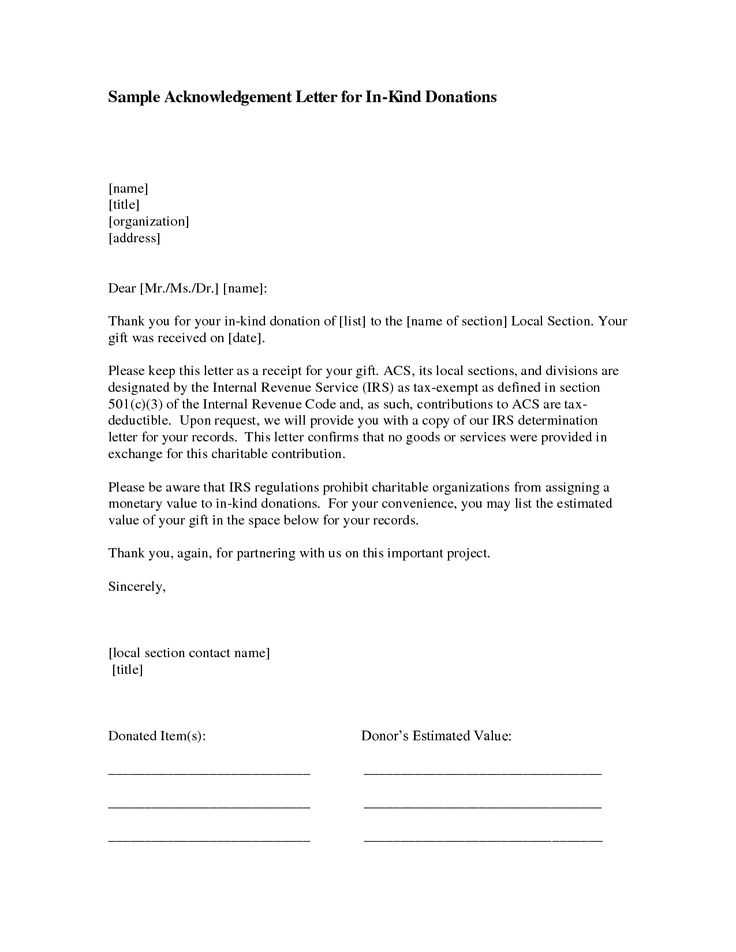

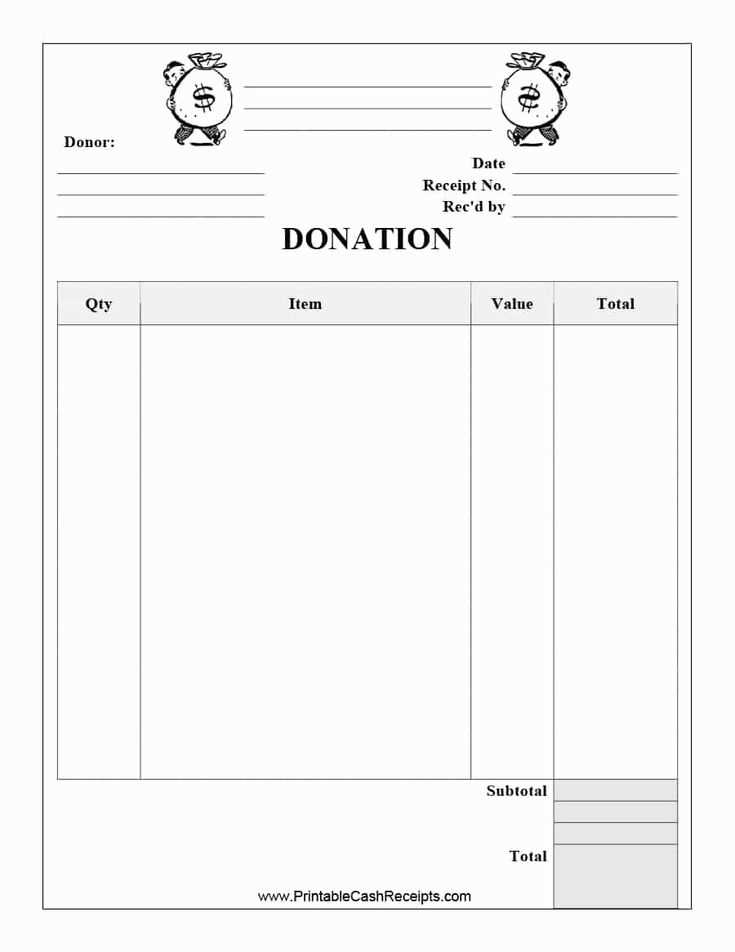

Provide a clear, detailed receipt for in-kind donations to ensure compliance with tax regulations and maintain transparency. Include the donor’s name, the organization’s details, a description of the donated items, and a statement confirming that no goods or services were exchanged.

Specify the Donation: Describe the donated items without assigning a monetary value. Donors are responsible for determining the fair market value for tax purposes. If the organization provides an estimate, note that it is for internal records only.

Include a Compliance Statement: To meet IRS requirements, add a statement confirming that the donor did not receive goods or services in return. If any benefits were provided, specify their estimated value.

Ensure accuracy and completeness before sending the receipt. A well-structured letter simplifies record-keeping for both the donor and the organization.

