Creating a nonprofit monetary donation receipt template is straightforward and ensures transparency in donations. The template should include the donor’s name, the amount donated, and a clear statement of whether the donation is tax-deductible. A properly formatted receipt helps the donor during tax season and provides documentation for both parties involved.

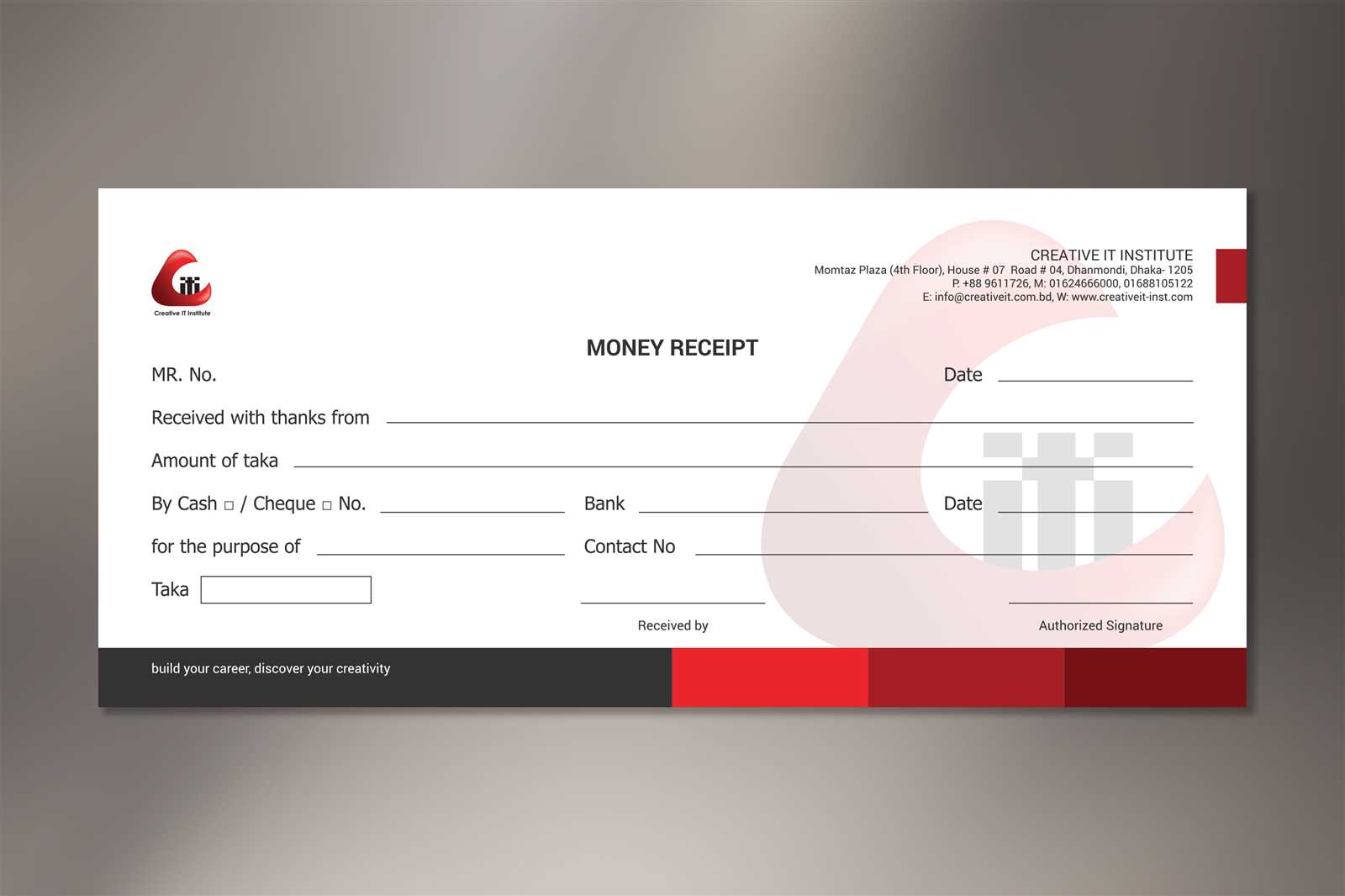

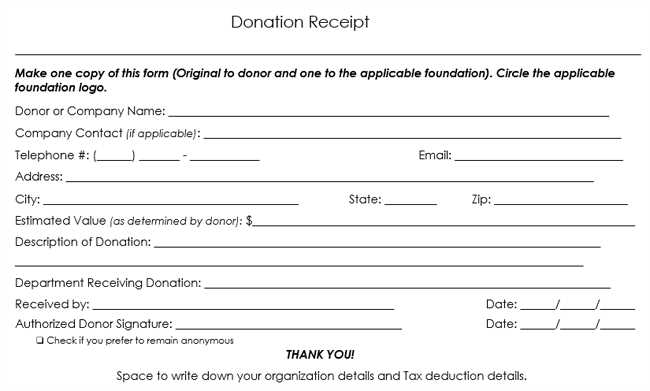

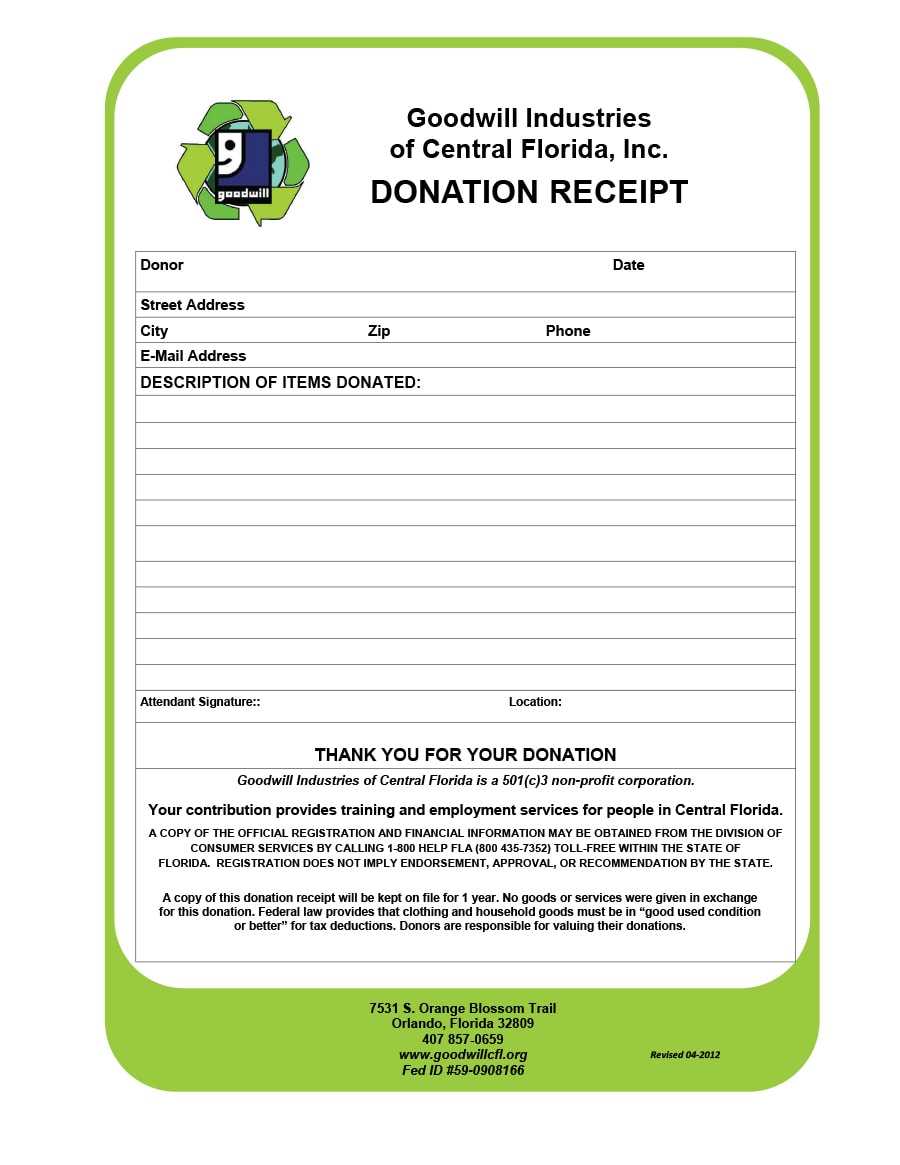

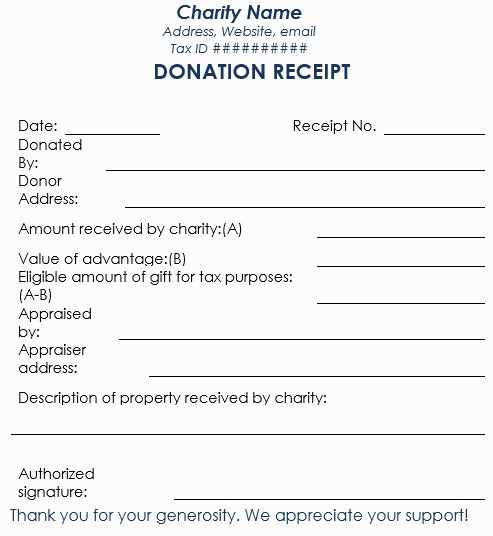

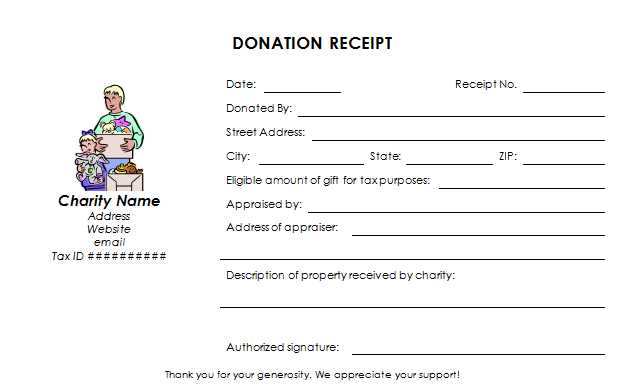

The template should start with the nonprofit’s name, logo, and contact information. Immediately below, add the donor’s full name and the date of the donation. Clearly state the donation amount, and whether it was cash or a different form of donation. If the donation includes goods or services, describe these in detail, with a fair market value attached. Lastly, include the nonprofit’s tax-exempt status number for verification.

Don’t forget to add a disclaimer about the donor’s responsibility to confirm the deductibility with their tax advisor. For transparency, make sure the receipt indicates whether any goods or services were provided in exchange for the donation and if so, an estimate of their value.

Having a structured template not only streamlines the donation process but also builds trust with your supporters. A clear, professional receipt is a simple yet powerful tool for maintaining good relationships with donors and ensuring compliance with tax laws.

Here are the corrected lines where repetition of words has been minimized:

Streamline your language by removing unnecessary repetition. For example, instead of saying “Your generous donation donation will help us,” say “Your generous donation will help us.” This eliminates redundancy and enhances clarity.

