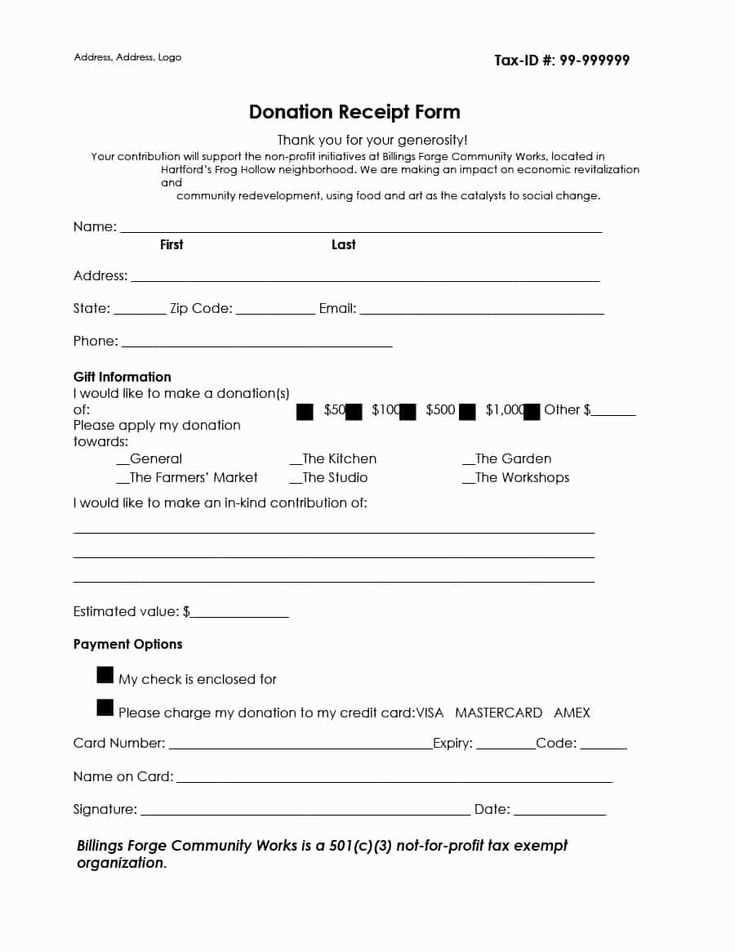

Creating a donation receipt for your non-profit organization is a straightforward process that can build trust with donors and ensure compliance with tax regulations. The receipt should clearly document the donation details, including the donor’s name, date of contribution, amount donated, and any goods or services provided in return. A well-organized donation receipt reflects the professionalism of your organization and helps ensure transparency with contributors.