Non-Profit In-Kind Donation Receipt Letter Template

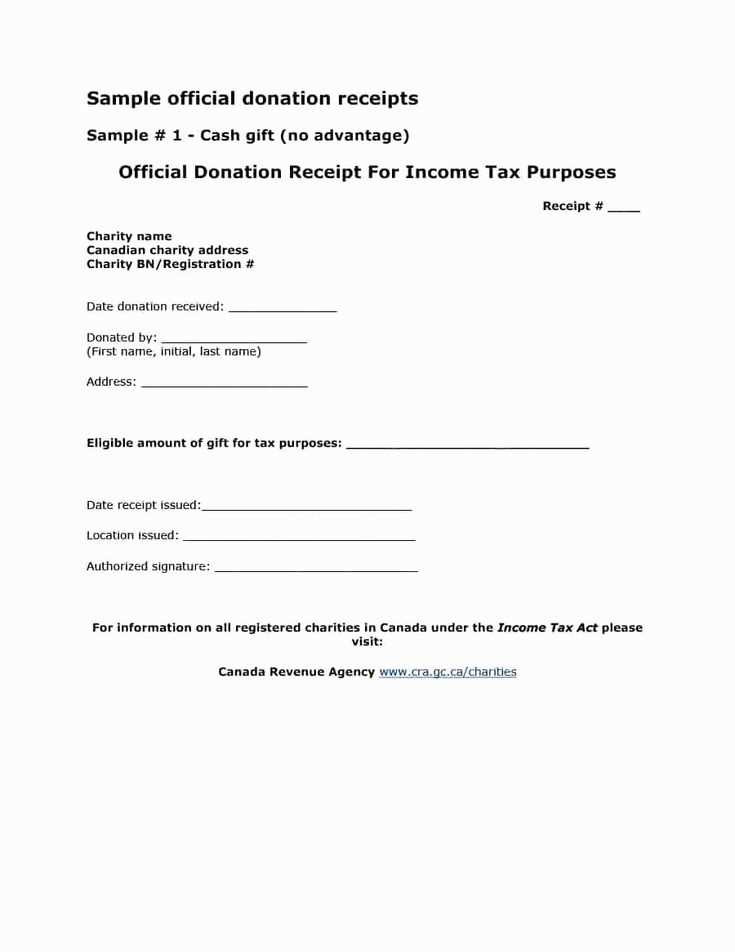

Include Donor and Organization Details: List the donor’s full name, contact information, and the name of your organization. Specify your nonprofit’s tax-exempt status to confirm eligibility.

Describe the Donated Items: Clearly state what was donated, including quantity and condition. Avoid assigning a monetary value–donors determine this for tax purposes.

Provide a Statement of No Goods or Services: Confirm that no goods or services were provided in exchange for the donation unless an exception applies.

Include a Thank You Message: Express gratitude for the donor’s generosity, reinforcing the impact of their contribution.

Sign and Date the Letter: A signature from an authorized representative ensures authenticity. Include the date to document the transaction properly.