Focus on variation in phrasing to avoid repetitive wording. Rather than repeating the same verb or noun, use synonyms or rephrase the sentence structure. For instance, instead of “We thank you for your contribution, your contribution is greatly appreciated,” say “We thank you for your generous contribution.” This keeps the message concise and to the point.

Adjust sentence length and structure to ensure a smooth flow without unnecessary repetition. A single well-constructed sentence is often more impactful than multiple sentences that say the same thing in different ways.

Recheck your content for redundancies, especially in donation receipts. The key is clarity and conciseness. Short, impactful phrases like “Thank you for supporting our cause” replace longer, repetitive expressions.

- Nonprofit Monetary Donation Receipt Template

Ensure your nonprofit organization provides accurate and clear monetary donation receipts. The receipt should include the donor’s name, the donation amount, and the date of the contribution. If the donation is above a certain threshold, specify whether goods or services were exchanged and their fair market value. This ensures compliance with tax requirements and builds trust with your donors.

Include the following key elements in your receipt:

- Organization Name and Contact Information: Display the nonprofit’s legal name, address, phone number, and website.

- Donor Information: List the donor’s full name and address.

- Donation Amount: Clearly state the monetary value donated, ensuring the amount is accurate.

- Date of Donation: Include the exact date the donation was received.

- Tax Identification Number (TIN): Provide your nonprofit’s TIN for the donor’s tax reporting purposes.

- Statement of Non-Exchange: Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable.

- Signature: Sign the receipt to validate it.

Tailor your template to meet local regulations and ensure it is clear and professional. Providing detailed and accurate receipts helps donors with their tax filings and promotes transparency in your nonprofit’s operations.