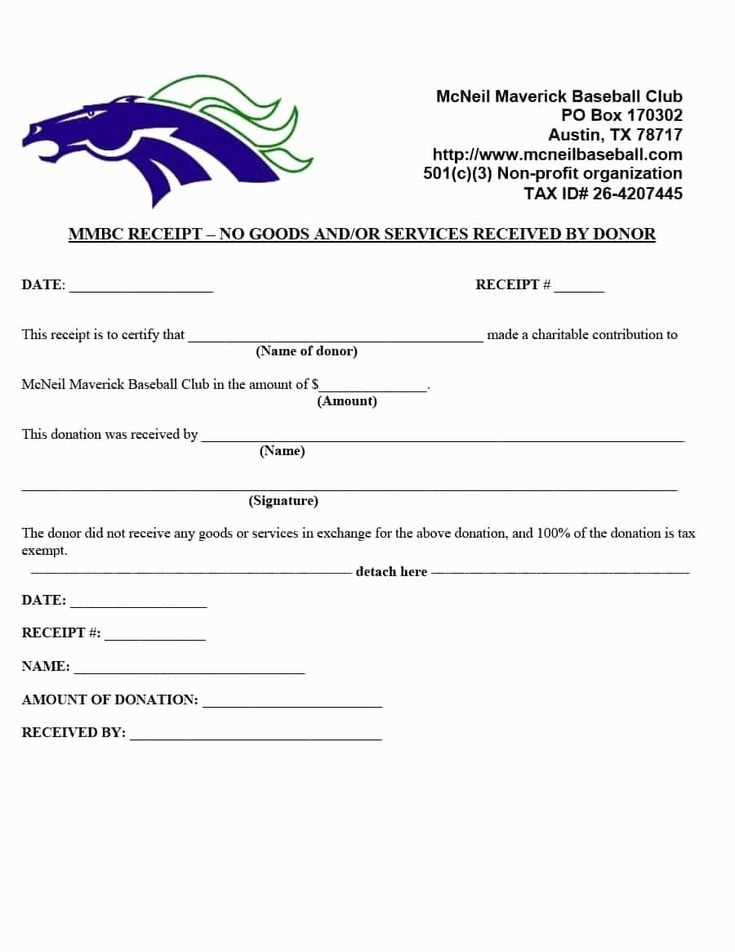

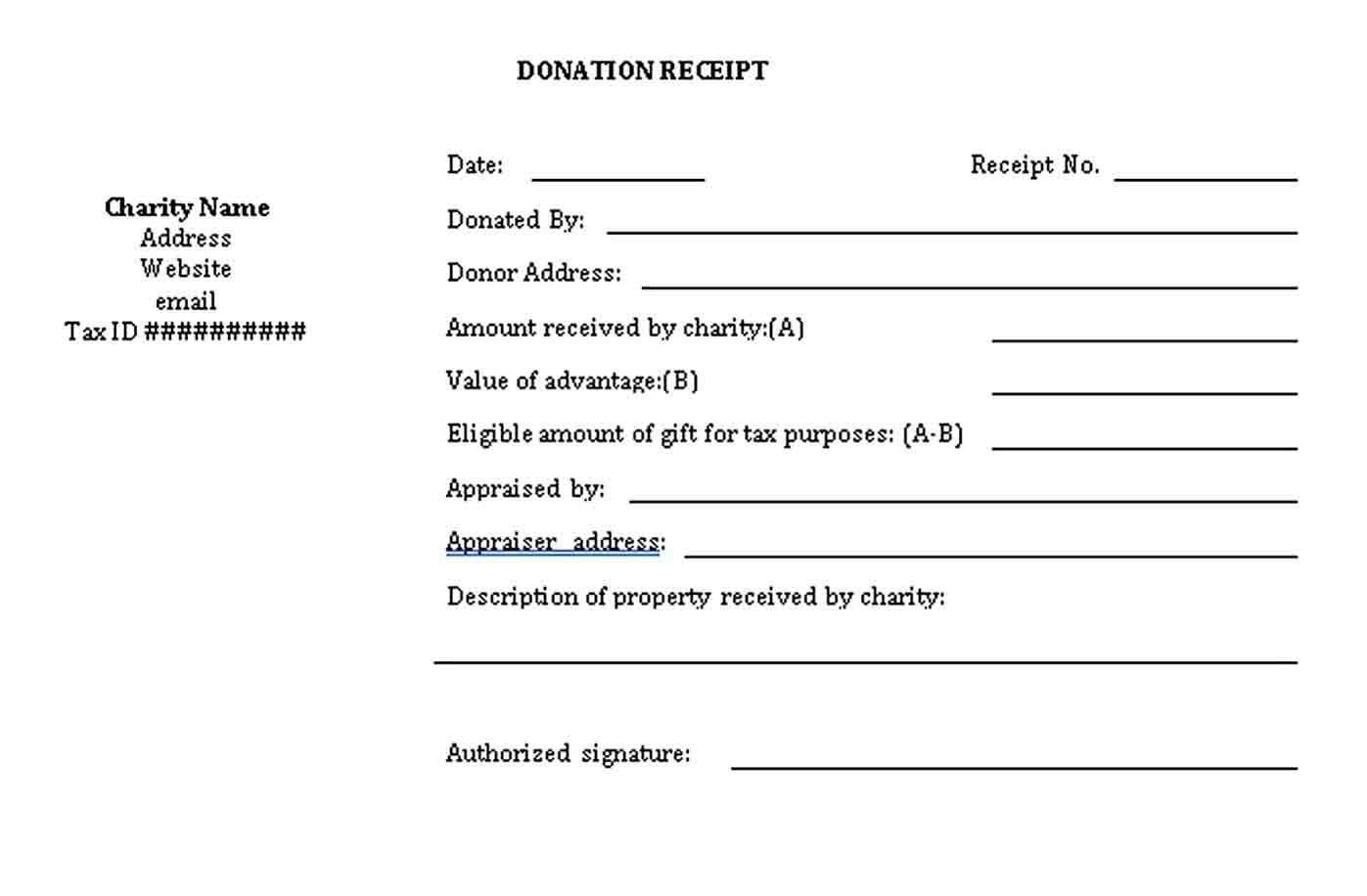

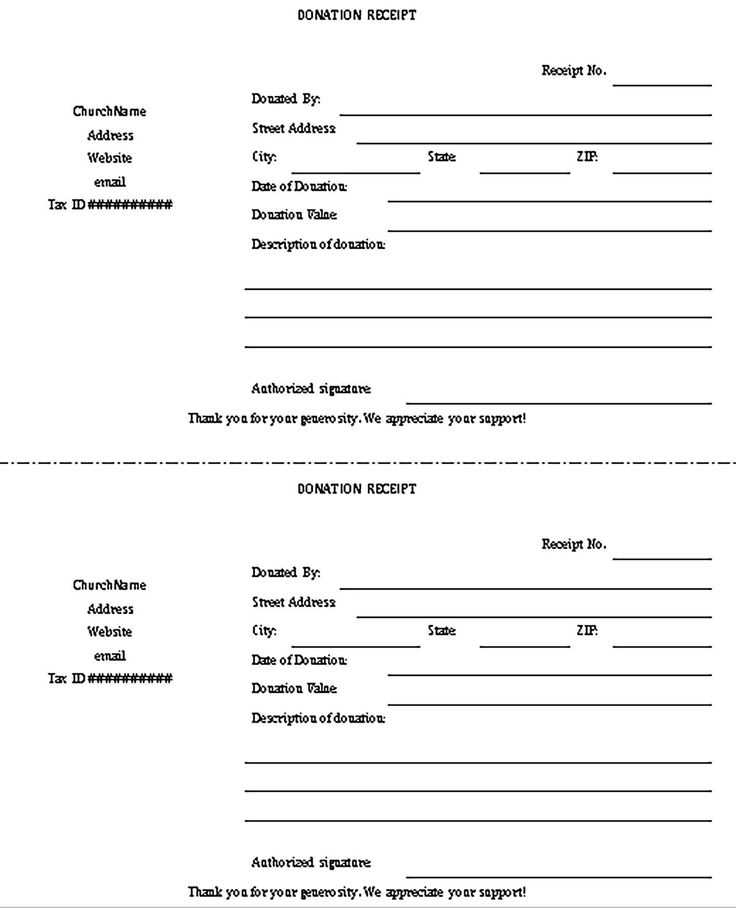

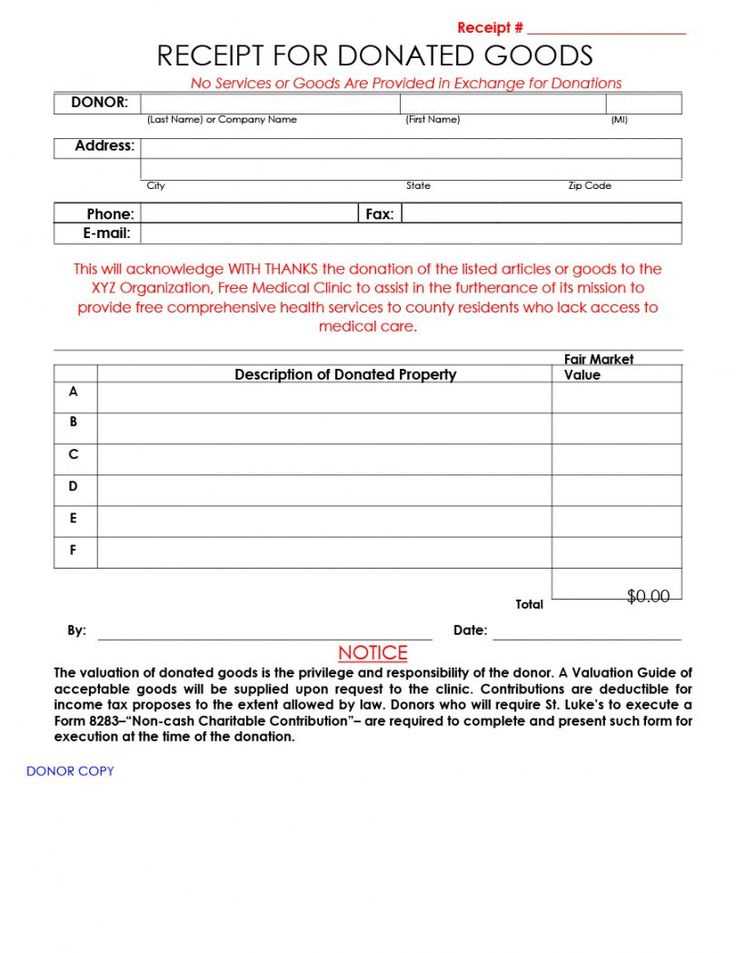

Key Elements: At a minimum, your donation receipt should include the donor’s name, the donation amount, the date of the donation, and your non-profit’s tax-exempt status. If the donation includes goods or services, be sure to note their value and provide a description. Also, a statement that no goods or services were exchanged for the donation (if applicable) can provide clarity.

Always include your organization’s contact information, and make sure to keep a copy of the receipt for your records. For IRS purposes, the receipt should clearly state whether the donation is tax-deductible. If you’re unsure of the exact wording, many templates are available that comply with IRS guidelines, making it easy for non-profits to issue correct receipts efficiently.

Pro Tip: Sending out receipts as soon as possible after the donation is made helps donors retain the necessary information for tax filing and demonstrates your organization’s commitment to transparency.

Here are the corrected lines with minimized repetition:

To create a donation receipt for a non-profit, it’s critical to include clear and concise information. Use unique wording for each section to avoid redundancy and ensure readability. This enhances the professionalism of your receipt and makes it easier for the donor to understand the details.

Receipt Format

Start with the organization’s name, address, and tax identification number. Follow with the donor’s name, donation amount, and the date of the transaction. It’s helpful to specify if the donation was in-kind or monetary. For in-kind donations, describe the donated items with as much detail as possible.

Additional Tips

Keep the receipt simple. Avoid repetitive phrases such as “thank you for your generous contribution.” Instead, opt for a more personalized expression like “Your support helps make a difference.” This way, each receipt feels unique and sincere.

For tax purposes, clearly state the donation amount or value. If applicable, include any services provided in exchange for the gift. Make sure to acknowledge that no goods or services were provided in return for the donation if that is the case.

Consider adding a line inviting the donor to reach out for any questions. It keeps the tone friendly while preventing an overwhelming amount of text. Adjust each receipt to the donor’s contribution type to avoid generic statements that could confuse the reader.

- Non-Profit Organization Donation Acknowledgment Template

For any non-profit organization, acknowledging donations correctly is key to building trust with donors and staying compliant with tax laws. A clear and concise donation acknowledgment template not only expresses gratitude but also ensures that the receipt meets IRS guidelines for tax deductions.

Key Elements of a Donation Acknowledgment

- Organization Information: Include the name, address, and tax-exempt status of the non-profit. This helps confirm the organization’s legitimacy and tax-exempt status.

- Donor Information: List the donor’s name and address. It’s essential for sending tax-deductible receipts to the right person.

- Donation Amount: State the exact amount donated. For monetary donations, it should be clear whether the amount is a cash gift, check, or credit card payment.

- Donation Date: Mention the exact date when the donation was received. This ensures accurate record-keeping for both the organization and the donor.

- Statement of Goods or Services: If any goods or services were provided in exchange for the donation, include a description and the estimated value of these items. If no goods or services were given, the acknowledgment should state this.

- Tax-Exempt Status Reminder: Include a statement that the organization is a 501(c)(3) tax-exempt charity, allowing the donor to claim tax deductions for their contribution.