Required Information for an In-Kind Donation Receipt

Include the donor’s full name and address to ensure proper documentation. The organization’s legal name, address, and tax identification number must also be clearly stated.

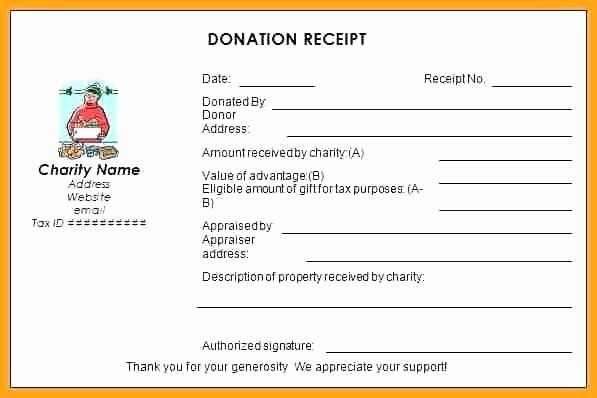

Description of the Donated Items

Provide a detailed description of the donated goods or services, including quantity and condition. Avoid assigning a monetary value–this is the donor’s responsibility.

Statement of No Goods or Services

Confirm that no goods or services were provided in exchange for the donation, except for any permissible token items. This statement is required for tax compliance.

Ensure the document is dated and signed by an authorized representative to validate its authenticity.

Structuring the Letter for Legal Compliance

Include the donor’s information: List the full name or business name and address of the donor. This ensures the document is properly attributed and meets reporting standards.

Provide a detailed description of the donation: Specify the donated items or services without assigning a monetary value. The recipient organization should describe the donation accurately, while the donor determines the value for tax purposes.

State the organization’s tax-exempt status: Mention the nonprofit’s status under applicable regulations, such as Section 501(c)(3), to confirm eligibility for deductions.

Include a statement of no goods or services in return: If the donor received nothing in exchange, explicitly state that no goods or services were provided. If something was given in return, describe it and its fair market value.

Date the receipt: Ensure the letter includes the date of the donation to establish eligibility for tax deductions in the correct year.

Provide contact details: Include a name, phone number, or email address in case the donor needs further documentation or verification.

Keep records: Maintain a copy of the receipt for organizational records to comply with audit requirements.

Describing Donated Items Accurately

Use clear and specific descriptions for each donated item. Instead of generic terms like “clothing” or “electronics,” provide details such as “five men’s cotton shirts, size L” or “Dell Latitude 5420 laptop, 16GB RAM, 512GB SSD.” This level of detail helps both donors and recipients understand the value and condition of the donation.

Include the brand, model, quantity, and any relevant specifications. If the item has unique features, note them. For example, instead of “office chair,” specify “Ergonomic mesh office chair with adjustable lumbar support.” This eliminates ambiguity and ensures proper acknowledgment.

Mention the condition of each item honestly. Use terms like “new with tags,” “gently used,” or “functional with minor wear.” Avoid vague descriptions that leave room for misinterpretation. Transparency builds trust and strengthens donor relationships.

For large or complex donations, such as furniture sets or medical equipment, attach a detailed list or inventory. If necessary, include serial numbers or expiration dates for regulatory compliance. Accurate descriptions not only enhance record-keeping but also facilitate smooth processing for tax documentation.

Providing Proper Acknowledgment Without Valuation

Express gratitude clearly and professionally by including essential details without assigning a monetary value. The acknowledgment letter should contain:

- Donor Information: Full name or organization name and contact details.

- Organization Details: Name, tax-exempt status, and EIN if applicable.

- Donation Description: A clear, concise list of donated goods or services.

- Statement on Valuation: A disclaimer such as, “No goods or services were provided in exchange for this donation. The donor is responsible for determining the value of the contribution.”

- Signature: An authorized representative’s name, title, and signature.

Ensure the letter is sent promptly via mail or email, keeping a copy for records. Consistent formatting and accurate information strengthen credibility and compliance with tax regulations.