Begin by including the nonprofit’s name, address, and contact details at the top. This ensures donors can quickly identify where the receipt originated from. Next, add the date of the donation along with a unique receipt number for tracking purposes.

Donation Details

Clearly state the donor’s name and address. This personalizes the receipt and makes it easier for the donor to keep records. Specify the donation amount, whether it was a cash donation or a non-cash item, and include an accurate description of any items donated. For non-cash donations, include a brief statement about the estimated value, though it’s helpful to note that donors should assess their own valuation for tax purposes.

Tax-Exempt Status and Legal Statements

Include a statement confirming the nonprofit’s tax-exempt status. A brief sentence such as “Your donation is tax-deductible to the fullest extent allowed by law” reassures donors. If no goods or services were exchanged for the donation, make that clear with a declaration like, “No goods or services were provided in exchange for this contribution.”

Ensure that your charitable receipt contains all legally required details to guarantee validity for tax purposes. Missing even a single piece of information can result in the receipt being invalid for donors’ tax claims.

- Organization’s Legal Name: The name of your charity as registered with the appropriate authorities must appear exactly as it appears on official documents.

- Charity Registration Number: Include your charity’s registration number issued by the IRS or relevant local government body. This helps verify your charity’s status as a tax-exempt entity.

- Date of Donation: The exact date when the donation was made is a mandatory element, as it is crucial for both donor and recipient records.

- Donor’s Details: Include the full name and address of the donor, as this will help them correctly claim tax deductions.