Donation Acknowledgment Example

- Non-Profit Organization Name

- Address: [Organization Address]

- Tax ID: [EIN Number]

- Phone: [Organization Contact Number]

- Email: [Organization Email Address]

- Donation Acknowledgment

- Dear [Donor Name],

- Thank you for your generous donation of $[Donation Amount] on [Date of Donation]. Your support is vital to our work in [Brief Description of Organization’s Mission].

- No goods or services were provided in exchange for this donation.

- This donation is tax-deductible as we are a 501(c)(3) tax-exempt organization. Our EIN is [EIN Number].

- If you have any questions, feel free to contact us at [Organization Email Address] or [Organization Phone Number].

- Sincerely,

- [Signature]

- [Organization’s Name]

This template provides all necessary information for both the organization and the donor, ensuring compliance and maintaining transparency. Adjust the details as needed to fit specific donation types or amounts.

To create a legally compliant contribution receipt, include the following key details in the document:

| Item | Description |

|---|---|

| Organization’s Name | The full legal name of the non-profit organization. |

| Donor’s Name | Include the full name of the donor as it appears in your records. |

| Date of Donation | State the exact date the donation was received. |

| Amount or Description of Donation | For monetary donations, specify the amount. For non-monetary donations, describe the item and its estimated value. |

| Statement of No Goods or Services | If the donor did not receive any goods or services in return, include a statement to that effect. |

| Tax-Exempt Status | Confirm the organization’s tax-exempt status by including the tax-exempt number, if applicable. |

Make sure the receipt is signed by an authorized representative of the organization. Include any additional notes required for compliance with local tax laws. Check specific rules in your jurisdiction for further details.

When creating a donation acknowledgment template, make sure it includes the following key elements to comply with tax laws and offer clear documentation for donors:

1. Donor’s Details

Start by including the donor’s full name, address, and any other relevant contact information. This ensures that the donor receives a proper acknowledgment and can be easily contacted for follow-up communications.

2. Organization’s Information

Clearly state the nonprofit organization’s name, address, and federal tax identification number (EIN). This allows donors to verify the legitimacy of the organization and provides necessary information for tax reporting.

3. Donation Details

Specify the amount of the donation and whether it was monetary or in-kind. For in-kind donations, describe the items donated and their estimated value. This helps donors properly value their contributions for tax purposes.

4. Date of Donation

Include the exact date the donation was received. This helps donors keep track of their charitable contributions and ensures that the acknowledgment corresponds to the correct tax year.

5. Statement of No Goods or Services Provided

If the donation was entirely monetary and no goods or services were provided in return, include a statement to confirm this. If goods or services were given, provide a description and the estimated value to comply with IRS guidelines.

6. Acknowledgment of the Charitable Nature

End the template with a note confirming the donor’s contribution supports the organization’s tax-exempt status, and clarify the nonprofit’s mission. This reinforces the impact of the donation and helps build a strong donor relationship.

Make sure the receipt includes all required details. Missing information like the donor’s full name, date of donation, or charity’s registration number can lead to complications for tax filings. Double-check for accuracy before sending receipts.

Incorrect Valuation of Non-Monetary Donations

When issuing receipts for non-cash donations, avoid assigning inaccurate values. The donor should be responsible for valuing their own donation, but it’s important to clarify that the charity cannot provide appraisals. Incorrect valuation can lead to issues with the IRS or local tax authorities.

Failure to Acknowledge the Absence of Goods or Services

If a donor receives goods or services in exchange for their contribution, the receipt must state the fair market value of what was provided. Failing to include this information can result in incorrect tax deductions. Ensure the donor understands the exact amount of their tax-deductible donation.

Inaccurately classifying donations also presents risks. For instance, some donations may not qualify for tax-deductible status due to restrictions or conditions tied to the gift. Always verify the nature of each donation before issuing receipts.

Include the donor’s full name, address, and contact information. This ensures that both parties have a clear record of the donation, making it easy to follow up if necessary.

Donation Details

Provide a clear description of the donation received, including the type (cash, goods, services) and the exact amount or value. If the donation is in-kind, specify what was given and its fair market value to avoid ambiguity.

Non-Profit Information

Include your non-profit’s name, tax identification number, and address. This confirms your organization’s legitimacy and helps donors claim their tax deductions. The receipt should also state that no goods or services were exchanged for the donation, if applicable.