Customizing the Template for Different Donations

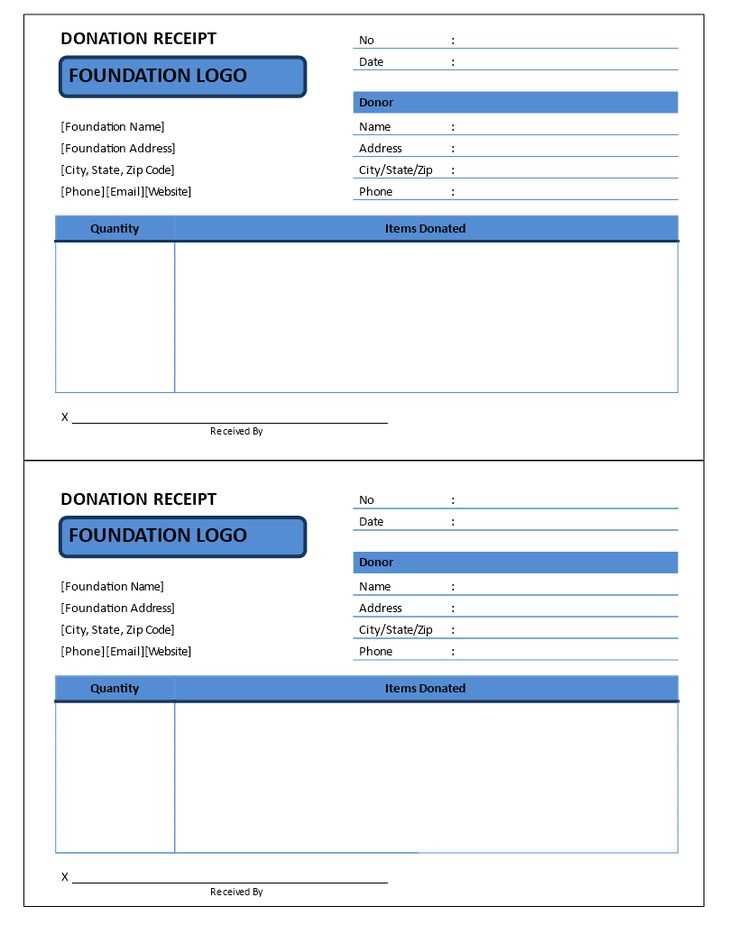

Tailor the receipt to match the nature of the contribution by specifying key details. Clearly describe the donated items, including their quantity and condition. For services, outline the type of assistance provided and the estimated time involved. When recognizing financial gifts, note whether they were given as cash, checks, or electronic transfers.

Structuring the Receipt

| Donation Type | Details to Include |

|---|---|

| Physical Items | Description, quantity, condition |

| Services | Type of service, hours contributed |

| Monetary Gifts | Payment method, amount, date |

Legal Compliance

Ensure the receipt meets tax regulations by stating whether the organization provided any goods or services in exchange. If none were given, include a declaration confirming this. Always use official letterhead and include the organization’s tax-exempt status.

Ensuring Record-Keeping and Donor Communication

Accurate record-keeping is a cornerstone of maintaining strong donor relationships. Track each in-kind donation clearly and consistently, logging key details such as the item description, estimated value, and the date it was received. Use a secure, organized system for storing this data, whether it’s a physical ledger or an electronic database. Regularly update records to reflect new contributions.

Donor communication plays a key role in maintaining transparency and trust. Always send a formal acknowledgment letter promptly after receiving a donation. Include the following:

- Donor’s name and contact information

- Description of the donated item(s)

- Estimated value of the donation (if applicable)

- Statement indicating no goods or services were provided in exchange

- Contact details for any inquiries

To simplify future communications, categorize donors by their contribution types. This allows for personalized and timely follow-ups, helping to strengthen ongoing support. Periodically update donors about how their contributions are used to further the mission. This maintains engagement and encourages continued giving.

Always ensure compliance with tax regulations. Provide donors with all necessary information for tax deductions, especially for significant gifts. Consult a tax expert regularly to confirm that your donation receipts meet the legal requirements.

Establish a donor-friendly approach to communication. Use a friendly, professional tone in all letters and updates, reinforcing the impact their donations make. Prompt and regular communication shows donors their value to the cause.