unless your nonprofit has an established procedure for determining fair market value.

Ensure you include a thank-you message, but avoid making it sound generic. A personalized note can go a long way in strengthening donor relations.

| Common Mistakes | Why It Matters |

|---|---|

| Missing the donation amount | Donors need this for their tax records. |

| Not including organization details | Tax ID and nonprofit details make the receipt legitimate. |

| Failure to specify the donation type | Ensures clarity on what was contributed. |

| Omitting the date | Helps track donations for tax purposes. |

| Not mentioning any exchange of value | Important for calculating the tax-deductible portion of a gift. |

| Inaccurate descriptions of in-kind donations | Donors need a clear picture of what they’ve contributed. |

| Generic thank-you message | Personalization enhances donor engagement. |