- Donation Amount: The exact amount of money donated should be clearly stated. If non-monetary items were donated, describe them and estimate their fair market value.

- Statement of No Goods or Services Provided: Include a declaration stating that no goods or services were provided in exchange for the donation, if applicable. This is vital for the donor’s ability to claim a full tax deduction.

- Signature of Authorized Representative: An authorized individual from your charity must sign the receipt to confirm its authenticity.

Always verify these details with current local tax laws to avoid complications and ensure your receipts meet all legal standards.

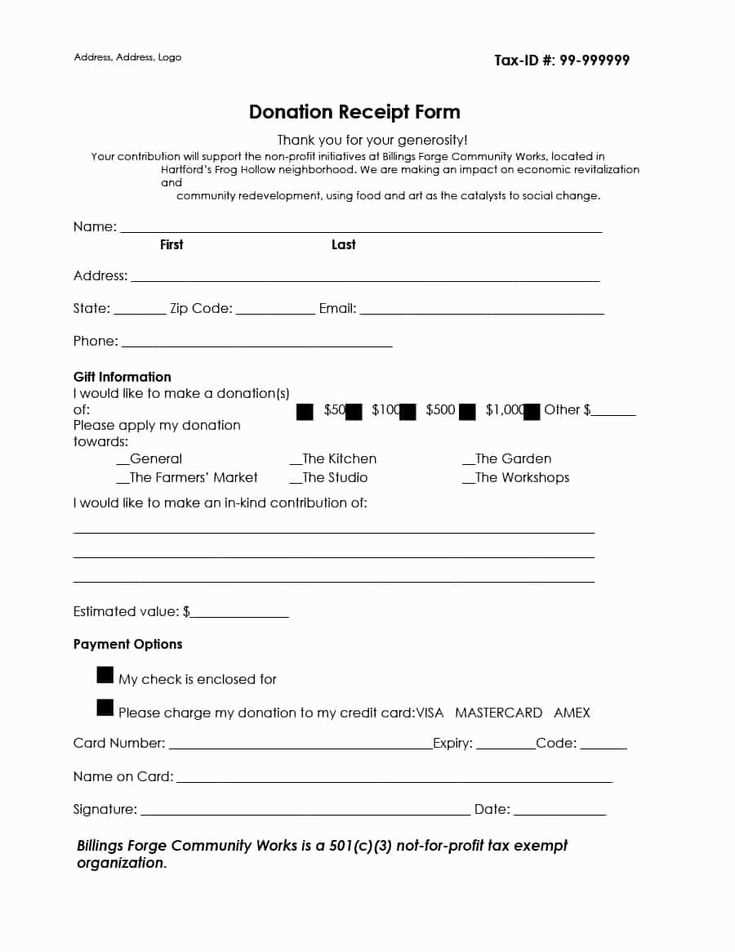

Adjust your donation receipt template based on the type and amount of donation received. A one-time monetary donation may require less detail than a recurring contribution, but each should clearly outline the donor’s contribution and the organization’s acknowledgment.

If the donation is for a specific project or campaign, include a section detailing how the funds will be used. This adds transparency and reassures the donor about the impact of their gift. A simple “Project/Program” field on the receipt is helpful for this purpose.

For in-kind donations, such as goods or services, specify the items donated, their fair market value (if known), and the condition of the items. A separate section dedicated to non-cash donations is recommended to prevent confusion.

For large donations, especially those over a specific threshold, consider adding a personalized thank-you note. This can be a brief sentence, such as “We deeply appreciate your generous contribution to our cause,” or a more detailed message based on your organization’s tone and relationship with the donor.

| Donation Type | Template Customization |

|---|---|

| Monetary Donation | Include the donation amount, date, and transaction details. If recurring, specify the frequency. |

| In-Kind Donation | List items donated and their fair market value. Include item condition if relevant. |

| Large Donation | Include a personalized thank-you message and detailed recognition of the donor’s contribution. |

By tailoring your template for different scenarios, you provide donors with clear, accurate information while reinforcing their decision to contribute.

Donation Receipt Template Recommendations

Ensure the donation receipt includes the donor’s full name, the date of the donation, and the amount donated. Specify whether the contribution was monetary or in-kind, and clearly describe any goods or services provided in exchange for the donation. This clarity helps both the donor and the nonprofit maintain accurate records for tax purposes.

Be sure to indicate that the donation is tax-deductible, if applicable. Include the nonprofit’s name, address, and tax identification number to confirm its eligibility for tax benefits. A statement affirming that no goods or services were provided in return for the donation can simplify the process for the donor during tax season.

Double-check the accuracy of all details. Minor mistakes could lead to confusion or even incorrect tax filings. Ensure that the language is straightforward and does not include unnecessary legal jargon, making it easy for the donor to understand their contribution’s impact.